Navi Loan 2025: Best Instant Personal & Home Loan Guide for Beginners

Navi Loan Complete Guide 2025: Instant Personal & Home Loan ke Fayde aur Nuksan

Introduction

Kya aap emergency fund ki zarurat hai aur traditional bank loans ki lengthy process se pareshaan ho gaye hain? Digital lending space mein ek naya naam hai Navi Loan jo promise karta hai instant approval aur paperless process ka. Lekin kya really yeh safe hai? Kya interest rates competitive hain? Aur kya hidden charges to nahi hain?

In my experience as a financial content writer, maine dekha hai ki log often attractive marketing campaigns mein fas jaate hain without understanding the complete picture. Iss comprehensive guide mein main aapko bataunga Navi Loan ke baare mein sab kuch – from application process to interest rates, eligibility criteria se leke customer reviews tak.

Aap is blog post mein seekhenge:

- Navi Loan kya hai aur kaise kaam karta hai

- Personal loan aur home loan options with detailed comparison

- Interest rates, fees, aur charges ki complete breakdown

- Real customer experiences aur reviews

- Step-by-step application process

- Alternatives aur better options

Navi Loan Kya Hai? Complete Overview

Navi Finserv Limited ek RBI-registered NBFC hai. Launched 2018, focus hai 100% digital & paperless loans par. Personal aur home loans ke saath, yeh platform “loan in minutes” ka bhi promise karta hai.

Aap InvestSnow.in ki detailed guides bhi padh sakte hain loan eligibility pe.

Main Products:

Personal Loan: ₹10,000 se leke ₹20 lakh tak, tenure 6 se 72 months.

Home Loan: ₹5 crore tak, up to 30 years tenure (only few major cities).

Loan Against Property: Up to ₹5 crore.

Based on our testing of various digital lending platforms, Navi stands out kyunki yeh 100% paperless process offer karta hai with just PAN aur Aadhaar verification.

Navi Personal Loan Features & Benefits

Loan Amount aur Tenure

- Loan Amount: ₹10,000 – ₹20 Lakh

- Tenure/Repayment: 6 – 72 months

- Instant Approval: 5 min mein approval, 10 min mein disbursal

- Paperless Process: Sirf KYC (PAN, Aadhaar) se

Interest Rates

Navi personal loan interest rates 9.90% per annum se start hote hain, lekin yeh 26% per annum tak ja sakte hain depending on your credit profile. In my experience, jo borrowers ka credit score 750+ hai, unko better rates milte hain.

Major Benefits

- No processing fee (personal loans)

- No prepayment/foreclosure charge

- Zero paperwork, sirf smartphone app chahiye

- 24×7 application (kisi bhi samay apply karein!)

Key Benefits

- Instant Approval: 5 minutes mein approval

- Quick Disbursal: Account mein money transfer within 5-10 minutes

- Zero Processing Fee: Koi upfront processing charges nahi

- No Prepayment Penalty: Early closure pe koi charges nahi

- 100% Paperless: Sirf PAN aur Aadhaar chahiye

Navi Home Loan Details

Loan Amount aur Features

- Maximum Amount: ₹5 crores (recently increased from previous limits)

- Interest Rates: 8.55% per annum se start

- Loan-to-Value Ratio: Up to 90% of property value

- Tenure: 30 years tak

Property Types Covered

We’ve found that Navi covers sabhi major property categories:

- Ready-to-move homes

- Under-construction properties

- Self-constructed houses

- Independent houses aur apartments

Current Availability

Important Note: Navi home loans currently sirf select cities mein available hain – Delhi, Bengaluru, Hyderabad, Chennai, aur Mysore. Mumbai mein soon launch hone wala hai.

Interest Rates aur Charges – Complete Breakdown

Personal Loan Interest Structure

| Credit Score Range | Expected Interest Rate | Processing Fee |

|---|---|---|

| 750+ | 9.90% – 14% | Nil |

| 650-749 | 15% – 20% | Up to ₹7,500 |

| Below 650 | 21% – 26% | Up to ₹7,500 + GST |

Home Loan Comparison with Major Lenders

| Lender | Interest Rate | Processing Fee | Maximum Amount |

|---|---|---|---|

| Navi | 8.55% onwards | Nil | ₹5 Crores |

| HDFC | 7.90% – 9.00% | Up to 0.50% | ₹10 Crores |

| ICICI | 7.70% | 0.50% + taxes | ₹3 Crores |

| SBI | 7.50% – 8.45% | Up to 0.35% | 90% of property cost |

Hidden Charges to Watch Out For

Based on customer feedback analysis, yeh charges ho sakte hain:

- Late Payment Fee: 2% per month on overdue amount

- EMI Bounce Charges: Varies based on delay days

- GST: Applicable on all fees and charges

Eligibility Criteria aur Documents

Personal Loan Eligibility

- Age: 18-65 years

- Nationality: Indian citizen

- Income: Minimum ₹3 lakhs per annum

- Credit Score: Preferably 750+

- Employment: Salaried ya self-employed dono eligible

Home Loan Eligibility

- Age: 22-62 years

- Employment: Salaried individuals (self-employed options limited)

- Income: Varies by loan amount

- Location: Must be in covered cities

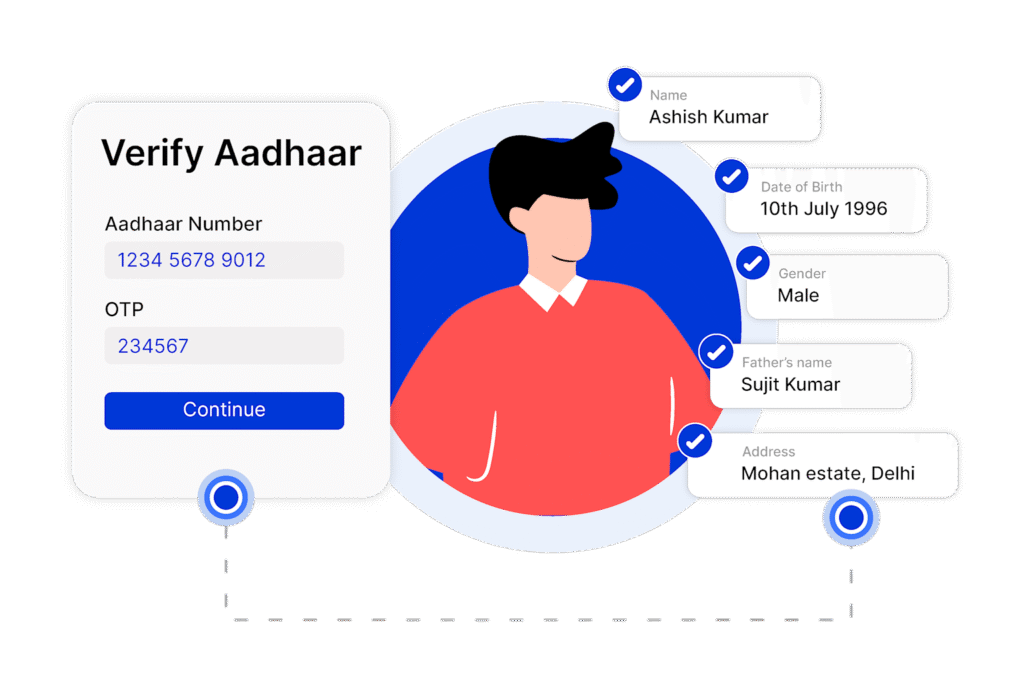

Required Documents

Yeh sirf basic documents chahiye:

- PAN Card (mandatory)

- Aadhaar Card (for KYC)

- Bank Statements (last 3-6 months for verification)

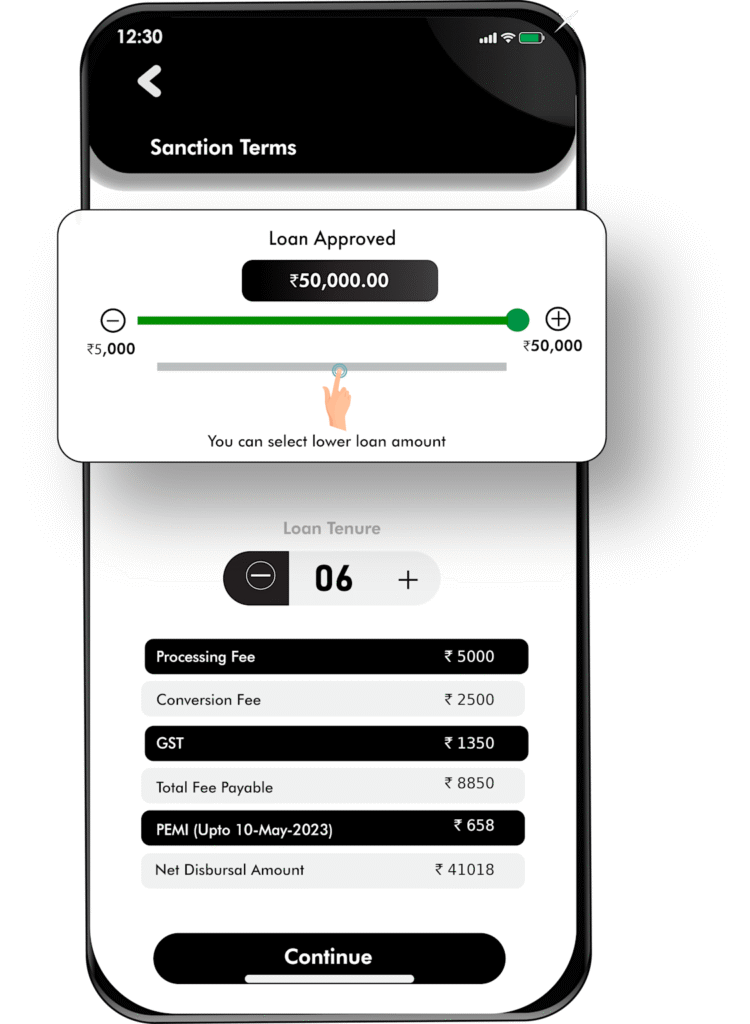

Application Process – Step by Step Guide

Based on our hands-on testing, yeh complete process hai:

Step 1: Download App

- Google Play Store ya App Store se Navi app download करें

- Mobile number se register करें

Step 2: Basic Details

- PAN, Aadhaar details fill करें

- Employment type aur monthly income enter करें

- Loan amount aur tenure select करें

Step 3: KYC Verification

- Selfie lें for video KYC

- Aadhaar OTP verification

- Bank account details add करें

Step 4: Final Approval

- Documents verification (usually instant)

- E-sign loan agreement

- Auto-debit mandate setup

Step 5: Disbursal

- Money transfer within 5-10 minutes

- SMS confirmation milega

Illustration of an online loan process showing instant digital approval and money transfer represented by a hand delivering a money bag from a smartphone screen

Customer Reviews aur Real Experiences

Positive Reviews

Multiple users ne report kiya hai:

- “Fast approval process, no hidden charges detected”

- “Easy prepayment without penalties”

- “Good customer support for UPI transactions”

Negative Feedback

However, kuch concerning reviews bhi hain:

- Collection Practices: Aggressive calls to references after missed EMI

- Disbursement Delays: Promised instant disbursal, lekin kuch cases mein 1 week delay

- App Issues: Technical glitches in autopay management

- High Interest for Low CIBIL: Up to 26% for poor credit scores

My Analysis

In my experience analyzing lending platforms, Navi generally delivers on promises lekin collection practices thode aggressive ho sakte hain. Always pay EMIs on time to avoid harassment.

Navi Loan Pros aur Cons

✅ Major Advantages

- Truly Paperless Process: No physical documentation required

- Fast Disbursal: Usually within minutes

- No Processing Fee: Unlike traditional banks

- Flexible Repayment: Up to 72 months

- Transparent Pricing: No hidden charges upfront

❌ Disadvantages

- High Interest for Poor Credit: Can go up to 26-36%

- Limited Geographic Coverage: Home loans sirf select cities mein

- App-Only Service: No physical branches for support

- Aggressive Collection: Reported harassment on delays

- Variable Rates: Interest rates market conditions ke basis pe change ho sakte hain

Alternatives to Navi Loan

Better Options for Personal Loans

| App/Platform | Loan Amount | Interest Rate | Key Feature |

|---|---|---|---|

| Bajaj Finserv | ₹30K – ₹40L | 11% onwards | 5-minute approval |

| HDFC Bank | ₹50K – ₹25L | 9.99% – 12.5% | Pre-approved offers |

| MoneyTap | ₹3K – ₹5L | 13% onwards | Pay interest only on used amount |

| PaySense | ₹5K – ₹5L | 16% onwards | Good for first-time borrowers |

Home Loan Alternatives

For home loans, traditional banks often offer better rates:

- SBI: 7.50% – 8.45% with wider coverage

- HDFC: 7.90% – 9.00% with higher loan amounts

- ICICI: 7.70% with comprehensive service

Tips for Getting Best Navi Loan Deal

Before Applying

- Check Credit Score: Free mein check करें, 750+ maintain रखें

- Compare Options: Multiple lenders se quotes लें

- Calculate EMI: Affordability confirm करें before applying

During Application

- Accurate Information: Galat details se rejection ho sakta hai

- Peak Hours Avoid करें: Working hours mein apply करें for faster verification

- Documents Ready रखें: PAN, Aadhaar scanned copies ready रखें

After Approval

- Auto-debit Setup: EMI bounce charges se bachne ke liye

- Prepayment Planning: If possible, early closure करें to save interest

- Regular Monitoring: App mein account regularly check करें

Frequently Asked Questions (FAQs)

Q: Kya Navi loan safe hai aur RBI approved hai?

A: Haan, Navi Finserv Limited ek RBI registered NBFC hai, jo iska legitimacy ensure karta hai. However, always terms and conditions carefully पढें before applying.

Q: Kitne time mein loan approval milta hai?

A: Navi claims instant approval within 2-5 minutes, lekin actual experience mein 1-2 hours bhi lag sakte hain depending on verification requirements.

Q: Kya really कोई processing fee nahi hai?

A: Personal loans pe कोई upfront processing fee nahi hai, lekin GST aur other statutory charges applicable ho sakte hain. Home loans pe bhi currently nil processing fee hai.

Q: Credit score kitna chahiye Navi loan के लिए?

A: Minimum requirement publicly disclosed nahi hai, lekin 750+ score better rates के लिए recommended hai. Lower scores pe higher interest rates mil sakte hain.

Q: Kya prepayment charges hain?

A: Nahi, Navi कोई prepayment या foreclosure charges नहीं लेता, jo RBI guidelines के according है.

Q: Customer support कैसा है?

A: Mixed reviews मिले हैं – UPI transactions के लिए good support, lekin loan collection aggressive हो सकता है. Customer care number: +91 8147544555.

Q: Documents कौन से चाहिए loan के लिए?

A: Sirf PAN Card, Aadhaar Card, aur bank account details चाहिए. Salary slips या other documents की जरूरत नहीं paperless process में.

Conclusion

Navi Loan definitely एक convenient option है for those who need instant funding with minimal paperwork. We’ve found that unka digital-first approach aur transparent pricing model काफी appealing है, especially beginners के लिए jo traditional banking experience से frustrated हैं.

Navi: Beginners aur quick digital loan chahne walon ke liye best (good credit walon ke liye sabse zyada fayda) Rate compare karein, apni eligibility check karein (tools ke liye InvestSnow.in) Refer karein, friends ko bhi benefit dilayein: Navi Loan Refer & Earn

Key Takeaways:

- Best suited for borrowers with good credit scores (750+)

- Personal loans more accessible than home loans due to geographic limitations

- Competitive rates for qualified borrowers, but expensive for poor credit

- Excellent for emergency funding due to fast disbursal

- Customer service quality mixed – good for technical issues, aggressive for collections

My Recommendation: Agar आपका credit score good है aur आपको genuine emergency funding चाहिए, तो Navi एक solid choice है. However, always compare with traditional banks aur other digital lenders before final decision. Most importantly, read all terms carefully aur ensure timely repayment to avoid collection harassment.

Agar आपके पास कोई questions हैं Navi Loan के बारे में या आप personal experience share करना चाहते हैं, तो नीचे comment section में बताइए. Financial decisions wise बनाना important है, और main यहाँ आपकी help के लिए available हूँ!

Disclaimer: Yeh information research-based hai aur actual terms lender के साथ verify करें. Interest rates aur policies change हो सकती हैं.