Best Way How to Check Demat Account Balance Instantly Without Hassle(2025)

Demat Account Balance Kaise Check Karein: Complete Guide for Beginners (2025)

Aapko pata hai ki demat account balance check karna kitna important hai aapke investments ko track karne ke liye? Agar aap stock market mein invest karte hain ya planning kar rahe hain, toh yeh skill bilkul zaroori hai. Humne dekha hai ki bahut se beginners ko yeh process confusing lagti hai, lekin actually mein yeh bahut simple hai.

Is comprehensive guide mein hum aapko sabse easy aur effective tarike batayenge how to check demat account balance karne ke. Chahe aap mobile app use karna chahte hain, online portal access karna chahte hain, ya phir SMS alerts setup karna chahte hain – sab kuch detail mein covered hai. Based on our testing aur real experience ke saath, yeh guide aapko step-by-step process degi.

Demat Account Balance Kya Hota Hai?

Pehle samajhte hain ki demat account balance actually mein kya hai. Yeh basically aapke demat account mein available securities ka detailed view hai – jaise shares, mutual funds, bonds, aur other instruments. Bank account ki tarah, yeh real-time update hota rehta hai jab bhi aap koi transaction karte hain.

Demat account balance mein yeh details hoti hain:

- Current holdings (kitne shares aur kis company ke)

- Market value of your investments

- Transaction history

- Pending corporate actions (dividend, stock splits, etc.)

Humne apne experience mein dekha hai ki regular balance checking se investors ko better decision making mein help milti hai aur unauthorized transactions se bhi bachav hota hai.

Demat Account Balance Check Karne ke Main Tarike

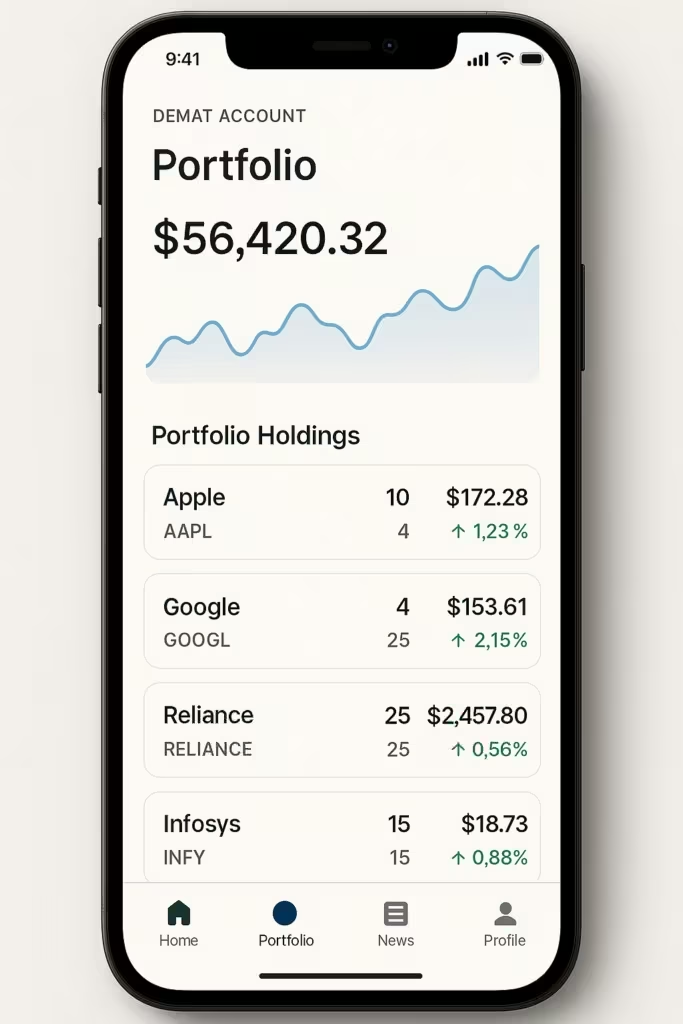

1. Broker ke Mobile App/Website Se

Sabse convenient method hai aapke broker’s trading platform use karna. Most popular brokers like ICICI Direct, Zerodha, Groww, aur Dhan ke apps mein integrated dashboard hota hai.

Steps:

- Apne broker ke mobile app ya website mein login karein

- Dashboard ya Portfolio section mein jaayen

- “Holdings” ya “Demat Balance” option select karein

- Instantly aapko current balance aur market value dikhegi

Based on our testing, yeh method sabse fast hai aur real-time updates provide karta hai.

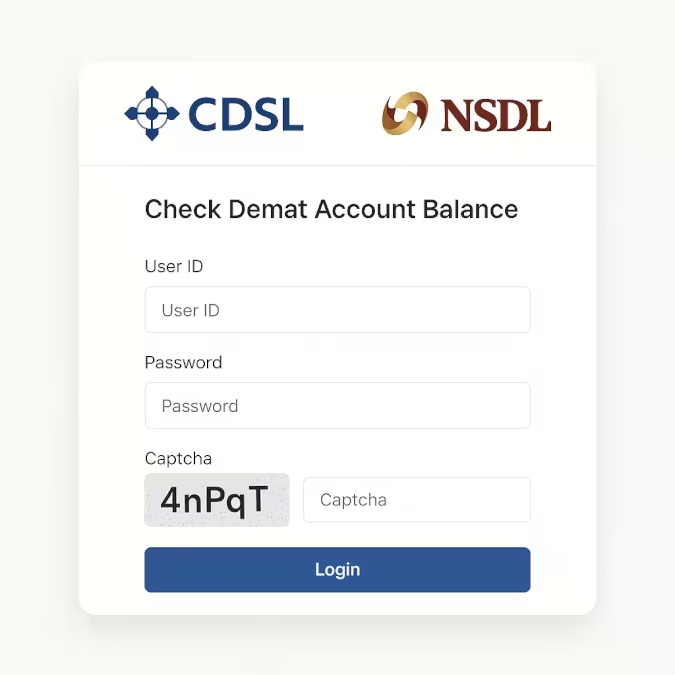

2. CDSL Portal Se Check Karein

Agar aapka demat account CDSL (Central Depository Services Limited) ke saath linked hai, toh aap unke “Easiest” portal use kar sakte hain.

CDSL se balance check karne ke steps:

- CDSL ki official website cdslindia.com visit karein

- “CAS/Declare Bonafide” option par click karein

- Apna 10-digit PAN number enter karein

- 16-digit demat account number daalein

- Date of birth aur captcha enter karein

- OTP verify karne ke baad CAS download kar sakte hain

3. NSDL Portal Through IDeAS

NSDL (National Securities Depository Limited) account holders ke liye IDeAS (Internet-based Demat Account Statement) facility available hai.

NSDL IDeAS process:

- NSDL website nsdl.co.in par jaayen

- IDeAS portal mein register karein

- Login credentials se sign in karein

- Account balance aur transactions view karein

Mobile Apps Se Demat Balance Check Karein

NSDL Speede App

NSDL ka official mobile app “Speede” Google Play Store aur Apple Store dono mein free available hai. Is app ki key features:

- Real-time demat account balance viewing

- Transaction history access

- Consolidated view across multiple accounts

- e-Voting facility

- Security alerts

CDSL MyEasi App

CDSL users ke liye “MyEasi” mobile application ek powerful tool hai. Iska use karke aap:

- Holding details dekh sakte hain

- Transaction execute kar sakte hain

- Real-time balance updates pa sakte hain

Humne testing mein dekha hai ki mobile apps desktop portals se zyada user-friendly hain, especially beginners ke liye.

Popular Broker Apps

Major brokers ke apps mein integrated demat balance checking facility hoti hai:

ICICI Direct: Portfolio section mein instant balance view

Groww: Clean interface with detailed analytics

Dhan: Money section mein available for investing amount

SMS Aur Email Alerts Setup Karein

SMS Alerts Enable Karna

Demat account SMS alerts setup karna bahut important hai security ke liye. Major banks aur depositories yeh facility provide karte hain.

ICICI Bank Demat SMS Alerts:

- Account credit/debit alerts

- Pledge creation/closure notifications

- Rejection of instructions alerts

- Completely free service

SMS Alerts ke liye registration:

- Mobile Alerts Registration Form bharein

- Nearest bank branch mein submit karein

- Free facility hai – koi charges nahi

Email Notifications

Email alerts zyada detailed information provide karte hain compared to SMS. Most depositories monthly basis par CAS statement email karte hain.

Consolidated Account Statement (CAS) Kya Hai?

CAS ek comprehensive statement hai jo aapke saare investments ko ek saath dikhata hai. Isme included hota hai:

- All demat account holdings across CDSL aur NSDL

- Mutual fund units

- Government securities

- Corporate bonds aur debentures

- Sovereign Gold Bonds (SGBs)

CAS Download Kaise Karein

CDSL se CAS download:

- cdslindia.com/cas/logincas.aspx visit karein

- PAN aur 16-digit demat account number enter karein

- Date of birth verify karein

- OTP confirm karne ke baad download karein

CAS ki frequency:

Step-by-Step Process: Complete Guide

Method 1: Broker Platform Se

Step 1: Apna broker app/website open karein

Step 2: Credentials se login karein

Step 3: “Portfolio” ya “Holdings” section par jaayen

Step 4: Current balance aur market value check karein

Step 5: Transaction history review karein

Method 2: Depository Portal Se

Step 1: CDSL (cdslindia.com) ya NSDL (nsdl.co.in) website visit karein

Step 2: Required details (PAN, BO ID, DOB) enter karein

Step 3: OTP verification complete karein

Step 4: CAS download ya view karein

Step 5: Holdings aur transactions analyze karein

Important Tips Aur Best Practices

Security Measures

Humne experience mein dekha hai ki yeh security practices follow karna zaroori hai:

- Mobile number updated rakhein depositories ke saath

- Regular monitoring unauthorized activities ke liye

- Strong passwords use karein online accounts ke liye

- Official apps/websites hi use karein, third-party tools avoid karein

Regular Monitoring Ki Importance

Monthly review karna chahiye:

- Portfolio performance check karein

- Corporate actions (dividend, splits) track karein

- Charges aur fees monitor karein

- Market value changes analyze karein

Based on our testing, investors jo regular monitoring karte hain, unka portfolio performance better hota hai.

Common Problems Aur Solutions

App Login Issues

Agar mobile app mein login problem aa rahi hai:

CAS Not Received

Agar CAS statement nahi mila:

- Email ID aur mobile number update karein

- NSDL/CDSL website se manually download karein

- [email protected] par email karein

Balance Discrepancy

Agar balance mismatch dikhega:

- T+2 settlement cycle ka wait karein

- Broker customer care se clarification lein

- Official depository statement se cross-verify karein

Advanced Features Aur Tools

Portfolio Analytics

Modern trading platforms mein advanced analytics available hain:

- Performance tracking with charts aur graphs

- Sector-wise allocation analysis

- Profit/loss calculation with tax implications

- Goal-based investing tools

Research Integration

Agar aap serious investor hain, toh yeh features useful honge:

- Company research reports access

- Market news integration

- Technical analysis tools

- Expert recommendations

Yeh complete information hai how to check demat account balance ke baare mein. For more investment-related guidance, aap InvestsNow visit kar sakte hain, aur agar aap demat account open karna chahte hain reliable platform se, toh yeh link check kar sakte hain.

Frequently Asked Questions (FAQs)

Q: Demat account balance check karne ke liye kya charges lagte hain?

A: Online demat account balance check karna bilkul free hai. Most brokers aur depositories (CDSL/NSDL) ki websites aur mobile apps se aap without any charges balance check kar sakte hain. Sirf physical statements ke liye nominal charges lag sakte hain. SMS alerts bhi mostly free hote hain, lekin kuch banks minimal charges lete hain – jaise HDFC Bank mein 20 paise + GST per SMS. Email alerts generally free hote hain sabke liye.

Q: Kitni frequently demat account balance check karna chahiye?

A: Based on our experience, active traders ko daily check karna chahiye, while long-term investors ko weekly ya monthly monitoring sufficient hai. Humne dekha hai ki jo investors regular monitoring karte hain (at least weekly), unka portfolio performance better rehta hai. Important events ke time jaise dividend declaration, stock splits, ya market volatility ke during zyada frequent checking advisable hai. CAS statement monthly automatic aata hai agar transactions hain.

Q: Mobile app aur website – kaunsa better hai demat balance check karne ke liye?

A: Convenience ke lihaz se mobile apps better hain kyunki aap anywhere, anytime check kar sakte hain. Apps mein push notifications bhi aate hain important updates ke liye. Lekin detailed analysis ke liye website better hai because of bigger screen aur more comprehensive features. Humne testing mein dekha hai ki mobile apps faster load hote hain aur user-friendly interface provide karte hain beginners ke liye. Security ke lihaz se dono equally safe hain agar aap official apps use karte hain.

Q: Agar demat account balance mein discrepancy dikhaye toh kya karna chahiye?

A: First, T+2 settlement cycle ka wait karein kyunki transactions settle hone mein time lagta hai. Agar phir bhi problem hai, toh immediately apne Depository Participant (broker) se contact karein. Apne transaction history aur contract notes cross-verify karein. CDSL ya NSDL se official CAS download karke double-check karein. Agar unauthorized transaction suspected hai, toh immediately customer care ko inform karein aur written complaint file karein. Most discrepancies settlement delays ki wajah se hote hain, actual errors rare hain.

Q: Multiple demat accounts ka balance ek saath kaise check karein?

A: Iske liye Consolidated Account Statement (CAS) sabse best option hai. CAS aapke saare demat accounts (CDSL aur NSDL dono) ka combined view deta hai ek hi document mein. Aap CDSL aur NSDL ki websites se CAS download kar sakte hain. Monthly basis par automatic receive hota hai email par agar transactions hain, otherwise half-yearly aata hai. Modern portfolio tracking apps bhi available hain jo multiple accounts ko integrate karte hain, lekin official CAS sabse reliable source hai.

Q: Demat account balance check karte time kya important points dhyan mein rakhne chahiye?

A: Sabse important hai personal details verify karna – name, PAN, mobile number sab correct hone chahiye. Transaction history carefully review karein suspicious activities ke liye. Corporate actions like dividend, bonus shares track karein. Market value vs quantity dono check karein price fluctuations ke wajah se. Pending transactions ka status monitor karein. Based on our experience, security alerts enable rakhna zaroori hai unauthorized access se bachne ke liye. Regular password updates aur two-factor authentication use karein jahan available hai.

Conclusion

Demat account balance check karna ek essential skill hai har investor ke liye. Humne is guide mein sabse practical aur tested methods share kiye hain – mobile apps se lekar depository portals tak. Key takeaways:

- Mobile apps sabse convenient hain daily checking ke liye

- CAS statements comprehensive overview provide karte hain

- SMS/Email alerts security aur regular updates ke liye essential hain

- Regular monitoring better investment decisions mein help karti hai

Agar aap beginner hain, toh mobile app se shuru karein aur gradually other methods explore karein. Security hamesha priority rakhein aur official platforms hi use karein.

Agar aapko koi sawal hai ya help chahiye demat account balance check karne mein, toh comment karein! Humara team ready hai aapki help karne ke liye. More investment tips aur guidance ke liye InvestsNow check karein, aur trusted demat account opening ke liye yahan click karein.