OctaFX Copy Trading: Best Guide for Beginners in 2025

OctaFX Copy Trading: Complete Guide for Beginners to Start Making Money in 2025

In this detailed guide, you’ll discover everything about OctaFX copy trading platform, from the basics to advanced strategies that can help you build a profitable trading portfolio. Whether you’re completely new to trading or looking for passive income opportunities, this post will give you all the tools and knowledge you need to succeed.

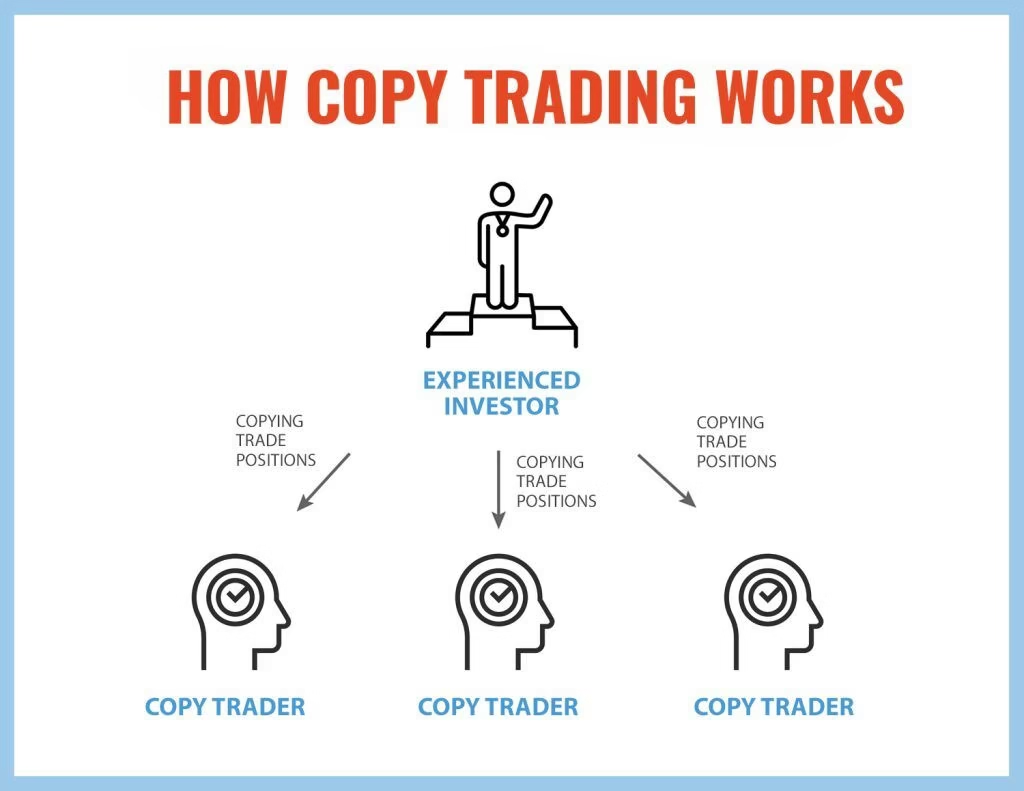

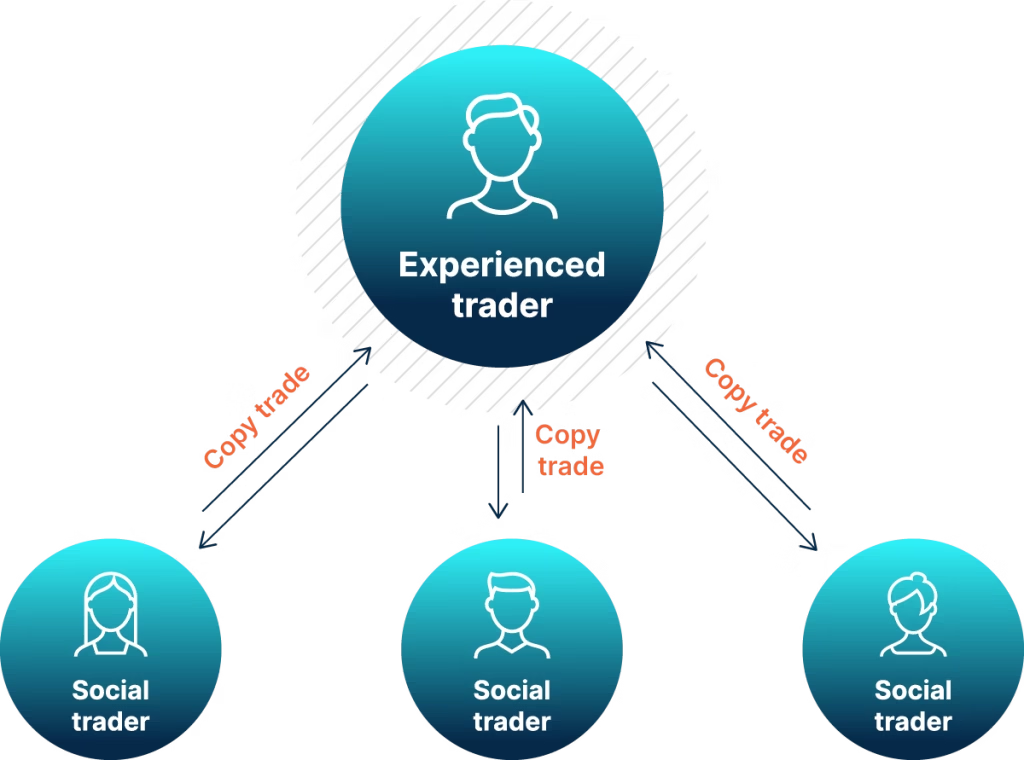

What is OctaFX Copy Trading? Understanding the Basics

OctaFX copy trading is a revolutionary social trading platform that allows you to automatically replicate the trades of experienced and successful traders, known as “Master Traders”. Think of it as having a professional trader manage your money while you maintain complete control over your investment.

The concept is beautifully simple: when a Master Trader opens a position, the same trade automatically opens in your account proportionally to your investment amount. You don’t need to analyze charts, study market trends, or make complex trading decisions – the experts do all the hard work for you.

How Copy Trading Works: The Complete Process

Copy trading operates through a sophisticated yet user-friendly system that connects traders worldwide. Here’s exactly how it works:

Master Traders are experienced professionals who allow others to copy their trades. They earn commissions ranging from 0% to 50% of your profits when you copy them. Copiers (that’s you!) select these Master Traders and automatically replicate their trading strategies.

The platform uses advanced algorithms to proportionally copy trades based on your account size. For example, if a Master Trader uses 10% of their account for a trade, the system will use 10% of your allocated funds for the same position.

Why Choose OctaFX Copy Trading? Key Benefits for Beginners

Based on humara extensive research, here are the compelling reasons why OctaFX copy trading stands out:

Easy Entry Point: You can start with just $25, though OctaFX recommends $100 for better results. This low barrier makes it accessible for beginners who want to test the waters without risking large amounts.

Time-Efficient: Perfect for busy professionals who want to participate in forex markets but don’t have hours for analysis. The automation handles everything while you focus on your day job.

Learning Opportunity: By watching how Master Traders operate, you gradually learn market dynamics, risk management, and trading psychology.

Transparent Performance: Every Master Trader’s complete history is visible – profits, losses, risk scores, and trading patterns. There’s no hidden information that could surprise you later.

Risk Management Tools: Built-in features like stop-loss settings, balance keeper percentages, and support funds help protect your investment.

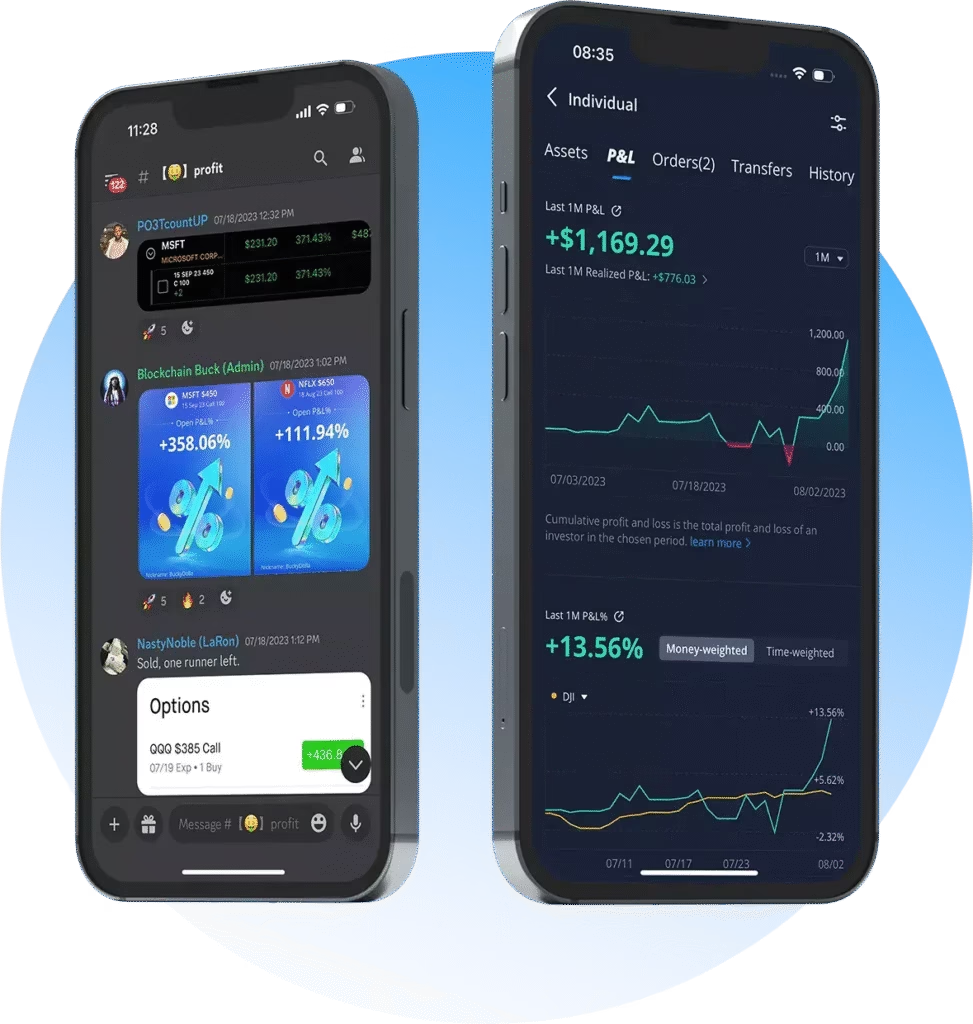

Getting Started: Step-by-Step Setup Guide

Setting up your OctaFX copy trading account is straightforward. In my experience testing various platforms, OctaFX offers one of the most intuitive onboarding processes.

Step 1: Account Creation and Verification

First, download the Octa Copy app from Google Play Store (it has over 500,000+ downloads and 4.0-star rating). Create your account using your email or social media credentials. The verification process requires a government-issued ID and proof of residence – this is mandatory for withdrawals.

Step 2: Making Your First Deposit

You can deposit through various methods including bank transfers, credit cards, e-wallets (Skrill, Neteller), and even cryptocurrencies like Bitcoin and Litecoin. The minimum deposit is $25, but starting with $100 gives you more flexibility in choosing Master Traders.

Step 3: Choosing Your First Master Trader

This is the most crucial step. The platform shows you detailed statistics for each Master Trader including:

- Gain percentage over different time periods

- Risk score (rated 1-6, with 1 being lowest risk)

- Number of copiers currently following them

- Commission rate they charge (0-50% of profits)

- Trading history and order details

- Profit and loss patterns

Step 4: Setting Up Copy Parameters

Once you’ve selected a Master Trader, you can customize your copying settings:

- Copy proportion: Equal (×1), double (×2), triple (×3), or any custom multiplier

- Investment amount: How much you want to allocate to this trader

- Support funds: Extra buffer to protect against market volatility

- Risk management: Set maximum drawdown limits

Understanding Costs and Fees

OctaFX maintains a transparent fee structure that’s competitive in the industry. Here’s what you need to know:

Trading Costs

- Spreads: Start from 0.6 pips for major currency pairs

- No commissions: OctaFX uses spread markups instead of per-trade commissions

- Copy trading service fee: 0.2 pips markup included in spreads

Master Trader Commissions

Master Traders set their own commission rates between 0% and 50% of your profits. You only pay when you make money – if the trades lose, you don’t owe any commission.

No Hidden Fees

- No deposit fees (though payment processors may charge)

- No withdrawal fees from OctaFX’s side

- No inactivity fees

- No account maintenance charges

Selecting the Right Master Traders: Expert Tips

Choosing Master Traders wisely is crucial for your success. Based on industry analysis and user feedback, here are the key criteria:

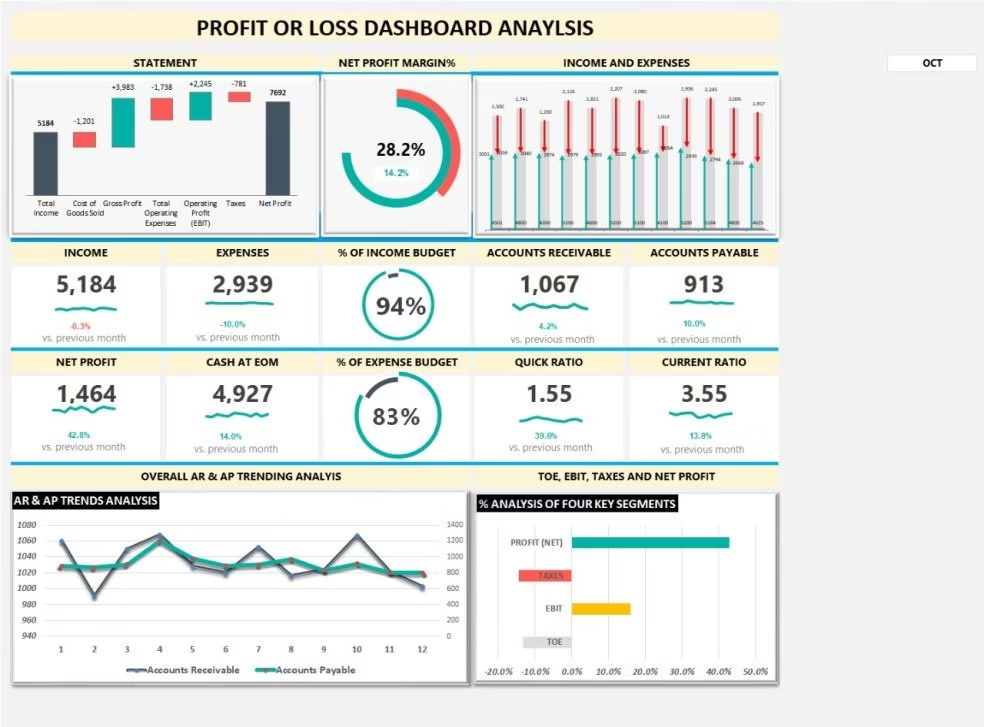

Performance Metrics to Evaluate

Long-term Consistency: Look for traders with at least 6-12 months of consistent performance rather than those with explosive short-term gains that might be unsustainable.

Risk Management: Choose traders with risk scores of 1-3 for stable, long-term strategies. Higher risk scores (4-6) might offer higher returns but with significantly more volatility.

Diversification: Select Master Traders who trade different instruments and use various strategies. This spreads your risk across multiple approaches.

Red Flags to Avoid

Based on community feedback and analysis:

- Traders who turned small amounts into huge sums very quickly (often unsustainable)

- Master Traders with extremely high commission rates (above 35-40%)

- Those with inconsistent performance or large drawdowns

- New traders without sufficient track record

Risk Management and Safety Measures

Copy trading, like all forms of investing, carries inherent risks. Here’s how to protect yourself:

Built-in Safety Features

Balance Keeper: Set a percentage threshold – if your investment drops below this level, copying automatically stops.

Risk Scores: OctaFX’s algorithm calculates risk levels based on trading patterns, helping you make informed decisions.

Stop Loss Settings: You can set maximum loss limits for individual trades or your entire portfolio.

Diversification Strategy

Humne dekha hai that successful copy traders typically:

- Allocate funds across 3-5 different Master Traders

- Choose traders with different risk profiles and strategies

- Never invest more than 20% of total capital with one Master Trader

- Regularly review and adjust their portfolio

Advanced Strategies for Better Results

Once you’re comfortable with the basics, these strategies can improve your returns:

Portfolio Approach

Create a balanced portfolio mixing conservative (risk score 1-2) and moderate-risk (risk score 3-4) Master Traders. This approach provides steady growth while capturing upside potential.

Dollar-Cost Averaging

Instead of investing a large sum at once, gradually increase your investment over time. This reduces the impact of market timing and volatility.

Performance Monitoring

Check your copy trading performance weekly, not daily. Short-term fluctuations are normal, but consistent underperformance over 4-6 weeks might indicate the need for changes.

Common Mistakes to Avoid

Based on community experiences and expert analysis:

The “Get Rich Quick” Trap

Many beginners are attracted to Master Traders showing massive short-term gains. However, these often result in complete losses when market conditions change.

Inadequate Diversification

Putting all funds with one Master Trader, no matter how successful, significantly increases risk. Market conditions change, and even the best traders have losing periods.

Emotional Decision Making

Stopping copy trading after a few losing trades or chasing the “hot” trader of the week leads to poor results. Successful copy trading requires patience and discipline.

OctaFX vs. Other Copy Trading Platforms

While several platforms offer copy trading, OctaFX stands out in several areas:

| Feature | OctaFX | Typical Competitors |

|---|---|---|

| Minimum Deposit | $25 | $100-500 |

| Commission Range | 0-50% | Fixed 20-30% |

| Risk Scoring | Yes (1-6 scale) | Limited |

| Mobile App Rating | 4.0/5 (65K+ reviews) | 3.5-4.0/5 |

| Regulatory Status | Multiple licenses | Varies |

| Copy Trading Fee | 0.2 pips | 0.5-1.0 pips |

The platform’s transparency, low entry requirements, and comprehensive risk management tools make it particularly suitable for beginners.

Regulatory Considerations and Safety

Important Note: While OctaFX offers copy trading services globally, there have been some regulatory challenges in certain regions. In India, for example, there have been investigations by enforcement agencies regarding forex trading activities. Always ensure you comply with local regulations and only trade with properly regulated brokers.

OctaFX holds multiple licenses and regulations, but it’s crucial to verify that forex trading is legal in your jurisdiction before starting.

Frequently Asked Questions

Q: Is OctaFX copy trading suitable for complete beginners?

A: Absolutely! OctaFX copy trading is specifically designed for beginners who want to participate in forex markets without extensive knowledge. The platform provides comprehensive educational resources, risk management tools, and transparent performance metrics for all Master Traders. You can start with just $25 and learn as you go. However, remember that all trading involves risk, so never invest more than you can afford to lose. The key is starting small, diversifying across multiple Master Traders, and gradually building your understanding of how the markets work through observation and experience.

Q: How much money do I need to start copy trading on OctaFX?

A: The minimum deposit for OctaFX copy trading is just $25, making it one of the most accessible platforms in the industry. However, OctaFX recommends starting with at least $100 for better results and more flexibility in choosing Master Traders. With $100, you can diversify across 2-3 Master Traders, which is much better for risk management than putting all your funds with one trader. Remember, some popular Master Traders have minimum investment requirements ranging from $25 to $100 or more, so having a larger starting amount gives you more options.

Q: What fees and commissions will I pay for copy trading?

A: OctaFX has a transparent fee structure with no hidden charges. You’ll pay spreads starting from 0.6 pips (about $6 per standard lot), plus a 0.2 pips copy trading service fee. The main cost is the commission to Master Traders, which ranges from 0% to 50% of your profits – you only pay when you make money. There are no deposit fees from OctaFX (though payment processors might charge), no withdrawal fees from their side, no inactivity fees, and no account maintenance charges. This makes it very cost-effective compared to traditional fund management.

Q: How do I choose the best Master Traders to copy?

A: Selecting the right Master Traders is crucial for success. Look for traders with consistent performance over at least 6-12 months rather than explosive short-term gains. Check their risk score (1-6 scale, with 1 being lowest risk) and choose based on your risk tolerance. Examine their trading history, maximum drawdowns, and how they perform during different market conditions. A good Master Trader should have a reasonable number of followers (indicating trust), manageable commission rates (below 35%), and transparent communication. Diversify by selecting 3-5 Master Traders with different strategies and risk profiles to spread your risk effectively.

Q: Can I lose all my money with copy trading?

A: Yes, like any form of trading or investment, copy trading carries the risk of significant losses, including potentially losing your entire investment. However, OctaFX provides several risk management tools to help protect your capital. You can set Balance Keeper percentages to automatically stop copying if losses reach a certain level, use stop-loss orders on individual trades, and add support funds as buffers. The key to minimizing risk is proper diversification (never put all funds with one Master Trader), starting with amounts you can afford to lose, choosing Master Traders with good risk scores and consistent track records, and regularly monitoring your investments. Remember, past performance doesn’t guarantee future results, and even the best traders have losing periods.

Conclusion: Your Path to Passive Income Through Copy Trading

OctaFX copy trading represents an excellent opportunity for beginners to enter the forex market without extensive training or time commitment. With its low minimum deposit of $25, transparent fee structure, comprehensive risk management tools, and user-friendly mobile app, it removes many barriers that traditionally prevented retail investors from accessing professional trading strategies.

The key to success lies in patient, disciplined approach – choose multiple Master Traders with proven track records, diversify your investments, use the platform’s risk management features, and remember that consistent modest returns often outperform spectacular short-term gains. While copy trading can provide passive income opportunities, it’s not a get-rich-quick scheme and requires careful selection and monitoring.

Whether you’re a busy professional looking for investment opportunities or someone interested in learning about forex markets, OctaFX copy trading offers a practical way to potentially grow your wealth while gaining valuable market experience. Start small, learn continuously, and gradually build your confidence and portfolio.

Agar aapko copy trading ke baare mein koi aur questions hai ya aap apne experiences share karna chahte hai, toh comment section mein zaroor batayiye! For more investment and trading insights, visit InvestsNow for comprehensive financial guidance.

Ready to start your copy trading journey? Visit OctaFX Copy Trading and begin with their user-friendly platform today.

Disclaimer: Trading involves substantial risk and may not be suitable for all investors. Please ensure you understand the risks involved and seek independent financial advice if necessary.