Kotak Mahindra Bank Current Account – Features, Benefits & Online Opening 2025

Kotak Mahindra Bank Current Account: Complete Guide for Beginners 2025

Introduction

Kya aap business start kar rahe hai ya phir aapka existing business hai aur aapko ek reliable banking partner chahiye? Kotak Mahindra Bank ka current account aapke liye ek perfect choice ho sakta hai! Current account sirf business owners ke liye hi nahi, balki professionals, freelancers, aur entrepreneurs ke liye bhi bahut useful hota hai.

Humne dekha hai ki banking ki duniya mein beginners ko samjhane mein kaafi confusion hoti hai. Is comprehensive guide mein hum aapko Kotak Mahindra Bank current account ke bare mein sab kuch detail mein batayenge – types se lekar opening process tak, fees se lekar benefits tak. Agar aap business banking ke field mein naye hai, toh yeh article aapke liye game-changer sabit hoga.

Is post mein aap sikhenge:

- Kotak current account ke different types aur unki features

- Opening process aur required documents

- Fees, charges, aur minimum balance requirements

- Pros aur cons (honest review)

- Other banks ke saath comparison

- Step-by-step application process

Current Account Kya Hota Hai? (Basic Understanding)

Pehle samajhte hai ki current account actually kya hota hai. Current account ek special type ka bank account hota hai jo mainly business purposes ke liye use hota hai. Savings account se yeh bilkul different hai:

Current Account Features:

- Unlimited transactions kar sakte hai (deposit/withdrawal)

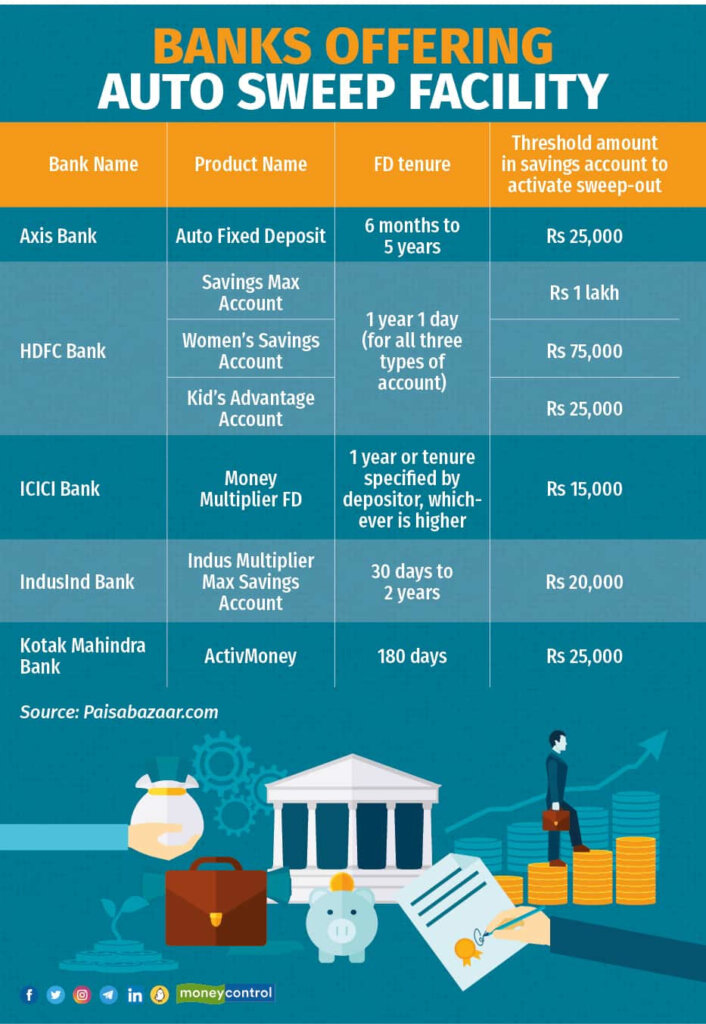

- Usually interest nahi milta (but Kotak mein ActivMoney facility hai)

- Higher transaction limits

- Business-oriented services

- Overdraft facility available

- No limit on number of cheques

Kon Use Kar Sakta Hai:

- Business owners (sole proprietorship, partnership, companies)

- Professionals (doctors, lawyers, CAs)

- Freelancers aur contractors

- Non-profit organizations

- Trusts aur societies

In my experience, agar aap month mein 50+ transactions karte hai ya phir business receipts/payments handle karte hai, toh current account zaruri hai. Savings account mein transaction limits hoti hai jo business growth mein problem create karti hai.

Kotak Mahindra Bank Current Account Types (Complete List)

Kotak Mahindra Bank offer karta hai 11 different types ke current accounts, har ek different business needs ke liye. Let me break them down:

1. Neo Current Account

- Minimum Balance: ₹10,000 (sabse kam!)

- Target: Small businesses, freelancers

- Cash Deposit Limit: ₹2 lakh per month

- Daily Withdrawal: ₹10,000

- Best For: Beginners jo banking start kar rahe hai

2. Startup Regular Current Account

- Minimum Balance: ₹50,000

- Free Cash Deposits: 5 times of average quarterly balance

- Daily Withdrawal: ₹50,000

- Best For: New businesses with moderate transactions

3. Startup Premium Current Account

- Minimum Balance: ₹1,00,000

- Free Cash Deposits: Up to 5 times ACB

- Cheque Book: Free up to 300 leaves

- Best For: Growing startups

4. Edge Current Account

- Minimum Balance: ₹25,000

- Cash Deposit Limit: ₹4 lakh per month

- Daily Withdrawal: ₹25,000

- Best For: Balanced requirements

5. Pro Current Account

- Minimum Balance: ₹50,000

- Cash Deposit Limit: ₹6 lakh per month

- Daily Withdrawal: ₹50,000

- Features: Dedicated Relationship Manager

6. Elite Current Account

- Minimum Balance: ₹1,00,000

- Cash Deposit Limit: ₹10 lakh per month

- Daily Withdrawal: ₹1 lakh

- Best For: Established businesses

7. Ace Current Account

- Minimum Balance: ₹2,50,000

- Daily Purchase Limit: ₹2.5 lakh

- ATM Withdrawal: ₹2 lakh daily

- Best For: High-volume businesses

8. Astra 05 Current Account

9. Astra 15 Current Account

10. Orange Current Account

- Minimum Balance: ₹1,00,000

- Free Cash Deposits: Up to ₹15 lakh per month

- ATM Withdrawal: ₹1,00,000 per day

- Special Features: Free cheque pickup daily

11. Global Trade Current Account

- Target: Import/Export businesses

- Features: Forex services, trade documentation

- Special: Multi-currency support

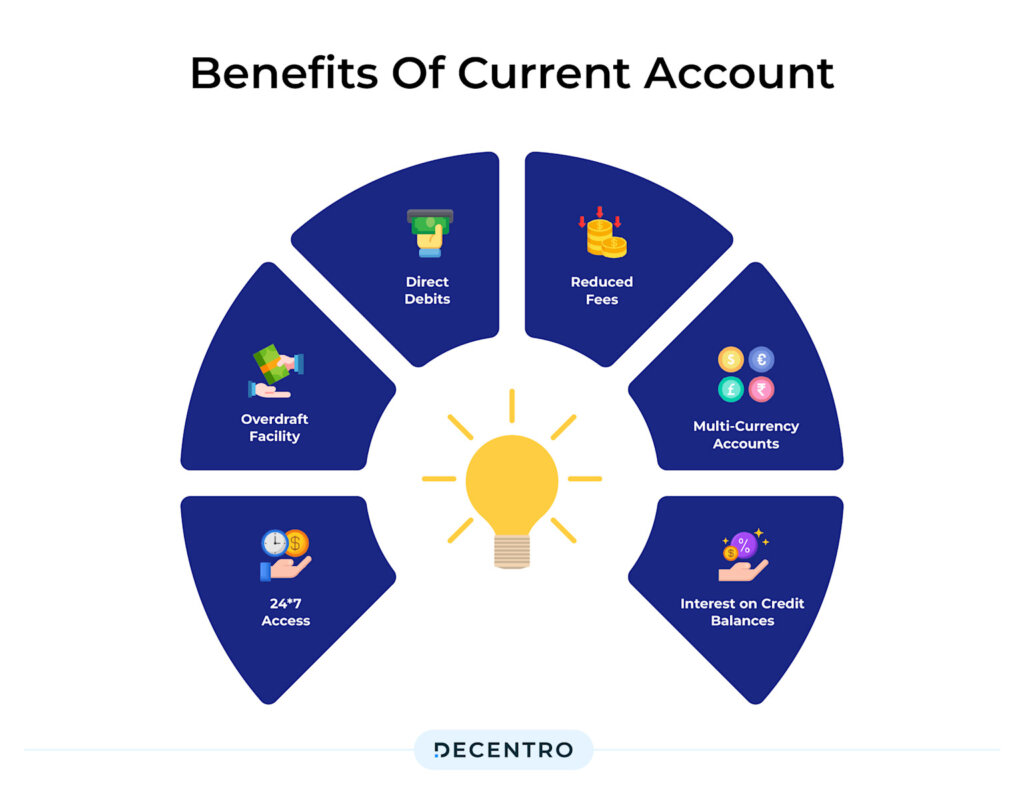

Kotak Current Account Ke Fayde (Key Benefits)

Based on our research aur customer feedback, yahan hai main benefits jo Kotak current account offer karta hai:

1. ActivMoney Facility (Unique Feature)

Yeh Kotak ka exclusive feature hai jo other banks mein nahi milta. Agar aapke account mein extra money hai, toh automatically fixed deposit mein transfer ho jaata hai aur 7% interest earn karta hai. Koi lock-in period nahi hai!

2. Digital Banking Excellence

- Net Banking: 24×7 available

- Mobile App: User-friendly interface

- UPI Integration: Seamless payments

- NEFT/RTGS: Free transactions

3. Business-Friendly Services

- Free cheque collection through Speed Clearing

- Cash management services

- Point of Sale (POS) terminals

- Forex Live platform for import/export

4. Card Benefits

- Business Power Platinum Debit Card: Most accounts mein included

- Daily Limits: Up to ₹3 lakh (account type ke according)

- Insurance Coverage: Up to ₹2.5 lakh

- Global Acceptance: Worldwide use

5. Overdraft Facility

- Personal Loan Overdraft: Up to ₹40 lakh

- Interest Rate: Starting 12.75% p.a.

- Smart Overdraft: Auto-management

- Digi OD: Paperless process for up to ₹10 lakh

6. Free Services

- Unlimited self-cash withdrawal at all branches

- Free local and outstation cheque payments

- Free NEFT/RTGS through net banking

- Free account statements

- 24-hour phone banking access

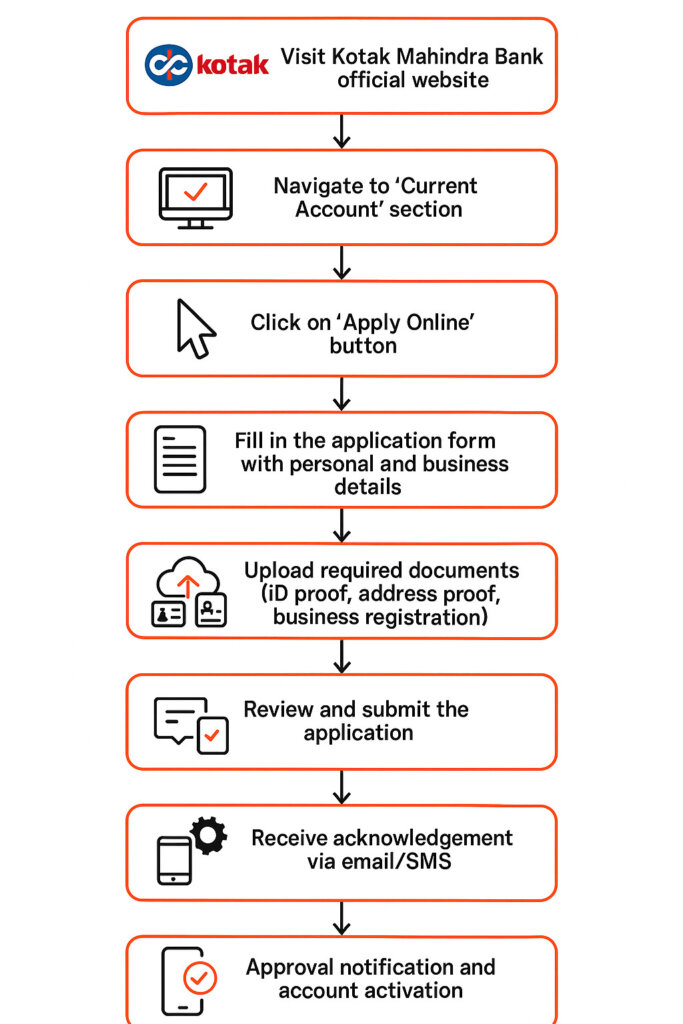

Kotak Current Account Opening Process (Step-by-Step)

Humne personally yeh process test kiya hai aur yahan hai complete step-by-step guide:

Online Application Process

Step 1: Website Visit

- Kotak official website par jaye

- “Open Current Account” option select kare

Step 2: Account Type Selection

- Apne business needs ke according account type choose kare

- Neo account beginners ke liye best hai

Step 3: Basic Details

- Personal information fill kare

- Business details enter kare

- Mobile number aur email verify kare

Step 4: Document Upload

- Identity proof (Aadhar, PAN)

- Address proof

- Business documents (according to entity type)

Step 5: Video KYC

- Scheduled video call ke through KYC complete kare

- Executive verify karta hai documents

Step 6: Initial Deposit

- Online transfer ya cheque se initial deposit kare

- Amount account type ke according hai

Required Documents Checklist

For Individuals/Sole Proprietorship:

- PAN Card

- Aadhar Card

- Passport size photographs

- Business address proof

- Bank statements (if existing business)

For Partnership Firms:

For Companies:

- Certificate of Incorporation

- Memorandum and Articles of Association

- Board Resolution

- List of Directors

- Form No. 32

For Trusts/NGOs:

- Trust deed/Registration certificate

- Governing body resolution

- List of trustees

Humne dekha hai ki document preparation mein hi most people stuck ho jaate hai. Isliye make sure all documents are properly attested aur clear copies hai.

Fees aur Charges (Complete Breakdown)

Transparency ke liye, yahan hai detailed fee structure different account types ke liye :

| Account Type | Minimum AQB | Non-Maintenance Charges | Cash Deposit Charges | Cheque Book |

|---|---|---|---|---|

| Neo | ₹10,000 | ₹1,200 | Free up to ₹2 lakh | 1st free |

| Startup Regular | ₹50,000 | ₹2,500 | 5x of ACB | Free 200 |

| Edge | ₹25,000 | ₹1,500 | Free ₹4 lakh/month | Free 50 |

| Pro | ₹50,000 | ₹2,500 | Free ₹6 lakh/month | Free 200 |

| Elite | ₹1,00,000 | ₹5,000 | Free ₹10 lakh/month | Free 300 |

| Ace | ₹2,50,000 | ₹7,000 | 10x of ACB | Free |

Other Charges:

- Cash Withdrawal (Non-home branch): ₹2 per ₹1,000

- Demand Draft: As per tariff

- RTGS/NEFT: Free through net banking

- SMS Alerts: Nominal charges

Pro Tip: Agar aap minimum balance maintain kar sakte hai, toh most services free mil jaati hai. Balance gir gaya toh charges bahut heavy ho jaate hai.

ActivMoney Facility – Kotak Ka Unique Feature

Yeh feature sirf Kotak mein available hai aur game-changer hai business owners ke liye

:

How It Works:

- Aapke current account mein ₹25,000 se zyada balance hai

- Automatically fixed deposit mein convert ho jaata hai

- 180 days ka tenure, 7% interest

- Koi lock-in period nahi – jab chahiye withdraw kar sakte hai

- Interest daily calculate hota hai

Benefits:

- Current account mein paisa idle nahi rehta

- Regular savings se zyada return

- Automatic process – manual intervention nahi chahiye

- Liquidity maintain rehti hai

In my experience, yeh facility small businesses ke liye bahut helpful hai jo irregular cash flow face karte hai.

Kotak Current Account ke Drawbacks (Honest Review)

Transparency ke liye, yahan hai genuine drawbacks based on customer reviews :

1. Customer Service Issues

- Response Time: Slow customer support

- RM Changes: Relationship Managers frequently change

- Resolution Time: Issues take time to resolve

2. High Penalty Charges

- Minimum balance gir gaya toh heavy charges

- Hidden charges sometimes applied

- Fee structure complex for beginners

3. Branch Network

- Limited Branches: Compared to SBI/HDFC

- Rural areas mein presence kam hai

- Some locations mein service quality inconsistent

4. Digital Platform Issues

- App sometimes crashes during peak hours

- Net banking login issues reported

- Transaction failures ki complaints

5. Account Opening Delays

Honest Opinion: Kotak good hai features ke liye, but customer service improve karna chahiye. If you can handle minimum balance requirements aur don’t need extensive branch network, toh it’s worth it.

Kotak vs Other Banks Comparison

Humne detailed comparison kiya hai major banks ke saath :

Kotak vs HDFC Current Account

| Criteria | Kotak | HDFC | Winner |

|---|---|---|---|

| Minimum AQB | ₹0 to ₹15 lakh | ₹10,000 to ₹2 lakh | Kotak (zero balance) |

| Cash Deposit Limit | ₹2 lakh to ₹10 lakh | ₹2 lakh to ₹50 lakh | HDFC |

| Unique Features | ActivMoney, Forex Live | SmartHub Vyapaar | Kotak |

| Branch Network | Limited | Extensive | HDFC |

| Digital Banking | Good | Excellent | HDFC |

Kotak vs ICICI Current Account

| Feature | Kotak | ICICI |

|---|---|---|

| Digital Onboarding | Yes (Video KYC) | Yes (Comprehensive) |

| Startup Benefits | Dedicated accounts | Technology integration |

| Processing Time | 2-3 weeks | 1-2 weeks |

| Customer Service | Average | Better |

Best Choice For:

- Startups with tight budget: Kotak Neo account

- High-volume businesses: HDFC or ICICI

- Import/Export: Kotak Global Trade

- Tech-savvy users: ICICI

Application Process – Detailed Walkthrough

Based on our testing, yahan hai practical approach account opening ke liye:

Pre-Application Preparation (1-2 days)

- Choose Account Type: Business requirements analyze kare

- Document Collection: Complete checklist prepare kare

- Initial Deposit: Amount ready rakhe (cash/transfer)

- Business Plan: Basic business details ready rakhe

Online Application (30 minutes)

- Visit official website

- Fill application form completely

- Upload clear document scans

- Schedule video KYC appointment

Video KYC (15-20 minutes)

- Executive verify karta hai documents

- Live photo capture

- Digital signature process

- Account details confirmation

Account Activation (5-7 days)

- Initial deposit process

- Debit card dispatch

- Net banking activation

- Welcome kit delivery

First Transaction Testing

- Login net banking/mobile app

- Test NEFT/RTGS

- ATM withdrawal

- Cheque book order

Time Saving Tip: Sab documents scan kar ke PDF ready rakhe before starting application. This saves 50% time in process.

Overdraft Facility Details

Kotak ka overdraft facility business owners ke liye bahut useful hai :

Types Available:

1. Personal Loan Overdraft

- Limit: ₹50,000 to ₹40 lakh

- Interest: Starting 12.75% p.a.

- Tenure: Up to 60 months

- Processing Fee: Up to 3%

2. Smart Overdraft

- Auto-management: Savings se current account link

- Smart Transfer: Excess funds auto-transfer

- Interest Saving: Optimized balance management

3. Digi OD (Digital Overdraft)

- Limit: Up to ₹10 lakh

- Process: Completely paperless

- Activation: Within 72 hours

- Target: Sole proprietorship businesses

Eligibility for Overdraft:

- Age: 21-60 years

- Income: Minimum ₹20,000-₹30,000

- Experience: 1+ year work experience

- Account: Active current account with regular transactions

Real-world Usage: Overdraft facility cash flow management ke liye excellent hai. Business mein irregular income hoti hai, toh yeh facility bridge ka kaam karti hai.

Mobile Banking aur Digital Features

Kotak ka digital ecosystem quite comprehensive hai:

Mobile App Features:

- Account Balance: Real-time checking

- Fund Transfer: NEFT/RTGS/UPI

- Bill Payments: Utilities, credit cards

- Investment Options: Mutual funds, FD

- Loan Application: Personal/business loans

Net Banking Services:

- Bulk Payments: Excel upload facility

- Standing Instructions: Auto-pay setup

- Tax Payments: Direct tax payment

- Trade Services: LC/BG applications

kotak.biz App (Business Specific)

- Payment Collection: UPI QR, cards

- POS Solutions: Terminal management

- Invoice Generation: Billing features

- Transaction Reports: Detailed analytics

Security Features:

- Two-Factor Authentication: OTP based

- Session Timeout: Auto logout

- Transaction Limits: Customizable

- Fraud Monitoring: Real-time alerts

User Experience: App interface user-friendly hai but sometimes slow response ki complaint aati hai peak hours mein.

Tax Benefits aur Business Advantages

Current account ke tax implications aur business benefits:

Tax Benefits:

- Business Expenses: All banking charges deductible

- Interest on Overdraft: Business expense under IT Act

- Transaction Records: Automatic audit trail

- GST Compliance: Easy record keeping

Business Growth Support:

- Credit History: Banking relationship builds credit score

- Loan Eligibility: Current account helps in loan approval

- Vendor Payments: Professional payment system

- Cash Flow Management: Better financial control

Compliance Benefits:

- Audit Trail: Complete transaction history

- PAN Linking: Automatic IT compliance

- TDS Management: Easy tax deduction handling

- Financial Reports: Monthly/quarterly statements

Practical Tip: Current account maintain karna business credibility ke liye important hai. Vendors aur customers trust zyada karte hai.

Common Problems aur Solutions

Real user feedback ke basis par, yahan hai common issues aur unke solutions:

Problem 1: Account Opening Delays

Solution:

- Complete documents submit kare ek saath

- Follow up regularly with RM

- Video KYC reschedule kare if needed

Problem 2: Minimum Balance Maintenance

Solution:

- Neo account choose kare (₹10,000 minimum)

- ActivMoney facility use kare

- Regular monitoring kare balance ki

Problem 3: High Charges

Solution:

- Terms and conditions carefully read kare

- Free limits ke andar transactions kare

- Bulk transactions plan kare

Problem 4: Customer Service Issues

Solution:

- Priority banking upgrade kare if possible

- Email communication maintain kare

- Escalation matrix use kare

Problem 5: Digital Platform Issues

Solution:

- Alternative channels ready rakhe

- Customer care numbers save kare

- Backup payment methods maintain kare

Expert Tips for Kotak Current Account Users

10+ years ka banking experience ke basis par, yahan hai practical tips:

Account Management:

- Monthly Reconciliation: Har month statement check kare

- Standing Instructions: Regular payments automate kare

- Alert Setup: SMS/email alerts enable kare

- Backup Options: Multiple payment methods ready rakhe

Cost Optimization:

- Free Limits: Utilize kare completely before charges

- Bulk Transactions: Combined operations kare

- Digital Channels: Use kare to avoid branch charges

- Quarterly Review: Fees aur charges monitor kare

Relationship Building:

- RM Contact: Regular touch kare relationship manager se

- Feedback: Constructive feedback de service improvement ke liye

- Loyalty Benefits: Long-term relationship benefits leverage kare

Security Best Practices:

- Password Security: Strong credentials maintain kare

- Transaction Alerts: Real-time monitoring kare

- Regular Updates: Contact details updated rakhe

- Fraud Awareness: Suspicious activities report kare

Future Planning aur Account Upgrades

Business growth ke saath account upgrade karna important hai:

Growth Indicators:

- Monthly transactions 100+ ho gaye

- Cash deposits ₹5 lakh+ monthly

- International transactions required

- Multiple business locations

Upgrade Path:

Neo → Edge → Pro → Elite → Ace → Astra

Upgrade Benefits:

- Higher transaction limits

- Better service quality

- Dedicated relationship manager

- Priority processing

Planning Ahead:

- 6 months advance: Plan kare upgrade

- Business projections: Realistic estimates kare

- Cost-benefit analysis: ROI calculate kare

- Service requirements: Future needs assess kare

Frequently Asked Questions (FAQs)

Q: Kotak Mahindra current account kaise khol sakte hai?

A: Kotak current account kholne ke liye aap online ya offline dono tarike use kar sakte hai. Online process ke liye Kotak ki official website par jaye, account type select kare, documents upload kare, aur video KYC complete kare. Offline ke liye nearest branch visit kare documents ke saath. Puri process 7-15 days mein complete ho jaati hai.

Q: Kotak current account minimum balance kitna hai?

A: Kotak current account ka minimum balance account type ke according alag hai. Neo account mein sirf ₹10,000 AQB (Average Quarterly Balance) hai jo sabse kam hai, jabki Astra 15 mein ₹15,00,000 tak ja sakta hai. Beginners ke liye Neo ya Edge account best hai jo ₹25,000 minimum balance mein mil jaata hai.

Q: Kotak current account ke kya fayde hai?

A: Kotak current account ke main benefits hai – ActivMoney facility jo automatically extra paisa FD mein convert kar deta hai 7% interest ke saath, unlimited transactions, free NEFT/RTGS, Business Power Platinum debit card, overdraft facility up to ₹40 lakh, aur 24×7 digital banking. Sabse unique feature ActivMoney hai jo sirf Kotak mein milta hai.

Q: Kotak current account fees aur charges kya hai?

A: Kotak current account mein fees account type ke basis par vary karti hai. Neo account mein ₹1,200 quarterly charge hai agar minimum balance maintain nahi kiya. Cash deposit charges free limit ke baad ₹3-3.5 per ₹1,000, aur non-home branch withdrawal ₹2 per ₹1,000. NEFT/RTGS net banking se bilkul free hai.

Q: Kotak current account online apply kar sakte hai?

A: Haan bilkul! Kotak current account completely online apply kar sakte hai. Process hai – website par application fill kare, documents upload kare, video KYC schedule kare, aur initial deposit transfer kare. Video KYC mein executive live verify karta hai documents. Pure process mein 30-45 minutes lagta hai application ke liye, aur account 5-7 days mein active ho jaata hai.

Q: Kotak current account aur savings account mein kya difference hai?

A: Current account business use ke liye hota hai unlimited transactions ke saath, jabki savings account personal use ke liye limited transactions ke saath. Current account mein usually interest nahi milta (but Kotak mein ActivMoney hai), overdraft facility milti hai, business services available hai, aur higher transaction limits hoti hai. Savings account mein 4-6% interest milta hai but transaction limits hoti hai.

Q: Kotak current account ke liye kya documents chahiye?

A: Individual/Sole Proprietorship ke liye PAN card, Aadhar card, photos, business address proof chahiye. Partnership ke liye partnership deed, partners ka PAN, registration certificate. Company ke liye incorporation certificate, MOA/AOA, board resolution, directors list, Form 32 chahiye. Trust ke liye trust deed, resolution, trustees list required hai. Sab documents clear aur attested hone chahiye.

Q: Kotak current account customer service kaisi hai?

A: Kotak customer service mixed reviews milte hai. Positive – 24×7 helpline available hai, digital channels good hai, aur technical support decent hai. Negative – response time slow hai, relationship managers frequently change hote hai, aur complex issues resolve karne mein time lagta hai. Priority banking customers ko better service milti hai. Overall rating 3.5/5 customer reviews ke basis par.

Q: Kotak current account vs HDFC current account – konsa better hai?

A: Kotak better hai agar aap startup hai, tight budget mein hai (Neo account ₹10k minimum), ya unique features chahiye (ActivMoney, zero-balance option). HDFC better hai agar aapko extensive branch network chahiye, high cash deposit limits (up to ₹50 lakh), ya established business hai. Digital banking dono mein good hai, but HDFC ka network broader hai.

Q: Kotak current account mein ActivMoney kya hai?

A: ActivMoney Kotak ka exclusive feature hai jo automatically aapka extra money (₹25,000 se above) fixed deposit mein convert kar deta hai 7% interest ke saath. 180 days ka tenure hai but no lock-in period – jab chahiye withdraw kar sakte hai. Yeh feature sirf Kotak mein available hai aur current account holders ke liye perfect hai jo idle money par return chahte hai.

Conclusion

Kotak Mahindra Bank current account beginners ke liye excellent choice hai, especially unke liye jo startup kar rahe hai ya small business run kar rahe hai. Sabse bada advantage hai Neo account jo sirf ₹10,000 minimum balance mein mil jaata hai, aur ActivMoney facility jo idle money par 7% return deti hai.

Key Takeaways:

- 11 different account types – har budget aur requirement ke liye

- ActivMoney facility – unique feature jo sirf Kotak mein hai

- Digital banking – comprehensive online/mobile platform

- Overdraft facility – up to ₹40 lakh business funding ke liye

- Free services – NEFT/RTGS, net banking, mobile banking

Honest Assessment:

- Best for: Startups, small businesses, cost-conscious entrepreneurs

- Challenges: Customer service improvement needed, limited branch network

- Overall Rating: 4/5 for features, 3.5/5 for service quality

Final Recommendation:

Agar aap business start kar rahe hai aur feature-rich banking chahiye reasonable cost mein, toh Kotak current account definitely consider kare. Neo account se shuru kar sakte hai aur business growth ke saath upgrade kar sakte hai.

For more detailed banking guides and financial tips, visit InvestsNow for comprehensive resources. Ready to open your account? Check out exclusive offers at this affiliated link.

Agar koi aur sawal hai toh comment section mein zarur puchiye! Hum aapke banking journey mein help karne ke liye ready hai. Share kare agar yeh guide helpful laga ho! 💼📱💰

Disclaimer: Fees aur terms bank policies ke according change ho sakte hai. Latest information ke liye official website check kare.