Stock Market Guide: Beginners के लिए Complete Investment Guide 2025

Stock Market Ki Duniya: Beginners Ke Liye Complete Guide

Introduction

Stock market – ye shabd sunte hi aapke dimag mein kya aata hai? Paisa kamana, risk, ya phir confusion? Agar aap ek beginner hai aur stock market mein investing shuru karna chahte hai, toh ye guide bilkul aapke liye hai! Humne dekha hai ki lakhs of young Indians ab share market ki duniya mein qadam rakh rahe hai – sirf August 2025 tak India mein 20 crore se zyada Demat accounts khule hai!bankrate

Stock market ek aise jaga hai jahan companies apne shares sell karti hai aur investors unhe kharid kar company mein ownership lete hai. Lekin yahan bas sunna aur karna – dono mein bahut fark hai. Is article mein hum stock market ki ABC se lekar advanced strategies tak sab kuch cover karenge – wo bhi simple Hinglish mein!hdfcbank

Ye guide kis liye hai?

- Stock market beginners jo bilkul zero se start kar rahe hai

- Young professionals jo passive income banana chahte hai

- Students jo financial literacy badhana chahte hai

- Anyone jo share market ki basics samajhna chahta hai

Kya milega is article mein?

- Stock market kya hai aur kaise kaam karta hai

- Investment shuru kaise karein step-by-step

- Risks aur benefits ki complete understanding

- Real examples aur practical tips

- FAQ section with detailed answerss3.amazonaws

Modern Indian stock exchange trading environment

Stock Market Kya Hai? (What is Stock Market?)

Stock market, jise share market bhi kehte hai, ek platform hai jahan publicly listed companies ke shares buy aur sell kiye jate hai. Simple words mein – ye ek bazaar hai jahan companies apne business ka chhota hissa bech deti hai aur investors us hisse ko kharid kar company ke owner ban jate hai.angelone

Stock Market Kaise Kaam Karta Hai?

Stock market ka concept bahut simple hai. Jab koi company grow karna chahti hai, toh use paisa chahiye hota hai. Ye paisa raise karne ke liye company apne shares public ko sell karti hai through IPO (Initial Public Offering).angelone

Example: Agar ek company ne 1000 shares issue kiye aur aapne 10 shares khareede, toh aap us company ke 1% owner ban gaye!

Primary aur Secondary Market:

- Primary Market: Jahan companies pehli baar apne shares sell karti hai (IPO)hdfcfund

- Secondary Market: Jahan already issued shares ko investors aapas mein buy-sell karte haiinvestopedia

India Mein Stock Exchanges

India mein do main stock exchanges hai:

1. Bombay Stock Exchange (BSE)

- 1875 mein establish hua – Asia ka oldest stock exchangebajajfinserv

- Market cap: $3.3 trillionwikipedia

- Sensex (30 companies) iska main index haiifinltd

- 6000+ companies listed haigroww

2. National Stock Exchange (NSE)

- 1992 mein establish huabajajfinserv

- Market cap: $5.23 trillionwikipedia

- Nifty 50 (50 companies) iska main index haiifinltd

- Electronic trading ka pioneer hai India meintestbook

Stock Market Mein Kaise Invest Karein? (How to Start Investing?)

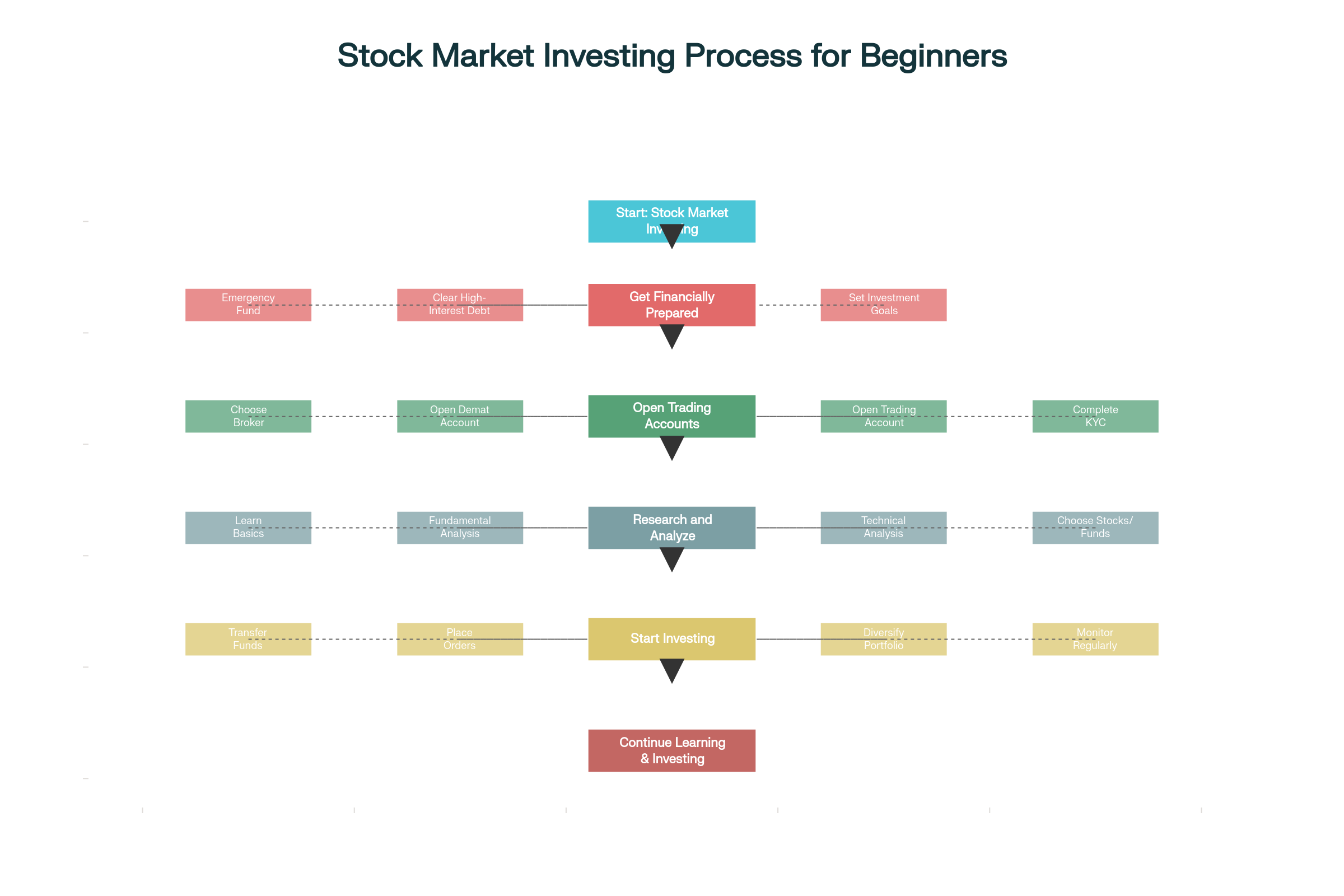

Stock market mein investing shuru karna rocket science nahi hai, lekin sahi steps follow karna zaroori hai. Yahan humne complete process break down kiya hai:s3.amazonaws

Stock market investment process for beginners in India

Step 1: Financial Planning Aur Goals Set Karein

Emergency Fund Banayein:

Investing se pehle minimum 6-12 months ka emergency fund ready rakhiye. Ye fund aapke monthly expenses ka 6-12 times hona chahiye. Stock market volatile hai, isliye emergency fund ke liye invest kiye gaye paise kabhi use na karein.bankrate

High-Interest Debt Clear Karein:

Agar aapke paas credit card debt ya personal loans hai 15-20% interest rate pe, toh pehle unhe clear kariye. Stock market se 15-20% guaranteed returns milna mushkil hai.bankrate

Investment Goals Define Karein:

- Short-term goals (1-3 years): House down payment, car, vacation

- Medium-term goals (3-10 years): Child education, business expansion

- Long-term goals (10+ years): Retirement planning, wealth creation

Step 2: Broker Choose Karein Aur Account Open Karein

Types of Brokers:

- Full-Service Brokers: Research reports, advisory services provide karte hai (higher charges)bajajfinserv

- Discount Brokers: Sirf trading platform provide karte hai (lower charges)bajajfinserv

- Online Brokers: Completely digital experiencetatacapitalmoneyfy

Documents Required:tatacapitalmoneyfy

- PAN Card

- Aadhaar Card

- Bank account details

- Income proof

- Address proof

- Passport size photos

Account Types:

- Demat Account: Shares ko electronic form mein store karta haihdfcbank

- Trading Account: Buy-sell orders execute karne ke liyehdfcbank

- Bank Account: Fund transfer ke liye (linked hona chahiye)hdfcbank

Step 3: KYC Process Complete Karein

SEBI regulations ke according, all investors ko KYC (Know Your Customer) complete karna mandatory hai. Ye process online ho sakti hai aur usually 2-3 days lagti hai verification mein.tatacapitalmoneyfy+1

Step 4: Market Research Aur Analysis

Fundamental Analysis:

Company ki financial health check karte hai:groww

- Revenue aur profit growth

- Debt-to-equity ratio

- P/E ratio (Price to Earnings)bajajfinserv

- Industry comparison

- Management quality

Technical Analysis:

Price charts aur patterns study karte hai:groww

- Support aur resistance levels

- Moving averages

- Trading volume

- Market trends

Step 5: Investment Strategy Decide Karein

Investment Approaches:

- Value Investing: Undervalued stocks find kar ke long-term hold karna

- Growth Investing: Fast-growing companies mein invest karna

- Dividend Investing: Regular dividend dene wali companies choose karna

- Index Investing: Market indices track karne wala approachhdfcfund

Stock Market Ki Basic Terms (Essential Terminology)

Market-Related Terms

Bull Market: Jab market prices continuously rise kar rahe ho, optimistic sentiment hobajajfinserv

Bear Market: Jab market prices fall kar rahe ho, pessimistic sentiment hobajajfinserv

Volatility: Price fluctuations ki intensityangelone

Liquidity: Kitni easily shares buy-sell kar sakte haibajajfinserv

Trading Terms

Bid Price: Buyer ki highest price offercleartax

Ask Price: Seller ki lowest price demandcleartax

Spread: Bid aur ask price ka differencecleartax

Market Order: Current market price pe immediately execute hone wala ordercleartax

Limit Order: Specific price pe execute hone wala ordercleartax

Stop Loss: Losses limit karne ke liye predetermined price pe sell orderbajajfinserv

Company Valuation Terms

Market Cap: Company ki total value (shares × price)cleartax

- Large Cap: ₹20,000+ crores

- Mid Cap: ₹5,000-20,000 crores

- Small Cap: ₹5,000 crores se kam

P/E Ratio: Price per share ÷ Earnings per sharebajajfinserv

EPS: Company ka per share profitbajajfinserv

Dividend: Shareholders ko distribute kiya jane wala profitbajajfinserv

Dividend Yield: Annual dividend ÷ Current stock pricebajajfinserv

Stock Market Mein Risks Aur Unhe Manage Kaise Karein

Systematic Risks (Market Risks)

Ye risks poore market ko affect karte hai aur diversification se avoid nahi ho sakte:angelone

1. Inflation Risk:

Inflation badne se aapki purchasing power kam ho jati hai. Example: 2022-23 mein food aur fuel prices badhne se investment returns ka real value kam hua.planetwealth+1

2. Interest Rate Risk:

RBI jab interest rates badhata hai toh stock prices generally girte hai. 2022-23 mein RBI ke continuous rate hikes se banking aur real estate stocks gire the.angelone

3. Political Risk:

Government policies change hone se market affect hota hai. Example: 2016 mein demonetization ke time market uncertainty thi.angelone

4. Currency Risk:

Rupee ki value fluctuate hone se foreign investments affect hote hai. 2022 mein Dollar के against Rupee depreciate hone se import-dependent companies struggle kiye.angelone

Unsystematic Risks (Company-Specific Risks)

Ye risks specific companies ya industries ko affect karte hai:angelone

1. Business Risk:

Company ki operational problems. Example: 2023 mein Byju’s financial crisis.angelone

2. Financial Risk:

Company ka high debt burden. Example: 2019 mein DHFL collapse due to excessive debt.angelone

3. Industry Risk:

Specific industry challenges. Example: 2023 mein IT stocks decline due to global recession fears.angelone

Risk Management Strategies

1. Diversification:

Different sectors, market caps, aur asset classes mein invest kariye:bajajfinserv

- Equity: 60-70%

- Debt: 20-30%

- Gold/Commodities: 5-10%

- International exposure: 10-15%timesofindia.indiatimes

2. Asset Allocation:

Age-based formula: 100 – your age = equity percentagebajajfinserv

Example: 30 years old = 70% equity, 30% debt

3. SIP (Systematic Investment Plan):

Monthly fixed amount invest karna market timing risks reduce karta hai.hdfcfund

4. Stop Loss Orders:

Pre-defined loss level pe automatic sell order.bajajfinserv

Investment Types Aur Strategies

Direct Stock Investment

Advantages:

- Complete control over portfolio

- No fund management fees

- Higher potential returns

- Direct ownership benefits (voting rights, bonus shares)

Disadvantages:

- High research requirement

- Time-consuming portfolio management

- Higher risk due to lack of diversification

- Emotional decision making tendency

Mutual Funds

Advantages:

- Professional fund managementhdfcfund

- Automatic diversification

- Lower minimum investment

- Different categories available

- SIP facility available

Types:

- Equity Funds: Primarily stocks mein investhdfcfund

- Debt Funds: Bonds aur fixed income securitieshdfcfund

- Hybrid Funds: Stocks aur bonds both mein investhdfcfund

- Index Funds: Market indices track karte haihdfcfund

ETFs (Exchange Traded Funds)

Benefits:

- Low expense ratios

- Real-time trading like stocksbajajfinserv

- Diversification benefits

- Tax efficiency

Portfolio Diversification Ki Complete Strategy

Geographic Diversification

Domestic Diversification:

- Different states ki companies

- Various economic cycles exposure

- Local market dynamics understanding

International Diversification:

Experts recommend 10-15% global allocation:timesofindia.indiatimes

- US markets (technology aur innovation)

- European markets (stability aur dividend)

- Emerging markets (growth potential)

- Developed Asian markets

Sector-wise Diversification

Core Sectors (40-50%):

- Banking & Financial services

- Information Technology

- Fast Moving Consumer Goods (FMCG)

- Pharmaceuticals

Growth Sectors (30-40%):

- Renewable Energy

- Electric Vehicles

- Digital Infrastructure

- Healthcare Technology

Defensive Sectors (10-20%):

- Utilities

- Consumer Staples

- Telecommunications

- Infrastructure

Market Cap Diversification

Recommended Allocation:

- Large Cap: 60-70% (stability aur consistent returns)

- Mid Cap: 20-30% (growth potential with moderate risk)

- Small Cap: 10-20% (high growth potential, high risk)

SEBI Regulations Aur Investor Protection

SEBI Ka Role

Securities and Exchange Board of India (SEBI) 1992 mein establish hua investor protection aur market integrity maintain karne ke liye:thelegalschool+1

Main Functions:byjus

- Market intermediaries ko regulate karna

- Fraudulent practices prevent karna

- Investor education promote karna

- Fair trading practices ensure karna

Recent SEBI Amendments (2025)

1. T+0 Settlement:

Top 500 stocks ke liye same-day settlement option availablethelegalschool

2. Insider Trading Rules:

UPSI (Unpublished Price Sensitive Information) definition expand kiya gayathelegalschool

3. ESG Disclosure:

Environmental, Social, Governance disclosures mandatory kiye gayethelegalschool

Investor Protection Measures

1. SEBI Investor Protection Fund:

Broker default ke case mein investor claims settle karne ke liye

2. SEBI Complaints Portal:

Online grievance redressal system

3. Investor Education Programs:

Regular workshops aur online courses

Real Examples Aur Case Studies

Success Story: SIP Ki Power

Case Study:

- Investment: ₹5,000 monthly SIP in Nifty 50 index fund

- Duration: 10 years (2013-2023)

- Total Investment: ₹6,00,000

- Final Value: Approximately ₹11,00,000+

- Returns: ~13-14% CAGR

Risk Management Example

Case Study – Diversification Benefits:

- Portfolio A (Not Diversified): Only IT stocks – suffered 30% loss in 2022 tech correction

- Portfolio B (Diversified): IT (30%), Banking (25%), FMCG (20%), Pharma (15%), Others (10%) – only 10% loss in same period

Advanced Strategies For Growth

SIP vs Lump Sum

SIP Benefits:

- Rupee cost averaginghdfcfund

- Disciplined investing habit

- Lower risk due to staggered investment

- Suitable for salaried professionals

Lump Sum Benefits:

- Full market exposure immediately

- Lower transaction costs

- Better for bull markets

- Suitable when you have surplus funds

Tax Planning With Equity

LTCG (Long Term Capital Gains):

- More than 1 year holding: 10% tax after ₹1 lakh exemption

- More diversified portfolio reduces tax burden through systematic withdrawals

STCG (Short Term Capital Gains):

- Less than 1 year: 15% tax

- Avoid frequent trading to minimize STCG tax

Value Investing Approach

Peter Lynch Style:

- Invest in businesses you understand

- Look for companies with sustainable competitive advantages

- Check consistent earnings growth

- Reasonable debt levels

- Strong management

Warren Buffett Principles:

- Buy when others are fearful

- Hold for very long term

- Focus on business fundamentals, not stock prices

- Invest in quality companies at reasonable prices

Psychological Aspects Of Investing

Common Behavioral Biases

1. FOMO (Fear of Missing Out):

Market peak pe invest karna bull market enthusiasm mein

2. Loss Aversion:

Losing stocks ko hold karna aur winning stocks ko early sell karna

3. Herding Mentality:

Crowd ke saath blindly follow karna without research

4. Confirmation Bias:

Sirf supporting information dhundhna, contra evidence ignore karna

Emotional Discipline

Rules to Follow:

- Pre-decided investment plan stick karna

- Regular review cycles maintain karna

- Panic selling avoid karna market downturns mein

- Greed control karna bull markets mein

Technology Aur Modern Trading

Mobile Trading Apps

Features to Look For:

- Real-time market data

- Advanced charting tools

- Research reports access

- Easy fund transfer

- Alert systems

- Portfolio tracking

Robo-Advisors

Benefits:

- Algorithm-based portfolio management

- Automatic rebalancing

- Lower fees compared to traditional advisors

- Goal-based investing

- Tax-loss harvesting

AI aur Machine Learning

Applications:

- Automated trading algorithms

- Risk assessment tools

- Market sentiment analysis

- Fraud detection systems

- Personalized investment recommendations

आइए देखते हैं यहाँ सम्बंधित YouTube video जो beginners के लिए helpful है:

Related Video Resource:

Stock market investing के बारे में और जानने के लिए यह helpful video देखिए: Learn How To Invest In Stock Market For Beginners जो step-by-step guidance देता है नए investors को।youtube

और अधिक comprehensive information के लिए visit करें InvestsNow.in – यहाँ आपको latest market insights और investment strategies मिलेंगी।

अगर आप stock market में सीधे investment करना चाहते हैं professional guidance के साथ, तो इस affiliated link से आप expert advisory services ले सकते हैं।

Frequently Asked Questions (FAQ)

Q: Stock market mein kitne paise se shuru kar sakte hai?

A: Stock market mein aap sirf ₹100 se bhi shuru kar sakte hai! Lekin practical approach ye hai:tatacapitalmoneyfy

- Minimum Recommended: ₹5,000-10,000 (proper diversification ke liye)

- SIP: Monthly ₹1,000-5,000 se start karo

- Emergency Fund: Investment se pehle 6 months ka emergency fund ready rakho

Most mutual funds ka minimum SIP ₹500 hai, aur direct stocks mein aap 1 share bhi kharid sakte hai. Lekin remember – brokerage charges aur transaction fees bhi lagti hai, toh very small amounts efficient nahi hote. Humne dekha hai ki ₹5,000+ monthly SIP se meaningful wealth creation hota hai. Start small, but be consistent!

Q: Demat account aur trading account mein kya difference hai?

A: Ye dono accounts alag purpose serve karte hai, lekin dono zaroori hai:hdfcbank+1

Demat Account:

- Digital locker ki tarah – shares store karta hai electronic format mein

- Previously physical certificates hote the, ab sab digital hai

- Share delivery ke bad yahan automatically credit ho jate hai

- Holding period track karta hai (tax implications ke liye)

- Annual maintenance charges lagti hai (usually ₹300-600)

Trading Account:

- Buy-sell orders execute karne ke liye

- Market orders, limit orders place karne ke liye

- Fund transfer facility

- Portfolio tracking aur P&L statements

- Real-time market data access

Simple Example: Trading account se aap order place karte hai “100 shares khareedne ka”, aur successful transaction ke bad wo shares aapke Demat account mein store ho jate hai. Bank account se paisa debit hota hai, Demat account mein shares credit hote hai!

Q: SIP aur lump sum mein se kya better hai beginners ke liye?

A: Beginners ke liye SIP definitely better option hai, yahan complete comparison hai:hdfcfund

SIP (Systematic Investment Plan) Benefits:

- Rupee Cost Averaging: Market high ho ya low, aap consistent amount invest karte ho – automatically average price mil jata hai

- Disciplined Approach: Monthly commitment se consistent investing habit banta hai

- Lower Risk: Market timing ka risk kam ho jata hai

- Suitable for Salaried: Monthly salary se easily afford ho jata hai

- Emotional Control: Market volatility mein panic decisions nahi lete

When to Choose Lump Sum:

- Large windfall amount available hai (bonus, inheritance)

- Market crash ke time (when everything is cheap)

- Very long investment horizon (10+ years)

- Aap experienced investor hai with market knowledge

Practical Strategy: Most financial experts recommend – SIP for regular investments + lump sum during market crashes. Example: Monthly ₹5,000 SIP + market 20% down hone par additional lump sum investment. Ye hybrid approach optimal results deta hai!

Q: Stock market mein losses se kaise bachein?

A: Complete loss avoid karna impossible hai, but smart strategies se minimize kar sakte hai:angelone+1

Risk Management Techniques:

1. Diversification (सबसे Important):

- Different sectors mein invest karo: IT, Banking, FMCG, Pharma

- Market cap diversification: Large cap (70%), Mid cap (20%), Small cap (10%)

- Asset allocation: Equity + Debt + Gold combination

- Geographic diversification: Domestic + International exposure

2. Stop Loss Strategy:

- Predefined loss level set karo (usually 20-25% down)

- Emotion mein decision mat lo – stick to your plan

- Trailing stop loss use karo rising markets mein

3. Position Sizing:

- Never put all money in one stock

- “Don’t put all eggs in one basket” rule follow karo

- Maximum 5-10% portfolio in single stock

4. Research Before Investing:

- Company fundamentals check karo

- Financial statements padhiye

- Industry trends understand karo

- Management quality assess karo

5. Long-term Perspective:

- Short-term volatility se ghabrao mat

- Historical data shows – 7-10 year holding se positive returns probable hai

- Market cycles understand karo

Common Mistakes to Avoid:

- FOMO (Fear of Missing Out) mein invest karna

- Tips aur rumors pe action lena

- Panic selling during market crash

- Over-leveraging (borrowed money se investing)

Q: Beginner investors ke liye best stocks kaun se hai?

A: Beginners ko direct stock picking से बचना चाहिए initially, but यदि करना ही है तो यहाँ guidelines हैं:angelone+1

Large Cap Stocks (Safest for Beginners):

- Blue Chip Companies: Consistent track record wali companies

- Dividend Paying Stocks: Regular income के साथ capital appreciation

- Market Leaders: Respective sectors मेंumber 1 या 2 position

Sectors to Consider:

- Banking: HDFC Bank, ICICI Bank (regulated sector, stable)

- IT Services: TCS, Infosys (global exposure, consistent growth)

- FMCG: Hindustan Unilever, ITC (defensive, steady demand)

- Pharmaceuticals: Dr. Reddy’s, Sun Pharma (essential products)

Better Alternative for Beginners:

Index Funds/ETFs:

- Nifty 50 Index Fund (top 50 companies automatic diversification)

- Sensex ETF (30 best companies)

- Lower risk compared to individual stocks

- Professional management नहीं चाहिए

Mutual Fund Categories:

- Large Cap Funds: 80%+ large cap stocks (stable returns)

- Multi-Cap Funds: All market caps mix (balanced approach)

- Index Funds: Market returns track करते हैं (lowest fees)

Golden Rule: Start with mutual funds/ETFs for 1-2 years, gain experience, then gradually move to direct stocks. Individual stock picking requires significant research time और market knowledge!

Q: Stock market timing important hai kya? Best time kab hai invest karne ka?

A: “Time in the market beats timing the market” – ye famous quote सच है! Market timing predict करना impossible है, but कुछ guidelines हैं:bankrate+1

Why Market Timing Doesn’t Work:

- Market movements short-term में unpredictable होती हैं

- Professional fund managers भी consistently time नहीं कर सकते

- Emotional decisions usually wrong होते हैं

- Best and worst days often back-to-back आते हैं

SIP Approach (Best for Beginners):

- Fixed dates पे invest करो (monthly 1st या 15th)

- Market high हो या low – consistently invest करो

- Rupee cost averaging automatically हो जाता है

- Emotions remove हो जाते हैं decision making से

When to Invest More (Opportunistic Approach):

- Market crash के time (20%+ correction)

- Panic selling के दौरान

- Economic uncertainty के time

- “Buy when others are fearful” principle

Trading Hours (यदि day trading कर रहे हैं):

- Market opens: 9:15 AM to 3:30 PMtatacapitalmoneyfy

- Pre-opening session: 9:00-9:15 AM

- Most volume: Opening और closing के time

- Avoid lunch time trading (12-2 PM) – lower volumes

Best Long-term Strategy:

- Start SIP immediately (don’t wait for perfect time)

- Increase SIP amount annually (step-up SIP)

- During market corrections – increase investment amount

- Stay invested for minimum 7-10 years

Historical Perspective: Data shows कि any 10-year period में equity ने positive returns दिये हैं Indian markets में. So, time in market ज्यादा important है timing the market से!

Conclusion

Stock market ki journey ek marathon hai, sprint nahi. Is comprehensive guide mein humne stock market ki A to Z cover kiya hai – basics se lekar advanced strategies tak. Remember, successful investing requires patience, discipline, aur continuous learning.

Key Takeaways:

- Financial planning aur emergency fund se start karo

- Proper research aur diversification zaroori hai

- SIP approach beginners ke liye ideal hai

- Risk management ko ignore mat karo

- Long-term perspective maintain karo

- Emotions control mein rakho

Your Next Steps:

- Emergency fund aur debt clearance complete karo

- Trusted broker choose kar ke accounts open karo

- Small SIP amount se start karo (₹1,000-5,000 monthly)

- Gradually knowledge badhao aur portfolio expand karo

- Regular review aur rebalancing karte raho

Stock market mein success overnight nahi milti, but consistent efforts se wealth creation definitely possible hai. Indian markets ka long-term trend positive raha hai, aur growing economy ke saath opportunities bhi badh rahi hai.

Remember: Invest only that money jo aap 5-7 years tak touch na kar sako. Stock market mein profit-loss natural hai, but educated decisions se losses minimize aur profits maximize ho sakte hai.

Agar aapko koi specific doubt hai ya personalized advice chahiye, toh comment section mein zaroor puchiye! Happy investing aur may your portfolio grow exponentially!

Disclaimer: Ye article sirf educational purposes ke liye hai. Investment decisions apni research aur risk appetite ke according lein. Past performance future results ki guarantee nahi hai. Professional financial advisor se consultation recommend kiya jata hai major investments se pehle.

For more detailed investment strategies and latest market insights, visit InvestsNow.in where you’ll find expert analysis and personalized investment guidance.