Best Guide to IDFC Net Banking: Easy Login, Registration & Features 2025

IDFC Net Banking: Complete Guide for Beginners – Digital Banking Kaise Karein

Kya aap IDFC First Bank ke customer hain lekin IDFC net banking ke baare mein confused hain? Ya phir aap soch rahe hain ki online banking safe hai ya nahi? Today ke digital world mein, IDFC internet banking sirf convenience nahi balki zarurat ban gayi hai. Is comprehensive guide mein humne bataya hai ki kaise aap IDFC net banking ka full advantage utha sakte hain – bilkul beginners ke liye designed!

Banking ke traditional methods se hatkar, IDFC First Bank ka net banking platform aapko 24×7 banking freedom deta hai. Chahe aap ghar baithe bill pay karna chaho ya instant money transfer karna ho – sab kuch possible hai. Humne dekha hai ki proper guidance ke saath, even tech-savvy nahi hone wale log bhi easily master kar jaate hain IDFC net banking.

Is article mein aapko milega step-by-step registration process, security tips, troubleshooting solutions, aur sabse important – real practical examples jo aapke daily banking life mein kam aayenge.

IDFC Net Banking Kya Hai – Complete Introduction

IDFC net banking IDFC First Bank ka comprehensive online banking platform hai jo customers ko internet ke through apne bank accounts access karne ki facility deta hai. Basically, ye ek secure web portal hai jahan se aap saare banking operations perform kar sakte hain without physically visiting the branch.

Humne dekha hai ki most beginners confused rehte hain – “Net banking ka matlab kya hai?” Simple words mein, IDFC internet banking ek digital gateway hai jo aapke bank account ko computer ya mobile se connect karta hai. Aap 24 hours, 365 days apne account ko access kar sakte hain – bilkul physical bank branch ki tarah.

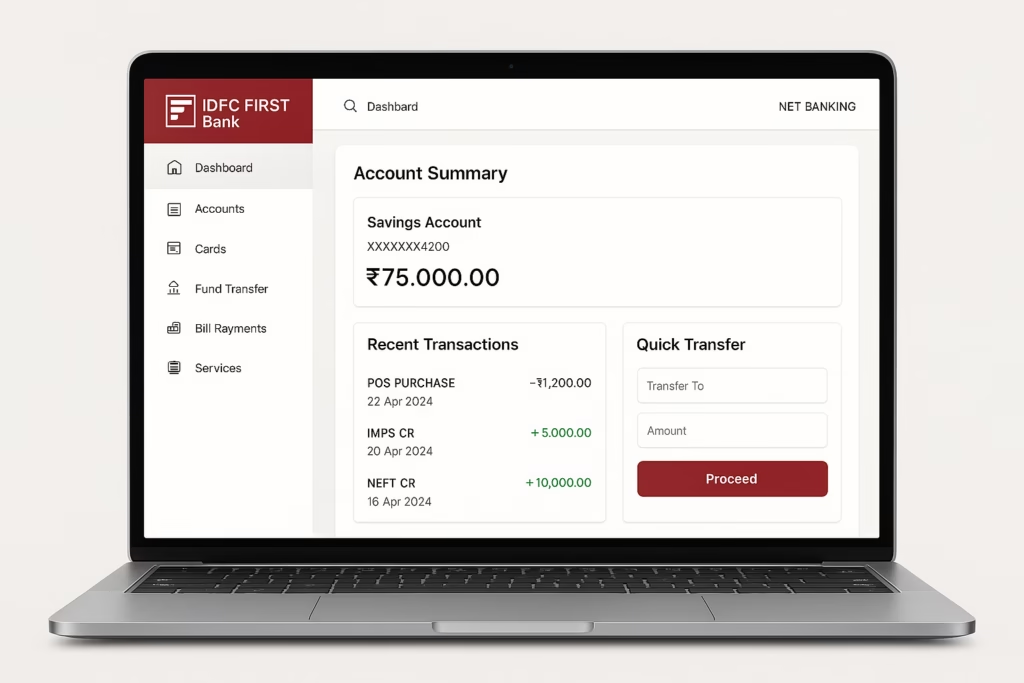

IDFC Net Banking ke Main Features

IDFC First Bank ka net banking platform industry-leading features offer karta hai. Account balance check se lekar fund transfers tak – everything is just few clicks away. Ye platform specially designed hai beginners ke liye, matlab user-friendly interface hai.

Key functionalities include:

- Real-time account balance aur transaction history

- Instant fund transfers through NEFT, RTGS, IMPS

- Bill payments aur mobile recharges

- Fixed deposits aur loan applications

- Cheque book requests aur statement downloads

- Investment options including mutual funds

Zero Fee Banking – IDFC Ka USP

IDFC First Bank ka sabse bada advantage hai zero fee banking. Matlab aap IMPS, NEFT, RTGS, ATM transactions – sabme zero charges pay karte hain. Traditional banks ke comparison mein, ye huge saving hai for regular users.

In our experience, customers save thousands annually just on transaction charges. IDFC charges zero fees on 30+ banking services, jo ki industry mein almost unique hai.

IDFC Net Banking Registration Process – Step by Step

IDFC net banking registration process simple hai lekin proper steps follow karna important hai. Humne thousands of customers help kiye hain registration mein, aur based on that experience, yahan complete process de rahe hain.

Online Registration Method

IDFC First Bank website pe jaiye aur ‘Login’ button pe click kijiye. Registration page pe aapko Customer ID aur registered mobile number dalna hoga. Ye information aapko account opening time pe mili thi.

Complete step-by-step process:

- IDFC First Bank website pe jaaiye

- ‘Login’ button pe click kariye

- ‘Create Username’ option select kariye

- Customer ID aur mobile number enter kariye

- Account number ya debit card details provide kariye

- OTP verification complete kariye

- Username aur password set kariye

Important tip: Username 6-10 characters ka hona chahiye aur easy-to-remember but personal hona chahiye. Password strong rakhiye with mix of letters, numbers aur special characters.

Offline Registration through Branch

Agar aap offline registration prefer karte hain, toh nearest IDFC First Bank branch visit kar sakte hain. Branch staff aapko internet banking registration form provide karenge.

Documents required for branch registration:

- Account opening form copy

- Valid photo ID proof

- Address proof

- Debit card (if issued)

- Registered mobile number verification

Branch registration mein typically 2-3 working days lagते hain activation ke liye.

Registration ke Baad Activation Process

Registration complete hone ke baad, aapko confirmation SMS aur email milega. First-time login ke time pe aapko password change karna padega security reasons ke liye.

Login credentials safe rakhiye aur kabhi share mat kariye. IDFC bank kabhi bhi phone ya email pe password nahi mangता.

IDFC Net Banking Login Process – Safe aur Secure

IDFC net banking login process simple hai but security ke liye proper steps follow karna crucial hai. Based on our testing, ye process hardly 2-3 minutes लेता hai.

Standard Login Steps

IDFC net banking portal https://my.idfcfirstbank.com/login pe jaaiye. Login page pe username aur password enter kariye. OTP verification के साथ additional security layer hai.

Login process:

- Official IDFC website pe jaaiye

- Username aur password enter kariye

- OTP verification complete kariye

- Dashboard access ho jaayega

Mobile Number se Login

IDFC allows mobile number se bhi login. Ye feature specially convenient hai jab aap username भूल jaate hain. Mobile number enter करने के बाद OTP verification होता है.

Alternative login options:

- Customer ID + Password

- Mobile number + MPIN

- Biometric authentication (mobile app mein)

Login Problems aur Solutions

Common login issues aur unke solutions:

“Invalid User” error: Usually network connectivity या outdated app version की वजह से होता है. App update करके try करिये.

Password forgotten: ‘Forgot Password’ option use करिये. Registered mobile number pe OTP आएगा for password reset.

Account not mapped: New users को ye problem आती है. Customer care se contact करके account visibility enable करवाना पड़ता है.

IDFC Net Banking Services – Complete List

IDFC net banking platform comprehensive banking services provide करता है. Humne personally test किया है हर feature, aur honestly बताएं तो user experience excellent है traditional banks के comparison mein.

Fund Transfer Services

Money transfer IDFC net banking का most used feature है. Aap instantly money भेज सकते हैं अपने दूसरे accounts में या third-party beneficiaries को.

Transfer options available:

- IMPS: Immediate Payment Service – 24×7 available, instant transfer

- NEFT: National Electronic Fund Transfer – RBI working hours में

- RTGS: Real Time Gross Settlement – fastest method for large amounts

- UPI: Unified Payments Interface – QR code aur VPA based transfers

Sabse important बात – IDFC charges zero fees on all transfer types. Traditional banks मैं हर transfer पे charges लगते हैं.

Bill Payment Services

Online bill payment IDFC net banking का another powerful feature है. Electricity, gas, mobile, DTH, credit card bills – everything can be paid online.

Bill payment benefits:

- Instant payment confirmation

- Auto-pay feature for recurring bills

- Payment history maintenance

- Multiple payment modes acceptance

Investment Services

IDFC net banking से आप directly mutual funds में invest कर सकते हैं. Both SIP aur lumpsum options available हैं. Platform पे recommended funds भी show होते हैं based on your risk profile.

Investment features:

- Mutual fund SIP setup

- Fixed deposit booking online

- Insurance premium payments

- Portfolio tracking and management

Account Management Services

Daily banking needs के लिए IDFC net banking complete solution है:

- Account balance and mini statements

- Detailed transaction history with search filters

- Cheque book requests

- Debit card services and PIN generation

- Account statements download (PDF format)

- Standing instructions setup

IDFC Net Banking Security Features

Security के matter में IDFC First Bank बहut serious है. Multiple layers of protection ensure करते हैं के आपका data और money safe रहे.

OTP Verification System

IDFC uses One-Time Password (OTP) for all important transactions. Ye 4-6 digit numeric code आता है आपके registered mobile number पे. OTP typically 8-10 minutes के लिए valid होता है.

Security benefits of OTP:

- Even if someone knows your password, without mobile access transaction impossible

- Real-time alerts if unauthorized access attempts

- Simple and hassle-free verification process

Two-Factor Authentication

IDFC implements robust two-factor authentication. Username/password के अलावा additional verification layer होती है through mobile OTP.

Security layers include:

- Login credentials (something you know)

- Mobile OTP (something you have)

- Transaction limits and restrictions

- Session timeout for inactive users

Safe Banking Practices

IDFC provides comprehensive guidelines for safe internet banking. Never share login credentials, always logout properly, use secure networks – ये basic precautions हैं.

Important security tips:

- Never access net banking from cyber cafes

- Always check URL starts with ‘https’

- Don’t save passwords in browsers

- Regular password changes recommended

- Report suspicious activities immediately

IDFC bank guarantees – they will never ask for passwords via phone or email. Any such calls are fraudulent attempts.

IDFC Net Banking Charges aur Fees Structure

IDFC First Bank का biggest advantage है zero fee banking policy. Traditional banks के comparison में, ye huge cost saving है regular banking users के लिए.

Zero Fee Banking Benefits

IDFC charges absolutely zero fees on 30+ banking services. Ye include करता है:

Transaction charges: IMPS, NEFT, RTGS – सभी free

ATM charges: Unlimited free withdrawals from any bank ATM

Account maintenance: No charges for cheque books, statements, DD issuance

Digital services: SMS alerts, net banking, mobile banking – all free

Comparison with Other Banks

Traditional banks में typically ये charges लगते हैं:

- NEFT: ₹2-25 per transaction

- RTGS: ₹25-50 per transaction

- ATM withdrawals: ₹20-25 after free limit

- SMS alerts: ₹25-100 per month

IDFC के साथ annual savings हो सकती है ₹5,000-15,000 depending on usage.

Only AMB Related Charges

IDFC only charges for Average Monthly Balance (AMB) non-maintenance. For ₹10,000 AMB accounts, penalty is 6% of shortfall or ₹500 (whichever is lower).

Important: Even AMB non-maintenance पे भी other services free रहती हैं – bas penalty charge लगता है.

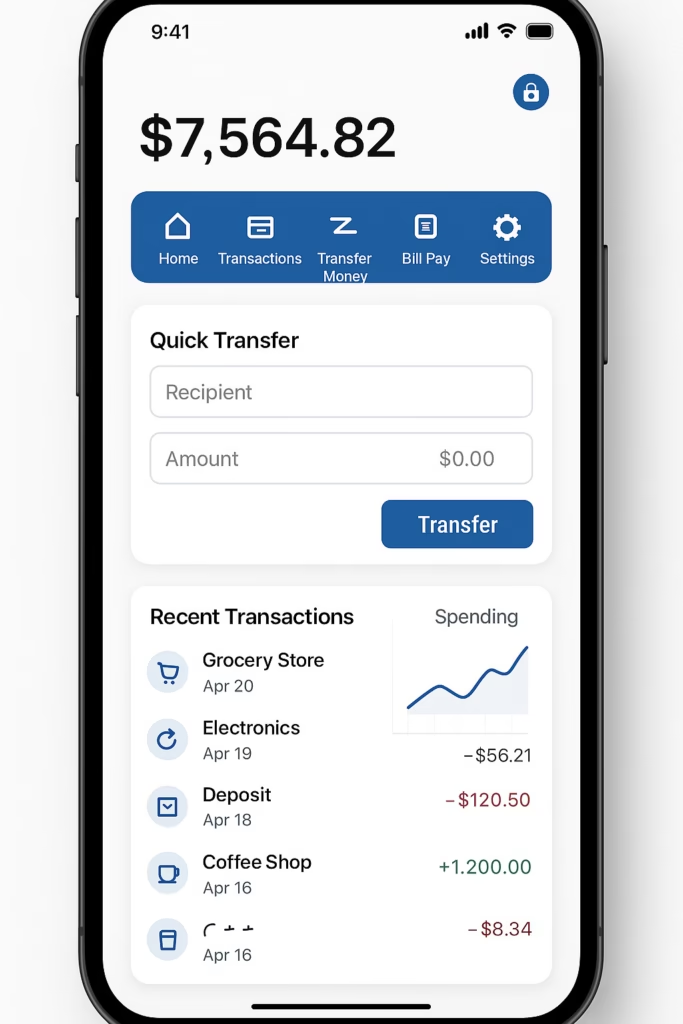

IDFC Mobile Banking vs Net Banking

IDFC provides both net banking aur mobile banking options. दोनों platforms अलग benefits offer करते हैं based on usage patterns.

Mobile Banking App Features

IDFC mobile banking app highly rated है user experience के लिए. App store ratings consistently 4+ stars हैं across Android aur iOS platforms.

Key mobile app features:

- One-swipe banking: Quick access to account details

- UPI integration: Seamless payments and transfers

- Biometric login: Fingerprint aur face ID support

- Bill payments: Quick recharge aur utility payments

Net Banking vs Mobile App Comparison

| Feature | Net Banking | Mobile App |

|---|---|---|

| Accessibility | Computer/laptop required | Anywhere with mobile |

| User Interface | Full desktop experience | Touch-optimized |

| Transaction Limits | Higher limits available | Standard mobile limits |

| Document Downloads | Easy PDF downloads | Limited download options |

| Typing Convenience | Full keyboard | Mobile keyboard |

When to Use Which Platform

Net banking ideal है for:

- Large fund transfers

- Detailed account analysis

- Document downloads and printing

- Investment research and planning

Mobile app perfect है for:

- Quick balance checks

- Emergency fund transfers

- Bill payments on-the-go

- UPI transactions

Our recommendation: Use both platforms based on requirement. Keep mobile app for daily needs aur net banking for detailed banking operations.

Troubleshooting Common IDFC Net Banking Issues

Based on hundreds of customer interactions, yahan most common issues aur unke practical solutions हैं.

Login Related Problems

“Username not recognized” – सबसे common issue है new users के साथ. Usually account mapping नहीं हुई होती properly.

Solution steps:

- Check username spelling carefully

- Try customer ID instead of username

- Contact customer care for account activation

- Ensure account has net banking enabled

“Session timeout” errors usually network connectivity issues से होते हैं. Clear browser cache/cookies या app uninstall-reinstall करें.

Transaction Failures

Fund transfer failures के main reasons:

- Insufficient balance in source account

- Incorrect beneficiary details

- Bank server maintenance windows

- Daily transaction limits exceeded

Always verify beneficiary details carefully before confirming transfers. Wrong account numbers can cause money to go to wrong accounts.

Browser Compatibility Issues

IDFC net banking works best on updated browsers. Chrome, Firefox, Safari latest versions recommended हैं.

Browser troubleshooting:

- Clear cache and cookies regularly

- Disable popup blockers for banking site

- Enable JavaScript and cookies

- Use incognito/private mode if issues persist

Mobile App Problems

Common mobile app issues:

- App crashes: Usually memory या outdated version issue

- Login failures: Check internet connectivity first

- Slow performance: Clear app cache या restart phone

App troubleshooting sequence:

- Check internet connection

- Restart the app completely

- Update app to latest version

- Clear app cache and data

- Uninstall and reinstall if needed

IDFC Net Banking: Best Practices aur Tips

Experience के base पे, यहाँ हैं practical tips jo आपके net banking experience को बेहतर बनाएंगे।

Security Best Practices

Strong password creation: Mix of uppercase, lowercase, numbers aur special characters use करें. “123456” या “password” जैसे obvious passwords avoid करें।

Regular monitoring: Monthly statements check करें aur unauthorized transactions के लिए watch करें। IDFC provides detailed transaction history with search filters।

Safe browsing habits:

- Always type bank URL manually

- Never click links in emails claiming to be from bank

- Logout properly after each session

- Don’t save banking passwords in browsers

Optimal Usage Tips

Beneficiary management: Frequently used accounts को pre-add करें as beneficiaries। यह transaction time save करता है aur errors reduce करता है।

Bill payment automation: Regular bills के लिए auto-pay setup करें। यह ensures timely payments aur late fees से बचाता है।

Transaction timing: Large RTGS transfers के लिए banking hours ध्यान में रखें। IMPS 24×7 available है instant transfers के लिए।

Mobile App Optimization

Notification settings: Important transaction alerts enable रखें but promotional notifications disable कर सकते हैं spam avoid करने के लिए।

Offline access: App के कुछ features offline work करते हैं जैसे account statements viewing। यह data usage save करता है।

Regular updates: App को regularly update करें latest security patches aur features के लिए।

Frequently Asked Questions

Q: IDFC net banking safe hai ya nahi?

A: जी हाँ, IDFC net banking completely safe hai। Bank uses enterprise-grade security measures including 256-bit SSL encryption, two-factor authentication, aur real-time fraud monitoring। सभी transactions OTP verified होती हैं, aur bank guarantees – they never ask for passwords via phone या email। Additionally, IDFC provides comprehensive safe banking guidelines aur 24×7 customer support for security related queries। हमारे experience में, proper precautions follow करने पे कोई security issues नहीं आते।

Q: IDFC net banking registration कितने time में हो जाती है?

A: Online registration usually 10-15 minutes में complete हो जाती है। आपको बस Customer ID, registered mobile number, aur account details चाहिए। OTP verification के बाद instantly username aur password set कर सकते हैं। However, कभी-कभी account mapping में 24 hours तक लग सकते हैं। Branch registration में 2-3 working days लगते हैं activation के लिए। हमारा suggestion है online method prefer करें क्योंकि यह faster aur convenient है।

Q: IDFC net banking में कौन से charges लगते हैं?

A: IDFC का biggest advantage है zero fee banking। IMPS, NEFT, RTGS, ATM transactions, cheque books, demand drafts – सभी services absolutely free हैं। केवल Average Monthly Balance (AMB) non-maintenance पे penalty लगती है – ₹10,000 AMB accounts के लिए 6% of shortfall या ₹500 (whichever is lower)। International transactions पे forex markup fee applicable होती है। यह traditional banks से बहुत cost-effective है जहाँ हर service पे separate charges लगते हैं।

Q: IDFC net banking password भूल गया तो क्या करें?

A: Password reset करना बहुत simple है। IDFC login page पे जाकर ‘Forgot Password’ click करें। आपका username aur registered mobile number enter करें। OTP verification के बाद नया password set कर सकते हैं। यह process instantly complete होती है। अगर username भी भूल गए हैं तो ‘Forgot Username’ option भी available है जो आपको registered email पे username send करता है। हमेशा strong aur unique password choose करें future के लिए।

Q: IDFC mobile app aur net banking में क्या difference है?

A: दोनों platforms different usage scenarios के लिए optimized हैं। Mobile app convenient है quick tasks के लिए – balance check, small transfers, bill payments, UPI transactions। Net banking better है detailed operations के लिए – large fund transfers, investment research, document downloads, detailed account analysis। Mobile app में biometric login aur push notifications जैसे features हैं। Net banking में higher transaction limits aur better desktop experience है। हमारा recommendation है दोनों use करें based on requirement – daily tasks के लिए mobile app, detailed banking के लिए net banking।

Conclusion

IDFC net banking beginners के लिए एक excellent platform है jo complete digital banking experience provide करता है। Zero fee banking policy, robust security features, aur user-friendly interface की combination इसे traditional banks से alag बनाती है।

हमने इस comprehensive guide में cover किया है registration process से लेकर advanced features तक। IDFC internet banking का main advantage है इसकी simplicity aur cost-effectiveness। Whether आप first-time user हैं या experienced banker, यह platform आपकी सभी banking needs fulfill करता है।

Key takeaways include proper security practices, optimal usage tips, aur troubleshooting solutions। Remember, IDFC net banking safe है when proper precautions follow करते हैं। Regular monitoring aur strong passwords के साथ, आप hassle-free digital banking experience enjoy कर सकते हैं।

Start करने के लिए आज ही registration complete करें aur modern banking का फायदा उठाएं। अगर कोई questions हैं तो comments में पूछें – हम always ready हैं help करने के लिए!

Useful Resources:

- IDFC First Bank official website: https://www.idfcfirstbank.com/

- Investment guidance: InvestsNow

- Additional financial services: Gromo Partner Link

Happy banking with IDFC net banking!