How to Open a Mutual Fund Account in 5 Steps – Complete Guide for Beginners

How to Open a Mutual Fund Account in 5 Steps – Complete Guide for Beginners

Mutual fund mein investment karna chahte hain? Par confused hain ki kaise start karein? Aapko humne “How to open a mutual fund account in 5 steps” ka complete guide banaya hai jo bilkul beginners ke liye perfect hai.

Mutual fund investment India mein sabse popular wealth creation method ban gaya hai kyunki yeh small amount se start kar sakte hain aur long-term mein achhe returns mil sakte hain. Agar aap pehli bar mutual fund mein invest kar rahe hain, toh yeh comprehensive guide aapko step-by-step process batayega – from KYC documentation se lekar first investment tak.miraeassetmf+2

Why Choose How to Open a Mutual Fund Account in 5 Steps?

Experience ke hisab se humne dekha hai ki mutual funds beginners ke liye sabse safe aur profitable investment option hai. Mutual fund companies (AMCs) professional fund managers hire karte hain jo aapke paise ko different stocks aur bonds mein invest karte hain, jisse risk diversify ho jata hai.kotakmf+2

Key benefits jo humne observe kiye hain:

- Rs. 100 se start kar sakte hain SIP ke through

- Professional management milti hai

- Diversification automatically ho jati hai

- Tax benefits ELSS funds mein milte hain

- Liquidity bhi achhi hai (lock-in periods ke alawa)

Step-by-step mutual fund investment process infographic

Step 1: Complete Your KYC Process (Know Your Customer)

KYC sabse important step hai mutual fund account opening mein. Yeh ek one-time process hai jo regulatory requirement hai.sipfund+2

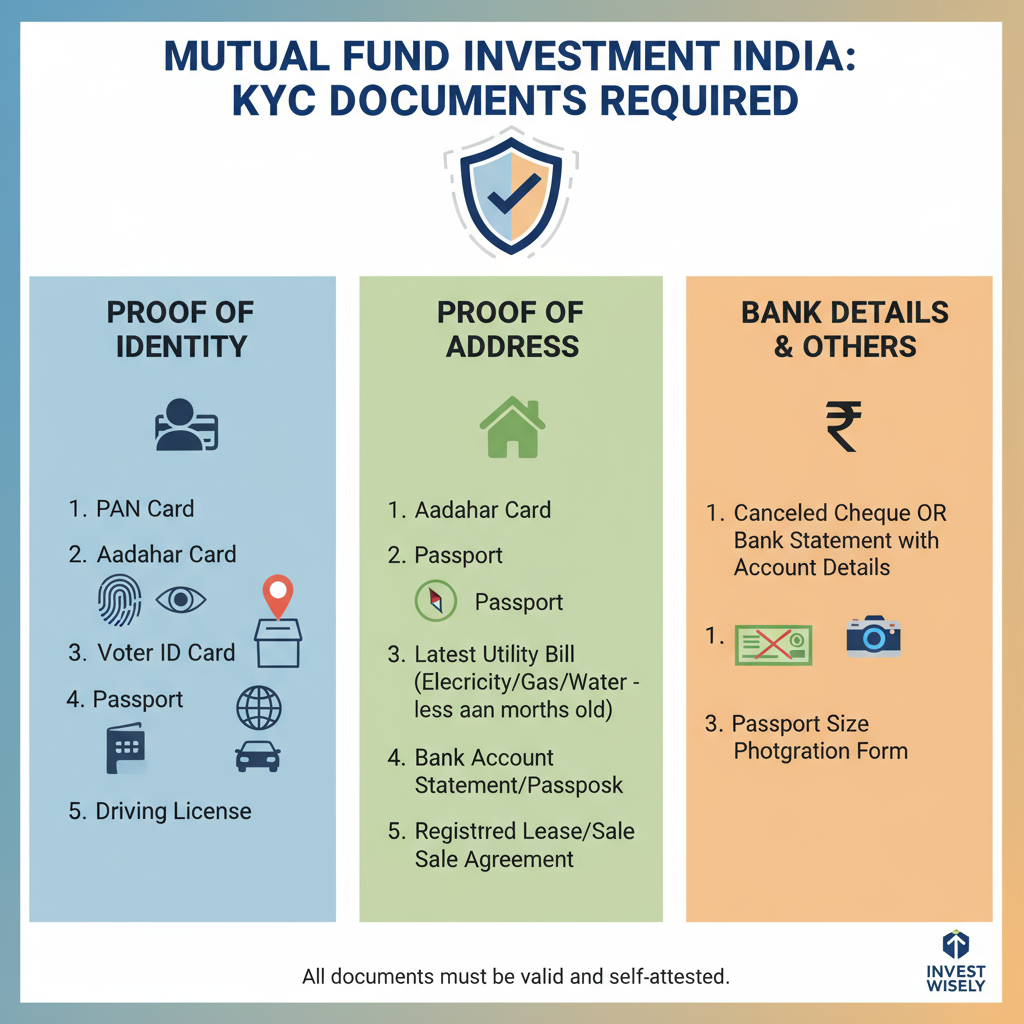

Documents Required for KYC:

KYC documents required for mutual fund investment

Mandatory Documents:

- PAN Card: Yeh compulsory hai – without PAN card koi mutual fund investment nahi kar saktesipfund+2

- Address Proof: Aadhaar card, passport, voter ID, driving license, bank statement (3 months se kam purana), utility billsbajajfinserv+1

- Identity Proof: Aadhaar card, passport, voter ID ya driving licensehdfcfund+1

- Passport Size Photo: Recent color photograph (30mm x 40mm)mfs.kfintech+1

- Bank Account Details: Account number, IFSC code, cancelled chequekotakmf+1

KYC Process Options:

Online KYC (eKYC):

- KRA websites par ja kar complete kar sakte hain (CVL, NSDL, CAMS, Karvy)

- Video call ke through In-Person Verification (IPV) hota hai

- Documents upload karne padte hain

- Fast process – same day completion possiblemiraeassetmf+1

Offline KYC:

- Physical documents submit karne padte hain

- AMC branches ya ISCs mein ja kar complete kar sakte hain

- Time lagta hai verification meinsipfund+1

Pro Tip: Humara experience kehta hai ki eKYC prefer karein kyunki yeh convenient aur fast hai.

Step 2: Choose the Right Mutual Fund Type

Mutual funds basically 3 main categories mein divide hote hain:hdfcfund+2

Equity Mutual Funds (High Risk, High Return)

- 65% se zyada equity stocks mein invest karte hain

- Long-term wealth creation ke liye best (5+ years)

- Market volatility zyada hoti hai

- Expected returns: 12-15% annually (historical average)

- Best for: Young investors, long-term goalshdfcfund+1

Debt Mutual Funds (Low Risk, Stable Return)

- Fixed income securities mein invest karte hain (bonds, government securities)

- Conservative investors ke liye suitable

- Short to medium term goals ke liye ideal

- Expected returns: 6-9% annually

- Types: Liquid funds, gilt funds, corporate bond fundshdfcfund+1

Hybrid Mutual Funds (Balanced Risk & Return)

- Equity aur debt dono mein invest karte hain

- Balanced approach provide karta hai

- Moderate risk tolerance wale investors ke liye

- Types: Conservative, balanced, aggressive hybrid fundshdfcfund+2

Humara suggestion: Beginners ke liye balanced hybrid funds se start karein – yeh stable returns dete hain with manageable risk.

Step 3: Select Investment Mode – SIP vs Lumpsum

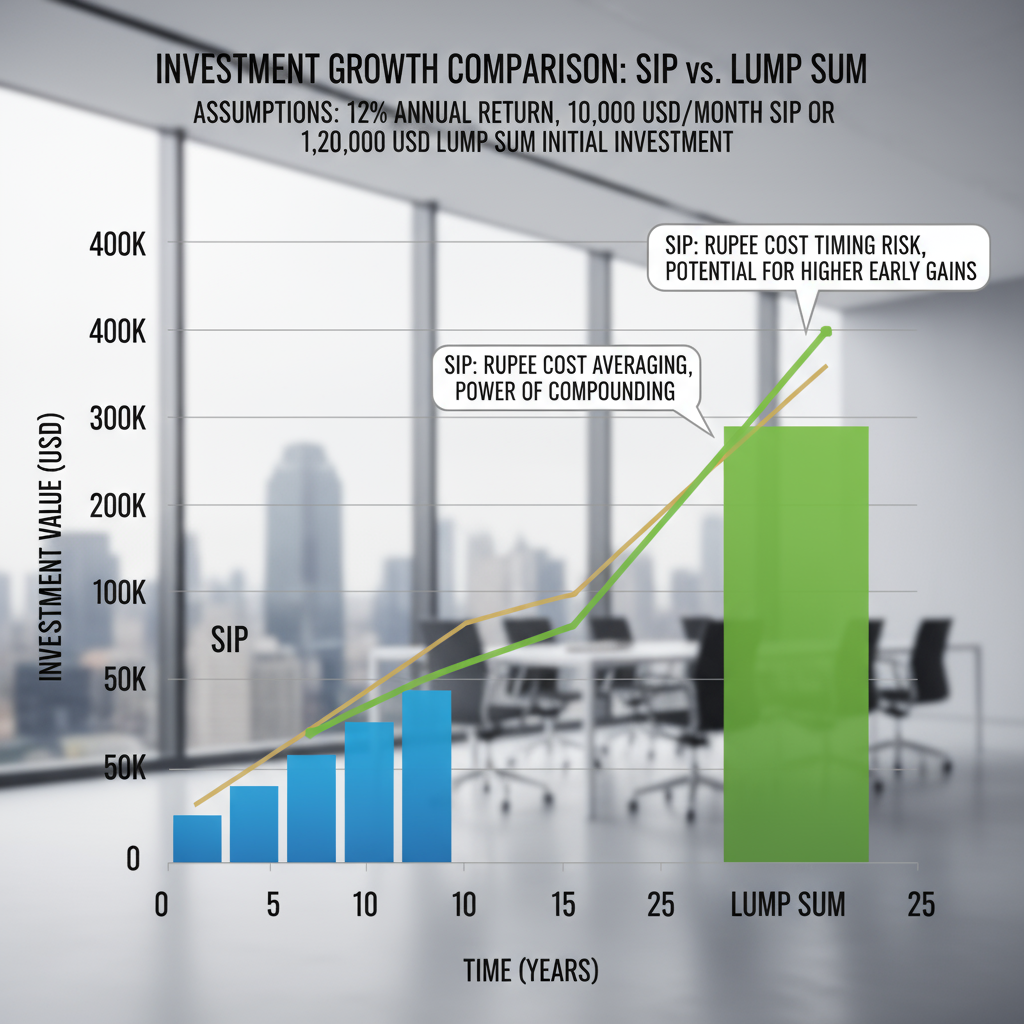

Yeh sabse confusing decision hai beginners ke liye. Hum dono options explain karte hain:

SIP vs lump sum investment comparison chart

SIP (Systematic Investment Plan) – Recommended for Beginners

SIP kya hai? Fixed amount regularly invest karna (monthly/quarterly)icicibank+2

SIP Benefits:

- Rs. 500 se start kar sakte hainshareindia+1

- Rupee Cost Averaging ka benefit milta hai

- Market timing ki tension nahi

- Financial discipline develop hoti hai

- Power of compounding ka full advantagehdfcbank+2

Example: Agar aap monthly Rs. 5,000 SIP karte hain equity fund mein, toh:

- Low market mein more units milte hain

- High market mein fewer units milte hain

- Overall average cost reduce ho jata haihdfcbank+1

Lumpsum Investment

Kab choose karें:

- Jab large surplus amount available ho

- Market correction ke time capitalize karna ho

- Short-term investment goals haintatamutualfund+2

Key Difference Table:

| Parameter | SIP | Lumpsum |

|---|---|---|

| Investment Amount | Rs. 500-1000+ monthly | Rs. 1000+ one-time |

| Market Risk | Low (averaging effect) | High (timing dependent) |

| Ideal For | Beginners, salaried people | Experienced investors |

| Flexibility | High (can pause/modify) | Low |

| Financial Discipline | Automatic habit building | Manual control needed |

Our Experience: 90% beginners ke liye SIP better option hai kyunki yeh safe aur systematic approach hai.hdfcbank+2

Step 4: Choose Investment Platform

Multiple options available hain mutual fund investment ke liye:creditkaro+1

Direct Investment Options:

1. AMC Websites (Asset Management Companies)

- HDFC Mutual Fund, SBI Mutual Fund, ICICI Prudential etc.

- Direct plans available (lower expense ratio)

- No intermediary chargeshdfcfund+2

2. Popular Investment Apps:

- Groww: Beginner-friendly, educational contentcreditkaro+1

- Paytm Money: Commission-free direct fundsjupiter+1

- Zerodha Coin: Demat mode holdingscreditkaro+1

- ET Money: Comprehensive portfolio trackingjupiter+1

3. Bank Platforms:

- ICICI Bank, HDFC Bank, SBI mutual fund services

- Convenience of existing relationship

- Regular plans (slightly higher charges)icicibank+1

4. Distributor/Advisor Route:

- Professional guidance milti hai

- Regular plans ke through investment

- Commission charges applicablemutualfundssahihai

Humara recommendation: Beginners ke liye Groww ya Paytm Money use karein – user-friendly interface aur educational resources milte hain.

Step 5: Complete Your First Investment

Online Investment Process:

1. Register on Platform:

- Mobile number aur email se signup karें

- PAN number verify karें

- Bank account link karेंmiraeassetmf+2

2. Select Mutual Fund Scheme:

- Risk profile assessment complete karें

- Investment goal set karें (retirement, child education, etc.)

- Scheme select karें based on recommendationkotakmf+1

3. Choose Investment Details:

- SIP amount decide karें (minimum Rs. 500)

- SIP date select karें (salary credit ke 2-3 din baad)

- Auto-debit mandate setup karेंkotakmf+2

4. Payment Setup:

- Net banking se first installment pay karें

- Auto-debit enable karें future SIPs ke liye

- UPI mandate bhi option haimiraeassetmf+1

5. Confirmation:

- SMS aur email confirmation milega

- Folio number generate hoga

- Units allotment same day (if before cut-off time)hdfcfund+1

Investment Amount Guidelines:

Beginners ke liye practical approach:

- Emergency fund pehle banayein (6 months expenses)

- Monthly income ka 10-20% mutual funds mein invest karें

- Start small – Rs. 1000-2000 monthly SIP se begin karें

- Gradually increase salary increment ke saath

Mutual Fund Charges & Fees – Complete Breakdown

Transparency ke liye saari charges explain kar rahe hain:groww+2

Ongoing Charges:

- Expense Ratio: 0.5% to 2.5% annually (fund management fee)hdfcfund+1

- Direct Plans: Lower expense ratio (0.5-1.5%)

- Regular Plans: Higher expense ratio (1-2.5%)

Transaction Charges:

- Entry Load: SEBI ne ban kar diya hai – zero chargegroww+1

- Exit Load: 1% if redeem within 1 yearhdfcfund+1

- Transaction Fee: Rs. 100-150 for investments above Rs. 10,000equiruswealth+1

- Stamp Duty: 0.005% on investment amountzerodha

Cost Calculation Example:

If you invest Rs. 1 lakh in direct equity fund with 1% expense ratio:

- Annual fee: Rs. 1,000

- Daily deduction: Rs. 2.7 (from returns)

Popular Mutual Fund Categories for Beginners

Large Cap Equity Funds

- Blue-chip companies mein invest karte hain

- Stable returns with moderate risk

- 3-5 years minimum investment horizon

ELSS Funds (Tax Saving)

- 80C benefit up to Rs. 1.5 lakh

- 3 years lock-in period

- Equity exposure with tax benefits

Balanced Advantage Funds

- Dynamic asset allocation

- Equity-debt ratio automatically adjust

- All-weather performance

Index Funds

- Market index ko track karte hain (Nifty 50, Sensex)

- Low expense ratio (0.1-0.5%)

- Passive investment strategy

Common Mistakes to Avoid

Humara 10+ years experience se yeh common mistakes observe kiye hain:

- Market timing ki koshish mat karें

- Short-term performance dekh kar decisions mat lें

- Too many funds mein invest mat karें (3-4 enough)

- SIP discontinue mat karें market volatility mein

- Goal-based investing ignore mat karें

- Emergency fund ke bina invest mat karें

Tax Implications – Important Information

Equity Mutual Funds:

- Long-term gains (>1 year): 10% tax if gains > Rs. 1 lakh

- Short-term gains (<1 year): 15% tax

- No TDS on growth options

Debt Mutual Funds:

- Long-term gains (>3 years): 20% with indexation

- Short-term gains: As per income tax slab

- TDS applicable on dividend payouts

Monitoring Your Investment

Regular Review Process:

- Monthly statements check karें

- Portfolio performance track karें

- Goal progress monitor karें

- Annual review aur rebalancing

Key Metrics to Track:

- XIRR (Extended Internal Rate of Return)

- Benchmark comparison

- Expense ratio changes

- Fund manager changes

Advanced Tips for Long-term Success

Professional insights based on market experience:

- STP (Systematic Transfer Plans) use karें market volatility mein

- Step-up SIP enable karें salary increment ke saath

- Goal-based segregation – different goals ke liye different funds

- Regular portfolio rebalancing – annually once

- Stay invested – market cycles ride karें

Frequently Asked Questions (FAQs)

Q: Mutual fund account opening mein kitna time lagta hai?

A: Online process mein same day account open ho jata hai agar KYC complete hai. eKYC se puri process 2-3 hours mein complete ho jati hai. Physical KYC mein 3-5 working days lag sakte hain. Documents verification fast hone ke liye sab kuch properly fill karें aur high-quality scanned copies upload karें.miraeassetmf+2

Q: Minimum kitna amount se mutual fund investment start kar sakte hain?

A: SIP mein Rs. 100 se start kar sakte hain kuch funds mein, lekin practically Rs. 500-1000 monthly better hai. Lumpsum mein minimum Rs. 1000-5000 (fund dependent). Beginners ke liye Rs. 1000 monthly SIP perfect starting point hai. Gradually amount increase kar sakte hain salary growth ke saath. Emergency fund pehle banayें, phir investment start karें.shareindia+2

Q: KYC ke baad kya same account se multiple funds mein invest kar sakte hain?

A: Haan, absolutely! Ek bar KYC complete hone ke baad same folio number se multiple AMCs ke funds mein invest kar sakte hain. Different categories ke funds add kar sakte hain – equity, debt, hybrid sab. Platform par easily switch kar sakte hain between funds. Portfolio diversification ke liye yeh very convenient feature hai. Bas make sure ki over-diversification na ho jayے.kotakmf+2

Q: SIP ke paise auto-debit nahi hue toh kya hoga?

A: Agar insufficient balance ya technical issue ki wajah se SIP amount debit nahi hua, toh fund house 3 attempts karta hai. Agar phir bhi fail ho jaye toh SIP pause ho jati hai. 2-3 consecutive failures ke baad SIP automatically terminate ho sakti hai. Re-activate karne ke liye fresh mandate dena padta hai. Pro tip: SIP date salary credit ke 2-3 din baad rakhें and sufficient balance maintain karें.miraeassetmf+2

Q: Market down mein SIP continue rakhni chahiye ya pause kar deni chahiye?

A: Absolutely continue rakhiye! Yeh sabse important strategy hai. Market down mein more units milte hain same amount mein, jo rupee cost averaging ka benefit deta hai. Historical data shows ki market corrections best buying opportunities hain long-term investors ke liye. Humne observe kiya hai ki jo investors market volatility mein consistent rehte hain, unke returns significantly better hote hain. Bear market SIP returns historically bull market SIP returns se zyada profitable hain.icicibank+2

Q: Mutual fund investment kab sell karna chahiye?

A: Goal achievement ya emergency ke alawa early exit avoid karें. Equity funds minimum 5-7 years hold karें, debt funds 1-3 years. ELSS funds 3 years lock-in hai. Exit strategy: Goal completion par systematic withdrawal plan (SWP) use karें. Don’t panic sell market volatility mein. Regular review karें – agar fund performance consistently benchmark se underperform kar raha hai 2-3 years se, tab switch consider karें. Tax implications bhi check karें before selling.hdfcfund+2

Conclusion

Mutual fund account opening ek simple 5-step process hai jo bilkul beginners ke liye designed hai. KYC completion se lekar first SIP setup tak, har step systematic aur user-friendly hai.

Key takeaways:

- Start small with Rs. 500-1000 monthly SIP

- Choose balanced hybrid funds for beginners

- Use reliable platforms like Groww, Paytm Money

- Stay consistent and don’t time the market

- Review portfolio annually

Ready to start your mutual fund journey? Visit investsnow.in for more detailed investment guidance and latest mutual fund recommendations.

Want professional help? Use our affiliate partner platform for expert investment advisory services.

Agar aapko koi aur sawal hai mutual fund investment ke baare mein, toh comment mein puchiye! Happy investing!

Disclaimer: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully. Past performance is not indicative of future results. Consult your financial advisor before making investment decisions.