How to Start Forex Trading in USA with $100:Best Guide for Beginners 2025

How to Start Forex Trading in USA with $100: A Complete Beginner’s Guide for 2025

Starting forex trading with just $100 might sound impossible, but it’s actually one of the smartest ways to enter the foreign exchange market in 2025. Agar aap soch rahe hain ki kya $100 se forex trading shuru kar sakte hain USA mein, toh answer hai—absolutely yes! While you won’t become a millionaire overnight, this modest capital is enough to gain real trading experience, develop discipline, and build a foundation for long-term success.litefinance+2

The forex market is the world’s largest financial market with over $5 trillion traded daily. Thanks to leverage, micro-lots, and regulated brokers accepting small deposits, beginners can now access this market without needing thousands of dollars. In this comprehensive guide, humne cover kiya hai everything you need to know—from choosing the right broker to mastering risk management strategies that actually work.investopedia

How to Start Forex Trading in USA Understanding Forex Trading: What Beginners Must Know

Forex trading, or foreign exchange trading, involves buying and selling currency pairs to profit from exchange rate fluctuations. When you trade forex, you’re essentially betting on whether one currency will strengthen or weaken against another. For example, if you believe the US Dollar will gain value against the Euro, you’d buy the USD/EUR pair.home+1

Why Forex is Perfect for Beginners with Small Capital:

The forex market operates 24 hours a day, five days a week, allowing you to trade whenever it suits your schedule. Unlike stock markets that require substantial capital to make meaningful trades, forex brokers offer leverage ratios that magnify your buying power. With a $100 deposit and 1:50 leverage (the maximum for major pairs in the USA), you can control positions worth $5,000.investopedia+2

The Reality Check: While leverage sounds exciting, it’s a double-edged sword. Agar price aapke against move karti hai, toh losses bhi magnified ho jaati hain. This is why proper education, demo account practice, and strict risk management are non-negotiable for beginners starting with $100.litefinance+2

Key Forex Terminology You Must Understand

Currency Pairs: Forex trades involve pairs like EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), or USD/JPY (US Dollar/Japanese Yen). The first currency is the “base” and the second is the “quote” currency.home+1

Pips: A pip (percentage in point) represents the smallest price movement in forex. For most pairs, it’s the fourth decimal place (0.0001). If EUR/USD moves from 1.1000 to 1.1001, that’s a 1-pip movement.admiralmarkets

Lot Sizes: Standard lot = 100,000 units, Mini lot = 10,000 units, Micro lot = 1,000 units, and Nano lot = 100 units. With a $100 account, you’ll primarily trade micro or nano lots.tradingwithrayner+1

Spread: The difference between the bid (selling) price and ask (buying) price. This is how brokers make money. Lower spreads mean lower trading costs for you.zforex+1

Leverage: The ratio of borrowed funds from your broker. In the USA, retail forex traders get maximum 50:1 leverage for major pairs and 20:1 for minor pairs due to CFTC regulations.innreg+2

Margin: The collateral required to open a leveraged position. With 50:1 leverage, you need 2% margin, meaning a $5,000 position requires only $100.investopedia+1

Can You Actually Make Money Trading Forex with $100?

The short answer: Yes, but set realistic expectations. With a $100 forex account, aiming for 2-10% monthly returns ($2-$10) is achievable and sustainable. Some experienced traders report turning $100 into $200 within weeks using proper strategies and favorable market conditions.telegramsignalcopier+3

Realistic Profit Expectations:

According to industry data, medium-level traders can earn 10% of their deposit per month on average, while professional traders’ annual earnings can exceed 500%. However, these figures require skill, experience, and impeccable discipline. As a beginner with $100, your primary goal should be learning and preserving capital, not getting rich quickly.litefinance+2

The Power of Compounding: If you consistently make 5% monthly returns and reinvest your profits, your $100 account could grow to $179 in one year through compounding alone (without additional deposits). While modest, this 79% annual return far exceeds traditional investments and demonstrates the market’s potential.linkedin

The Harsh Reality: Most beginner forex traders lose money initially because they overtrade, use excessive leverage, ignore risk management, or trade emotionally. Studies show that about 70-80% of retail forex traders lose money, primarily due to poor discipline and unrealistic expectations.shareindia+3

What Professional Traders Earn

According to Glassdoor, professional forex traders in the USA earn around $154,000 annually, which equals about $420 per day. However, these traders typically manage accounts worth tens or hundreds of thousands of dollars. With a $100 account, your daily profit target should be more like $2-5 to maintain sustainable growth.opofinance+2

Image: Forex trading chart analysismetatrader5

Screenshot of MetaTrader 5 Forex trading platform showing EUR/USD chart, technical indicators, and trade management panel in a demo account environment metatrader5

Step-by-Step Guide: How to Start Forex Trading with $100 in USA

Step 1: Choose a Regulated Broker That Accepts $100

Your broker selection is arguably the most critical decision you’ll make. In the USA, all forex brokers MUST be registered with the Commodity Futures Trading Commission (CFTC) and be members of the National Futures Association (NFA). This regulation ensures your funds are segregated, trading is fair, and you have recourse if disputes arise.innreg+2

Top USA-Regulated Brokers Accepting $100 Minimum Deposit:

FOREX.com requires a $100 minimum deposit and has been operating since 2001. They offer powerful platforms including MetaTrader 4, MetaTrader 5, and their proprietary Web Trader. The broker provides access to over 80 currency pairs with competitive spreads starting from 1-2 pips.brokerchooser+1

OANDA is renowned for exceptional research tools and fast, user-friendly account opening. They accept $100 deposits and provide outstanding educational resources for beginners.forexbrokers+1

IG offers first-class web trading platforms and superb educational tools. Their minimum deposit is $100, and they’re regulated by multiple tier-one authorities globally.brokerchooser+1

tastyfx (powered by IG) is recommended specifically for US beginners, offering seamless integration with TradingView, competitive spreads from 0.8 pips, and cashback rebates up to 15%.tastyfx+1

Plus500US also requires just $100 minimum deposit and provides low thresholds for new traders while maintaining full CFTC/NFA compliance.fxleaders+1

What to Look for in a Broker:

✓ Regulation: Verify CFTC registration and NFA membership using the NFA BASIC database at nfa.futures.org/basicnetdailyforex+2

✓ Minimum Deposit: Ensure they accept $100 or lesssashares+2

✓ Micro/Nano Lots: The broker must allow trading in 0.01 lots (1,000 units) or smaller to manage risk properly with limited capitalzforex+1

✓ Low Spreads and Commissions: Every pip counts when trading small accounts. Look for tight spreads (under 2 pips for majors) and transparent commission structuresdailyforex+2

✓ Educational Resources: Quality tutorials, webinars, market analysis, and demo accounts are invaluable for beginnershome+2

✓ Customer Support: Responsive 24/5 support can help resolve issues quicklyzforex

✓ Trading Platforms: MetaTrader 4, MetaTrader 5, or user-friendly proprietary platforms with charting tools and indicatorshycm+2

Red Flags to Avoid:

× Unregulated offshore brokers promising unrealistic returns

× Brokers not listed in the NFA BASIC database

× Excessive hidden fees or withdrawal restrictions

× Poor online reviews mentioning fund withdrawal issues

For beginners, we recommend checking out OctaFX, which offers competitive trading conditions suitable for small account holders. You can also explore additional financial resources and guides at InvestsNow to broaden your investment knowledge.

Step 2: Open and Practice with a Demo Account First

Never skip the demo account phase! Virtually all reputable brokers provide free demo accounts loaded with $10,000-$20,000 in virtual funds. This risk-free environment allows you to practice trading strategies, familiarize yourself with the platform interface, test technical indicators, and understand market dynamics without risking real money.home+5

How to Use a Demo Account Effectively:

Treat your demo account as if it’s real money. Set the virtual balance to $100 to mirror your intended live account size. Practice for at least 2-3 months or until you achieve consistent profitability. Test different trading strategies, timeframes, and currency pairs to find what suits your personality and schedule.litefinance+5

Track every trade in a trading journal, noting entry/exit reasons, emotions felt, and lessons learned. This documentation becomes invaluable for identifying patterns in your decision-making.pineconnector+1

Important Reality Check: Demo accounts operate in real market conditions with actual prices, but they don’t perfectly replicate live trading psychology. The fear and greed you’ll experience when real money is at stake can significantly impact your decisions. Still, demo practice builds essential technical skills and platform familiarity.fxpro+3

Recommended Demo Account Features:

- MetaTrader 4 or MetaTrader 5 platform access

- Real-time market data and pricing

- Full charting and technical indicator tools

- Ability to practice various order types (market, limit, stop-loss, take-profit)

- Mobile app access for on-the-go practiceig

Popular demo accounts include those from tastyfx (offering $10,000 virtual funds), IG (access to 17,000+ markets), FXTM (up to $1 million virtual money), and Dukascopy (14-day free virtual account).tastyfx+3

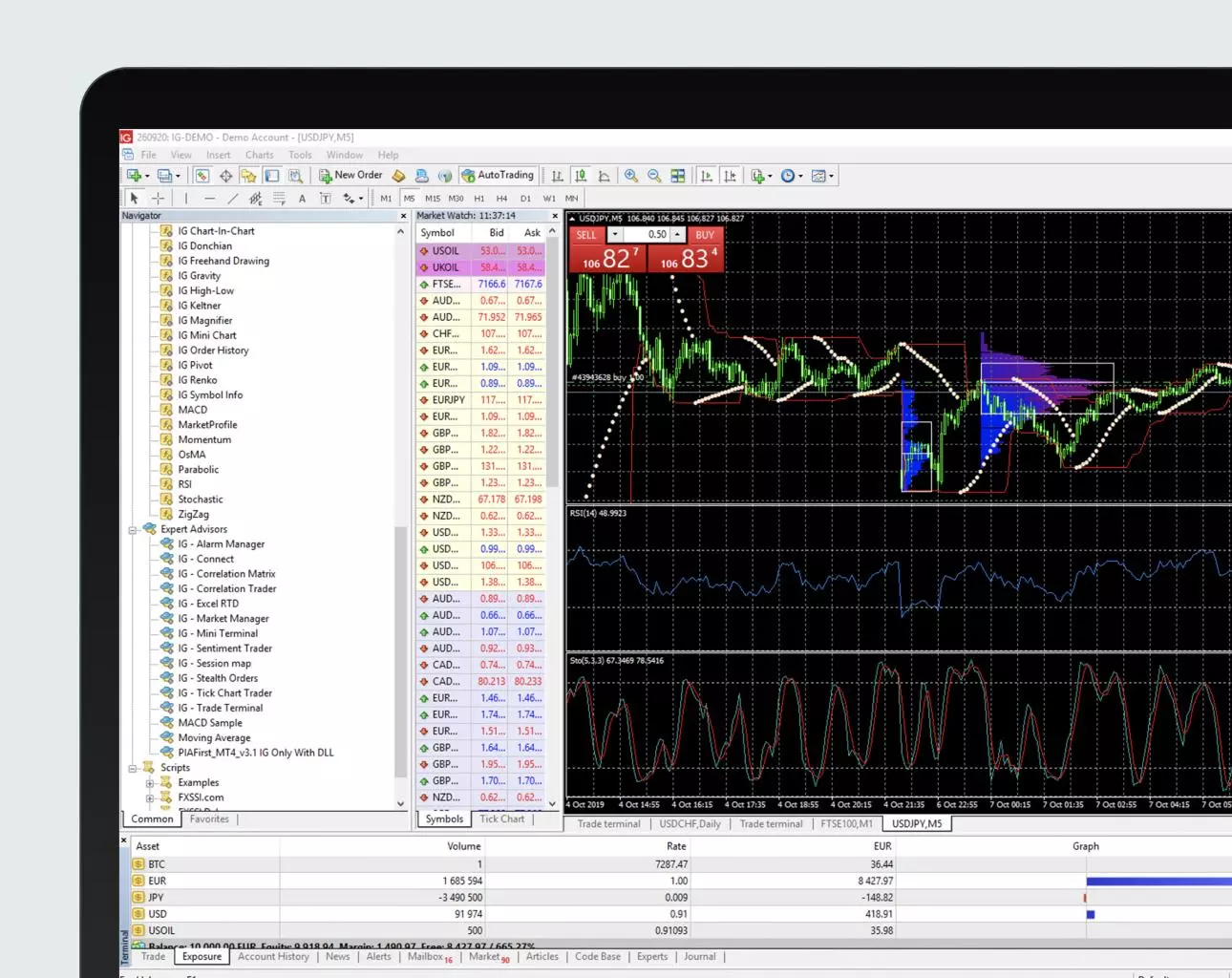

Image: Forex trading platform interface MetaTrader

MetaTrader 4 forex trading platform interface showing market watch, trading tools, and USDJPY currency pair chart ig

Step 3: Fund Your Live Account with $100

Once you’ve demonstrated consistent profitability in your demo account (ideally for 60-90 days), it’s time to fund your live account. Most US-regulated brokers accept deposits via bank transfer (ACH), credit/debit cards, and sometimes e-wallets like PayPal or Skrill.fxleaders+1

Funding Methods and Processing Times:

Bank Transfer/ACH: Usually free but takes 1-3 business days to process. Most reliable method for US residents.fxleaders

Credit/Debit Cards: Instant or same-day processing. Some brokers charge small fees (1-2%).oscprofessionals

E-wallets: Fast processing (minutes to hours) but may have transaction fees.oscprofessionals

Important: Only deposit money you can afford to lose completely. Forex trading carries substantial risk, and while $100 is a manageable learning investment, you should never trade with rent money, emergency funds, or borrowed capital.litefinance+1

Account Verification Requirements: Due to anti-money laundering (AML) and Know Your Customer (KYC) regulations, you’ll need to provide proof of identity (driver’s license or passport) and proof of address (utility bill or bank statement). This verification process typically takes 24-48 hours.innreg+1

Step 4: Understand and Apply Strict Risk Management

Risk management is the difference between traders who survive and those who blow up their accounts. With a $100 account, proper risk management is even more critical because you have less margin for error.zforex+2

The Golden Rule: Never Risk More Than 1-2% Per Trade

Professional traders universally recommend risking no more than 1-2% of your total account balance on any single trade. With a $100 account, this means risking only $1-$2 per trade. Sounds small? It is—but it’s what keeps you in the game long enough to develop skills and see results.admiralmarkets+5

Why is this important? Let’s say you risk 10% ($10) per trade instead. After just 5 consecutive losses (which happens to every trader), you’ve lost half your account. Recovering from a 50% loss requires a 100% gain. But risking only 2% per trade, even 10 consecutive losses would reduce your account to only $82, requiring just a 22% gain to recover.tradingstrategyguides

Essential Risk Management Tools:

Stop-Loss Orders: A stop-loss automatically closes your position if the price moves against you by a predetermined amount. Never enter a trade without a stop-loss. This single tool prevents catastrophic losses and removes emotion from the exit decision.shareindia+2

Take-Profit Orders: Automatically closes your position when you reach your profit target. This prevents greed from turning winning trades into losers.fpmarkets+1

Position Sizing: Calculate the exact lot size based on your risk tolerance. With $100 and 2% risk ($2), if your stop-loss is 20 pips away and you’re trading EUR/USD (where each pip = $0.10 for a micro lot), your maximum position size is 0.01 lots (1,000 units).tradingwithrayner+1

Risk-Reward Ratio: Aim for trades where potential profit is at least twice your potential loss (1:2 ratio or better). If risking $2 with a 20-pip stop-loss, target at least $4 profit with a 40-pip take-profit.opofinance+2

Leverage Management: In the USA, you can use up to 50:1 leverage for major pairs, but just because you can doesn’t mean you should. With a $100 account, consider using modest leverage of 10:1 to 20:1 initially. This provides adequate exposure while limiting catastrophic loss potential.telegramsignalcopier+5

Image: Forex risk management strategyblog.elearnm

Six essential risk management tools for a trading plan: stop loss, risk-reward ratio, position size, risk per trade, trading rules, and leverage blog.elearnmarkets

Step 5: Select Your Trading Strategy

Different trading strategies suit different personalities, schedules, and risk tolerances. Here are the most beginner-friendly strategies for $100 accounts:

Scalping (Very Short-Term)

Scalping involves making dozens of trades daily, each lasting seconds to minutes, targeting 5-10 pip gains. This high-frequency approach capitalizes on tiny price movements and requires intense focus, fast execution, and tight spreads.admiralmarkets+1

Pros: Quickly accumulates small profits; minimizes overnight risk; exciting and engaging.linkedin

Cons: Extremely time-intensive; high stress; requires constant monitoring; transaction costs add up.linkedin

Best for: Full-time traders with excellent discipline and fast decision-making abilities.

Day Trading (Short-Term)

Day traders open and close all positions within the same trading day, typically during high-volume sessions like the London-New York overlap. Positions last minutes to hours, targeting 20-50 pips.babypips+1

Pros: No overnight exposure; defined risk; consistent opportunity during active sessions.admiralmarkets+1

Cons: Requires several hours daily; can be stressful; needs discipline to close all positions before market close.admiralmarkets

Best for: Traders who can dedicate 2-4 hours during market sessions.

Swing Trading (Medium-Term)

Swing traders hold positions for 2-7 days, capitalizing on medium-term price swings. This strategy identifies trends and enters during temporary pullbacks, using higher timeframes (4-hour, daily charts).techpoint+2

Pros: Less time-intensive; allows for deeper analysis; fewer transaction costs; suitable for those with jobs.techpoint+1

Cons: Overnight and weekend exposure; requires patience; fewer trading opportunities.linkedin+1

Best for: Busy professionals who check markets once or twice daily.

Trend Following Strategy

One of the most beginner-friendly approaches, trend following uses indicators like moving averages (50-day, 200-day) to identify and follow established trends. The famous saying applies: “The trend is your friend.”nurp+2

How it works: When the 50-day moving average crosses above the 200-day moving average (a “golden cross”), it signals an uptrend—time to buy. When it crosses below (a “death cross”), it signals a downtrend—time to sell.ig+1

Pros: Clear rules; works in trending markets; relatively simple to implement.nurp+1

Cons: Performs poorly in sideways/ranging markets; lagging indicators mean delayed entries.nurp+1

Breakout Trading

Breakout trading involves entering positions when price breaks through established support or resistance levels, anticipating significant moves. Often combined with volume analysis to confirm breakout strength.admiralmarkets+1

Best for: Major news events or high-volatility pairs like EUR/USD or GBP/JPY.nurp

Support and Resistance Trading

This strategy identifies key price levels where buying or selling pressure historically emerges. Buy near support (lower bound) and sell near resistance (upper bound) in ranging markets.babypips+2

Pros: Clear entry/exit points; works well in non-trending markets.ig+1

Cons: Requires accurate level identification; breakouts can trigger losses.ig

For detailed video tutorials on various trading strategies, check out this comprehensive YouTube guide: Forex Trading For Beginners In 2025.

Step 6: Master Technical and Fundamental Analysis

Successful forex trading requires understanding both technical analysis (chart patterns, indicators) and fundamental analysis (economic news, central bank policies).home+2

Technical Analysis Tools for Beginners:

Moving Averages (MA): Smooth price data to identify trends. Simple Moving Average (SMA) averages closing prices over specified periods. Exponential Moving Average (EMA) gives more weight to recent prices.hycm+2

Relative Strength Index (RSI): Measures momentum on a 0-100 scale. Readings below 30 suggest oversold conditions (potential buying opportunity); above 70 suggests overbought conditions (potential selling opportunity).ig+2

MACD (Moving Average Convergence Divergence): Compares two moving averages to detect momentum changes. When MACD line crosses above signal line, it signals bullish momentum; crossing below signals bearish momentum.admiralmarkets+3

Bollinger Bands: Shows volatility and potential overbought/oversold conditions. Price touching the lower band might indicate oversold conditions; touching upper band suggests overbought.investopedia+2

Support and Resistance Levels: Horizontal lines marking price levels where buying or selling pressure historically emerges.babypips+2

Candlestick Patterns: Visual representations of price action. Patterns like hammer, shooting star, engulfing, and doji signal potential reversals or continuations.forextime+2

Popular Trading Platforms for Technical Analysis:

MetaTrader 4/5: Industry-standard platforms with built-in indicators, customizable charts, automated trading capabilities (Expert Advisors), and mobile access.brokerchooser+2

TradingView: Web-based platform with powerful charting, hundreds of indicators, Pine Script for custom indicators, and social community features.tastyfx+1

cTrader: Professional platform with depth of market (DOM), one-click trading, and advanced risk management tools.hycm

Fundamental Analysis Essentials:

Economic calendars track major news events that impact currency prices. Key events include:fxstreet+1

- Interest Rate Decisions: Central bank rate changes are the most impactful eventsinvestinglive+1

- Non-Farm Payrolls (NFP): US employment data released first Friday of each monthfxstreet

- GDP Reports: Economic growth indicatorsinvestinglive+1

- Inflation Data (CPI, PPI): Affects central bank policy decisionsfxstreet

- Central Bank Speeches: Comments from Fed Chair, ECB President, etc.fxstreet

Resources: FXStreet Economic Calendar, Investing.com Economic Calendar, ForexFactory News, and FXLive Market News.forexfactory+2

Pro Tip: Avoid trading immediately before or during high-impact news releases as volatility spikes create unpredictable price swings. Wait for the dust to settle before entering positions.shareindia+1

Step 7: Develop Trading Discipline and Emotional Control

Trading psychology often determines success more than technical knowledge. Fear, greed, impatience, and overconfidence destroy more accounts than poor strategies.pineconnector+4

Common Emotional Pitfalls:

Fear: Causes premature exit from profitable trades or paralysis preventing entry altogether.plancana+1

Greed: Leads to holding winners too long, using excessive leverage, or abandoning risk limits.oanda+1

Revenge Trading: After a loss, impulsively entering trades to “get even” without proper analysis.forextraders+1

Overconfidence: After winning streaks, abandoning risk management or increasing position sizes irrationally.pineconnector+1

How to Build Trading Discipline:

Create and Follow a Trading Plan: Document your strategy, entry/exit rules, risk parameters, and trading hours. Never deviate from your plan based on emotions.home+3

Keep a Trading Journal: Record every trade with entry/exit prices, rationale, emotions felt, and lessons learned. Review weekly to identify patterns and improve decision-making.forextraders+1

Set Realistic Goals: Aim for consistent small gains (2-5% monthly) rather than getting rich quickly. Unrealistic expectations create emotional pressure and poor decisions.litefinance+2

Accept Losses as Part of Trading: Every trader loses—even the best. Your strategy should account for losses and compensate over time. Don’t chase losses or overtrade.telegramsignalcopier+2

Use Automation: Set stop-loss and take-profit orders in advance to remove emotional decision-making when positions move against you.oanda+1

Take Breaks: If experiencing consecutive losses or emotional stress, step away from the screen. Trading while emotional leads to irrational decisions.citytradersimperium+1

Practice Mindfulness: Meditation, deep breathing, and mental training help maintain calm during volatile market conditions.citytradersimperium+2

Focus on Process, Not Profits: Concentrate on executing your strategy correctly. Profits will follow consistent execution.linkedin+1

Common Mistakes to Avoid When Trading Forex with $100

Overtrading: Making too many trades out of boredom, enthusiasm, or desperation. Stick to high-quality setups matching your strategy rather than forcing trades.shareindia+1youtube

Using Excessive Leverage: In the USA, 50:1 leverage is available for majors, but using maximum leverage with a $100 account is extremely risky. Start conservatively with 10:1 to 20:1.investopedia+2

Ignoring Stop-Losses: Trading without protective stop-losses exposes you to catastrophic losses. Always use stop-losses on every trade.fpmarkets+1

Lack of Trading Plan: Trading randomly or on “gut feelings” without defined rules is gambling, not trading.forextraders+2

Not Using Demo Account: Jumping into live trading without adequate practice leads to expensive lessons.shareindia+1

Emotional Trading: Making impulsive decisions based on fear, greed, or revenge rather than analysis.pineconnector+2

Trading Major News Without Experience: High volatility during news releases causes unpredictable price swings that can wipe out small accounts.fpmarkets+1

Neglecting Technical Indicators: Trading without understanding basic technical analysis handicaps your decision-making.shareindia

Chasing Losses: After losing trades, increasing position size to recover quickly usually compounds losses.telegramsignalcopier+2

Inadequate Education: Failing to continuously learn about markets, strategies, and analysis techniques limits your growth.home+2

US Forex Regulations: CFTC and NFA Explained

The United States maintains some of the strictest forex regulations globally, which protects retail traders but also imposes certain limitations.innreg+2

Commodity Futures Trading Commission (CFTC):

The CFTC is the primary federal regulator for leveraged retail forex transactions in the USA. Their responsibilities include setting capital requirements for brokers, establishing leverage limits (50:1 for majors, 20:1 for minors), requiring risk disclosure statements, and enforcing rules through investigations and civil actions.dailyforex+2

Any firm dealing with US retail forex customers without CFTC registration faces enforcement action, including offshore brokers soliciting US residents.innreg+1

National Futures Association (NFA):

The NFA is a self-regulatory organization for the US derivatives industry, including retail forex. Membership is mandatory for CFTC-registered forex firms. The NFA conducts regular audits, issues detailed compliance rules, monitors financial filings, and has disciplinary authority to fine, suspend, or expel members.fxleaders+2

Key US Trading Restrictions:

Leverage Caps: Maximum 50:1 for major pairs (EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, NZD/USD) and 20:1 for minor pairs.dailyforex+1

No Hedging Rule: You cannot hold simultaneous long and short positions on the same currency pair.fxleaders+1

FIFO (First-In-First-Out): Multiple positions on the same pair must be closed in the order they were opened.dailyforex+1

Pros of US Regulation:

✓ Segregated client funds separate from broker operationsinnreg+1

✓ Minimum capitalization requirements ($20 million for brokers) ensure financial stabilityinnreg

✓ Fair and transparent trade executiondailyforex

✓ Dispute resolution channels through NFAdailyforex

✓ Protection from fraud and manipulationinnreg+1

Cons of US Regulation:

× Lower leverage than offshore brokers (some offer 500:1 or 1000:1)fxleaders+1

× No hedging capabilitydailyforex

× FIFO restrictions limit flexible position managementdailyforex

× Fewer broker choices as many international brokers avoid US market due to compliance costsfxleaders

How to Verify a Broker’s Registration:

Visit the NFA BASIC database at nfa.futures.org/basicnet and search by broker name or NFA ID number. This free tool shows registration status, disciplinary history, and financial information.cftc+2

Warning: The CFTC publishes a “RED List” of foreign brokers that are not registered but appear to offer services in the US illegally. Always verify registration before depositing funds.dailyforex

Free Educational Resources to Accelerate Your Learning

Online Courses:

BabyPips School of Pipsology: Comprehensive free course covering everything from forex basics to advanced strategies. Structured in grade levels (Preschool through College) with quizzes and progress tracking.babypips

AvaAcademy: Free courses from AvaTrade with video lessons, articles, quizzes, and certificates. Covers all asset classes with up to 21 lessons per course.academy.avatrade

Interactive Brokers IBKR Campus: Free forex education including video courses, live webinars, podcasts, and market analysis.interactivebrokers

FXAcademy: 100% free online forex courses for beginners with expert lessons, strategies, and video education.fxacademy

Alison Forex Courses: Free online courses covering forex market understanding, how trading works, currency pairs, and more.alison

Coursera Forex Courses: University-level courses including “Trading Basics,” “Financial Markets” (Yale University), and “Trading Strategies in Emerging Markets”.coursera

Market Analysis and News:

FXStreet: Reliable economic calendar, market analysis, speech tracker, and real-time forex news.fxstreet+1

Investing.com: Forex news, technical indicators, economic calendar, and live quotes.investinglive+2

ForexFactory: Fast-breaking news, analysis, and active trader forums.forexfactory

InvestingLive (formerly ForexLive): Daily news, analysis, and insights on forex, stocks, gold, and crypto.investinglive

Books and Articles:

Many brokers provide free educational materials including e-books, webinars, and market commentary. Take advantage of these resources to continuously improve your knowledge.home+2

YouTube Channels:

Search for reputable forex educators offering free tutorials. Some recommended videos include “Forex Trading For Beginners In 2025 (Full Course)” and “How to Start Forex Trading With No Money (Step-by-Step Plan)”.youtube+2

FAQ: Frequently Asked Questions About Starting Forex Trading with $100 in USA

Q: Is $100 enough to start forex trading in the USA?

A: Absolutely yes, $100 is enough to start forex trading in the USA. While you won’t be able to open large positions or make life-changing profits immediately, this amount provides sufficient capital to trade micro lots (0.01 lots = 1,000 units) while maintaining proper risk management. With $100, you can gain real market experience, learn to control emotions, test strategies in live conditions, and develop trading discipline without exposing yourself to catastrophic financial risk.litefinance+4

The key advantage is that many regulated US brokers like FOREX.com, OANDA, IG, and tastyfx accept $100 minimum deposits and provide access to micro-lot trading. This allows you to risk only 1-2% per trade ($1-$2), which is exactly what professional traders recommend. Additionally, with leverage ratios up to 50:1 for major currency pairs in the USA, your $100 can control positions worth $5,000, providing meaningful market exposure.investopedia+7

However, realistic expectations are critical. Professional traders suggest aiming for 2-10% monthly returns on a $100 account, which translates to $2-$10 per month. While this seems small, it represents exceptional percentage returns compared to traditional investments and demonstrates the forex market’s profit potential. The primary purpose of starting with $100 should be education and skill development, not immediate wealth accumulation.opofinance+3

Remember that approximately 70-80% of retail forex traders lose money, primarily due to poor risk management, emotional trading, and unrealistic expectations. Starting with a modest $100 allows you to learn these critical lessons without devastating financial consequences. Once you demonstrate consistent profitability with $100 over 3-6 months, you can gradually increase your capital and position sizes.tradingstrategyguides+3

Q: Which forex broker is best for beginners in the USA with $100?

A: For beginners in the USA starting with $100, the best forex brokers are FOREX.com, tastyfx (powered by IG), OANDA, and IG, all of which accept $100 minimum deposits and are fully regulated by the CFTC and NFA. Each offers distinct advantages depending on your specific needs.brokerchooser+3

FOREX.com is excellent for beginners because it provides multiple platform options including MetaTrader 4, MetaTrader 5, and their user-friendly Web Trader. They offer over 80 currency pairs with spreads starting from 1-2 pips and have been operating since 2001, demonstrating reliability and stability. The broker provides robust educational resources, market analysis, and 24/5 customer support, making it ideal for those just starting out.fxleaders+1

tastyfx (formerly IG US) is specifically recommended for US beginners by industry experts. It offers seamless integration with TradingView’s powerful charting platform, competitive spreads from 0.8 pips, and unique benefits like earning 6% APY on available funds in Prime accounts plus cashback rebates up to 15%. Their platform is intuitive and designed for both new and experienced traders.tastyfx+1

OANDA stands out for its exceptional research tools, fast account opening process, and outstanding educational resources. They’re particularly strong in technical analysis tools and market insights, helping beginners understand market movements and develop analytical skills.forexbrokers+1

IG provides first-class web trading platforms and superb educational tools including tutorials, webinars, and comprehensive market analysis. They’re regulated by multiple tier-one authorities globally, adding an extra layer of security and trustworthiness.brokerchooser+1

When choosing between these brokers, consider these critical factors: Ensure they allow micro-lot trading (0.01 lots or smaller) so you can properly manage risk with limited capital. Check that spreads are competitive (under 2 pips for major pairs) since every pip counts with small accounts. Verify they provide quality educational resources including demo accounts, tutorials, and market analysis. Confirm they offer MetaTrader 4 or 5, or equally capable proprietary platforms with full charting capabilities. Look for responsive 24/5 customer support to help resolve issues quickly.zforex+6

You can also consider OctaFX for competitive trading conditions. Always verify any broker’s CFTC registration and NFA membership using the NFA BASIC database at nfa.futures.org/basicnet before depositing funds. Never use unregulated offshore brokers regardless of promised benefits like higher leverage, as they lack legal protections for US traders.innreg+3

Q: What is the best trading strategy for a $100 forex account?

A: For a $100 forex account, the best trading strategies are swing trading and trend following because they require less frequent monitoring, lower transaction costs, and are more forgiving for beginners learning market dynamics. These strategies allow you to make informed decisions without the stress of constant chart watching while maintaining proper risk management.admiralmarkets+2

Swing trading involves holding positions for 2-7 days to capitalize on medium-term price movements. This strategy is ideal for busy individuals with jobs or other commitments because it only requires checking markets once or twice daily. You analyze 4-hour or daily charts to identify trends and temporary pullbacks, entering positions when price retraces to support levels during uptrends (or resistance during downtrends). The advantage is that swing trading generates fewer trades, reducing commission and spread costs that can quickly erode a small account. Additionally, it allows time for proper analysis rather than rushed decisions. The risk-reward ratios in swing trading are typically 1:2 or better, meaning you can achieve profitability even with a win rate below 50%.linkedin+2

Trend following is another excellent strategy for $100 accounts, especially for beginners. This approach uses technical indicators like moving averages (50-day and 200-day) to identify established trends and trade in their direction. The famous trading adage “the trend is your friend” reflects the strategy’s effectiveness—trending markets offer the highest probability trade setups. When the 50-day moving average crosses above the 200-day moving average (a “golden cross”), you enter long positions. When it crosses below (a “death cross”), you enter short positions or exit longs. The beauty of trend following is its clear, objective rules that remove emotional decision-making. It works best on higher timeframes (4-hour, daily), reducing the impact of market noise and allowing more considered analysis.techpoint+4

Scalping and day trading, while popular, are generally NOT recommended for $100 beginners. Scalping requires intense focus, constant monitoring, lightning-fast execution, and generates high transaction costs from numerous trades that can devastate small accounts. Day trading demands several dedicated hours daily and creates significant stress, which often leads to emotional mistakes.babypips+2

Regardless of which strategy you choose, these principles are non-negotiable for $100 accounts: Risk only 1-2% ($1-$2) per trade maximum. Always use stop-loss orders to limit potential losses. Target risk-reward ratios of at least 1:2 (risk $1 to make $2+). Focus on major currency pairs (EUR/USD, GBP/USD, USD/JPY) with tight spreads and high liquidity. Trade only during high-volume sessions (London-New York overlap) for better execution. Practice your chosen strategy on a demo account for 60-90 days before risking real money.litefinance+12

The most important factor isn’t which strategy you choose, but rather your discipline in executing it consistently while strictly following risk management rules. Many traders fail not because their strategy is flawed, but because they lack the emotional discipline to follow it during losing streaks or periods of market uncertainty.tradingstrategyguides+2

Q: How much leverage should I use with a $100 forex account in the USA?

A: With a $100 forex account in the USA, you should use conservative leverage between 10:1 and 20:1, even though regulations allow up to 50:1 for major currency pairs and 20:1 for minor pairs. While higher leverage might seem attractive for maximizing profit potential, it dramatically increases the risk of account destruction, especially for beginners still developing trading skills and emotional discipline.investopedia+3

Understanding leverage: Leverage is essentially a loan from your broker that allows you to control larger positions with smaller capital. For example, with 50:1 leverage, your $100 can control a $5,000 position. If the trade moves 1% in your favor, you gain $50 (50% return on your $100). However, if it moves 1% against you, you lose $50 (50% of your account). This amplification works both ways—magnifying profits AND losses.tastyfx+3

Why conservative leverage is critical for small accounts: With a $100 account, you have minimal margin for error. Using maximum 50:1 leverage means a mere 2% adverse price movement can wipe out your entire account through a margin call. The forex market routinely experiences 1-2% daily fluctuations, making account destruction frighteningly easy with high leverage. In contrast, using 10:1 leverage provides meaningful exposure while requiring a 10% adverse move to threaten your account—far less likely in typical market conditions.forextime+2

Practical example: Trading EUR/USD at 1.1000, you want to buy based on your analysis. With a $100 account and 50:1 leverage, you could open a position of 0.05 lots (5,000 units), where each pip movement equals $0.50. A 20-pip stop-loss would risk $10 (10% of account)—far exceeding the recommended 1-2% risk limit. This setup violates fundamental risk management and invites disaster.tradingwithrayner

Using 10:1 leverage instead, you’d control a smaller position of 0.01 lots (1,000 units), where each pip equals $0.10. The same 20-pip stop-loss now risks only $2 (2% of account)—exactly within recommended limits. While profits are smaller per trade, you can withstand losing streaks without devastating your account, which is essential for long-term survival and success.quantifiedstrategies+1

US regulatory restrictions: The CFTC limits retail forex leverage to 50:1 for major pairs (EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, NZD/USD) and 20:1 for all other pairs. These restrictions exist specifically to protect retail traders from excessive risk, though many traders view them as limiting. In reality, these caps prevent the worst excesses seen in offshore markets where brokers offer 500:1 or even 1000:1 leverage, which are essentially account destruction machines for inexperienced traders.zforex+3

Professional perspective: Experienced traders actually use far less leverage than regulations allow. Many successful professionals operate with effective leverage of 5:1 to 10:1 regardless of available limits, recognizing that preservation of capital is paramount to long-term success. The goal is consistent, sustainable growth—not gambling on outsized returns that come with catastrophic risk.tradingstrategyguides+1

Best practice approach: Start with minimal leverage (10:1), focus on developing consistent profitability, and only gradually increase leverage as your skills improve and account grows. Never use leverage just because it’s available. Your leverage decisions should be driven by risk management calculations, not profit maximization desires.zforex+3

Q: Do I need to pay taxes on forex trading profits in the USA?

A: Yes, forex trading profits in the USA are taxable, and you must report all gains and losses on your annual tax return. The specific tax treatment depends on whether your forex trading is classified under Section 1256 contracts or Section 988 (ordinary gain or loss), which significantly impacts your tax liability.innreg

Section 1256 Contract Treatment (Default for most retail forex): Most regulated US forex brokers offer forex contracts that fall under IRC Section 1256, which provides favorable “60/40” tax treatment. Under this classification, 60% of your gains are taxed as long-term capital gains (maximum 20% rate for high earners, lower for most taxpayers) and 40% are taxed as short-term capital gains (your ordinary income tax rate, up to 37%). This mixed treatment results in a maximum effective tax rate of approximately 26.8% for high-income traders, compared to 37% if all gains were taxed as ordinary income.innreg

Section 988 Treatment (Ordinary Gain or Loss): Alternatively, forex gains and losses can be treated as ordinary income/loss under Section 988. This means all profits are taxed at your regular income tax rate (10-37% depending on bracket), and all losses are fully deductible against ordinary income. This treatment might benefit traders with overall losses or those in lower tax brackets.innreg

Important: You must make an election to opt out of Section 988 treatment in favor of Section 1256 treatment before January 1st of the tax year or before your first trade of the year, whichever is earlier. Most traders prefer Section 1256 due to the favorable 60/40 split, but consult a tax professional to determine what’s best for your situation.innreg

Record keeping requirements: You must maintain detailed records of all forex trades including entry/exit dates and prices, profit/loss for each trade, fees and commissions paid, and broker statements. Most regulated brokers provide Form 1099 or equivalent tax documents summarizing your annual trading activity, making tax preparation easier.innreg

Mark-to-market accounting: Professional traders can elect mark-to-market accounting under Section 475(f), which treats all open positions as if they were closed at year-end for tax purposes. This prevents wash sale rule complications and allows unlimited loss deductions against ordinary income. However, this election requires specific procedures and is generally only beneficial for very active traders.innreg

Key considerations: Even if you only made $2 profit on your $100 account, it’s technically taxable income. You can deduct trading-related expenses like education courses, platform fees, data subscriptions, and home office costs if you qualify. Losses can offset gains, and under Section 1256, net losses can be carried back up to 3 years or forward indefinitely. State taxes may also apply depending on your residence.

Professional advice: Tax treatment of forex trading is complex and varies based on individual circumstances, trading volume, and classification. Consult a CPA or tax attorney specializing in trader taxation to ensure compliance and optimize your tax position. The cost of professional tax advice is tax-deductible and far outweighs the risk of improper reporting or overpaying taxes.

For more financial guidance and investment resources, visit InvestsNow.

Conclusion: Your Journey to Forex Trading Success Starts Now

Starting forex trading in the USA with $100 is not only possible—it’s actually one of the smartest approaches for beginners in 2025. While you won’t become a millionaire overnight, this modest capital provides the perfect foundation to gain real market experience, develop essential trading skills, master risk management principles, and build the psychological discipline required for long-term success.litefinance+3

The key to success with a $100 forex account lies in maintaining realistic expectations and strict discipline. Aim for sustainable 2-10% monthly returns ($2-$10) rather than chasing unrealistic profits that inevitably lead to emotional trading and account destruction. Remember that professional traders focus on consistent execution of their strategy rather than individual trade outcomes—the profits follow naturally from disciplined process.opofinance+2

Your action plan should include these critical steps: Choose a CFTC-regulated, NFA-member broker accepting $100 deposits like FOREX.com, tastyfx, OANDA, or IG. Practice for 60-90 days on a demo account until achieving consistent profitability. Fund your live account with $100 you can afford to lose completely. Never risk more than 1-2% ($1-$2) per trade using proper position sizing. Always use stop-loss orders to protect capital. Focus on one or two trading strategies (swing trading or trend following recommended for beginners). Trade only major currency pairs during high-volume sessions. Keep a detailed trading journal to track progress and identify improvement areas. Continuously educate yourself through free resources like BabyPips, AvaAcademy, and market analysis sites.zforex+18

The forex market offers tremendous opportunity, but it demands respect, education, and discipline. Agar aap serious ho forex trading ke baare mein, toh start small, learn continuously, aur never stop improving your skills. Your $100 today, with consistent profitable trading and capital additions, can grow into a substantial trading account over time through the power of compounding and skill development.linkedin

Trading is a marathon, not a sprint. Those who succeed are those who survive long enough to develop expertise. Starting with $100 gives you the perfect balance—enough capital to gain meaningful experience without risking financial devastation if things go wrong.

For additional resources and to explore more investment opportunities, visit InvestsNow. To get started with a reliable broker offering competitive conditions for small account holders, check out OctaFX. For comprehensive video tutorials on forex trading strategies, watch this beginner’s guide on YouTube.

Ready to take the first step? Open a demo account today and begin your journey to becoming a successful forex trader. The knowledge and discipline you build now will serve you throughout your entire trading career. Good luck, and trade responsibly!

Disclaimer: Forex trading carries substantial risk and is not suitable for everyone. The high degree of leverage available can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment. Therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results. This article is for educational purposes only and does not constitute financial advice.