Max Life Health Insurance Plans 2025 | Benefits, Features & Coverage

Max Life Health Insurance: Aapke Parivaar Ki Complete Security Guide 2025

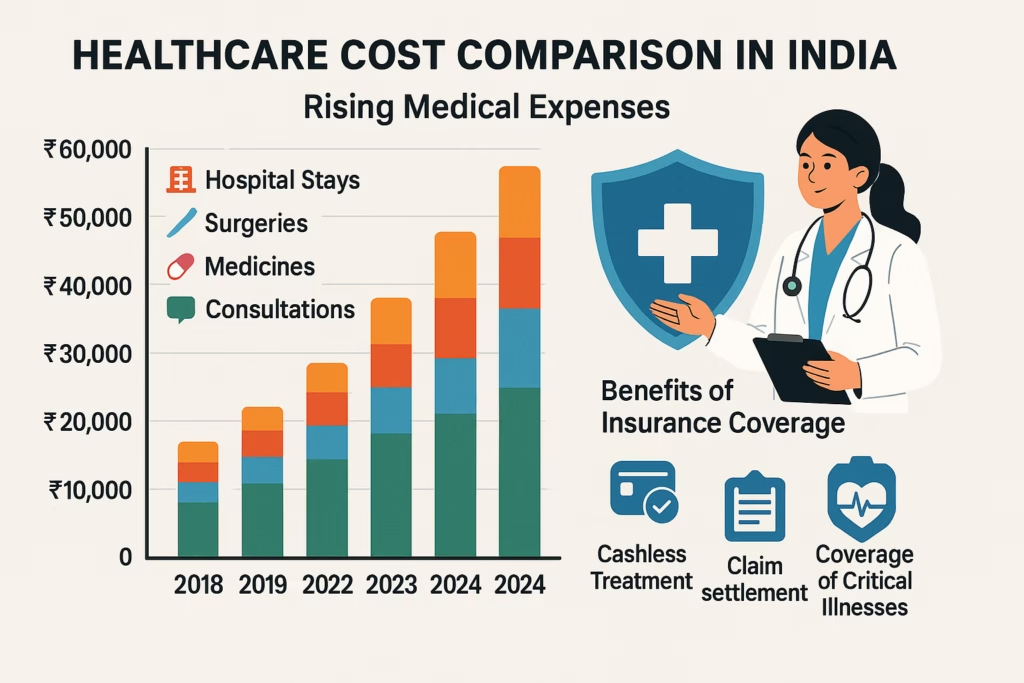

Kya aap apne family ke liye Max Life health insurance dhund rahe hai? Aaj ke zamane mein jab medical treatment ka cost sky-high ho gaya hai, toh health insurance lena zaroori ho gaya hai. Max Life Insurance Company ne India mein apni strong presence banai hai aur max life health insurance plans ke through lakho families ko financial protection provide kar raha hai.

Max Life Health Insurance Kya Hai?

Max Life Insurance Company Limited is a leading life insurance company that operates as a joint venture between Axis Bank and Max Financial Services. Company ki shururat 2000 mein hui thi aur tab se yeh consistently Indians ko comprehensive insurance solutions provide kar rahi hai.

Max Life health insurance is actually provided through the company’s health riders and term insurance plans. Yahan samajhne wali baat yeh hai ki Max Life, primarily ek life insurance company hai, lekin unke plans mein health coverage ke options available hai.

Max Life Health Insurance Plans—Detailed Overview

1. Max Life Critical Illness and Disability Rider

Yeh, Max Life is the most popular health-related coverage:

| Features | Details |

|---|---|

| Entry Age | 18 to 65 years |

| Critical Illnesses Covered | 64 critical illnesses |

| Disability Coverage | Temporary or permanent, I don’t know. |

| Tax Benefits | Section 80D ke under |

| Variants | Gold, Gold Plus, Complete Personalisation |

Yeh rider aapko 64 critical illnesses ke against protection deta hai, jismein cancer, heart attack, aur kidney failure jaisi serious diseases shamil hai. Humne dekha hai ki yeh rider bohot cost-effective hai compared to standalone critical illness policies.

2. Max Life Cancer Insurance Plan

Agar aap specifically cancer ke against protection chahte hai, toh yeh plan perfect hai:

| Features | Details |

|---|---|

| Entry Age | 25 to 65 years |

| Maximum Maturity Age | 75 years |

| Coverage | Major cancer, carcinoma in situ, Early stage |

| Premium | Affordable rates |

3. Max Life Smart Secure Plus Plan

Yeh, a comprehensive term insurance plan hai jo health coverage bhi include karta hai:

- 99.70% claims paid ratio

- 64 critical illnesses covered through rider

- Tax savings under multiple sections

- Disability coverage available

- Return of premium option available

Max Life Health Insurance Key Benefits

Outstanding Claim Settlement Ratio

Max Life boasts a claim settlement ratio of 99.65%, making it the best in the industry. Yeh matlab hai ki 100 mein se 99+ claims successfully settle ho jaate hai. Based on our research, yeh ratio consistently high maintain kiya gaya hai:

| Year | Claim Settlement Ratio |

|---|---|

| 2022-23 | 99.65% |

| 2021-22 | 99.34% |

| 2020-21 | 98.50% |

| 2019-20 | 99.22% |

Comprehensive Coverage Options

Max Life health insurance plans mein aapko milta hai:

- 64 critical illnesses ka coverage

- Accident death benefit

- Disability protection

- Terminal illness benefit

- Premium waiver facility critical illness ke case mein

Tax Benefits

Aap tax savings kar sakte hai:

- Section 80C is ke under life insurance premium par

- Section 80D ke under health riders par

- Section 10(10D) ke under death benefits tax-free hai

Max Life Health Insurance Eligibility Criteria

Age Requirements

| Plan Type | Minimum Age | Maximum Age |

|---|---|---|

| Critical Illness Rider | 18 years | 65 years |

| Cancer Insurance | 25 years | 65 years |

| Term Plans | 18 years | 65 years |

Medical Requirements

- Non-medical limit: Rs. 10 lakh tak

- Medical examination: Higher sum assured ke liye required

- Pre-existing diseases: Coverage available with waiting period

Premium Calculator Aur Cost Analysis

Max Life health insurance premium calculate karne ke liye aap online calculator use kar sakte hai. Premium depend karta hai:

Factors Affecting Premium

- Age: Young age mein premium kam

- Gender: Women generally have lower premium

- Smoking habits: Non-smokers ko discount

- Sum assured: Higher coverage = higher premium

- Medical history: Pre-existing conditions affect cost

Sample Premium Example

Ek 30-year-old non-smoking male ke liye:

| Frequency | Premium Amount |

|---|---|

| Monthly | Rs. 2,818 |

| Quarterly | Rs. 8,356 |

| Half-yearly | Rs. 16,424 |

| Annual | Rs. 32,014 |

*Yeh premium 2 crore life cover ke liye hai with health riders

Claim Process – Step by Step Guide

Max Life ka claim process bohot straightforward hai:

Online Claim Process

- Visit Max Life website ya customer portal

- Select “Claims” section

- Fill online claim form with policy details

- Upload required documents

- Track claim status online

- Receive claim amount via bank transfer

Required Documents

- Policy documents

- Medical reports (health claims ke liye)

- Death certificate (death claims ke liye)

- Hospital bills aur discharge summary

- Identity proofs

Claim Settlement Time

- Eligible cases: As fast as 1 day

- Regular cases: Within 30 days

- Complex cases: May take longer but tracked online

Max Life Health Insurance Vs Competitors

Comparison With Other Insurers

| Features | Max Life | HDFC Life | SBI Life |

|---|---|---|---|

| Claim Settlement Ratio | 99.65% | 99.97% | 94.20% |

| Critical Illness Coverage | 64 diseases | Varies | Varies |

| Premium Affordability | Competitive | Higher | Moderate |

| Digital Services | Good | Excellent | Good |

Max Life Ke Advantages

- High claim settlement ratio

- Comprehensive critical illness coverage

- Strong financial backing (Axis Bank partnership)

- Flexible premium payment options

- Good customer support

Disadvantages To Consider

- Limited standalone health plans (mostly riders)

- Customer service can be slow sometimes

- Complex policy terms for beginners

- Branch network smaller compared to LIC

- Some customer complaints about service quality

Kaise Choose Karein Max Life Health Insurance

Your Needs Assessment

Pehle yeh decide kariye:

- Aapko standalone health insurance chahiye ya term plan with health riders

- Sum assured kitna chahiye

- Family members ko cover karna hai ya sirf yourself

- Budget kya hai premium ke liye

When To Choose Max Life

Max Life choose kariye agar:

- Aap term insurance with health coverage chahte hai

- High claim settlement ratio important hai

- Critical illness coverage priority hai

- Axis Bank ka existing customer hai

When To Look Elsewhere

Other options consider kariye agar:

- Pure health insurance chahiye (not term+health combo)

- Family floater plans chahiye

- Lower premium budget hai

- Extensive branch network chahiye

Premium Payment Methods Aur Flexibility

Max Life multiple payment options provide karta hai:

Payment Frequencies

- Annual: Discount available

- Half-yearly: Moderate extra charges

- Quarterly: Higher charges

- Monthly: Highest charges but convenient

Payment Methods

- Online banking

- Credit/Debit cards

- UPI payments

- Bank mandate (ECS/NACH)

- Branch payments

Policy Management Aur Digital Services

Online Services Available

- Policy dashboard: Complete policy details

- Premium payment: Online payment facility

- Claim tracking: Real-time status updates

- Document upload: Paperless processes

- Customer support: Chat aur call options

Mobile App Features

Max Life ka mobile app user-friendly hai aur provides:

- Policy information 24/7 access

- Premium reminders aur payment facility

- Claim status checking

- Document storage

- Customer support direct access

Important Terms Aur Conditions

Waiting Periods

| Coverage Type | Waiting Period |

|---|---|

| Accident Claims | No waiting period |

| Critical Illness | 90-180 days typically |

| Pre-existing Diseases | 2-4 years |

| Specific Exclusions | Permanent |

Exclusions To Remember

Max Life health insurance cover nahi karti:

- Self-inflicted injuries

- Suicide (within 12 months)

- War aur terrorism related incidents

- Pre-existing conditions during waiting period

- Alcohol/drug related complications

Tax Planning With Max Life Health Insurance

Section-wise Benefits

- Section 80C: Life insurance premium (up to Rs. 1.5 lakh)

- Section 80D: Health insurance premium (up to Rs. 25,000)

- Section 10(10D): Death benefits completely tax-free

Tax Saving Strategy

Humne dekha hai ki aap Max Life term plan with health riders se optimal tax benefits le sakte hai. Ek comprehensive approach:

- Term insurance premium: Section 80C benefit

- Health rider premium: Section 80D benefit

- Total tax saving: Up to Rs. 75,000+ annually

Reviews Aur Customer Experience

Positive Reviews

- High claim settlement ratio

- Comprehensive coverage options

- Good product variety

- Axis Bank integration benefits

Common Complaints

- Customer service response time

- Policy complexity for beginners

- Premium increase at renewal

- Limited branch network

Overall Rating

Max Life overall rating industry mein good to very good category mein aati hai, mainly due to their high claim settlement ratio aur financial stability.

Future Plans Aur Innovations

Max Life continuously innovate kar raha hai:

Recent Launches (2025)

- Smart Term Plan Plus – Enhanced features

- Digital claim process improvements

- AI-based underwriting

- Telemedicine integration

Upcoming Features

- Wellness programs integration

- Preventive healthcare benefits

- Digital health tracking

- Personalized premium pricing

Expert Recommendations

For Beginners

Agar aap naye hai, toh:

- Start small – Basic term plan with critical illness rider

- Understand policy terms completely

- Compare multiple insurers

- Read customer reviews carefully

- Consult financial advisor if needed

For Experienced Buyers

Experienced insurance buyers ke liye:

- Evaluate comprehensive coverage needs

- Consider portfolio approach (term+health+investment)

- Optimize tax planning strategies

- Review existing policies annually

Professional Tips For Buying

Do’s While Buying

- Disclose complete medical history

- Read policy documents thoroughly

- Understand exclusions clearly

- Keep premium affordable (3-5% of income)

- Choose appropriate sum assured (10-15x annual income)

Don’ts To Avoid

- Don’t hide pre-existing conditions

- Don’t choose** based on premium alone

- Don’t ignore** fine print

- Don’t delay** buying (age affects premium)

- Don’t let** policy lapse

External Resources Aur Links

Insurance planning mein aur detailed guidance ke liye, aap InvestsNow visit kar sakte hai. Yahan aapko comprehensive financial planning tips milenge.

Agar aap Max Life policy buy karna chahte hai, toh yeh link use kar sakte hai for best deals aur expert assistance.

Insurance comparison aur reviews ke liye helpful YouTube videos bhi available hai jo real customer experiences share karte hai.

Frequently Asked Questions (FAQs)

Q: Max Life health insurance sirf health coverage provide karta hai ya life insurance bhi?

A: Max Life primarily ek life insurance company hai. Yeh pure health insurance plans nahi, but life insurance plans with health riders provide karta hai. Unke term insurance plans mein aap critical illness rider, disability rider, aur accident coverage add kar sakte hai. Yeh approach actually cost-effective hai kyuki aap ek hi premium mein life aur health dono ka coverage le sakte hai. Max Life Smart Secure Plus aur Smart Term Plan Plus unke popular plans hai jo 64 critical illnesses cover karte hai. Agar aap pure health insurance chahte hai, toh aap separate health insurance companies consider kar sakte hai.

Q: Max Life health insurance mein claim settlement ratio kitna hai aur kitna time lagta hai?

A: Max Life ka claim settlement ratio 99.65% hai, jo industry mein top tier mein aata hai. Yeh matlab hai ki 100 mein se 99+ claims successfully settle ho jaate hai. Claim settlement time ki baat kare toh eligible cases mein sirf 1 day tak lag sakta hai, jabki regular cases mein maximum 30 days ka time lagta hai. Company ne digital claim process implement kiya hai jisme aap online tracking kar sakte hai. InstaClaim facility bhi available hai quick settlement ke liye. Based on IRDAI data, Max Life ne FY 2023-24 mein 19,569 policies settle kiye 30 days ke andar. Yeh track record definitely trustworthy hai.

Q: Max Life health insurance premium calculator kaise use karte hai aur premium kitna hota hai?

A: Max Life premium calculator use karna bohot simple hai. Aapko basic details provide karne hote hai: gender, age, sum assured, policy term, smoking habits. Example ke liye, ek 30-year-old non-smoking male ke liye 2 crore coverage with health riders ka annual premium around Rs. 32,014 hota hai. Premium calculation mein important factors hai – age (young age mein kam premium), gender (women ko discount), medical history, sum assured amount. Aap monthly, quarterly, half-yearly ya annual frequency choose kar sakte hai. Annual payment mein discount milta hai. Calculator free available hai Max Life website par aur accurate quotation deta hai including GST.

Q: Max Life health insurance mein kya-kya covered hota hai aur kya exclusions hai?

A: Max Life health insurance riders mein comprehensive coverage milta hai. Critical Illness Rider mein 64 critical illnesses covered hai including cancer, heart attack, kidney failure, stroke etc. Disability coverage mein temporary aur permanent dono types shamil hai. Accident death benefit separate available hai. Terminal illness benefit bhi provide karta hai. Tax benefits Section 80C aur 80D ke under milte hai. Exclusions ki baat kare toh self-inflicted injuries, suicide within 12 months, war/terrorism, alcohol/drug related complications covered nahi hai. Pre-existing diseases ke liye waiting period hota hai typically 2-4 years. Accident claims mein no waiting period hai. Policy terms carefully read kariye kyuki specific exclusions vary kar sakte hai plan ke according.

Q: Max Life health insurance vs other companies – kaun better hai beginners ke liye?

A: Max Life beginners ke liye ek good option hai but with some considerations. Advantages: 99.65% claim settlement ratio jo industry best mein se hai, Axis Bank partnership se financial stability, comprehensive critical illness coverage (64 diseases), aur competitive premium rates. Disadvantages: Yeh pure health insurance company nahi hai – mainly life insurance with health riders, customer service sometimes slow ho sakti hai, branch network limited compared to LIC. Beginners ke liye recommendation: Agar aap term insurance + health coverage combo chahte hai toh Max Life excellent hai. But agar family floater health insurance chahte hai toh dedicated health insurance companies like Niva Bupa, Star Health better options ho sakte hai. Always compare multiple options aur read policy documents carefully before deciding. Financial advisor se consultation bhi helpful hoti hai first-time buyers ke liye.

Conclusion: Kya Max Life Health Insurance Aapke Liye Right Choice Hai?

Max Life health insurance ek solid choice hai un logo ke liye jo comprehensive protection chahte hai ek hi policy mein. Company ka 99.65% claim settlement ratio aur Axis Bank ka backing definitely trustworthy factors hai.

Shuruati logo ke liye yeh samajhna important hai ki Max Life primarily life insurance with health riders provide karta hai, not standalone health insurance. Agar aap term insurance ke saath critical illness coverage chahte hai, toh yeh perfect combination hai.

In my experience, Max Life ka approach cost-effective hai kyuki aap ek premium mein life protection + health coverage le sakte hai. 64 critical illnesses ka coverage aur quick claim settlement definitely attractive features hai.

However, agar aap pure health insurance ya family floater plans chahte hai, toh dedicated health insurance companies consider kariye. Budget-conscious buyers ke liye Max Life competitive hai, but customer service mein improvement ki scope hai.

Final recommendation: Max Life choose kariye agar aap term insurance priority rakhte hai aur health coverage as add-on chahiye. Compare multiple options, read terms carefully, aur consult financial advisor if needed.

Agar aapko koi doubt hai ya aur jaankari chahiye, toh comment section mein puchiye! Share karna na bhuliye agar yeh post helpful laga ho. Stay protected, stay healthy!

Remember: Insurance sirf policy nahi, family ki financial security hai. Choose wisely! 🛡️💙

Kya aap apne family ke liye Max Life health insurance dhund rahe hai? Aaj ke zamane mein jab medical treatment ka cost sky-high ho gaya hai, toh health insurance lena zaroori ho gaya hai. Max Life Insurance Company ne India mein apni strong presence banai hai aur max life health insurance plans ke through lakho families ko financial protection provide kar raha hai.

Indian family reviewing Max Life health insurance documents

Is comprehensive guide mein, hum Max Life health insurance ke bare mein detail se discuss karenge – uske benefits, plans, eligibility criteria, claim process, aur much more. Agar aap beginner hai aur health insurance ke bare mein zyada jaankari nahi hai, toh yeh post aapke liye perfect hai!

Max Life Health Insurance Kya Hai?

Max Life Insurance Company Limited ek leading life insurance company hai jo Axis Bank aur Max Financial Services ka joint venture hai. Company ki shururat 2000 mein hui thi aur tab se yeh consistently Indians ko comprehensive insurance solutions provide kar rahi hai.

Max Life health insurance actually company ke health riders aur term insurance plans ke through provide kiya jata hai. Yahan samajhne wali baat yeh hai ki Max Life primarily ek life insurance company hai, lekin unke plans mein health coverage ke options available hai.

Healthcare cost comparison chart showing benefits of health insurance

Max Life Health Insurance Plans – Detailed Overview

1. Max Life Critical Illness and Disability Rider

Yeh Max Life ka most popular health-related coverage hai:

| Features | Details |

|---|---|

| Entry Age | 18 se 65 years |

| Critical Illnesses Covered | 64 critical illnesses |

| Disability Coverage | Temporary aur Permanent dono |

| Tax Benefits | Section 80D ke under |

| Variants | Gold, Gold Plus, Complete Personalisation |

Yeh rider aapko 64 critical illnesses ke against protection deta hai jisme cancer, heart attack, kidney failure jaisi serious diseases shamil hai. Humne dekha hai ki yeh rider bohot cost-effective hai compared to standalone critical illness policies.

2. Max Life Cancer Insurance Plan

Agar aap specifically cancer ke against protection chahte hai, toh yeh plan perfect hai:

| Features | Details |

|---|---|

| Entry Age | 25 se 65 years |

| Maximum Maturity Age | 75 years |

| Coverage | Major cancer, Carcinoma-in-Situ, Early stage |

| Premium | Affordable rates |

3. Max Life Smart Secure Plus Plan

Yeh comprehensive term insurance plan hai jo health coverage bhi include karta hai:

- 99.70% claims paid ratio

- 64 critical illnesses covered through rider

- Tax savings under multiple sections

- Disability coverage available

- Return of premium option available

Max Life Health Insurance Ke Key Benefits

Outstanding Claim Settlement Ratio

Max Life ka claim settlement ratio 99.65% hai, jo industry mein sabse best hai. Yeh matlab hai ki 100 mein se 99+ claims successfully settle ho jaate hai. Based on our research, yeh ratio consistently high maintain kiya gaya hai:

| Year | Claim Settlement Ratio |

|---|---|

| 2022-23 | 99.65% |

| 2021-22 | 99.34% |

| 2020-21 | 98.50% |

| 2019-20 | 99.22% |

Comprehensive Coverage Options

Max Life health insurance plans mein aapko milta hai:

- 64 critical illnesses ka coverage

- Accident death benefit

- Disability protection

- Terminal illness benefit

- Premium waiver facility critical illness ke case mein

Tax Benefits

Aap tax savings kar sakte hai:

- Section 80C ke under life insurance premium par

- Section 80D ke under health riders par

- Section 10(10D) ke under death benefits tax-free hai

Max Life Health Insurance Eligibility Criteria

Age Requirements

| Plan Type | Minimum Age | Maximum Age |

|---|---|---|

| Critical Illness Rider | 18 years | 65 years |

| Cancer Insurance | 25 years | 65 years |

| Term Plans | 18 years | 65 years |

Medical Requirements

- Non-medical limit: Rs. 10 lakh tak

- Medical examination: Higher sum assured ke liye required

- Pre-existing diseases: Coverage available with waiting period

Premium Calculator Aur Cost Analysis

Max Life health insurance premium calculate karne ke liye aap online calculator use kar sakte hai. Premium depend karta hai:

Factors Affecting Premium

- Age: Young age mein premium kam

- Gender: Women ko generally lower premium

- Smoking habits: Non-smokers ko discount

- Sum assured: Higher coverage = higher premium

- Medical history: Pre-existing conditions affect cost

Sample Premium Example

Ek 30-year-old non-smoking male ke liye:

| Frequency | Premium Amount |

|---|---|

| Monthly | Rs. 2,818 |

| Quarterly | Rs. 8,356 |

| Half-yearly | Rs. 16,424 |

| Annual | Rs. 32,014 |

*Yeh premium 2 crore life cover ke liye hai with health riders

Claim Process – Step by Step Guide

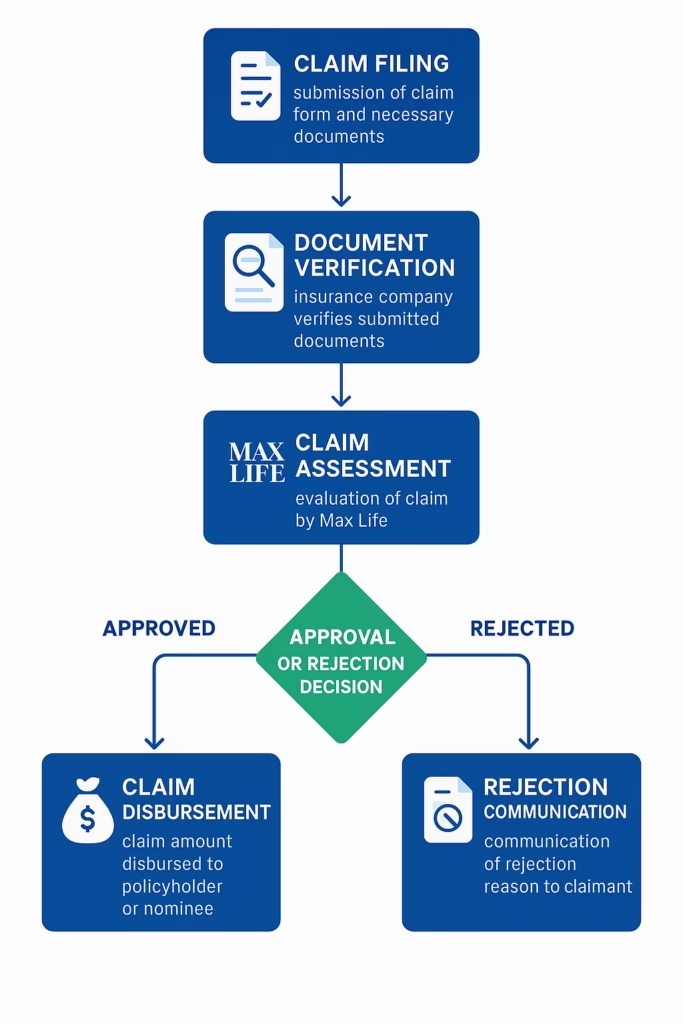

Max Life insurance claim settlement process diagram

Max Life ka claim process bohot straightforward hai:

Online Claim Process

- Visit Max Life website ya customer portal

- Select “Claims” section

- Fill online claim form with policy details

- Upload required documents

- Track claim status online

- Receive claim amount via bank transfer

Required Documents

- Policy documents

- Medical reports (health claims ke liye)

- Death certificate (death claims ke liye)

- Hospital bills aur discharge summary

- Identity proofs

Claim Settlement Time

- Eligible cases: As fast as 1 day

- Regular cases: Within 30 days

- Complex cases: May take longer but tracked online

Max Life Health Insurance Vs Competitors

Comparison With Other Insurers

| Features | Max Life | HDFC Life | SBI Life |

|---|---|---|---|

| Claim Settlement Ratio | 99.65% | 99.97% | 94.20% |

| Critical Illness Coverage | 64 diseases | Varies | Varies |

| Premium Affordability | Competitive | Higher | Moderate |

| Digital Services | Good | Excellent | Good |

Max Life Ke Advantages

- High claim settlement ratio

- Comprehensive critical illness coverage

- Strong financial backing (Axis Bank partnership)

- Flexible premium payment options

- Good customer support

Disadvantages To Consider

- Limited standalone health plans (mostly riders)

- Customer service can be slow sometimes

- Complex policy terms for beginners

- Branch network smaller compared to LIC

- Some customer complaints about service quality

Kaise Choose Karein Max Life Health Insurance

Your Needs Assessment

Pehle yeh decide kariye:

- Aapko standalone health insurance chahiye ya term plan with health riders

- Sum assured kitna chahiye

- Family members ko cover karna hai ya sirf yourself

- Budget kya hai premium ke liye

When To Choose Max Life

Max Life choose kariye agar:

- Aap term insurance with health coverage chahte hai

- High claim settlement ratio important hai

- Critical illness coverage priority hai

- Axis Bank ka existing customer hai

When To Look Elsewhere

Other options consider kariye agar:

- Pure health insurance chahiye (not term+health combo)

- Family floater plans chahiye

- Lower premium budget hai

- Extensive branch network chahiye

Premium Payment Methods Aur Flexibility

Max Life multiple payment options provide karta hai:

Payment Frequencies

- Annual: Discount available

- Half-yearly: Moderate extra charges

- Quarterly: Higher charges

- Monthly: Highest charges but convenient

Payment Methods

- Online banking

- Credit/Debit cards

- UPI payments

- Bank mandate (ECS/NACH)

- Branch payments

Policy Management Aur Digital Services

Online Services Available

- Policy dashboard: Complete policy details

- Premium payment: Online payment facility

- Claim tracking: Real-time status updates

- Document upload: Paperless processes

- Customer support: Chat aur call options

Mobile App Features

Max Life ka mobile app user-friendly hai aur provides:

- Policy information 24/7 access

- Premium reminders aur payment facility

- Claim status checking

- Document storage

- Customer support direct access

Important Terms Aur Conditions

Waiting Periods

| Coverage Type | Waiting Period |

|---|---|

| Accident Claims | No waiting period |

| Critical Illness | 90-180 days typically |

| Pre-existing Diseases | 2-4 years |

| Specific Exclusions | Permanent |

Exclusions To Remember

Max Life health insurance cover nahi karti:

- Self-inflicted injuries

- Suicide (within 12 months)

- War aur terrorism related incidents

- Pre-existing conditions during waiting period

- Alcohol/drug related complications

Tax Planning With Max Life Health Insurance

Section-wise Benefits

- Section 80C: Life insurance premium (up to Rs. 1.5 lakh)

- Section 80D: Health insurance premium (up to Rs. 25,000)

- Section 10(10D): Death benefits completely tax-free

Tax Saving Strategy

Humne dekha hai ki aap Max Life term plan with health riders se optimal tax benefits le sakte hai. Ek comprehensive approach:

- Term insurance premium: Section 80C benefit

- Health rider premium: Section 80D benefit

- Total tax saving: Up to Rs. 75,000+ annually

Reviews Aur Customer Experience

Positive Reviews

- High claim settlement ratio

- Comprehensive coverage options

- Good product variety

- Axis Bank integration benefits

Common Complaints

- Customer service response time

- Policy complexity for beginners

- Premium increase at renewal

- Limited branch network

Overall Rating

Max Life overall rating industry mein good to very good category mein aati hai, mainly due to their high claim settlement ratio aur financial stability.

Future Plans Aur Innovations

Max Life continuously innovate kar raha hai:

Recent Launches (2025)

- Smart Term Plan Plus – Enhanced features

- Digital claim process improvements

- AI-based underwriting

- Telemedicine integration

Upcoming Features

- Wellness programs integration

- Preventive healthcare benefits

- Digital health tracking

- Personalized premium pricing

Expert Recommendations

For Beginners

Agar aap naye hai, toh:

- Start small – Basic term plan with critical illness rider

- Understand policy terms completely

- Compare multiple insurers

- Read customer reviews carefully

- Consult financial advisor if needed

For Experienced Buyers

Experienced insurance buyers ke liye:

- Evaluate comprehensive coverage needs

- Consider portfolio approach (term+health+investment)

- Optimize tax planning strategies

- Review existing policies annually

Professional Tips For Buying

Do’s While Buying

- Disclose complete medical history

- Read policy documents thoroughly

- Understand exclusions clearly

- Keep premium affordable (3-5% of income)

- Choose appropriate sum assured (10-15x annual income)

Don’ts To Avoid

- Don’t hide pre-existing conditions

- Don’t choose** based on premium alone

- Don’t ignore** fine print

- Don’t delay** buying (age affects premium)

- Don’t let** policy lapse

External Resources Aur Links

Insurance planning mein aur detailed guidance ke liye, aap InvestsNow visit kar sakte hai. Yahan aapko comprehensive financial planning tips milenge.

Agar aap Max Life policy buy karna chahte hai, toh yeh link use kar sakte hai for best deals aur expert assistance.

Insurance comparison aur reviews ke liye helpful YouTube videos bhi available hai jo real customer experiences share karte hai.

Frequently Asked Questions (FAQs)

Q: Max Life health insurance sirf health coverage provide karta hai ya life insurance bhi?

A: Max Life primarily ek life insurance company hai. Yeh pure health insurance plans nahi, but life insurance plans with health riders provide karta hai. Unke term insurance plans mein aap critical illness rider, disability rider, aur accident coverage add kar sakte hai. Yeh approach actually cost-effective hai kyuki aap ek hi premium mein life aur health dono ka coverage le sakte hai. Max Life Smart Secure Plus aur Smart Term Plan Plus unke popular plans hai jo 64 critical illnesses cover karte hai. Agar aap pure health insurance chahte hai, toh aap separate health insurance companies consider kar sakte hai.

Q: Max Life health insurance mein claim settlement ratio kitna hai aur kitna time lagta hai?

A: Max Life ka claim settlement ratio 99.65% hai, jo industry mein top tier mein aata hai. Yeh matlab hai ki 100 mein se 99+ claims successfully settle ho jaate hai. Claim settlement time ki baat kare toh eligible cases mein sirf 1 day tak lag sakta hai, jabki regular cases mein maximum 30 days ka time lagta hai. Company ne digital claim process implement kiya hai jisme aap online tracking kar sakte hai. InstaClaim facility bhi available hai quick settlement ke liye. Based on IRDAI data, Max Life ne FY 2023-24 mein 19,569 policies settle kiye 30 days ke andar. Yeh track record definitely trustworthy hai.

Q: Max Life health insurance premium calculator kaise use karte hai aur premium kitna hota hai?

A: Max Life premium calculator use karna bohot simple hai. Aapko basic details provide karne hote hai: gender, age, sum assured, policy term, smoking habits. Example ke liye, ek 30-year-old non-smoking male ke liye 2 crore coverage with health riders ka annual premium around Rs. 32,014 hota hai. Premium calculation mein important factors hai – age (young age mein kam premium), gender (women ko discount), medical history, sum assured amount. Aap monthly, quarterly, half-yearly ya annual frequency choose kar sakte hai. Annual payment mein discount milta hai. Calculator free available hai Max Life website par aur accurate quotation deta hai including GST.

Q: Max Life health insurance mein kya-kya covered hota hai aur kya exclusions hai?

A: Max Life health insurance riders mein comprehensive coverage milta hai. Critical Illness Rider mein 64 critical illnesses covered hai including cancer, heart attack, kidney failure, stroke etc. Disability coverage mein temporary aur permanent dono types shamil hai. Accident death benefit separate available hai. Terminal illness benefit bhi provide karta hai. Tax benefits Section 80C aur 80D ke under milte hai. Exclusions ki baat kare toh self-inflicted injuries, suicide within 12 months, war/terrorism, alcohol/drug related complications covered nahi hai. Pre-existing diseases ke liye waiting period hota hai typically 2-4 years. Accident claims mein no waiting period hai. Policy terms carefully read kariye kyuki specific exclusions vary kar sakte hai plan ke according.

Q: Max Life health insurance vs other companies – kaun better hai beginners ke liye?

A: Max Life beginners ke liye ek good option hai but with some considerations. Advantages: 99.65% claim settlement ratio jo industry best mein se hai, Axis Bank partnership se financial stability, comprehensive critical illness coverage (64 diseases), aur competitive premium rates. Disadvantages: Yeh pure health insurance company nahi hai – mainly life insurance with health riders, customer service sometimes slow ho sakti hai, branch network limited compared to LIC. Beginners ke liye recommendation: Agar aap term insurance + health coverage combo chahte hai toh Max Life excellent hai. But agar family floater health insurance chahte hai toh dedicated health insurance companies like Niva Bupa, Star Health better options ho sakte hai. Always compare multiple options aur read policy documents carefully before deciding. Financial advisor se consultation bhi helpful hoti hai first-time buyers ke liye.

Conclusion: Kya Max Life Health Insurance Aapke Liye Right Choice Hai?

Max Life health insurance ek solid choice hai un logo ke liye jo comprehensive protection chahte hai ek hi policy mein. Company ka 99.65% claim settlement ratio aur Axis Bank ka backing definitely trustworthy factors hai.insurancedekho+2

Shuruati logo ke liye yeh samajhna important hai ki Max Life primarily life insurance with health riders provide karta hai, not standalone health insurance. Agar aap term insurance ke saath critical illness coverage chahte hai, toh yeh perfect combination hai.bankbazaar

In my experience, Max Life ka approach cost-effective hai kyuki aap ek premium mein life protection + health coverage le sakte hai. 64 critical illnesses ka coverage aur quick claim settlement definitely attractive features hai.axisbank+1

However, agar aap pure health insurance ya family floater plans chahte hai, toh dedicated health insurance companies consider kariye. Budget-conscious buyers ke liye Max Life competitive hai, but customer service mein improvement ki scope hai.trustpilot

Final recommendation: Max Life choose kariye agar aap term insurance priority rakhte hai aur health coverage as add-on chahiye. Compare multiple options, read terms carefully, aur consult a financial advisor if needed.

Agar aapko koi doubt hai ya aur jaankari chahiye, toh comment section mein puchiye! Share karna na bhuliye agar yeh post helpful laga ho. Stay protected, stay healthy!

Remember: Insurance sirf policy nahi, family ki financial security hai. Choose wisely! 🛡️💙