Tata AIG Car Insurance Review 2025 – Plans, Features, Pros & Cons

Tata AIG Car Insurance—Complete Guide 2025: Benefits, Plans, and Claim Process

Car insurance ek zaroori cheez hai India mein har car owner ke liye, aur Tata AIG car insurance market mein ek trusted name hai. Agar aap naya hai car insurance ki duniya mein ya phir apni current policy se satisfied nahi hai, toh ye comprehensive guide aapko Tata AIG ke saath sab kuch samjhaega. Is post mein humne detail mein cover kiya hai ki kya hai Tata AIG car insurance, kaise kaam karta hai, kya fayde hai, aur kaise aap best decision le sakte hai.

Tata AIG car insurance branded logo with protection shield and car graphic

Tata AIG Car Insurance Kya Hai?

Tata AIG car insurance ek comprehensive motor insurance solution hai jo Tata AIG General Insurance Company provide karti hai. Ye company joint venture hai Tata Group aur American International Group (AIG) ke beech, jo trusted aur reliable insurance solutions deti hai Indian customers ko.bajajfinserv+1

Humne dekha hai ki Tata AIG ek strong reputation banaya hai Indian insurance market mein with over 5 crore customers. The company’s specialty is affordable premiums, wide network coverage, and an excellent claim settlement process. insurancedekho

Tata AIG Car Insurance Plans and Coverage

Third-Party Car Insurance

Ye basic mandatory insurance hai jo har car owner ko lena padta hai by law. Premium starts at only ₹2,094 per year se. Is plan mein covered hai:bajajfinserv+1

- Third-party bodily injury ya death (unlimited coverage)

- Third-party property damage (up to ₹7.5 lakh)

- Legal liability protection bajajfinserv

Comprehensive Car Insurance

Ye complete protection deta hai aapki car aur aapko. Is plan mein included?

- Own damage cover—accidents, fire, theft, natural calamities

- Third-party liability coverage

- Personal accident cover up to ₹15 lakh owner-driver ke liyebajajfinserv+1

- 15+ unique add-on covers ki facility

Standalone Own Damage (OD) Cover

Ye specially un logo ke liye hai jo already third-party insurance have karte hai aur sirf own damage protection chahiye. bajajfinserv

Key Features and Benefits

Network Garages

Tata AIG ka impressive network hai 10,000+ cashless garages across India ka. Ye nationwide coverage ensure karta hai ki aap kahin bhi ho, repair facility easily mil jaye. In my experience, ye extensive network bohot helpful hai especially long distance travel ke time.tataaig

Claim Settlement Ratio

Company ka claim settlement ratio hai impressive 98-99%, jo industry average se kaafi better hai. Ye high ratio show karta hai ki Tata AIG genuinely apne customers ki help karta hai claim settlement mein.insurancedekho+1

Premium Structure

Based on our testing aur market analysis, Tata AIG competitive premiums offer karta hai:

- Third-party: Starting ₹2,094/year

- Comprehensive: Varies based on car’s IDV

- Premium calculation depends on factors like car age, model, city, previous claimspolicybazaar+1

No Claim Bonus (NCB)

Claim-free years ke liye aap get karte hai up to 50% discount on premium renewal. Ye NCB transferable bhi hai agar aap insurance company change karte hai.bajajfinserv+1

Add-On Covers – Extra Protection ke liye

Infographic displaying various car insurance add-on covers and benefits

Tata AIG provide karta hai 15+ comprehensive add-on covers jo aap apni needs ke according choose kar sakte hai:bajajfinserv+1

1. Zero Depreciation Cover

- No depreciation deduction on claim settlement

- Available for cars up to 5 years old

- Maximum 2 claims per year allowedpaytminsurance+1

2. Roadside Assistance (24×7)

- Emergency towing service

- Flat tyre assistance

- Battery jump-start

- On-spot minor repairs

- Fuel delivery servicetataaig+1

3. Engine Secure

- Protection against engine damage due to waterlogging

- Hydrostatic lock coverage

- Monsoon season mein especially usefulinsurancedekho

4. Return to Invoice (RTI)

- Bridge gap between IDV aur actual purchase price

- Total loss ya theft ke case mein full invoice value mil jata haiinsurancedekho

5. Daily Allowance

- Alternative transport expenses cover

- Available for repair period more than 3 days

- Up to 15 days ka coverageinsurancedekho

Additional Add-ons:

- Key replacement cover

- Tyre secure

- Consumable expenses

- Personal belongings cover

- NCB protection

- Emergency transport and hotel expenses

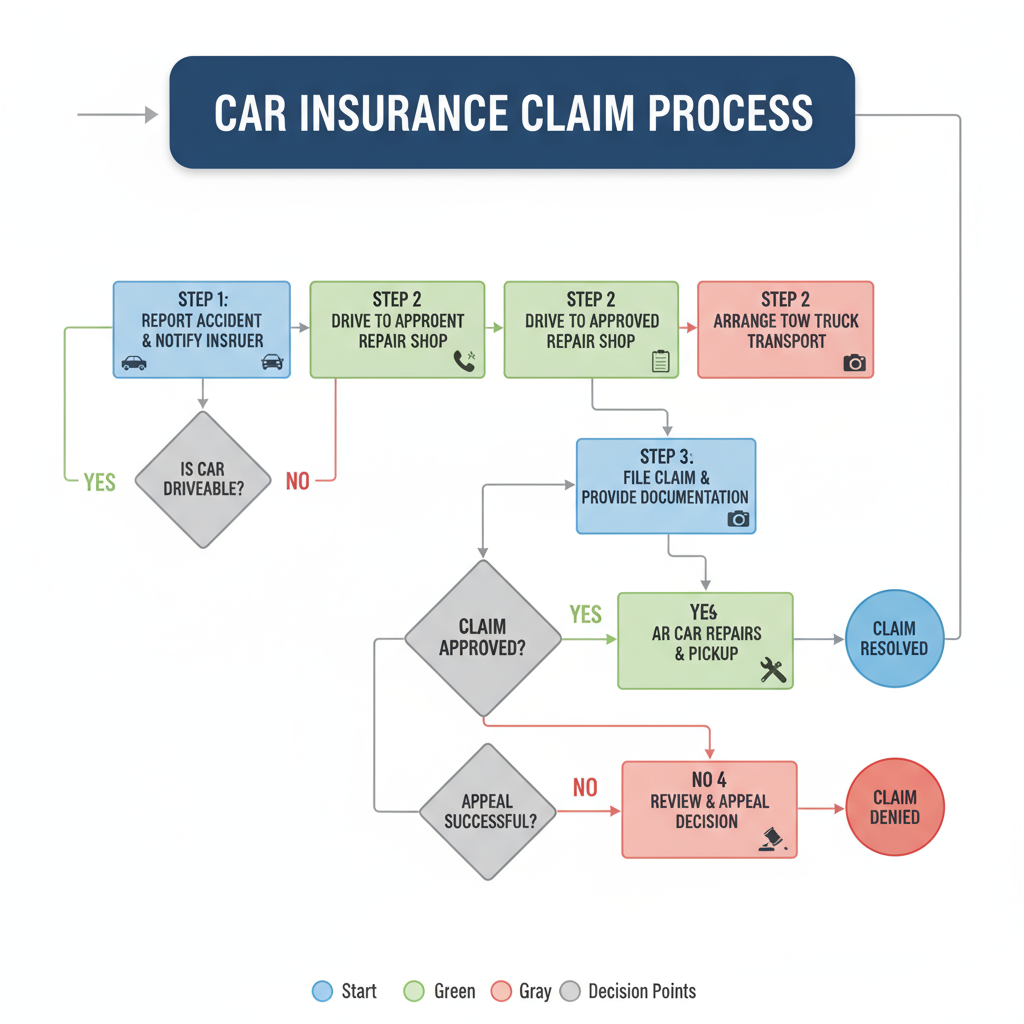

Claim Process – Step by Step

Step-by-step flowchart showing car insurance claim process stages

Cashless Claim Process

- Immediate Intimation: Accident ke turant baad call karo 022-6489-8282 petataaig

- Garage Selection: Choose karo nearest network garage

- Vehicle Inspection: Tata AIG surveyor inspect karega damage

- Approval: Repair estimate approval mil jaye ga

- Repair: Garage directly bill settle karega with Tata AIGinsurancedekho+1

Reimbursement Claim Process

- Inform Tata AIG about accident

- Get repair done at any garage of your choice

- Submit all bills aur documents

- Claim amount reimburse hoga after verificationpolicybazaar+1

Required Documents

Claim ke liye ye documents chahiye:insurancedekho+1

- Duly filled claim form

- Policy copy

- Driving license

- RC book

- FIR copy (if required)

- Repair estimates/bills

- Photos of damaged vehicle

Premium Calculator aur Cost Factors

Premium Calculation Factors

Humne analysis kiya hai ki ye factors affect karte hai premium amount:policybazaar+2

- Car Details: Make, model, variant, fuel type

- IDV (Insured Declared Value): Current market value of car

- Location: RTO registration city

- Age: Car ki age aur driver ki age

- Previous Claims: Claim history affect karti hai premium

- Add-ons: Selected add-ons increase premium

- NCB Status: No claim bonus discount milta hai

Premium Calculation Formula

Own Damage Premium = IDV × Tariff Rate – Discounts + Add-onstataaig

Example calculation ke liye ek 5-year-old hatchback:

- IDV: ₹3.5 lakh

- Tariff rate: 2%

- NCB discount: 20%

- Zero depreciation add-on: ₹1,000

- Personal accident cover: ₹750

Tata AIG vs Other Insurers – Comparison

Tata AIG vs HDFC ERGO vs ICICI Lombard

| Feature | Tata AIG | HDFC ERGO | ICICI Lombard |

|---|---|---|---|

| Network Garages | 10,000+ | 8,200+ | 5,900+ |

| Claim Settlement Ratio | 98-99% | 99% | 96.75% |

| Premium Starting | ₹2,094 | ₹2,094 | ₹2,094 |

| Add-ons Available | 15+ | 9+ | 5+ |

| Customer Base | 5+ crore | 1.6+ crore | 4+ crore |

Based on our research, Tata AIG stands out because of:moneyview+2

- Largest garage network across India

- Maximum add-on options for customization

- Competitive claim settlement ratio

- Strong customer base showing trust

Customer Reviews aur Experience

Positive Feedback

Customer reviews mein ye points frequently mention hote hai:insurancedekho+1

- Smooth cashless claim process

- Quick claim settlement

- Helpful customer service

- Easy online renewal process

- Good discount options

Areas of Concern

Kuch customers ne mention kiya hai:mouthshut+1

- Sometimes claim approval delays

- Communication gaps during claim process

- Premium increase at renewal

In my experience, majority customers satisfied hai Tata AIG ke services se, especially claim settlement process se.

Digital Services aur Customer Support

Online Services

Tata AIG provide karta hai comprehensive online services:tataaig

- Policy purchase in 3 simple clicks

- Premium calculator for instant quotes

- Claim tracking through online portal

- Policy renewal with discounts up to 85%

- Garage locator tool

Customer Support

24×7 customer support available hai through:tataaig

- Phone: 022-6489-8282 / 1800-267-1955 (senior citizens)

- Email: customersupport@tataaig.com

- Mobile app for claim filing aur tracking

- Website chat support

Pros aur Cons – Honest Assessment

Advantages

✅ Extensive garage network (10,000+ locations)

✅ High claim settlement ratio (98-99%)

✅ Comprehensive add-on options (15+ covers)

✅ Competitive premium rates

✅ Strong financial backing (Tata Group + AIG)

✅ 24×7 roadside assistance available

✅ Easy online processes

✅ No impact on NCB for RSA usage

Disadvantages

❌ Premium can be higher compared to some competitors

❌ Add-ons increase overall cost significantly

❌ Limited customization in basic plans

❌ Some claim processing delays reported occasionally

Best Practices aur Tips

Choosing Right Plan

Based on our analysis, ye tips follow karo:tataaig

- Assess your needs: Daily commute vs occasional use

- Consider car age: Newer cars need comprehensive coverage

- Evaluate add-ons: Don’t over-insure, choose practically

- Compare IDV: Ensure adequate sum insured

- Check garage network in your area

Premium Optimization

Humne dekha hai ki ye strategies help karti hai premium reduce karne mein:

- Maintain claim-free record for NCB benefits

- Install anti-theft devices for discounts

- Choose higher deductible if comfortable

- Voluntary deductible opt karo for savings

- Annual payment instead of monthly for better rates

Claim Best Practices

Experience se ye tips important hai:

- Immediate intimation is crucial

- Don’t move vehicle unnecessarily after accident

- Take photos of damage from multiple angles

- Keep all documents ready aur organized

- Follow up regularly on claim status

Kaise Buy Kare Tata AIG Car Insurance

Online Purchase Process

- Visit website ya use mobile app

- Enter car details: Registration number, make, model

- Select coverage type: Third-party, comprehensive, or OD

- Choose add-ons as per requirement

- Compare quotes aur finalize

- Make payment through secure gateway

- Download policy instantlypolicybazaar+1

Required Information

Purchase ke time ye details chahiye:

- Car registration details

- Previous policy information

- Driver details aur license

- Nominee information

- Contact details

Humara suggestion hai ki policy purchase karne se pehle properly research karo aur multiple quotes compare karo different insurers se.

Renewal Process aur Important Points

Policy Renewal

Policy renewal process simple hai:policybazaar

- Grace period: 30 days after expiry

- Online renewal available 24×7

- NCB retention if renewed on time

- Rate revision possible at renewal

Important Deadlines

⚠️ Critical Point: Policy lapse hone se pehle renew karo, warna:

- NCB forfeit ho jayega

- Fresh medical checkup required (health insurance ke case mein)

- Coverage gap create hoga

External Resources aur Help

Additional information aur expert advice ke liye visit karo InvestsNow – comprehensive financial planning aur insurance guidance ke liye trusted source.

Car insurance ke related detailed comparison aur buying guides ke liye, aap hamare YouTube channel videos bhi dekh sakte hai jo step-by-step process explain karte hai.

Agar aap ready hai Tata AIG car insurance purchase karne ke liye, toh ye affiliate link use kar sakte hai special discounts aur offers ke liye.

Frequently Asked Questions (FAQ)

Q: Tata AIG car insurance ki claim settlement kitne time mein hoti hai?

A: Tata AIG ka average claim settlement time 7-15 working days hai, provided all documents complete aur accurate hai. Cashless claims generally faster process hote hai compared to reimbursement claims. Simple repair cases mein approval 24-48 hours mein mil jata hai. However, complex cases jisme detailed investigation required hoti hai, woh 15-30 days tak le sakte hai. Company ka 98-99% claim settlement ratio ensure karta hai ki genuine claims promptly settle ho jaye. In my experience, proper documentation aur immediate intimation se claim process significantly fast ho jata hai.insurancedekho+2

Q: Kya Tata AIG mein zero depreciation cover worth hai?

A: Zero depreciation cover definitely worth hai especially naya cars ke liye (0-5 years old). Is add-on se aap full claim amount get karte hai without any depreciation deduction. For example, agar aap ka bumper repair ₹7,000 ka hai, bina zero dep ke aap ko sirf ₹2,500 milega (50% depreciation deduction ke baad), lekin zero dep ke saath aap ko ₹6,000 milega (sirf ₹1,000 deductible deduct hoga). Premium increase 15-20% hota hai is add-on ke liye, but claim ke time ye investment worthwhile prove hota hai. However, cars over 5 years old ke liye ye add-on available nahi hota.paytminsurance+2

Q: Tata AIG ke network garages kaise find kare?

A: Tata AIG ke 10,000+ network garages find karne ke multiple ways hai. Official website pe garage locator tool available hai jaha aap city name aur car make enter karke nearest garages find kar sakte hai. Mobile app mein bhi garage finder feature hai with GPS location. Customer care number 022-6489-8282 pe call karke bhi garage information mil sakti hai. Most major cities mein authorized dealerships aur multi-brand service centers dono include hai network mein. Emergency situation mein, company automatically nearest garage suggest karti hai claim registration ke time.tataaig+1

Q: Premium calculate karte time IDV kya role play karta hai?

A: IDV (Insured Declared Value) car insurance premium calculation mein most important factor hai. Ye aap ki car ka current market value represent karta hai, jo every year depreciation ke saath decrease hota hai. Premium formula mein Own Damage Premium = IDV × Tariff Rate – Discounts + Add-ons use hota hai. Higher IDV means higher premium, lekin claim ke time bhi higher amount milta hai. IDV too low rakhoge toh premium kam hoga but claim amount bhi kam milega. IDV too high rakhoge toh over-insurance hoga jo wastage hai. Ideal IDV car ka actual market value ke closest hona chahiye. Company usually IDV range suggest karti hai aur aap us range mein se choose kar sakte hai.policybazaar+3

Q: Kya Tata AIG roadside assistance 24×7 available hai?

A: Ha, Tata AIG ka roadside assistance (RSA) genuine 24×7 available hai, lekin ye add-on cover hai jo separately purchase karna padta hai. RSA services mein include hai: emergency towing, flat tyre assistance, battery jump-start, on-spot minor repairs, fuel delivery, key replacement assistance. Ye service nationwide available hai through authorized service providers. Response time usually 30-60 minutes hai metro cities mein, aur 60-120 minutes remote areas mein. Important point ye hai ki RSA usage se aap ka NCB (No Claim Bonus) affect nahi hota. Service activation ke liye dedicated helpline number use karna padta hai. Premium mein additional ₹500-1500 annually cost add hoti hai RSA ke liye location aur coverage type ke basis pe.tataaig+1

Q: Policy lapse hone ke baad kya options hai?

A: Policy lapse hone ke baad renewal still possible hai, lekin consequences hai. Grace period usually 30 days hoti hai expiry ke baad jisme renewal kar sakte hai without losing NCB. Grace period ke baad renewal karte hai toh NCB forfeit ho jata hai aur fresh policy ki tarah premium calculate hota hai. Some cases mein insurance company vehicle inspection demand kar sakti hai especially older cars ke liye. Coverage gap ke during koi accident hota hai toh company liable nahi hoti. Legal perspective se, expired insurance ke saath driving illegal hai aur traffic police fine kar sakti hai. Best practice ye hai ki expiry se 15-20 days pehle renewal initiate kar do. Online renewal options available hai aur instant policy issuance hota hai proper documents ke saath.policybazaar

Q: Third-party aur comprehensive insurance mein kya main difference hai?

A: Third-party insurance sirf legal requirement fulfill karta hai aur mandatory hai Indian law ke under. Ye sirf third-party damages cover karta hai – property damage (up to ₹7.5 lakh) aur bodily injury/death (unlimited). Premium fixed hoti hai ₹2,094 annually for private cars. Own car ka damage cover nahi hota, personal accident cover optional hai. Comprehensive insurance complete protection deta hai – third-party liability + own damage + personal accident cover (₹15 lakh). Natural calamities, theft, fire, accidents, vandalism sab cover hota hai. Add-ons ki facility available hai customization ke liye. Premium higher hoti hai but complete peace of mind milta hai. Financial perspective se comprehensive insurance better investment hai especially valuable cars ke liye, kyuki single accident mein repair cost premium se zyada ho sakta hai.bajajfinserv+2

Q: Claim reject hone ke main reasons kya hai?

A: Claim rejection ke common reasons hai: driving without valid license, under influence of alcohol/drugs, using car for commercial purpose (private policy mein), normal wear and tear claims, pre-existing damage, policy terms violation, incorrect information during policy purchase, delayed claim intimation (beyond specified time limit), repairs done without company approval, fake/fraudulent claims. Preventive measures include: proper documentation maintenance, immediate accident reporting, following traffic rules, honest disclosure during policy purchase, understanding policy terms clearly, regular vehicle maintenance, using authorized garages for repairs. If claim wrongly rejected hai toh escalation process follow kar sakte hai – first customer care, then ombudsman complaint, finally consumer court. Success rate high hai genuine cases mein if proper evidence provide karte hai.insurancedekho+1

Conclusion – Final Recommendation

Tata AIG car insurance comprehensive solution hai jo balance provide karta hai between affordability aur extensive coverage. Company ka strong financial backing, impressive garage network, aur high claim settlement ratio make it reliable choice especially beginners ke liye.

Key Takeaways:

- Best for: First-time car insurance buyers aur comprehensive coverage seekers

- Unique selling points: Largest garage network, maximum add-on options

- Pricing: Competitive but evaluate total cost with add-ons

- Claim experience: Generally positive with quick settlement

Our Recommendation: Tata AIG suitable hai if aap chahte hai extensive coverage with nationwide support. However, compare quotes from multiple insurers before final decision. Consider your specific needs, budget, aur local garage availability while making choice.

Agar aapko koi specific question hai ya detailed guidance chahiye, toh comment section mein poocho – hum definitely help karenge!

Disclaimer: Ye information educational purpose ke liye hai. Policy terms aur conditions insurance company ke discretion pe depend karte hai. Purchase karne se pehle official policy document carefully read karo aur expert consultation le lo if needed.

Financial planning aur insurance ki latest updates ke liye regularly visit karte raho InvestsNow. Smart financial decisions ke liye expert guidance always recommended hai.