Best Way to Invest in Mutual Funds Through UPI (2025 Guide)

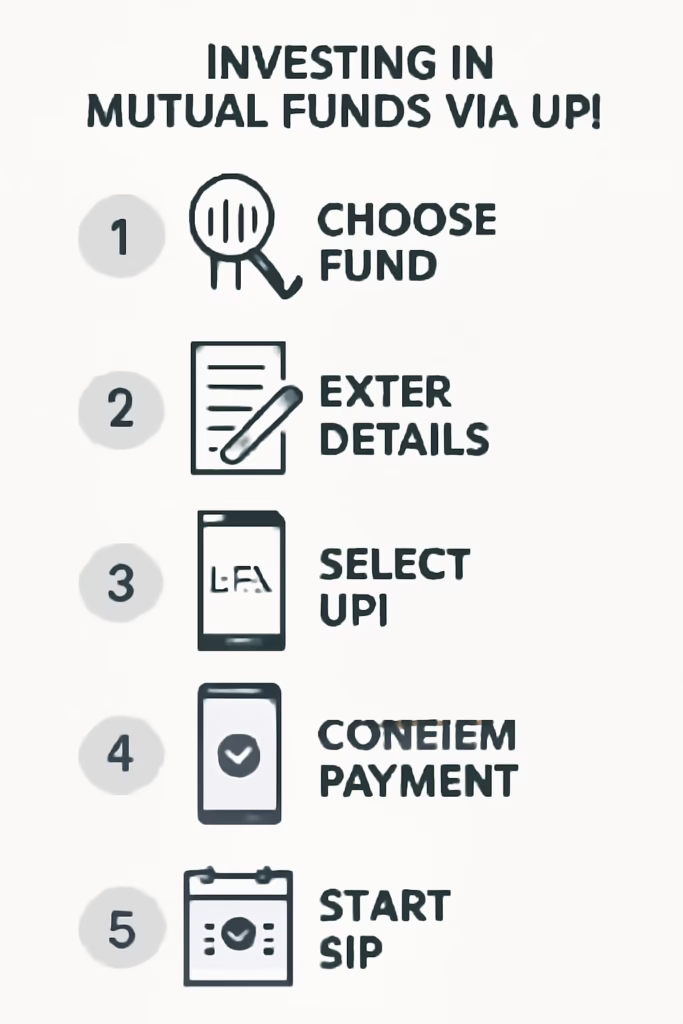

How to Invest in Mutual Funds Through UPI in India (Step-by-Step)

Investing in mutual funds has become a popular choice for many Indians looking to grow their wealth. With the rise of digital payment systems like UPI (Unified Payments Interface), the process has become even more convenient. If you’re wondering how to invest in mutual funds through UPI in India, this step-by-step guide will walk you through everything you need to know. Whether you’re a beginner or a seasoned investor, using UPI can make your investment journey seamless and hassle-free.

In this blog, we’ll cover the process of investing in mutual funds using UPI, why it’s a great option, and some practical tips to get started. Plus, we’ll include a FAQ section in Hinglish to address common doubts. Let’s dive in!

Why Choose UPI for Mutual Fund Investments?

Before we get into the steps, let’s understand why UPI is a game-changer for mutual fund investments. UPI, developed by the National Payments Corporation of India (NPCI), allows instant money transfers between bank accounts using a mobile device. Its integration with mutual fund platforms has simplified the investment process by eliminating the need for net banking logins or cheques. Here are some benefits:

- Instant Transactions: UPI enables real-time fund transfers, ensuring your mutual fund units are allotted faster compared to traditional methods like NEFT or cheques.

- Ease of Use: With apps like Google Pay, PhonePe, or BHIM, you can invest with just a few taps.

- No Additional Costs: Most platforms don’t charge extra for UPI transactions.

- Accessibility: UPI is widely accepted by mutual fund houses and distributors, making it a convenient option for investors across India.

For more insights on why mutual funds are a smart investment choice, check out our detailed guide on why invest in mutual funds.

Step-by-Step Guide to Investing in Mutual Funds Through UPI

Step 1: Complete Your KYC

Before you can invest in mutual funds, you need to complete your Know Your Customer (KYC) process. This is a mandatory requirement in India to ensure safe and compliant transactions. Here’s what you need:

- Documents: PAN card, Aadhaar card, and proof of address (like a utility bill).

- Process: You can complete KYC online by uploading scanned copies of your documents on a mutual fund house’s website, app, or through platforms like Groww or ET Money. Alternatively, visit a KYC Registration Agency (KRA) or mutual fund distributor for in-person verification.

- Timeline: KYC processing typically takes a few days. You can check your KYC status online using your PAN on the CDSL website.

Pro Tip: Ensure your mobile number is linked to your bank account, as it’s required for both KYC and UPI setup.

Step 2: Set Up a UPI ID

If you’re already using UPI apps like Google Pay, PhonePe, or Paytm, you likely have a UPI ID (e.g., yourname@bankname). If not, here’s how to set it up:

- Download a UPI-enabled app from the Google Play Store or Apple App Store.

- Register using the mobile number linked to your bank account.

- Link your bank account to the app and create a UPI ID.

- Set a UPI PIN for secure transactions.

For a detailed guide on setting up UPI, check out this HDFC Mutual Fund guide.

Step 3: Choose a Mutual Fund Platform

Several platforms in India support UPI for mutual fund investments. You can invest directly through a mutual fund house’s website (e.g., HDFC Mutual Fund or Aditya Birla Sun Life AMC) or via third-party platforms like:

- Groww: Offers a user-friendly interface and supports direct mutual funds with no commission.

- ET Money: Provides portfolio tracking and investment in multiple fund houses.

- FundsIndia: Ideal for beginners with a wide range of mutual fund options.

For a list of top platforms, visit InvestSnow’s recommended platforms.

Step 4: Select a Mutual Fund Scheme

Choosing the right mutual fund depends on your financial goals, risk appetite, and investment horizon. Here are some popular types of mutual funds:

- Equity Funds: High-risk, high-return funds ideal for long-term goals (e.g., retirement).

- Debt Funds: Low-risk funds suitable for short-term goals.

- ELSS Funds: Tax-saving funds with a 3-year lock-in, offering deductions up to ₹1.5 lakh under Section 80C.

- Hybrid Funds: A mix of equity and debt for balanced risk and returns.

Research funds based on past performance, expense ratio, and fund manager expertise. Platforms like Value Research provide detailed fund analysis to help you decide.

Step 5: Initiate the Investment

Once you’ve chosen a platform and fund, follow these steps to invest using UPI:

- Log In: Sign in to your chosen platform or create an account.

- Select Fund: Browse and select the mutual fund scheme you want to invest in.

- Choose Investment Type: Decide between a lump-sum investment or a Systematic Investment Plan (SIP). For SIPs, select the amount and frequency (e.g., monthly).

- Select UPI as Payment Mode: On the payment page, choose UPI as your payment option.

- Enter UPI ID: Provide your UPI ID (e.g., yourname@okaxis).

- Authorize Payment: You’ll receive a notification on your UPI app. Verify the transaction details and enter your UPI PIN to authorize the payment.

- Confirmation: Once the payment is successful, the amount is debited from your bank account, and the investment is processed. You’ll receive a confirmation from the platform.

Note: For SIPs, UPI is currently used for the first installment, as standing instructions for recurring payments are not widely supported. Check with your platform for UPI Autopay options, as mentioned in a recent post by Motilal Oswal.

Step 6: Track Your Investments

After investing, monitor your portfolio regularly. Most platforms like IndusInd Bank or InvestSnow’s portfolio tracker offer real-time updates, performance charts, and detailed reports. This helps you stay informed and adjust your investments based on your goals.

Tips for Successful Mutual Fund Investing Through UPI

- Start Small: You can begin with as little as ₹500 via SIP, making it accessible for beginners.

- Use a SIP Calculator: Tools like the SIP Calculator on Advisorkhoj help estimate potential returns.

- Diversify: Spread your investments across equity, debt, and hybrid funds to reduce risk.

- Stay Disciplined: Regular SIPs help you benefit from rupee cost averaging and compounding.

- Check Transaction Limits: UPI apps have daily transaction limits (e.g., ₹1 lakh for most banks). Confirm with your bank to avoid issues.

If you’re looking for additional financial products, explore personal loans to meet urgent needs at Gromo Loans.

FAQ: Mutual Funds Through UPI in Hinglish

1. Kya main UPI se mutual fund mein invest kar sakta hoon?

Haan, bilkul! Aap Google Pay, PhonePe, ya Paytm jaise UPI apps se mutual funds mein invest kar sakte hain. Bas aapka KYC complete hona chahiye aur bank account UPI se linked hona chahiye.

2. UPI se SIP kaise start karoon?

Pehle ek mutual fund platform (jaise Groww ya ET Money) pe account banayein. Phir fund choose karein, SIP amount aur date set karein, aur UPI ID daal kar payment authorize karein. First installment ke liye UPI kaam karta hai, lekin recurring SIP ke liye check karein ki platform UPI Autopay support karta hai ya nahi.

3. Kya UPI se mutual fund mein invest karna safe hai?

Haan, UPI ek secure payment system hai, developed by NPCI. Bas ensure karein ki aap trusted platforms use kar rahe hain aur apna UPI PIN kisi se share nahi karte.

4. Minimum kitna invest kar sakta hoon?

Aap ₹500 se SIP start kar sakte hain. Lump-sum ke liye minimum amount fund ke rules pe depend karta hai, usually ₹5,000 se shuru hota hai.

5. Kya UPI se ELSS funds mein tax saving ke liye invest kar sakta hoon?

Haan, ELSS funds mein bhi UPI se invest kar sakte hain, aur aap Section 80C ke under ₹1.5 lakh tak tax deduction claim kar sakte hain. Bas yaad rakhein, ELSS mein 3 saal ka lock-in hota hai.

For more FAQs, visit InvestSnow’s FAQ page.

Conclusion

Investing in mutual funds through UPI in India is a simple, fast, and secure way to grow your wealth. By following the steps outlined above—completing KYC, setting up a UPI ID, choosing a platform, and authorizing payments—you can start your investment journey with ease. Whether you’re investing a lump sum or starting a SIP, UPI makes the process accessible to everyone.

Ready to take control of your financial future? Explore top mutual fund schemes on InvestSnow and start investing today. For additional financial needs, check out Loans for quick and reliable loan options.

Internal Links

One thought on “Best Way to Invest in Mutual Funds Through UPI (2025 Guide)”