Top 5 Crypto Coins to Invest in 2025 for Huge Returns

Top 5 Crypto Coins: Beginners ke liye Complete Guide 2025

Crypto market mein invest karne ka sochte time, agar aap naya hai to sabse pehle ye janna zaroori hai ki Top 5 Crypto Coins kaun se hain aur kyun ye 2025 mein best investment opportunities provide kar rahe hain. Humne apne experience ke basis pe dekha hai ki jitne bhi successful crypto investors hain, ve sab ne ek systematic approach follow kiya hai – sirf hype ke basis pe investment nahi kiya.

Cryptocurrency market dashboard showing top 5 crypto coins with price analysis

October 2025 mein crypto market ne “Uptober” rally dikhayi hai, jismein Bitcoin 119,000$$ ko paar kar gaya hai aur total market cap 4.23 trillion$$ ko cross kar gaya. Iske saath hi institutional investors ka confidence bhi badha hai, jisse beginners ke liye ye perfect timing ban gayi hai crypto journey start karne ki.zebpay+1

Is detailed guide mein hum aapko Top 5 Crypto Coins ke bare mein complete information denge – unki technology se lekar investment strategy tak. Humara goal hai ki aap confident decision le saken aur common mistakes se bach saken.

Cryptocurrency Kya Hai – Beginners ke liye Basic Understanding

Cryptocurrency basically ek digital currency hai jo blockchain technology pe based hai. Traditional banking system ke unlike, ye decentralized network pe operate karti hai – matlab koi single authority ya central bank iske control mein nahi hai.mintos

Blockchain Technology kaise kaam karti hai:

- Har transaction cryptographically secure hoti hai

- Transactions distributed ledger pe record hoti hain

- Network ke nodes consensus mechanism se transactions verify karte hain

- Proof of Work (PoW) ya Proof of Stake (PoS) se security maintain hoti haiyouhodler

Humne dekha hai ki jo log cryptocurrency ko sirf “internet money” samajhte hain, ve aksar galat decisions lete hain. Reality ye hai ki crypto ek complete financial ecosystem hai jismein smart contracts, DeFi protocols, aur real-world applications included hain.

Current Crypto Market Analysis – October 2025

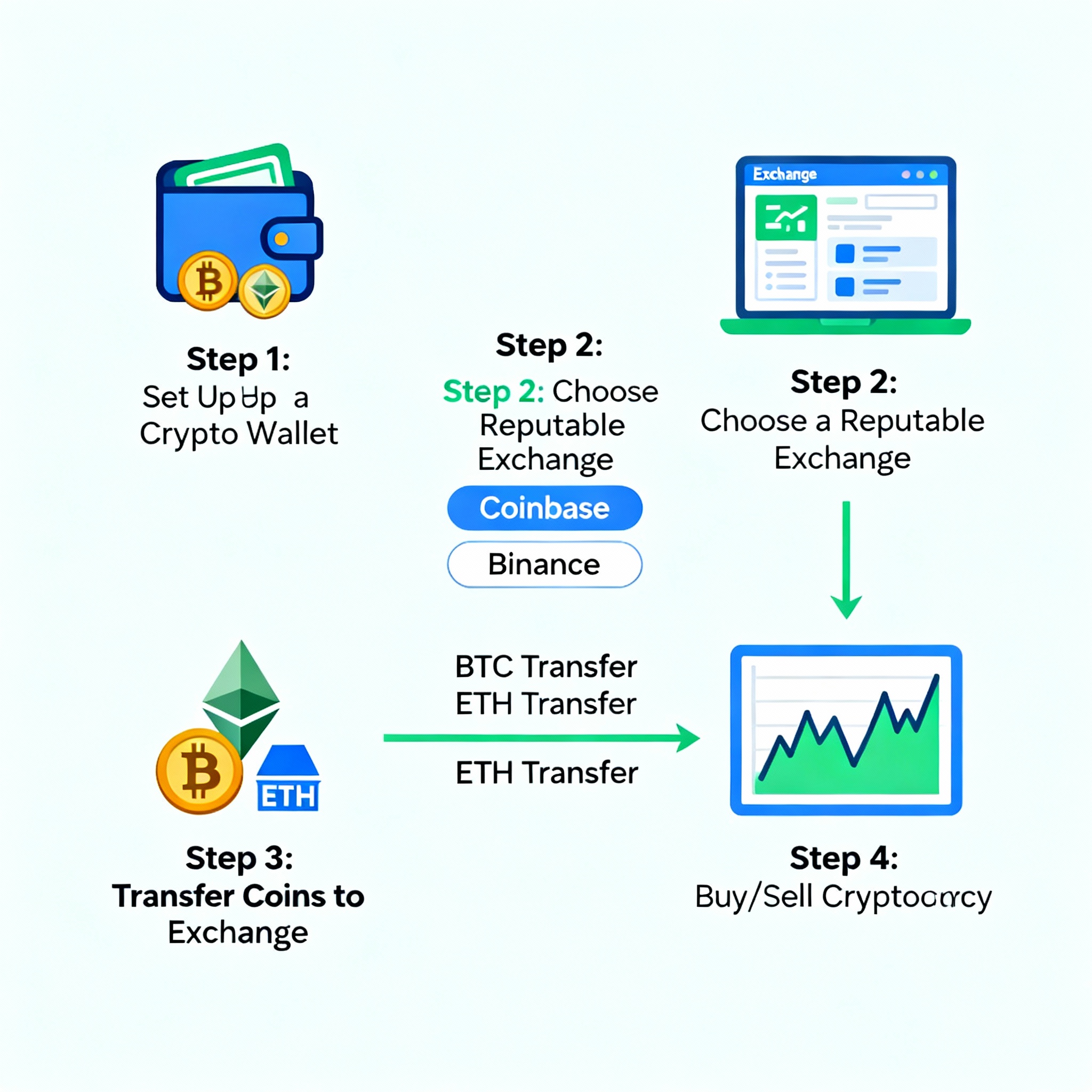

Step-by-step cryptocurrency investment guide for beginners with wallet and exchange illustrations

Market ki current situation:

- Total crypto market cap: ₹35,00,000 crores (approx $4.23 trillion)economictimes+1

- 24-hour trading volume: ₹18,00,000 crores (approx $215 billion)finance.yahoo

- Bitcoin dominance: 58% market share maintain kar raha haicoinmarketcap

- Top 100 coins mein se 98 coins green mein trading kar rahi hainfinance.yahoo

“Uptober” Phenomenon ka Impact:

October historically crypto ke liye bullish month raha hai, aur 2025 mein bhi ye trend continue hai. Bitcoin ne 7 out of last 10 Octobers mein positive returns diye hain. Is year bhi Bitcoin $119,000 cross kar gaya hai, jo August ke lows se significant recovery hai.business-standard+2

Institutional Interest:

- US Bitcoin ETFs mein $675 million daily inflows aa rahe hainfinance.yahoo

- Ethereum ETFs mein $80.79 million weekly inflows recordedfinance.yahoo

- BlackRock aur Fidelity jaise major firms actively crypto space mein invest kar rahe hainfinance.yahoo

Top 5 Crypto Coins 2025 – Detailed Analysis

1. Bitcoin (BTC) – Digital Gold ka King

Current Price: $119,000 (₹99,50,000 approx)zebpay+1

Market Cap: $2.36 trillioncoincentral

24h Change: +3.7%finance.yahoo

Bitcoin kyun hai #1 choice beginners ke liye:

Bitcoin ko “digital gold” kehte hain kyunki iske paas limited supply (21 million coins) hai aur ye inflation hedge ka kaam karta hai. Humne dekha hai ki jitne bhi crypto investors successful bane hain, sabne Bitcoin se start kiya hai.

Technical Analysis:

- Resistance levels: $120,000 aur $125,000economictimes

- Support levels: $115,500 aur $117,000economictimes

- RSI: Currently 65, indicating healthy momentumtechfinancials

Price Predictions 2025:

- Short-term (October 2025): $115,700 – $129,900 rangeeconomictimes+1

- Year-end target: $150,000 – $170,000 expert predictionschangelly+1

- Conservative average: $124,467 for Octoberchangelly

Investment Strategy for Beginners:

Based on our experience, Bitcoin mein Dollar Cost Averaging (DCA) strategy sabse safe hai. Monthly $50-100 invest karne se market volatility ka impact kam hota hai.materialbitcoin

2. Ethereum (ETH) – Smart Contracts ka Ecosystem

Current Price: $4,399 (₹3,68,000 approx)finance.yahoo+1

Market Cap: $518.74 billionzebpay

24h Change: +6.3%finance.yahoo

Ethereum ki Unique Value Proposition:

Ethereum sirf currency nahi hai – ye ek complete platform hai jahan smart contracts, DeFi protocols, aur NFTs operate karte hain. EIP-4844 upgrade ke baad gas fees reduce ho gayi hain aur transaction speed badh gayi hai.mintos+1

Recent Developments:

- Pectra upgrade (May 2025) se Layer-2 app development easy ho gayamoney

- BlackRock aur other institutions ethereum infrastructure use kar rahe hain traditional assets ko tokenize karne ke liyemoney

- Ethereum ETFs mein institutional interest badh raha haimoney

Technical Outlook:

- Support: $4,236 (50-day EMA)fxstreet

- Resistance: $4,500 – $4,750fxstreet

- MACD: Buy signal activefxstreet

Why Beginners Should Consider ETH:

Ethereum ecosystem mein maximum innovation ho rahi hai. Agar aap long-term wealth creation chahte hain, to ETH ka exposure zaroori hai portfolio mein.

3. Solana (SOL) – High-Speed Blockchain Leader

Current Price: $223 (₹1,86,000 approx)finance.yahoo+1

Market Cap: $125.84 billionzebpay

6-month Performance: +83.09%techfinancials

Solana ki Speed aur Efficiency:

Solana ko “Ethereum Killer” kehte hain kyunki ye per second 65,000+ transactions process kar sakta hai, jabki Ethereum sirf 15 transactions kar sakta hai. Transaction fees bhi extremely low hain – typically $0.00025 per transaction.money+1

Key Innovations:

- Firedancer validator client se network reliability dramatically improve hui haimoney

- Solana Pay integration with Shopify real-world adoption badha raha haimoney

- DeFi aur NFT ecosystem rapidly growinginvestopedia

Technical Analysis:

- Current range: $188.99 – $234.99techfinancials

- Next targets: $259, then $305techfinancials

- RSI: 65 (healthy buying momentum)techfinancials

- Support levels: $167.03, deeper at $121.03techfinancials

Risk-Reward for Beginners:

Solana high-risk, high-reward category mein aata hai. Portfolio ka 10-15% allocation reasonable hai experienced guidance ke saath.

4. XRP (Ripple) – Cross-Border Payments ka Future

Current Price: $2.88 (₹2,41,000 approx)zebpay+1

Market Cap: $177 billioncoincentral

6-month Performance: +40.27%techfinancials

XRP ka Real-World Use Case:

XRP specially cross-border payments ke liye design kiya gaya hai. Traditional SWIFT system se 3-5 days lagti hain international transfers mein, lekin XRP sirf 7 seconds mein complete ho jati hai.mintos+1

Recent Regulatory Clarity:

After years of SEC legal battle, XRP ab regulatory clarity mil gayi hai. RippleNet partnerships global banks ke saath expand ho rahi hain.money+1

Technical Outlook:

- Current support: $2.93 (50-day EMA)fxstreet

- Resistance levels: $3.18, then $3.66fxstreet

- RSI: 57 with gradual uptrendfxstreet

Long-term Potential:

Some experts predict ki XRP 2030 tak Bitcoin ko surpass kar sakta hai market cap mein, though ye highly ambitious prediction hai.coincentral

5. Binance Coin (BNB) – Exchange Ecosystem Token

Current Price: $1,034 (₹86,500 approx)zebpay

Market Cap: $143.92 billionzebpay

BNB ki Utility aur Demand:

BNB sirf trading fee discount ke liye nahi – ye complete Binance Smart Chain (BSC) ecosystem power karta hai. DeFi protocols, gaming, aur NFT platforms BNB use karte hain.mintos+1

Key Benefits:

- Trading fee discount up to 25% on Binance exchange

- Launchpad access for new token offerings

- BSC network gas fees for smart contracts

- Quarterly token burns supply ko reduce karte hain

Cryptocurrency Investment Strategies for Beginners

1. Dollar Cost Averaging (DCA) Strategy

DCA kya hai aur kaise kaam karta hai:

DCA matlab regular intervals pe fixed amount invest karna, regardless of price. Ye strategy market timing ka pressure remove kar deti hai.materialbitcoin+1

Practical Example:

- Monthly ₹10,000 Bitcoin mein invest करें

- Price high ho ya low, amount same रखें

- 6-12 months mein average cost nikle ga

- Emotional decisions avoid hongematerialbitcoin

Benefits:

- Risk mitigation through price averaging

- Disciplined approach without market timing stress

- Lower impact of volatility

- Beginner-friendly strategyzignaly

2. Portfolio Diversification Strategy

Crypto Portfolio Allocation for Beginners:

Industry experts recommend 5-10% of total portfolio crypto mein allocate करना. Humara suggested allocation:angelone+1

- Bitcoin (40-50%): Stability ke liye

- Ethereum (25-30%): Growth potential

- Altcoins (15-20%): SOL, XRP, BNB

- Stablecoins (5-10%): Liquidity ke liyematerialbitcoin

3. HODLing vs Trading

Long-term HODLing Benefits:

- Lower stress levels

- Reduced fees compared to frequent trading

- Tax advantages on long-term holdings

- Historical outperformance vs short-term tradingmaterialbitcoin

Case Study: Agar aapne 2015 mein ₹30,000 ka Bitcoin खरीदा होता, to 2025 mein vo ₹3.5 crores ke around होता.materialbitcoin

Crypto Wallet Security – Apke Funds ko Safe रखना

Cold wallet vs hot wallet security comparison for cryptocurrency storage

Hot Wallets vs Cold Wallets

Hot Wallets (Online Wallets):

- Mobile apps like Trust Wallet, Coinbase Wallet

- Exchange wallets like WazirX, CoinSwitch

- Browser extensions like MetaMask

- Pros: Easy access, convenient for trading

- Cons: Online threats, hacking riskszimperium+1

Cold Wallets (Hardware Wallets):

- Ledger Nano S/X, Trezor physical devices

- Paper wallets with printed private keys

- Pros: Maximum security, offline storage

- Cons: Less convenient, physical loss risk1finance+1

Security Best Practices

Essential Security Measures:

- Strong Passwords aur 2FA:

- 12+ character complex passwords

- Two-Factor Authentication everywhere enable करें

- Biometric locks jahan available होzimperium+1

- Seed Phrase Security:

- 24-word recovery phrase safely store करें

- Multiple copies different locations पे

- Never digital storage – paper/metal पे लिखें1finance+1

- Phishing Protection:

- Official websites से ही access करें

- URLs carefully verify करें

- Suspicious emails/links avoid करेंeccu+1

- Transaction Verification:

- Small test amounts भेजने से पहले

- Recipient address double-check करें

- Gas fees reasonable होंhackernoon

Step-by-Step Investment Process for Indian Beginners

Step 1: KYC aur Exchange Selection

Top Indian Crypto Exchanges:

- WazirX: User-friendly interface, INR deposits

- CoinSwitch Kuber: Good for beginners

- Zebpay: Established platform with good securityangelone

KYC Requirements:

- Aadhaar Card verification

- PAN Card mandatory

- Bank account linking

- Selfie verificationgroww+1

Step 2: Fund Transfer aur First Purchase

Banking Process:

- IMPS/UPI se instant transfer

- NEFT/RTGS for larger amounts

- Minimum investment: Usually ₹100

- Transaction fees: 0.1% – 1% typicallyangelone

Step 3: Wallet Setup aur Security

Initial Setup:

- Exchange wallet initially use करें

- Small amounts के लिए sufficient

- Larger investments के लिए hardware wallet

- Backup recovery phrases properlyangelone+1

Tax Implications aur Legal Aspects in India

Current Tax Structure (2025):

- 30% tax on crypto profits

- 1% TDS on all transactions above ₹10,000

- No offset of losses against other income

- Gift tax applicable on crypto transfersangelone

Compliance Best Practices:

- Maintain detailed records of all transactions

- Calculate profits/losses accurately

- File ITR properly with crypto income

- Consult CA for complex situations

Risk Management aur Common Mistakes to Avoid

Major Risks in Crypto Investment

Market Risks:

- Extreme volatility – prices can swing 20-50% daily

- Regulatory changes affecting market sentiment

- Technology risks like network failuresquppy

Security Risks:

- Exchange hacks resulting in fund loss

- Phishing attacks targeting private keys

- Lost access to wallets without backupzimperium

Common Beginner Mistakes

- FOMO Investing: Hype के basis पे buying

- Leverage Trading: Borrowed money से investment

- No Research: Fundamental analysis skip करना

- Emotional Decisions: Panic selling in dipsquppy

Risk Mitigation Strategies:

- Never invest more than you can afford to lose

- Diversify across multiple cryptocurrencies

- Start small and gradually increase exposure

- Education first, investment secondquppy

Market Analysis Tools aur Resources

Technical Analysis Basics

Key Indicators for Beginners:

- RSI (Relative Strength Index): Overbought/oversold levels

- MACD: Trend confirmation

- Moving Averages: Support/resistance levels

- Volume Analysis: Market participationyoutube

Recommended Resources

News aur Analysis:

- CoinDesk, CoinTelegraph for daily news

- Glassnode for on-chain analytics

- TradingView for technical charts

- InvestsNow for Indian market insights

YouTube Channels for Learning:

- Cryptocurrency education channelsyoutube

- Technical analysis tutorials

- Market update videos

Future Outlook aur Price Predictions

Short-term Predictions (Q4 2025)

Bitcoin Outlook:

- October targets: $121,000 – $129,900economictimes+1

- Year-end projection: $150,000 – $170,000economictimes

- Key resistance: $125,000 leveleconomictimes

Altcoin Projections:

- Ethereum: $4,500 – $5,000 possiblefxstreet

- Solana: $270 target in “Uptober”cryptodnes

- XRP: Breaking $3.18 could lead to $3.66fxstreet

Long-term Vision (2026-2030)

Industry Transformation:

- Central Bank Digital Currencies (CBDCs) mainstream adoption

- DeFi protocols replacing traditional banking

- NFTs aur Metaverse integration

- Institutional custody solutions improvingmoney

Investment Thesis:

Crypto market ने अभी तक sirf 4-5% global population को reach kiya है. Mass adoption के साथ market cap $10-20 trillion तक जा सकती है next 5 years में.bravenewcoin

Frequently Asked Questions

Q: Crypto mein invest karne ke liye minimum kitna paisa chahiye?

A: Indian exchanges पे aap sirf ₹100 से start kar sakte hain. हमारी recommendation है कि beginners ₹5,000-10,000 से शुरुआत करें और धीरे-धीरे portfolio बढ़ाएं। Industry experts suggest करते हैं कि total portfolio का maximum 5-10% ही crypto में invest करें initially. Ye amount ऐसी होनी चाहिए जिसे lose करने से aapकी financial stability पर impact ना पड़े। DCA strategy use करके monthly ₹2,000-5,000 invest करना एक practical approach है beginners के लिए।angelone+1

Q: Bitcoin aur Ethereum mein se kaun sa better hai beginners के लिए?

A: Beginners के लिए हमारी recommendation है 70% Bitcoin, 30% Ethereum का allocation. Bitcoin zyada stable hai और “digital gold” का status achieve कर चुका है, जबकि Ethereum में innovation और growth potential zyada है smart contracts की वजह से. Bitcoin का market dominance 58% है और institutional investors की first choice है, इसलिए volatility comparatively कम है। Ethereum का ecosystem DeFi, NFTs, और Web3 applications power करता है, जो future growth के लिए promising है. Both coins ka long-term track record good है, लेकिन portfolio risk management के लिए diversification important है।mintos+2

Q: Crypto investment में tax कैसे calculate करें India में?

A: India में crypto taxation बहुत clear-cut है – 30% flat tax सभी crypto profits पर applicable है, चाहे short-term हो या long-term. साथ ही 1% TDS भी deduct होता है ₹10,000 से ऊपर के सभी transactions पर। Important बात ये है कि crypto losses को किसी और income के against offset नहीं कर सकते। Detailed record keeping करना जरूरी है – हर buy/sell transaction, dates, amounts, exchange rates सब maintain करें। Cost of acquisition, cost of improvement, और sale consideration properly calculate करके net profit/loss निकालें। Professional CA से consult करना advisable है complex cases में।angelone

Q: Cold wallet aur hot wallet mein kya difference है aur kaun sa use करना चाहिए?

A: Hot wallets internet से connected रहते हैं (mobile apps, exchange wallets) जो convenient हैं daily transactions के लिए लेकिन security risk zyada है. Cold wallets offline storage provide करते हैं (hardware wallets like Ledger, Trezor) जो maximum security देते हैं लेकिन less convenient हैं. हमारी strategy है – daily trading के लिए hot wallet में 10-20% funds रखें और long-term holdings के लिए cold wallet में 80-90% funds store करें. Beginners initially exchange wallets use कर सकते हैं छोटी amounts के लिए, लेकिन ₹1 lakh से ऊपर के investments के लिए hardware wallet जरूरी है। Seed phrase security most critical aspect है – 24-word recovery phrase को safely store करें multiple physical locations पर।zimperium+2

Q: Market volatility के time कैसे handle करें emotions को?

A: Crypto market में 20-50% daily swings normal हैं, इसलिए emotional discipline most important skill है. DCA strategy follow करने से market timing का pressure eliminate हो जाता है – regular intervals पे fixed amount invest करते रहें regardless of price. HODL mentality develop करें – historical data shows कि long-term holders सबसे ज्यादा profitable रहे हैं। Stop-loss orders set करें अगर आप active trading कर रहे हैं, लेकिन beginners के लिए long-term investment approach better है। Portfolio tracking ज्यादा frequent ना करें – daily price checking से anxiety बढ़ती है। Diversification करें different coins में और never invest emergency funds या borrowed money. Education continue करते रहें market fundamentals के बारे में, जिससे confident decisions ले सकें।materialbitcoin+2

Conclusion: Apka Crypto Journey शुरू करने का Time

Top 5 Crypto Coins – Bitcoin, Ethereum, Solana, XRP, और BNB – में currently strong fundamentals और growth potential है 2025-26 के लिए. Market की “Uptober” rally aur institutional adoption के साथ, ye perfect timing है beginners के लिए crypto space में entry करने की.

Key Takeaways for Beginners:

- Start small – Portfolio का 5-10% से शुरुआत करेंquppy

- DCA strategy use करें market timing stress avoid करने के लिएmaterialbitcoin

- Security first – Proper wallet setup aur seed phrase backup जरूरीzimperium

- Continuous learning – Market fundamentals समझना long-term success के लिए importantyoutube

- Diversification – Single coin में सब कुछ invest ना करेंmaterialbitcoin

Immediate Action Steps:

- KYC complete करें trusted Indian exchange पर

- Small investment (₹5,000-10,000) से start करें

- Bitcoin aur Ethereum combination से begin करें

- Security measures properly implement करें

- Monthly SIP setup करें gradual exposure के लिए

Crypto investment एक marathon है, sprint नहीं. Patience, discipline, aur proper education के साथ आप इस emerging asset class से significant wealth creation कर सकते हैं.

Affiliate Link: Crypto investment start करने के लिए professional guidance यहाँ लें.

More Resources: Advanced investment strategies aur market analysis के लिए InvestsNow visit करें.

Agar aapko कोई specific sawal है crypto investment के बारे में, तो comment करें! Humara goal है कि aap confident aur informed decisions ले सकें apni financial journey में.