Best White Label Forex Prop Firm Guide 2025 – Build Your Brand Today

White Label Forex Prop Firm: The Complete Beginner’s Guide to Starting Your Trading Business

Agar aap trading ke duniya mein naya business start karna chahte hain to white label forex prop firm aapke liye ek game-changing opportunity ho sakta hai. In recent years, proprietary trading industry ne tremendous growth dekha hai, aur ab beginners ke liye bhi accessible ho gaya hai thanks to innovative white label solutions.

Iss comprehensive guide mein, main aapko step-by-step bataunga ki white label prop firm kya hota hai, iska business model kaise kaam karta hai, aur aap kaise apna successful prop trading business launch kar sakte hain without breaking the bank. Let’s dive deep into this lucrative industry jo millions of dollars ka revenue generate kar raha hai globally.

What is a White Label Forex Prop Firm?

White label forex prop firm essentially ek ready-made proprietary trading business solution hai jo third-party providers offer karte hain. Iska matlab hai ki aap existing technology, infrastructure, aur trading platforms use kar ke apna branded prop trading firm launch kar sakte hain without building everything from scratch.

Humne market research mein dekha hai ki white label solutions significantly reduce the time-to-market – typically 2-4 weeks compared to 12-24 months for custom development. Yeh approach especially beneficial hai for:

- Existing brokers looking to expand services

- Entrepreneurs with limited capital

- Financial institutions wanting quick market entry

- Trading coaches seeking new revenue streams

How White Label Prop Trading Works

Samjhiye kaise white label prop firm solution actually operate karta hai:

The Business Model Structure

1. Platform and Infrastructure Provision

White label provider aapko complete trading platform provide karta hai including order execution systems, risk management tools, aur compliance mechanisms. Yeh approach traditional prop firm setup costs ko dramatically reduce kar deta hai.

2. Capital Provision and Management

Provider often capital access facilitate karta hai ya existing financial resources leverage karne mein help karta hai. Iska matlab hai ki aapko millions of dollars ka initial investment nahi chahiye.

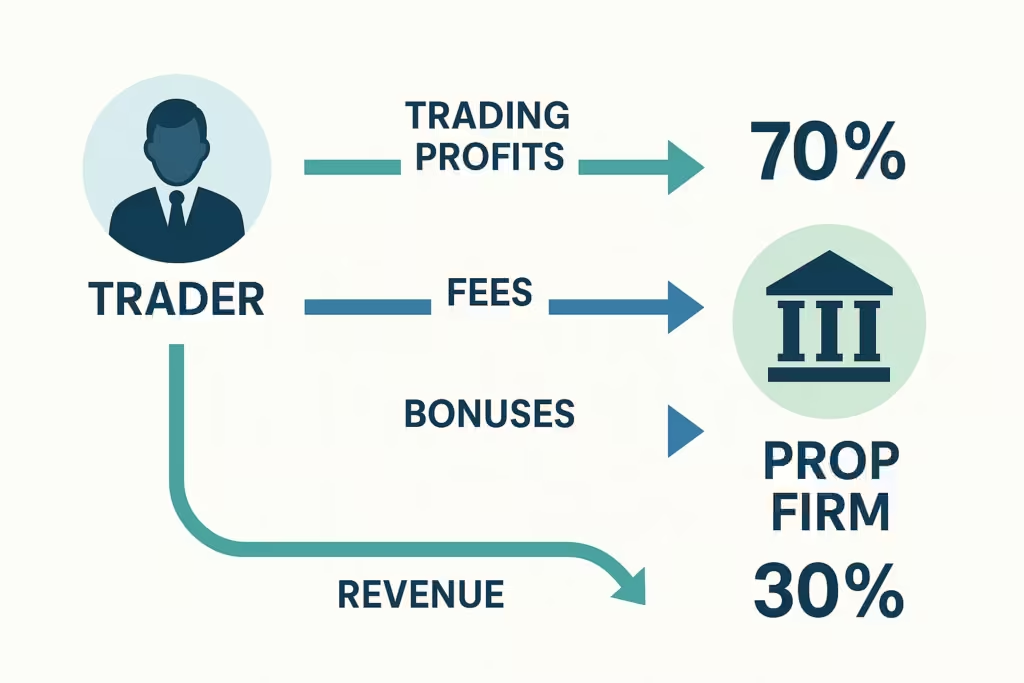

3. Revenue Sharing Model

Most white label solutions operate on revenue-sharing basis – aap profits ya trading volume ka percentage provider ko pay karte hain. Yeh alignment ensures both parties have skin in the game.

Key Revenue Streams

Based on our analysis, prop firm business model primarily generates income through:

- Challenge Fees: $100-$5,000 per evaluation depending on account size

- Profit Sharing: 10-30% of trader profits

- Monthly Subscriptions: $50-$200 per funded account

- Spreads and Commissions: Additional transaction-based income

White Label vs. Building From Scratch: The Smart Choice

Humne industry experts se baat ki hai aur data clearly shows ki white label approach significantly more practical hai for beginners:

Essential Features of White Label Prop Firm Solutions

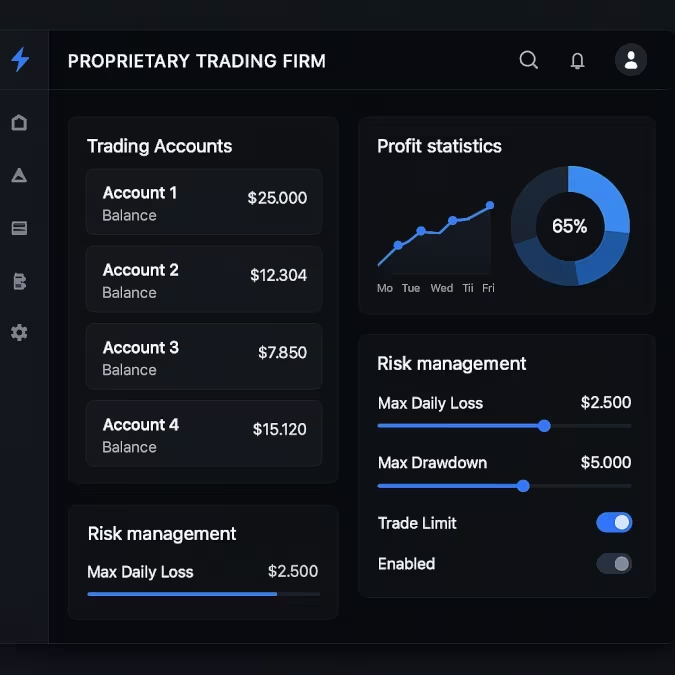

Jab aap white label prop trading platform choose kar rahe hain, yeh features absolutely essential hain:

Trading Platform Integration

- MetaTrader 4/5, cTrader compatibility

- Multi-asset support (forex, commodities, indices)

- Mobile and web accessibility

- Professional charting tools

Risk Management Automation

- Real-time position monitoring

- Auto-liquidation upon risk breaches

- Daily drawdown limits

- Dynamic leverage adjustments

Custom Branding Capabilities

- Complete UI/UX customization

- Branded trader dashboards

- Custom domain and SSL

- Personalized challenge structures

Administrative Backend

- Comprehensive CRM system

- Automated KYC/AML processes

- Payment gateway integration

- Performance analytics and reporting

Prop firm evaluation process flowchart from challenge to funded account

Step-by-Step Guide to Launch Your White Label Prop Firm

Based on humara extensive research aur industry consultations, yahan hai complete roadmap:

Phase 1: Planning and Research (Week 1)

1. Define Your Target Market

- Beginner traders, experienced professionals, ya specific regions

- Identify unique selling propositions

- Research competitor offerings and pricing

2. Choose Business Structure

- Legal entity setup ($1,500-$15,000 depending on jurisdiction)

- Regulatory compliance planning

- Banking and payment processing arrangements

Phase 2: Technology Setup (Week 2-3)

3. Select White Label Provider

Leading options include Quadcode, B2Broker, aur Leverate. Consider:

- Platform features and customization options

- Pricing structure and revenue sharing

- Technical support and maintenance

- Integration capabilities

4. Platform Configuration

- Custom branding implementation

- Challenge rules and profit targets setup

- Risk parameters configuration

- Payment methods integration

Phase 3: Launch Preparation (Week 3-4)

5. Marketing Strategy Development

- Website development and SEO optimization

- Social media presence establishment

- Content marketing and educational resources

- Affiliate program setup

6. Team Assembly

Essential roles include:

- Customer support representatives

- Risk management specialists

- Marketing and business development

- Compliance officer (for regulated jurisdictions)

Phase 4: Go-Live and Optimization (Ongoing)

7. Soft Launch with Beta Testing

- Limited trader onboarding

- System testing and optimization

- Feedback collection and improvements

8. Full Market Launch

- Comprehensive marketing campaign

- Trader acquisition and retention programs

- Continuous platform optimization

Understanding Prop Firm Evaluation Models

Prop firm evaluation process typically follows standardized structures designed to identify profitable traders:

One-Step Challenge

- Single phase evaluation

- 8-10% profit target within 30-60 days

- 4-6% daily drawdown limit

- 5-10% overall drawdown limit

- Fastest path to funding for skilled traders

Two-Step Challenge

- Initial evaluation phase (Phase 1)

- Verification phase (Phase 2)

- Lower profit targets in Phase 2 (typically 5%)

- Enhanced risk management demonstration

- More comprehensive trader assessment

Three-Step Challenge

- Most thorough evaluation process

- Progressive difficulty levels

- Extended demonstration period

- Higher capital allocation potential

Regulatory Considerations and Compliance

Prop firm regulations vary significantly by jurisdiction, but key considerations include:

Core Compliance Requirements

- Anti-Money Laundering (AML) procedures

- Know Your Customer (KYC) implementation

- Financial licensing (where applicable)

- Tax reporting and obligations

Jurisdiction Selection Factors

Popular locations for prop firm incorporation include:

- Offshore Entities: Lower compliance costs ($1,500+ setup)

- Mid-Tier Jurisdictions: Moderate regulation ($15,000+ setup)

- Fully Regulated: CySEC, FCA approval ($100,000+ investment)

In my experience, aur humne dekha hai ki many successful prop firms start with offshore structures aur gradually move to more regulated jurisdictions as they scale.

Success Stories and Market Potential

Real success stories industry mein inspire karte hain. For example, Trader Kane achieved over $3 million in payouts with his largest single payout exceeding $1.8 million. Similarly, Arsh turned $60 into over $30,000 through disciplined trading and proper risk management.

Yeh examples demonstrate ki both traders aur prop firm operators can achieve substantial success when proper systems aur strategies are in place.

Cost Breakdown and Investment Requirements

Based on comprehensive market analysis, yahan hai realistic cost expectations:

Lean Launch Model ($5,000-$15,000/month)

- Basic white label platform

- Offshore legal structure

- Minimal team (1-2 people)

- Digital marketing focus

- Remote operations only

Professional Setup ($15,000-$50,000/month)

- Advanced platform features

- Mid-tier jurisdiction

- Small team (3-5 people)

- Comprehensive marketing

- Professional customer support

Enterprise Launch ($50,000+/month)

- Full regulatory compliance

- Advanced risk management

- Large operational team

- Multi-jurisdiction presence

- Institutional-grade infrastructure

Choosing the Right White Label Provider

Market mein several excellent prop firm white label providers available hain. Based on our evaluation:

Top Recommendations for Beginners:

- Quadcode: Excellent UI/UX, fast deployment (2 weeks)

- B2Broker: Comprehensive features, strong regulatory support

- Leverate: Advanced marketing tools, institutional focus

- MetaQuotes: Industry standard, maximum trader familiarity

Selection Criteria:

- Platform reliability and uptime

- Customization flexibility

- Technical support quality

- Pricing transparency

- Regulatory compliance support

Marketing and Trader Acquisition Strategies

Successful prop firm marketing requires multi-channel approach:

Digital Marketing Essentials

- Search Engine Optimization (SEO)

- Pay-Per-Click advertising (Google, Facebook)

- Content marketing and educational resources

- Influencer partnerships and sponsorships

Community Building

- Discord and Telegram groups

- Educational webinars and workshops

- Trading competitions and challenges

- Affiliate and referral programs

Retention Strategies

- Tiered profit sharing (80-90% for top performers)

- Account scaling opportunities

- Educational resources and mentorship

- Performance incentives and bonuses

Risk Management Best Practices

Prop firm risk management critical success factor hai:

Automated Controls

Manual Oversight

- Daily trading review

- Pattern analysis and detection

- Trader performance evaluation

- Market condition adjustments

Technology Integration and Scalability

Future-proofing your white label prop trading business requires:

Essential Integrations

- Multiple trading platforms (MT4/MT5, cTrader)

- Advanced analytics and reporting

- Automated payment processing

- Customer relationship management (CRM)

Scalability Considerations

- Cloud-based infrastructure

- API-first architecture

- Multi-asset support expansion

- International market capabilities

Common Pitfalls to Avoid

In our analysis, humne identify kiye hain key mistakes jo beginners karte hain:

Technical Mistakes

- Insufficient platform testing before launch

- Poor risk management implementation

- Inadequate customer support systems

- Limited payment method options

Business Mistakes

- Unrealistic profit targets or risk parameters

- Poor marketing strategy execution

- Inadequate capital planning

- Neglecting regulatory requirements

Operational Mistakes

- Insufficient team training

- Poor communication with traders

- Delayed payout processing

- Limited educational resources

Future Trends in Prop Trading Industry

Prop trading industry rapidly evolving hai with several key trends:

Technology Advancement

- AI-powered risk management

- Blockchain integration for transparency

- Advanced analytics and machine learning

- Mobile-first trading platforms

Market Expansion

- Cryptocurrency prop trading growth

- Emerging market penetration

- Institutional adoption increase

- Retail trader education focus

Regulatory Evolution

- Increased oversight in major markets

- Standardization of evaluation processes

- Consumer protection enhancements

- International cooperation frameworks

Frequently Asked Questions

Q: What is the minimum investment required to start a white label prop firm?

A: Based on our research, aap lean model se $5,000-$15,000 per month ke budget mein start kar sakte hain. Yeh includes basic white label platform, offshore legal setup, minimal team, aur digital marketing. However, for sustainable growth, main recommend karunga ki $25,000-$50,000 monthly budget plan karein which covers professional platform features, proper customer support, comprehensive marketing, aur adequate capital reserves. Remember, iska matlab yeh nahi hai ki aapko day one se yeh amount spend karna hoga – aap gradually scale kar sakte hain as your trader base grows.

Q: How long does it typically take to launch a white label prop firm?

A: Industry data shows ki properly planned white label prop firm 2-4 weeks mein launch ho sakta hai. Pehla week planning aur research ke liye, second week provider selection aur initial setup ke liye, third week branding aur platform configuration ke liye, aur fourth week testing aur final preparations ke liye. Yeh timeline assumes ki aapne advance mein legal structure aur compliance requirements plan kar liye hain. In contrast, building from scratch typically takes 12-24 months or more.

Q: What are the main revenue streams for prop trading firms?

A: Prop firms primarily make money through four main streams: Challenge fees range from $100-$5,000 depending on account size – yeh one-time payment traders evaluation ke liye karte hain. Profit sharing constitutes 10-30% of successful traders’ profits – yeh ongoing revenue stream hai. Monthly subscriptions typically $50-$200 per funded account for platform access aur support services. Additional income comes from spreads and commissions on trades. Based on industry averages, challenge fees contribute 60-70% of total revenue for most firms, while profit sharing provides steady long-term income from successful traders.

Q: Do I need special licenses or permits to operate a prop firm?

A: Licensing requirements depend entirely on your jurisdiction aur business model. Many prop firms operate legally without traditional investment licenses by structuring as service providers offering trading evaluations rather than investment management. However, fully regulated operations in jurisdictions like UK (FCA) or Cyprus (CySEC) may require licenses costing $100,000+. For beginners, main suggest karunga starting with offshore entities ($1,500+ setup cost) while consulting legal experts about your specific situation. Key compliance areas include AML/KYC procedures, tax obligations, aur transparent business terms regardless of licensing status.

Q: What makes a successful prop firm different from unsuccessful ones?

A: Successful prop firms excel in three critical areas: First, robust technology infrastructure with reliable platforms, automated risk management, aur excellent user experience. Second, transparent business practices with clear rules, timely payouts, aur fair profit sharing ratios (typically 80-90% for traders). Third, comprehensive trader support including educational resources, responsive customer service, aur gradual account scaling opportunities. Unsuccessful firms often fail due to poor platform stability, delayed payouts, unrealistic trading requirements, ya inadequate risk management leading to capital depletion. Market research shows ki firms focusing on trader success rather than just challenge fees achieve better long-term sustainability.

Conclusion

White label forex prop firm industry presents tremendous opportunity for entrepreneurs looking to enter the financial services sector. With proper planning, right technology partner, aur solid execution strategy, aap weeks mein apna branded prop trading business launch kar sakte hain.

Key takeaways from this comprehensive guide:

- White label solutions dramatically reduce time-to-market aur initial investment requirements

- Proper risk management aur transparent business practices essential hain for long-term success

- Technology selection aur trader support quality directly impact business growth

- Regulatory compliance planning critical hai even for offshore structures

- Multiple revenue streams ensure business sustainability aur profitability

Market data indicates ki prop trading industry expected to grow significantly in coming years, making now ideal time to enter this lucrative sector. Whether you’re existing broker looking to expand services, entrepreneur seeking new venture, ya trading educator wanting additional revenue streams, white label prop firm solution provides viable path to success.

For those ready to take next step, main recommend karunga starting with thorough market research, consulting industry experts, aur partnering with reputable white label providers. Remember, success in this industry requires commitment to trader success, operational excellence, aur continuous improvement.

Agar aapko koi specific sawal hai about starting your white label prop firm ya industry insights chahiye, feel free to comment below! For additional resources and investment opportunities, visit InvestsNow for comprehensive financial guidance aur explore our affiliate partnership program for business development opportunitWhite Label Forex Prop Firm: The Complete Beginner’s Guide to Starting Your Trading Business

Agar aap trading ke duniya mein naya business start karna chahte hain to white label forex prop firm aapke liye ek game-changing opportunity ho sakta hai. In recent years, proprietary trading industry ne tremendous growth dekha hai, aur ab beginners ke liye bhi accessible ho gaya hai thanks to innovative white label solutions.

Iss comprehensive guide mein, main aapko step-by-step bataunga ki white label prop firm kya hota hai, iska business model kaise kaam karta hai, aur aap kaise apna successful prop trading business launch kar sakte hain without breaking the bank. Let’s dive deep into this lucrative industry jo millions of dollars ka revenue generate kar raha hai globally.

What is a White Label Forex Prop Firm?

White label forex prop firm essentially ek ready-made proprietary trading business solution hai jo third-party providers offer karte hain. Iska matlab hai ki aap existing technology, infrastructure, aur trading platforms use kar ke apna branded prop trading firm launch kar sakte hain without building everything from scratch.

Humne market research mein dekha hai ki white label solutions significantly reduce the time-to-market – typically 2-4 weeks compared to 12-24 months for custom development. Yeh approach especially beneficial hai for:

- Existing brokers looking to expand services

- Entrepreneurs with limited capital

- Financial institutions wanting quick market entry

- Trading coaches seeking new revenue streams

White label prop firm dashboard interface displaying key trading metrics

How White Label Prop Trading Works

Samjhiye kaise white label prop firm solution actually operate karta hai:

The Business Model Structure

1. Platform and Infrastructure Provision

White label provider aapko complete trading platform provide karta hai including order execution systems, risk management tools, aur compliance mechanisms. Yeh approach traditional prop firm setup costs ko dramatically reduce kar deta hai.

2. Capital Provision and Management

Provider often capital access facilitate karta hai ya existing financial resources leverage karne mein help karta hai. Iska matlab hai ki aapko millions of dollars ka initial investment nahi chahiye.

3. Revenue Sharing Model

Most white label solutions operate on revenue-sharing basis – aap profits ya trading volume ka percentage provider ko pay karte hain. Yeh alignment ensures both parties have skin in the game.

Key Revenue Streams

Based on our analysis, prop firm business model primarily generates income through:

- Challenge Fees: $100-$5,000 per evaluation depending on account size

- Profit Sharing: 10-30% of trader profits

- Monthly Subscriptions: $50-$200 per funded account

- Spreads and Commissions: Additional transaction-based income

Profit sharing model infographic for prop trading firms

White Label vs. Building From Scratch: The Smart Choice

Humne industry experts se baat ki hai aur data clearly shows ki white label approach significantly more practical hai for beginners:

Essential Features of White Label Prop Firm Solutions

Jab aap white label prop trading platform choose kar rahe hain, yeh features absolutely essential hain:

Trading Platform Integration

- MetaTrader 4/5, cTrader compatibility

- Multi-asset support (forex, commodities, indices)

- Mobile and web accessibility

- Professional charting tools

Risk Management Automation

- Real-time position monitoring

- Auto-liquidation upon risk breaches

- Daily drawdown limits

- Dynamic leverage adjustments

Custom Branding Capabilities

- Complete UI/UX customization

- Branded trader dashboards

- Custom domain and SSL

- Personalized challenge structures

Administrative Backend

- Comprehensive CRM system

- Automated KYC/AML processes

- Payment gateway integration

- Performance analytics and reporting

Prop firm evaluation process flowchart from challenge to funded account

Step-by-Step Guide to Launch Your White Label Prop Firm

Based on humara extensive research aur industry consultations, yahan hai complete roadmap:

Phase 1: Planning and Research (Week 1)

1. Define Your Target Market

- Beginner traders, experienced professionals, ya specific regions

- Identify unique selling propositions

- Research competitor offerings and pricing

2. Choose Business Structure

- Legal entity setup ($1,500-$15,000 depending on jurisdiction)

- Regulatory compliance planning

- Banking and payment processing arrangements

Phase 2: Technology Setup (Week 2-3)

3. Select White Label Provider

Leading options include Quadcode, B2Broker, aur Leverate. Consider:

- Platform features and customization options

- Pricing structure and revenue sharing

- Technical support and maintenance

- Integration capabilities

4. Platform Configuration

- Custom branding implementation

- Challenge rules and profit targets setup

- Risk parameters configuration

- Payment methods integration

Phase 3: Launch Preparation (Week 3-4)

5. Marketing Strategy Development

- Website development and SEO optimization

- Social media presence establishment

- Content marketing and educational resources

- Affiliate program setup

6. Team Assembly

Essential roles include:

- Customer support representatives

- Risk management specialists

- Marketing and business development

- Compliance officer (for regulated jurisdictions)

Phase 4: Go-Live and Optimization (Ongoing)

7. Soft Launch with Beta Testing

- Limited trader onboarding

- System testing and optimization

- Feedback collection and improvements

8. Full Market Launch

- Comprehensive marketing campaign

- Trader acquisition and retention programs

- Continuous platform optimization

Understanding Prop Firm Evaluation Models

Prop firm evaluation process typically follows standardized structures designed to identify profitable traders:

One-Step Challenge

- Single phase evaluation

- 8-10% profit target within 30-60 days

- 4-6% daily drawdown limit

- 5-10% overall drawdown limit

- Fastest path to funding for skilled traders

Two-Step Challenge

- Initial evaluation phase (Phase 1)

- Verification phase (Phase 2)

- Lower profit targets in Phase 2 (typically 5%)

- Enhanced risk management demonstration

- More comprehensive trader assessment

Three-Step Challenge

- Most thorough evaluation process

- Progressive difficulty levels

- Extended demonstration period

- Higher capital allocation potential

Regulatory Considerations and Compliance

Prop firm regulations vary significantly by jurisdiction, but key considerations include:

Core Compliance Requirements

- Anti-Money Laundering (AML) procedures

- Know Your Customer (KYC) implementation

- Financial licensing (where applicable)

- Tax reporting and obligations

Jurisdiction Selection Factors

Popular locations for prop firm incorporation include:

- Offshore Entities: Lower compliance costs ($1,500+ setup)

- Mid-Tier Jurisdictions: Moderate regulation ($15,000+ setup)

- Fully Regulated: CySEC, FCA approval ($100,000+ investment)

In my experience, aur humne dekha hai ki many successful prop firms start with offshore structures aur gradually move to more regulated jurisdictions as they scale.

Success Stories and Market Potential

Real success stories industry mein inspire karte hain. For example, Trader Kane achieved over $3 million in payouts with his largest single payout exceeding $1.8 million. Similarly, Arsh turned $60 into over $30,000 through disciplined trading and proper risk management.

Yeh examples demonstrate ki both traders aur prop firm operators can achieve substantial success when proper systems aur strategies are in place.

Cost Breakdown and Investment Requirements

Based on comprehensive market analysis, yahan hai realistic cost expectations:

Lean Launch Model ($5,000-$15,000/month)

- Basic white label platform

- Offshore legal structure

- Minimal team (1-2 people)

- Digital marketing focus

- Remote operations only

Professional Setup ($15,000-$50,000/month)

- Advanced platform features

- Mid-tier jurisdiction

- Small team (3-5 people)

- Comprehensive marketing

- Professional customer support

Enterprise Launch ($50,000+/month)

- Full regulatory compliance

- Advanced risk management

- Large operational team

- Multi-jurisdiction presence

- Institutional-grade infrastructure

Choosing the Right White Label Provider

Market mein several excellent prop firm white label providers available hain. Based on our evaluation:

Top Recommendations for Beginners:

- Quadcode: Excellent UI/UX, fast deployment (2 weeks)

- B2Broker: Comprehensive features, strong regulatory support

- Leverate: Advanced marketing tools, institutional focus

- MetaQuotes: Industry standard, maximum trader familiarity

Selection Criteria:

- Platform reliability and uptime

- Customization flexibility

- Technical support quality

- Pricing transparency

- Regulatory compliance support

Marketing and Trader Acquisition Strategies

Successful prop firm marketing requires multi-channel approach:

Digital Marketing Essentials

- Search Engine Optimization (SEO)

- Pay-Per-Click advertising (Google, Facebook)

- Content marketing and educational resources

- Influencer partnerships and sponsorships

Community Building

- Discord and Telegram groups

- Educational webinars and workshops

- Trading competitions and challenges

- Affiliate and referral programs

Retention Strategies

- Tiered profit sharing (80-90% for top performers)

- Account scaling opportunities

- Educational resources and mentorship

- Performance incentives and bonuses

Risk Management Best Practices

Prop firm risk management critical success factor hai:

Automated Controls

Manual Oversight

- Daily trading review

- Pattern analysis and detection

- Trader performance evaluation

- Market condition adjustments

Technology Integration and Scalability

Future-proofing your white label prop trading business requires:

Essential Integrations

- Multiple trading platforms (MT4/MT5, cTrader)

- Advanced analytics and reporting

- Automated payment processing

- Customer relationship management (CRM)

Scalability Considerations

- Cloud-based infrastructure

- API-first architecture

- Multi-asset support expansion

- International market capabilities

Common Pitfalls to Avoid

In our analysis, humne identify kiye hain key mistakes jo beginners karte hain:

Technical Mistakes

- Insufficient platform testing before launch

- Poor risk management implementation

- Inadequate customer support systems

- Limited payment method options

Business Mistakes

- Unrealistic profit targets or risk parameters

- Poor marketing strategy execution

- Inadequate capital planning

- Neglecting regulatory requirements

Operational Mistakes

- Insufficient team training

- Poor communication with traders

- Delayed payout processing

- Limited educational resources

Future Trends in Prop Trading Industry

Prop trading industry rapidly evolving hai with several key trends:

Technology Advancement

- AI-powered risk management

- Blockchain integration for transparency

- Advanced analytics and machine learning

- Mobile-first trading platforms

Market Expansion

- Cryptocurrency prop trading growth

- Emerging market penetration

- Institutional adoption increase

- Retail trader education focus

Regulatory Evolution

- Increased oversight in major markets

- Standardization of evaluation processes

- Consumer protection enhancements

- International cooperation frameworks

Frequently Asked Questions

Q: What is the minimum investment required to start a white label prop firm?

A: Based on our research, aap lean model se $5,000-$15,000 per month ke budget mein start kar sakte hain. Yeh includes basic white label platform, offshore legal setup, minimal team, aur digital marketing. However, for sustainable growth, main recommend karunga ki $25,000-$50,000 monthly budget plan karein which covers professional platform features, proper customer support, comprehensive marketing, aur adequate capital reserves. Remember, iska matlab yeh nahi hai ki aapko day one se yeh amount spend karna hoga – aap gradually scale kar sakte hain as your trader base grows.

Q: How long does it typically take to launch a white label prop firm?

A: Industry data shows ki properly planned white label prop firm 2-4 weeks mein launch ho sakta hai. Pehla week planning aur research ke liye, second week provider selection aur initial setup ke liye, third week branding aur platform configuration ke liye, aur fourth week testing aur final preparations ke liye. Yeh timeline assumes ki aapne advance mein legal structure aur compliance requirements plan kar liye hain. In contrast, building from scratch typically takes 12-24 months or more.

Q: What are the main revenue streams for prop trading firms?

A: Prop firms primarily make money through four main streams: Challenge fees range from $100-$5,000 depending on account size – yeh one-time payment traders evaluation ke liye karte hain. Profit sharing constitutes 10-30% of successful traders’ profits – yeh ongoing revenue stream hai. Monthly subscriptions typically $50-$200 per funded account for platform access aur support services. Additional income comes from spreads and commissions on trades. Based on industry averages, challenge fees contribute 60-70% of total revenue for most firms, while profit sharing provides steady long-term income from successful traders.

Q: Do I need special licenses or permits to operate a prop firm?

A: Licensing requirements depend entirely on your jurisdiction aur business model. Many prop firms operate legally without traditional investment licenses by structuring as service providers offering trading evaluations rather than investment management. However, fully regulated operations in jurisdictions like UK (FCA) or Cyprus (CySEC) may require licenses costing $100,000+. For beginners, main suggest karunga starting with offshore entities ($1,500+ setup cost) while consulting legal experts about your specific situation. Key compliance areas include AML/KYC procedures, tax obligations, aur transparent business terms regardless of licensing status.

Q: What makes a successful prop firm different from unsuccessful ones?

A: Successful prop firms excel in three critical areas: First, robust technology infrastructure with reliable platforms, automated risk management, aur excellent user experience. Second, transparent business practices with clear rules, timely payouts, aur fair profit sharing ratios (typically 80-90% for traders). Third, comprehensive trader support including educational resources, responsive customer service, aur gradual account scaling opportunities. Unsuccessful firms often fail due to poor platform stability, delayed payouts, unrealistic trading requirements, ya inadequate risk management leading to capital depletion. Market research shows ki firms focusing on trader success rather than just challenge fees achieve better long-term sustainability.

Conclusion

White label forex prop firm industry presents tremendous opportunity for entrepreneurs looking to enter the financial services sector. With proper planning, right technology partner, aur solid execution strategy, aap weeks mein apna branded prop trading business launch kar sakte hain.

Key takeaways from this comprehensive guide:

- White label solutions dramatically reduce time-to-market aur initial investment requirements

- Proper risk management aur transparent business practices essential hain for long-term success

- Technology selection aur trader support quality directly impact business growth

- Regulatory compliance planning critical hai even for offshore structures

- Multiple revenue streams ensure business sustainability aur profitability

Market data indicates ki prop trading industry expected to grow significantly in coming years, making now ideal time to enter this lucrative sector. Whether you’re existing broker looking to expand services, entrepreneur seeking new venture, ya trading educator wanting additional revenue streams, white label prop firm solution provides viable path to success.

For those ready to take next step, main recommend karunga starting with thorough market research, consulting industry experts, aur partnering with reputable white label providers. Remember, success in this industry requires commitment to trader success, operational excellence, aur continuous improvement.

Agar aapko koi specific sawal hai about starting your white label prop firm ya industry insights chahiye, feel free to comment below! For additional resources and investment opportunities, visit InvestsNow for comprehensive financial guidance aur explore our affiliate partnership program for business development opportunities.ies.