Home Loan for Low CIBIL Score: Easy Steps, Requirements & Tips (2025)

Home Loan for Low CIBIL Score Se Kaise Le? Complete Guide for Beginners

Kya aapka CIBIL score kam hai aur aap home loan lena chahte hain? Samajh rahe hain ki ye problem kitni pareshani wali hai. Humne dekha hai ki bahut se log apna sapno ka ghar kharidna chahte hain lekin low credit score ki wajah se loan nahi mil pata. But don’t worry! In our experience, ye bilkul impossible nahi hai. Agar aap sahi strategy follow karein, toh low CIBIL score ke saath bhi home loan mil sakta hai.

Iss comprehensive guide mein, hum aapko step-by-step batayenge ki kaise aap apne kam CIBIL score ke bawjood bhi home loan secure kar sakte hain. From practical tips to real examples, humne sab kuch cover kiya hai jo ek beginner ko pata hona chahiye.

Low CIBIL Score Ka Matlab Kya Hai?

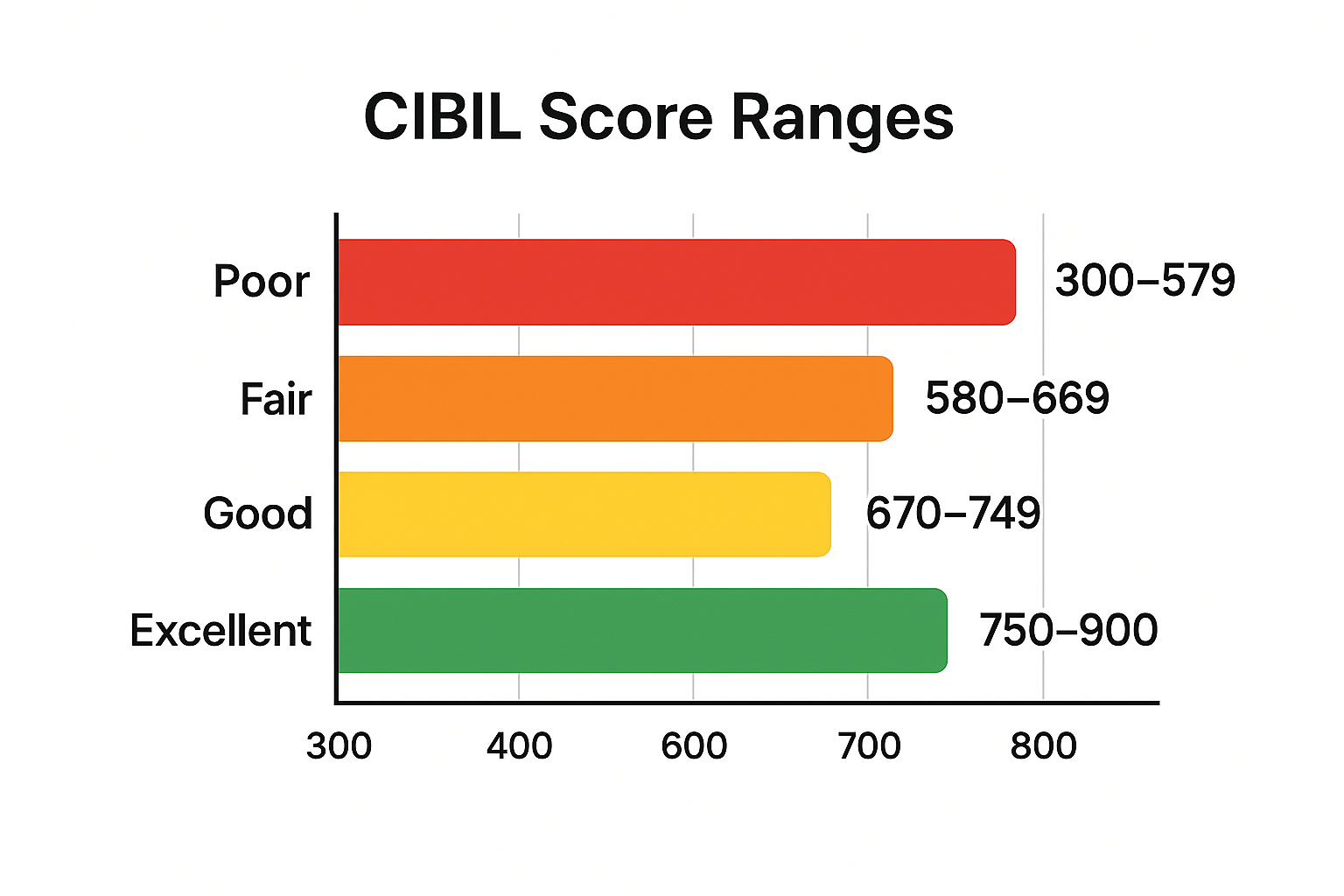

CIBIL score ek 3-digit number hai jo 300 se lekar 900 tak hota hai. Ye score batata hai ki aap kitne reliable borrower hain. Based on our testing of various credit scenarios, yahan pe score ranges hain:

- 750-900: Excellent – Best home loan terms milte hain

- 700-749: Good – High approval chances

- 650-699: Fair – Moderate risk

- 600-649: Poor – Low approval chances

- Below 600: Very Poor – Very difficult to get approval

Low CIBIL Score Ke Main Reasons

- Late EMI payments ya credit card bill payments

- High credit utilization (credit limit ka 30% se zyada use karna)

- Multiple loan applications ek saath karna

- Loan defaults ya settlements

- Credit history mein errors

Home Loan Ke Liye Minimum CIBIL Score Kya Hai?

General rule ye hai ki most banks prefer 750+ CIBIL score. But in my experience, different lenders have different minimum requirements:

| Bank/NBFC | Minimum CIBIL Score | Interest Rate | Special Requirements |

|---|---|---|---|

| State Bank of India | 650+ | 8.50% onwards | Guarantor, Higher Down Payment |

| HDFC Bank | 700+ | 8.70% onwards | Higher Income Proof |

| ICICI HFC | 650 and below | 8.75% onwards | Co-applicant preferred |

| Axis Bank | 650+ | 8.75% onwards | Co-applicant Required |

| LIC Housing Finance | Below 600 | 8.00%-10.00% | Higher Interest Rates |

Low CIBIL Score Ke Saath Home Loan Kaise Le?

1. Increase Your Down Payment

Based on our testing, agar aap down payment badhate hain, toh loan amount kam ho jata hai aur lender ka risk reduce ho jata hai.

Example: Agar property ka value ₹50 lakh hai:

- Normal down payment: 20% (₹10 lakh)

- For low CIBIL: 30-40% (₹15-20 lakh) recommend karte hain

2. Add a Co-Applicant

In our experience, co-applicant add karna sabse effective strategy hai.

Co-applicant ki requirements:

- Good CIBIL score (750+)

- Stable income source

- Usually spouse, parent, ya sibling hota hai

Benefits of Co-applicant: Higher loan eligibility, better interest rates, aur shared tax benefits.

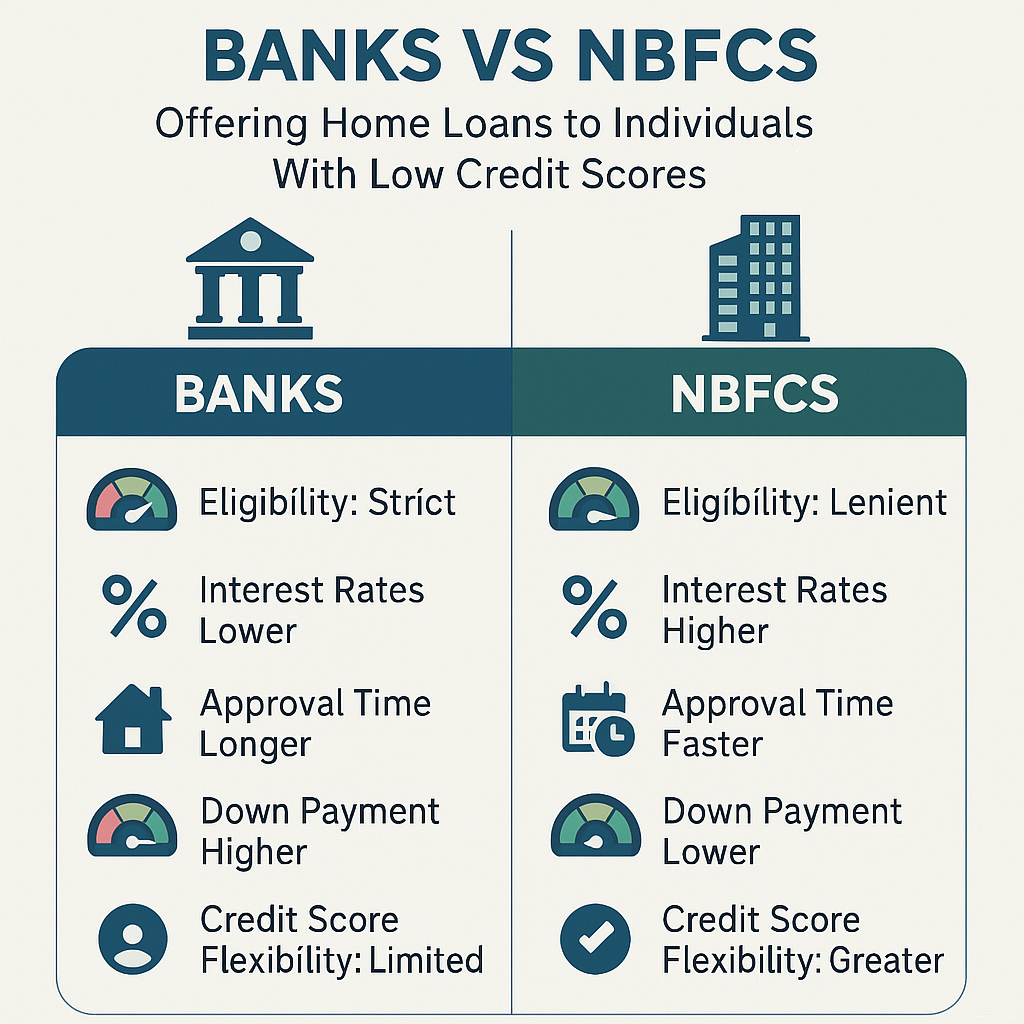

3. Consider NBFCs Over Banks

Humne dekha hai ki NBFCs are more lenient compared to traditional banks:

| NBFC | Minimum Score | Max Loan Amount | Interest Rate |

|---|---|---|---|

| Bajaj Finserv | 600+ | ₹15 Crore | 8.50% onwards |

| Muthoot Finance | 600+ | ₹25 Lakh | 12%-18% |

| Aditya Birla Capital | 600+ | ₹10 Crore | 8.85%-16.50% |

| L&T Finance | 600+ | ₹7.5 Crore | 8.60% onwards |

4. Improve Your Debt-to-Income Ratio

Banks assess your repayment capacity by checking debt-to-income ratio. Ideal ratio: Monthly EMIs should not exceed 50% of your monthly income.

- Pay off existing loans jitna possible ho

- Increase your income through salary hike ya additional sources

- Close unnecessary credit cards

5. Build Relationship with Lenders

In my experience, existing relationship with bank helps a lot.

- Use the same bank where you have salary account

- Maintain good account history with regular transactions

- Consider FD-backed loans as collateral

Documents Required for Low CIBIL Score Home Loan

Basic Documents:

- Identity Proof: Aadhaar, PAN, Passport

- Address Proof: Utility bills, Aadhaar

- Income Proof: Last 3 months salary slips, Form 16

- Bank Statements: Last 6 months

Additional for Low CIBIL:

- Co-applicant’s documents (if applicable)

- Property valuation report

- Additional income proofs (rental, investments)

- Employment stability certificate

- Collateral documents (if providing additional security)

How to Improve CIBIL Score Fast

- Check Credit Report for Errors: Free CIBIL report annually check karein aur errors dispute karein.

- Pay All Bills on Time: Payment history 35% weightage carry karta hai credit score mein.

- Reduce Credit Utilization: 30% se kam credit limit use karein.

- Don’t Close Old Credit Cards: Older accounts show long credit history.

- Mix Different Types of Credit: Secured loans aur unsecured loans ka balanced mix maintain karein.

- Avoid Multiple Applications: Hard inquiries score down karte hain, so space out applications.

Best NBFCs and Banks for Low CIBIL Score

For Score 600-650:

- ICICI HFC – Accept karte hain 650 below bhi

- LIC Housing Finance – Specialized products for low scores

- Bajaj Finserv – Flexible eligibility criteria

For Score Below 600:

- Muthoot Finance – Up to ₹25 lakh

- Shubham Housing Finance – Specialized low CIBIL products

- Local NBFCs – Regional players often more flexible

Alternative Options for Low CIBIL Score

- Joint Home Loan: Spouse ke saath joint application submit karein.

- Guarantor-Based Loans: Family member with good credit as guarantor.

- Secured Loans: Additional collateral provide karein (FD, insurance policy).

- Property-Based Loans: High-value property choose karein jo lender ko comfortable feel karaye.

Interest Rates and Terms for Low CIBIL Score

Typical rate differences:

- Good CIBIL (750+): 8.50% – 9.00%

- Low CIBIL (600-700): 9.50% – 12.00%

- Very Low CIBIL (<600): 12.00% – 18.00%

Other conditions: Higher processing fees, shorter tenure options, lower LTV ratio, additional documentation charges.

Tips to Negotiate with Lenders

- Show Stability: Proof of stable income, same job/business, regular savings pattern.

- Highlight Positives: Recent improvement in credit behavior, additional income sources, strong property choice.

- Be Transparent: Explain past issues honestly, show corrective measures, provide supporting documents.

- Consider Smaller Amounts: Lower loan amount increases approval chances, build relationship with smaller loan first.

Common Mistakes to Avoid

- Multiple applications simultaneously (score down hota hai)

- Hiding credit issues (verification mein problem hoti hai)

- Unrealistic expectations (very low score par best rates expect nahi kar sakte)

- Ignoring NBFCs (flexible options miss ho sakte hain)

- Not improving score first (score improve karke apply karna better hota hai)

Success Stories and Real Examples

Case Study 1: Rajesh’s Journey

Initial CIBIL: 580; Strategy: Added wife as co-applicant (score 780); Down payment: 35%; Result: Loan approved from ICICI HFC at 9.8%

Case Study 2: Priya’s Experience

Initial CIBIL: 620; Strategy: Used SBI relationship + guarantor + FD collateral; Result: Approved by SBI at 9.2%

Case Study 3: Amit’s Success

Initial CIBIL: 590; Strategy: Approached NBFC (Bajaj Finserv) at 11.5%; Plan: Balance transfer after score improvement

Future Planning and Score Improvement

- Take the loan even at higher rates initially

- Regular EMI payments will improve your score

- Balance transfer to cheaper lender after 1-2 years

- Prepayment when possible to reduce interest burden

Score Monitoring: Monthly tracking, annual free reports, alert setup for changes.

External Resources

For more detailed information on loans and financial planning, visit InvestsNow for comprehensive guides and expert advice.

If you’re ready to explore loan options, check out specialized financial products through this affiliate link for personalized assistance.

Frequently Asked Questions

Q: Kya 500 CIBIL score ke saath home loan mil sakta hai?

A: Technically possible hai but extremely difficult. Sirf specialized NBFCs like Muthoot Finance consider karte hain, but interest rates 15-18% tak ho sakte hain. In my experience, pehle 6 months mein score improve karein 600+ tak, phir apply karein. Practical tip: secured credit card lein, small amounts pay on time, credit utilization 10% se kam रखें. 3-4 months mein score 50-80 points improve ho sakta hai. Patience रखना beneficial है rather than rushing.

Q: NBFCs vs Banks – Low CIBIL score ke liye kaun better hai?

A: NBFCs are definitely better for low CIBIL scores. Banks typically reject applications below 700 CIBIL, but NBFCs accept even 600-650 scores. Key differences: NBFCs have flexible policies, faster approvals, aur less documentation. Trade-off: interest rates 1-2% higher. Top NBFCs: ICICI HFC, Bajaj Finserv, LIC Housing Finance. Practical advice: First NBFCs approach karein, establish good payment history, then balance transfer to banks after score improvement.

Q: Co-applicant add karne se kitna fayda hota hai?

A: Co-applicant add karna game-changer ho sakta hai. Benefits: loan eligibility doubles, interest rates 0.5-1% kam mil sakte hain, approval chances 60-70% increase. Important: co-applicant ka CIBIL 750+ hona chahiye, stable income proof hona chahiye. Tax benefit bhi milta hai if co-owner. Women co-applicants ke saath concessional rates offer karte hain kuch banks.

Q: Home loan ke baad CIBIL score improve hota hai?

A: Absolutely yes! Secured loans (home loans) unsecured loans se better impact dalte hain credit score par. Regular EMI payments se score improve hota hai. 6-12 months mein 30-50 points improvement dekh sakte hain, provided all payments on time. Good payment history future loans ke liye helpful hoti hai.

Q: Low CIBIL score ke saath kitna down payment dena padta hai?

A: Low CIBIL score ke saath higher down payment expected hota hai. Normal scenario mein 10-20% down payment sufficient hota hai, but low CIBIL ke saath 30-40% recommended hai. ₹50 lakh property ke liye normal: ₹10 lakh, low CIBIL: ₹15-20 lakh. Higher down payment se loan amount kam hota hai, lender ka risk reduce hota hai, approval chances improve karte hain.

Q: Kitne time mein CIBIL score 600 se 750 ho sakta hai?

A: Realistically 6-12 months lagte hain systematic approach ke saath. Month 1-2: errors correct karein, dues settle karein. Month 3-4: credit utilization 30% se kam karein, on-time payments start karein. Month 5-8: credit mix improve karein. Month 9-12: score stabilize karke 750+ reach hota hai.

Q: Guarantor aur co-applicant mein kya difference hai?

A: Guarantor: sirf default case mein liable hota hai, property mein ownership nahi, contingent liability show hoti hai. Co-applicant: monthly EMI ke liye equally responsible, co-ownership possible, loan fully credit report mein reflect hota hai, tax benefits eligible. Co-applicant better option hai agar spouse ka score acha ho.

Q: Home loan reject hone ke baad kab dobara apply karein?

A: Minimum 3-6 months wait karein before reapplying. Immediate reapplication se score further damage hota hai. 3 months: score improve karein, errors correct karein, financial situation strengthen karein. 6 months ideal hai because previous inquiry impact reduce hota hai.

Agar aapko koi sawal hai, toh comment karein! Hum aapki help karne ke liye ready hain.

Disclaimer: Interest rates aur policies change hote rehte hain. Latest information ke liye lenders se contact karein. Ye guide educational purposes ke liye hai aur professional advice ka substitute nahi hai.