KreditBee Review 2025 – Best Instant Loan App in India

KreditBee Personal Loan Kya Hai? Complete Guide for Beginners 2025

Aaj ke digital zamane mein jab paisa ki zaroorat achanak aa jaye, toh banks ki lines aur paperwork se bachne ke liye instant loan apps sabse behtar option hain. KreditBee ek popular instant personal loan platform hai. Lekin kya ye sach mein reliable hai? Is guide mein hum sab kuch cover karenge – features, eligibility, process, pros-cons, aur FAQs – bilkul beginners ke nazariye se.

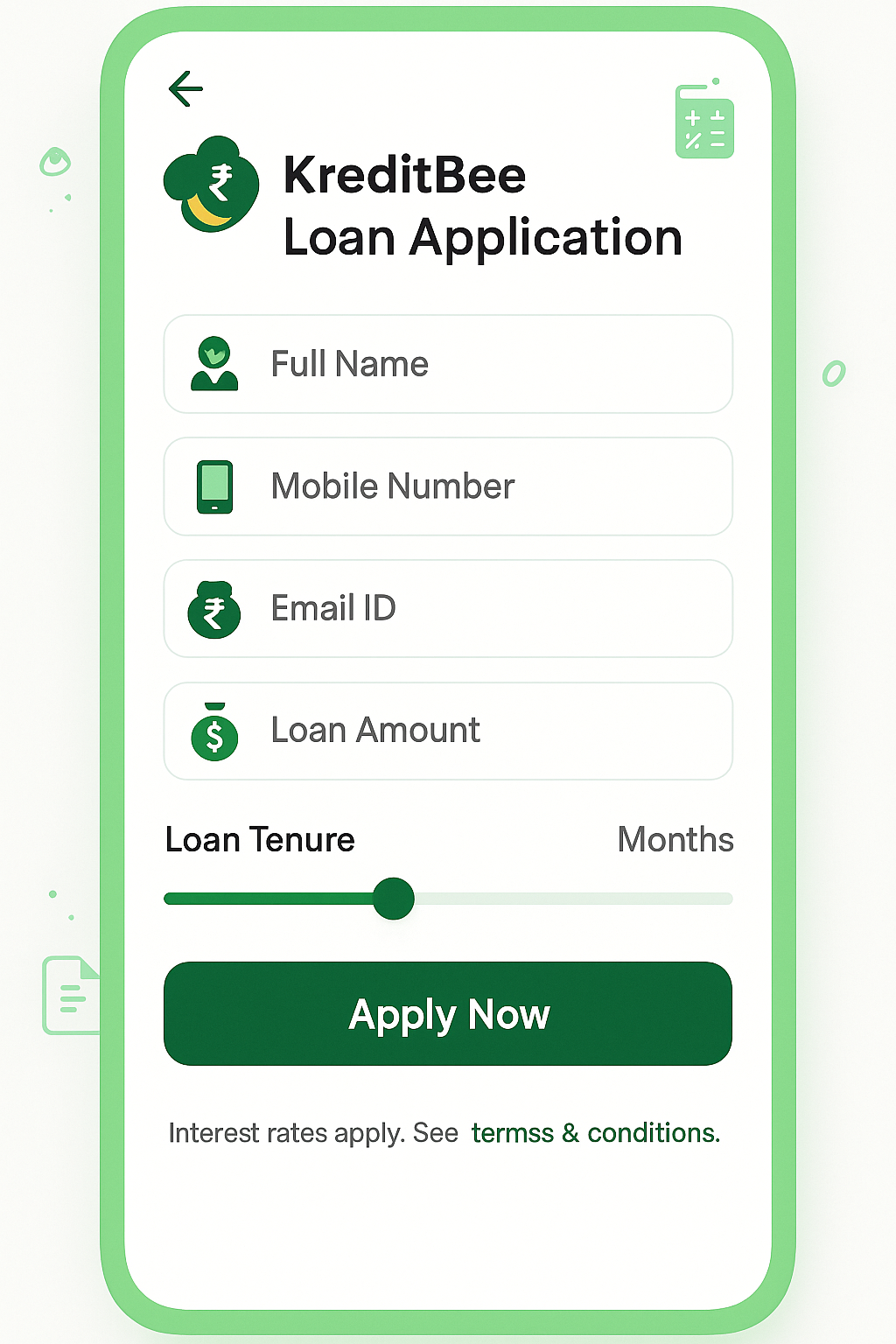

Image: KreditBee mobile app interface showing loan application screen

Introduction

Instant personal loan apps ne loan lene ka process simplify kar diya hai. KreditBee 2017 mein launch hui Bangalore-based fintech company hai jo RBI-registered NBFCs se connect karke aapko unsecured loans deti hai. Beginners ke liye ye guide bahut valuable hai, kyunki hum practical tips, step-by-step process, aur real examples share karenge.

KreditBee Kya Hai?

KreditBee ek digital lending platform hai jo personal loans provide karta hai without collateral. Humne dekha hai ki ye primarily young professionals aur salaried users ko target karta hai.

- Instant Approval: 10-30 minutes mein

- Loan Range: ₹1,000 – ₹10,00,000

- Tenure: 3 – 60 months

- 100% Online Process

KreditBee Loan Types

Teen main types loans offer kiye jaate hain:

Flexi Personal Loan

- Amount: ₹1,000 – ₹80,000

- Tenure: 3–10 months

- Interest: 24%–29.95% p.a.

Salaried Personal Loan

- Amount: ₹6,000 – ₹10,00,000

- Tenure: 6–60 months

- Interest: 12%–28.5% p.a.

Self-Employed Personal Loan

- Amount: ₹1,000 – ₹200,000

- Tenure: 3–24 months

- Interest: 16%–29.95% p.a.

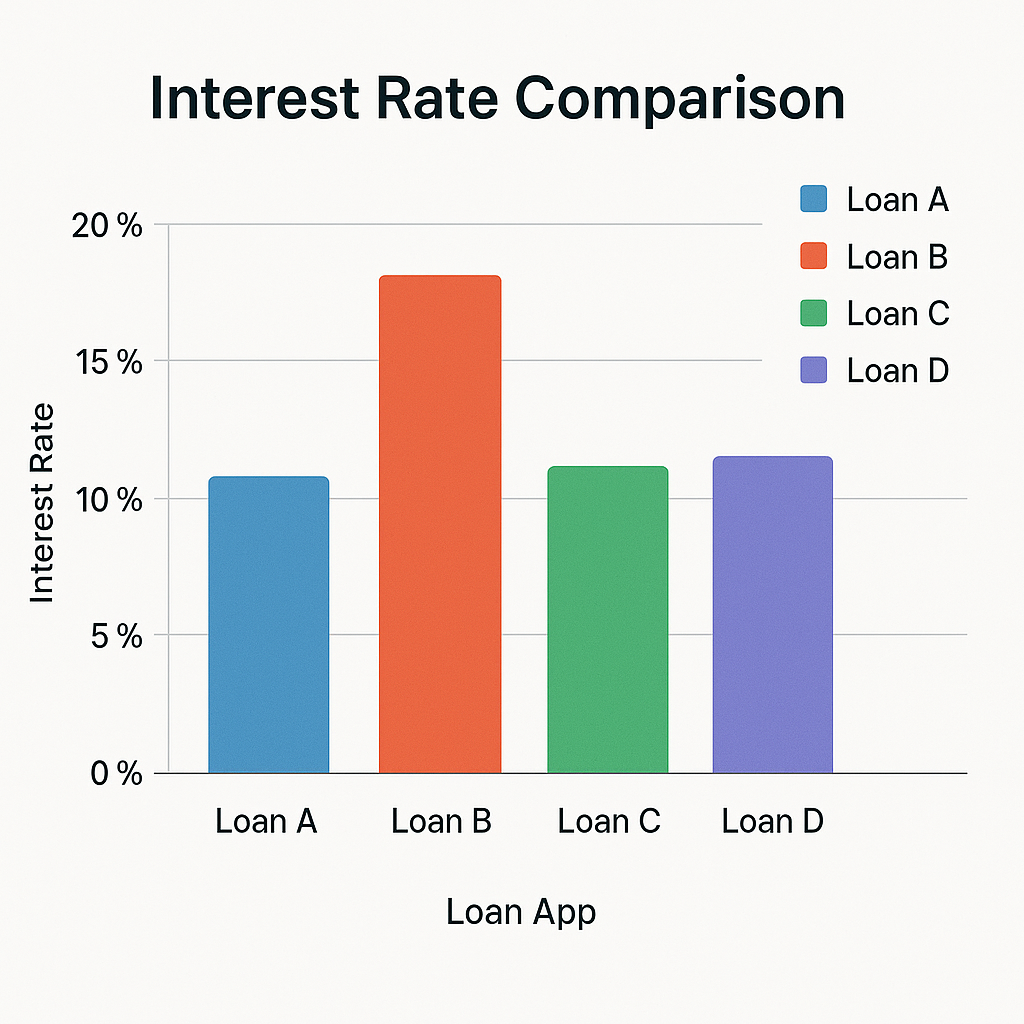

Interest Rates & Charges

Humne dekha hai ki charges transparent hain, lekin total cost thoda high ho sakta hai:

- Processing Fee: Up to 5.1% + GST

- Foreclosure Charge: 4% + GST

- Late Payment Penalty: 36% p.a.

- EMI Bounce Fee: ₹500 or 4% (lower)

Image: Interest rate comparison between different loan apps

Eligibility Criteria

Aap eligible hai agar:

- Age: 21–60 years

- Income: ₹10,000+ monthly

- Employment: 3+ months in current job/business

- Documents: PAN, Aadhaar, bank statements, salary slips/ITR

Step-by-Step Application Process

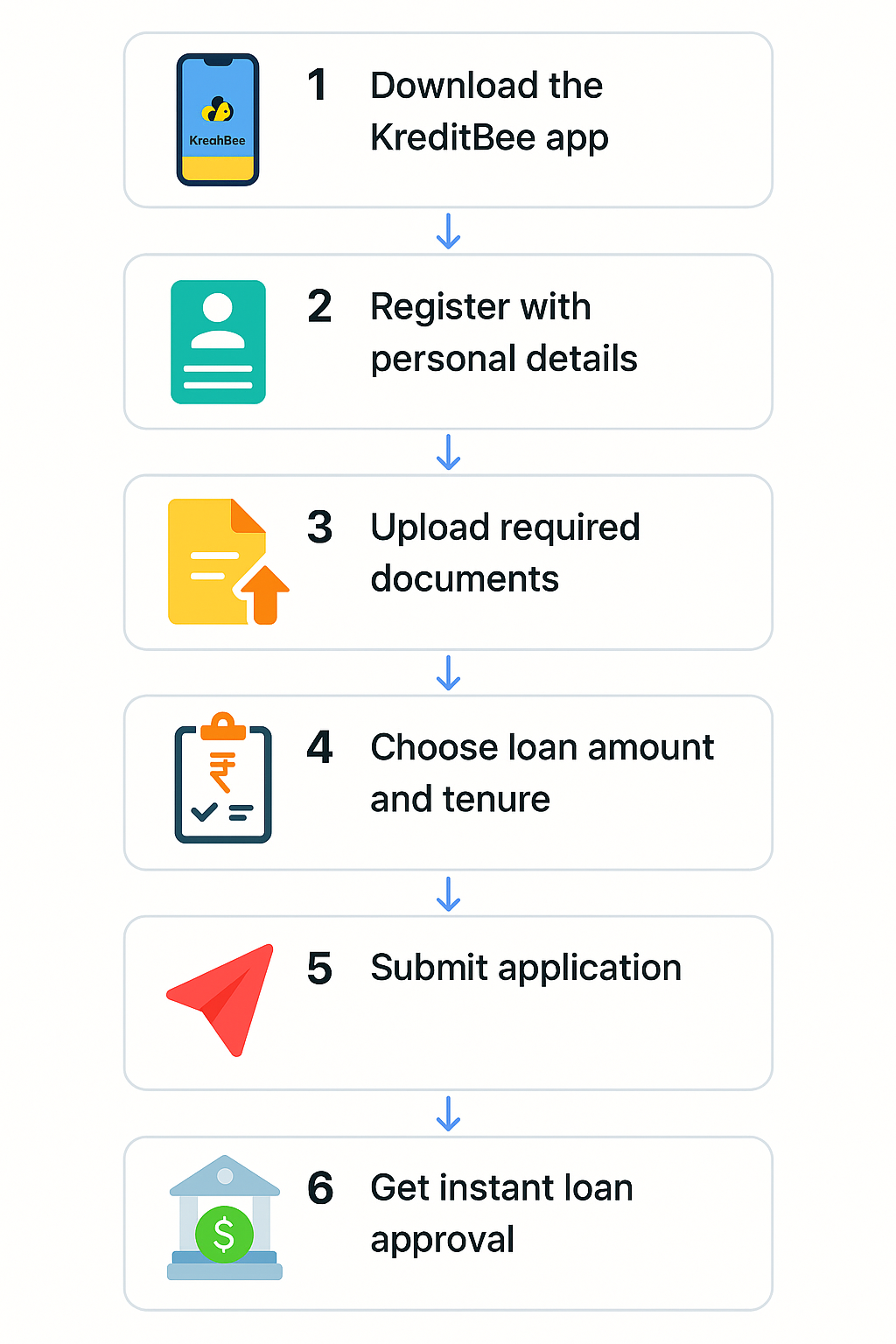

Image: Step-by-step infographic showing KreditBee loan application process

- Registration: App download karke sign-up

- Details: Personal aur employment info fill karein

- Upload Documents: PAN, Aadhaar, bank statement, selfie

- Verification: Video KYC aur bank verification

- Approval: AI-based assessment aur loan offer

- Disbursal: Funds aapke bank account mein transfer

Pros and Cons

Advantages

- Rapid approval aur disbursal

- Flexible loan amounts

- No collateral required

- Completely digital

Disadvantages

- High interest rates

- Significant processing fees

- Limited customer support

- Android-only app

KreditBee vs Competitors

| Feature | KreditBee | Other Apps | Traditional Banks |

|---|---|---|---|

| Approval Time | 10–30 min | 30 min–2 days | 7–15 days |

| Interest Rate | 12%–29.95% | 15%–36% | 10%–16% |

| Loan Range | ₹1K–₹10L | ₹1K–₹5L | ₹50K–₹40L |

| Doc. Required | Minimal | Minimal–Moderate | Extensive |

Safety & Security

KreditBee sirf facilitator hai; loans RBI-registered NBFCs se aate hain. Data encryption, PCI DSS compliance, aur regular audits ensure karte hain ki aapka data safe rahe.

Tips for First-Time Borrowers

- Credit score check karein before applying

- Multiple options compare karein on InvestsNow

- EMI affordability calculate karein

- Documents ready rakhein

- Auto-debit mandate set karein

Ready to apply? Get expert guidance and start your loan journey today!

Frequently Asked Questions

Q: KreditBee ke liye minimum CIBIL score kya hona chahiye?

A: Official requirement nahi, lekin 650+ recommended hai. Low score par high interest milega.

Q: Loan prepayment charges kitne hain?

A: 4% of outstanding principal + GST lagte hain prepayment par.

Q: iPhone users apply kar sakte hain?

A: App currently sirf Android ke liye hai. Web version limited features deta hai.

Q: Late payment par kya hota hai?

A: 36% p.a. penalty, CIBIL report hota hai, collection calls start.

Q: Loan disbursal time kitna?

A: Documents perfect hone par 10–30 minutes mein paisa mil sakta hai.

*Disclaimer: Ye article educational purpose ke liye hai. Loan terms and charges time-to-time change ho sakte hain. Apply karne se pehle official website check karein.*