HDFC Bank Personal Loan – Best Features & Benefits (2025)

HDFC Bank Personal Loan: Complete Guide for Beginners

HDFC Bank से personal loan lena aaj ke zamane mein ek smart financial decision hai. Ye India ki leading private sector bank hai jo quick approval, competitive rates, aur hassle-free process ke saath personal loans offer karti hai. Agar aap ek beginner hain aur HDFC personal loan ke bare mein puri jankari chahte hain, toh ye comprehensive guide aapke liye hai.

HDFC Bank Personal Loan Kya Hai?

HDFC Bank personal loan ek unsecured loan hai jo aapko bina kisi collateral ke mil jata hai. Iska matlab ye hai ki aapko apna ghar, car ya koi aur property mortgage karne ki zarurat nahi hai. Ye loan aap kisi bhi purpose ke liye use kar sakte hain – wedding, vacation, medical emergency, education, home renovation ya phir koi bhi personal expense.groww+3

HDFC Bank ke personal loans ki sabse badi specialty ye hai ki ye 10 seconds mein disburse ho jata hai existing customers ke liye. Beginners ke liye ye sunne mein amazing lagta hai, lekin sach mein HDFC Bank ka digital platform itna advanced hai ki pre-approved customers ko instant funds mil jate hain.hdfcbank+1

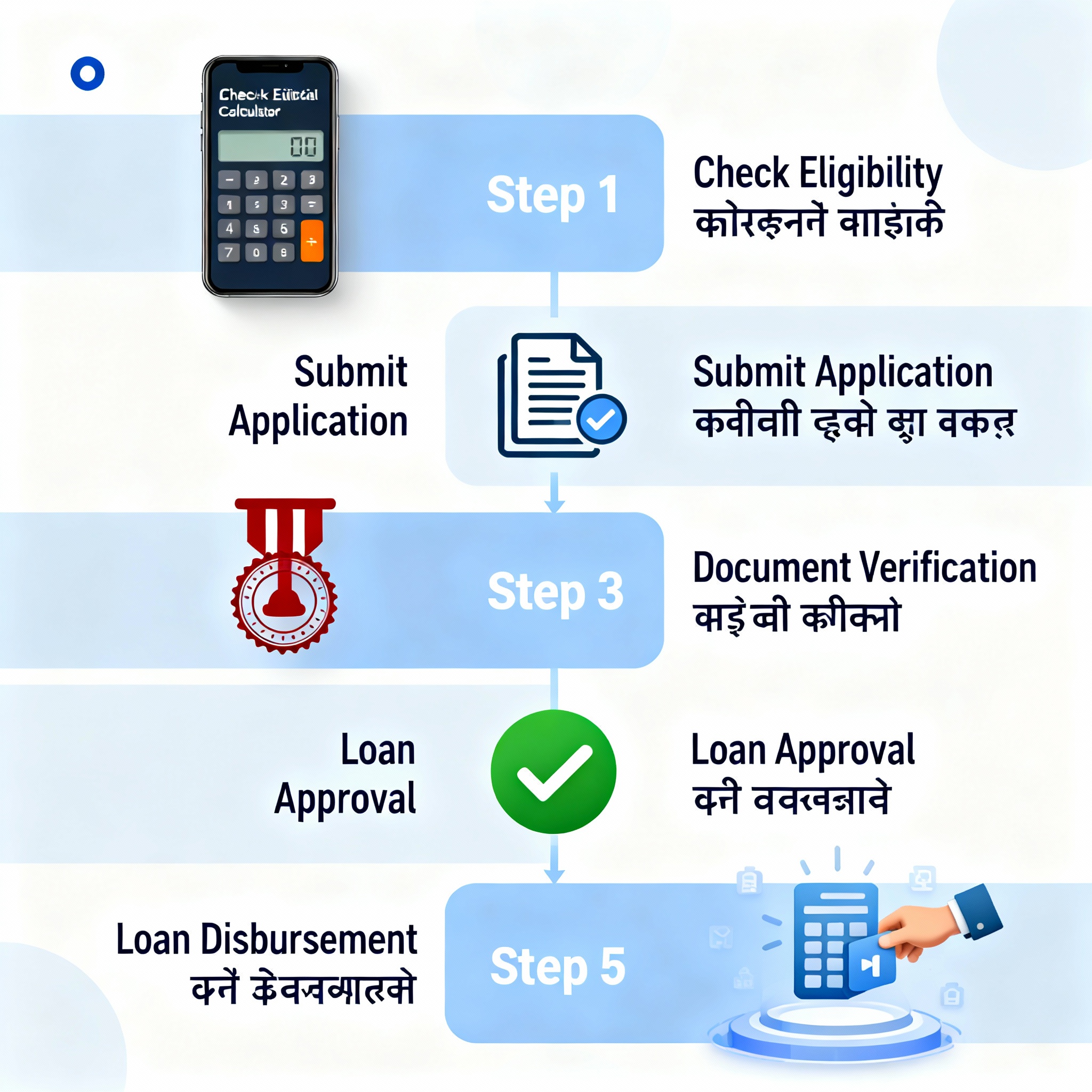

HDFC Bank personal loan application process step-by-step guide

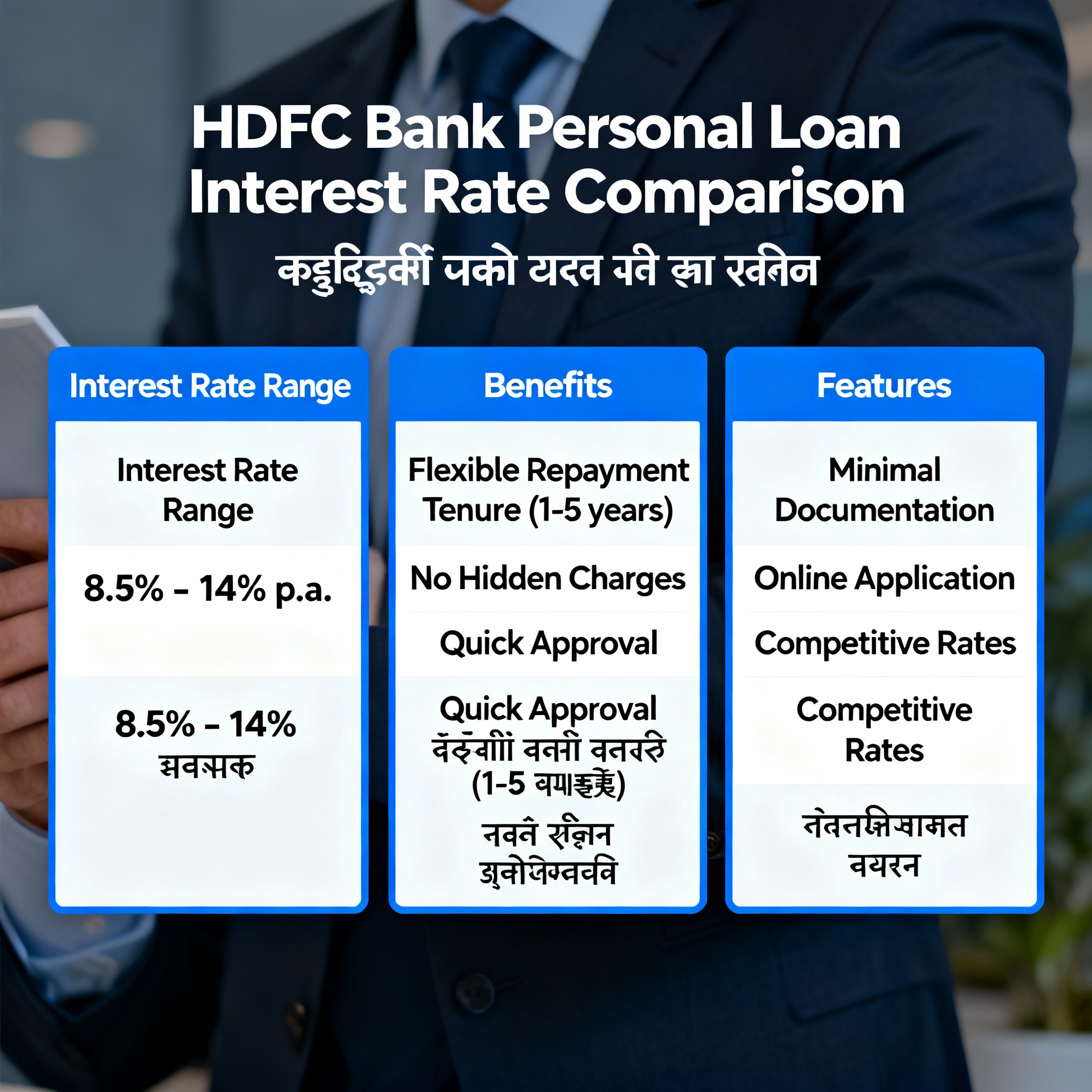

Interest Rates aur Charges: Kitna Paisa Lagega?

Current Interest Rates (2024-25)

HDFC Bank personal loan interest rates 9.99% se 24% per annum tak hain. Ye rates fixed hain, matlab aapka EMI pura loan tenure ke dauran same rahega. Aapko jo exact rate milega, wo depend karta hai:groww+2

- Aapka credit score (750+ best hai)cleartax+1

- Monthly income (minimum Rs. 25,000 chahiye)hdfcbank+1

- Employment stability

- Existing relationship with HDFC Bank

Detailed Charges Breakdown:

| Charge Type | Amount |

|---|---|

| Interest Rate | 9.99% – 24% p.a. |

| Processing Fee | Up to Rs. 6,500 + GST |

| Loan Amount | Rs. 50,000 to Rs. 40 Lakh |

| Tenure | 3 months to 72 months |

| Prepayment Charges | Up to 25% of outstanding |

| Cheque Bounce Charges | Rs. 550 per bounce |

| EMI Delay Charges | 2% per month on overdue |

HDFC Bank personal loan features and benefits overview

Eligibility Criteria: Kya Aap Qualify Karte Hain?

Basic Requirements:

Age: 21 se 60 yearshdfcbank

Income: Minimum Rs. 25,000 net monthly incomecleartax+1

Employment: Minimum 2 years total experience with 1 year current employerhdfcbank

Credit Score: 720+ ideal (750+ ke liye best rates)cleartax+1

Employment Categories:

- Private company employees

- Public sector employees

- Government employees

- Central/State/Local body employeeshdfcbank

Important Note: Self-employed individuals ke liye alag criteria hai aur unhe additional documents submit karne padte hain.mymoneymantra+1

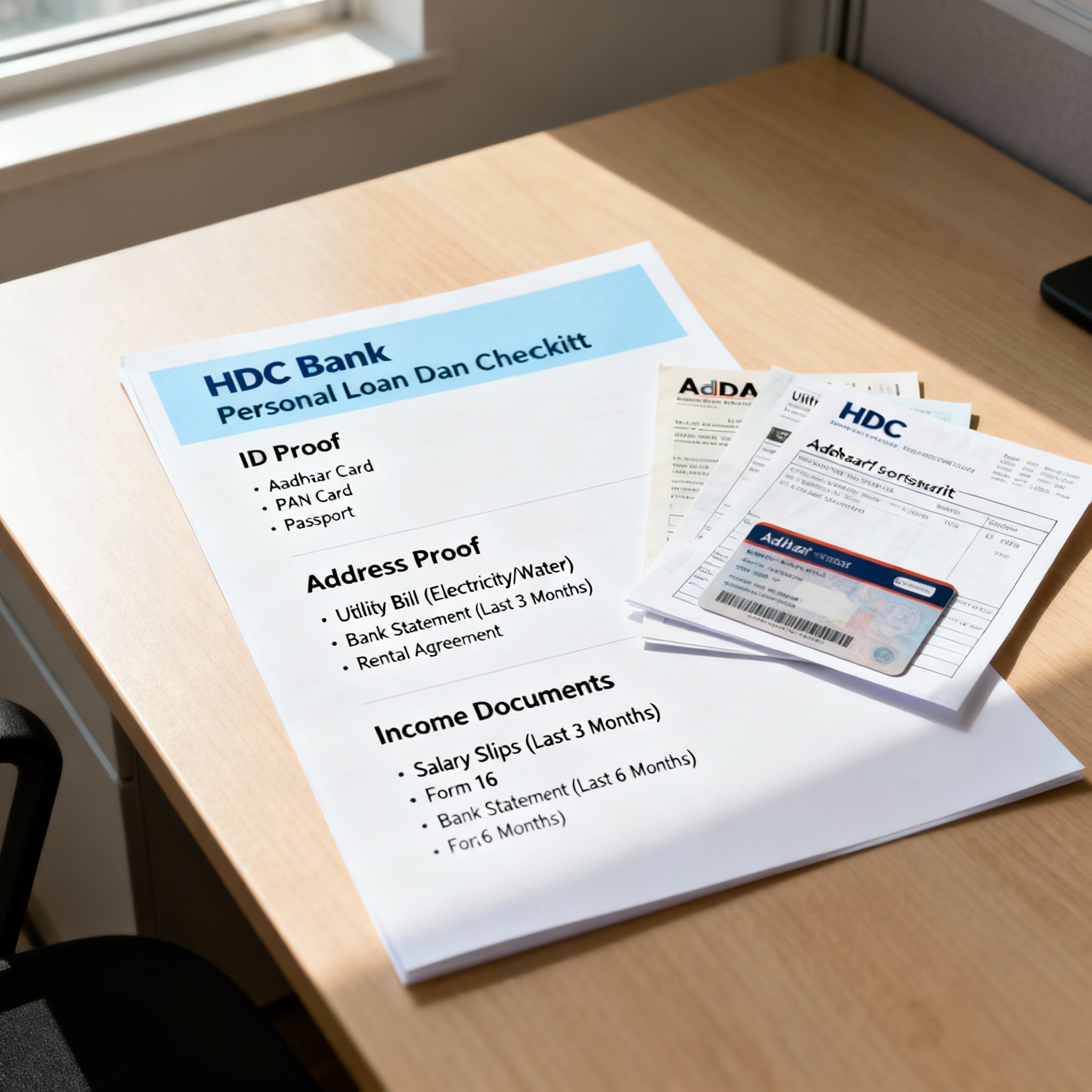

Documents Required: Kya Kya Chahiye?

For Salaried Applicants:

Identity Proof (koi ek):

- Aadhaar Card

- Passport

- Voter ID

- Driving Licensehdfcbank+2

Address Proof (koi ek):

- Aadhaar Card

- Passport

- Voter ID

- Driving Licensemymoneymantra+2

Income Proof:

- Last 2 months salary slipspaisabazaar+1

- Latest Form 16mymoneymantra+1

- Bank statements (last 3 months)hdfcbank+2

- Salary certificatepaisabazaar+1

Essential documents required for HDFC Bank personal loan application

For Self-Employed:

- Same identity aur address proof

- Income Tax Returns (last 2 years)hdfcbank

- Bank statementsmymoneymantra+1

- Business lease agreementpaisabazaar+1

- Profit & Loss statements

Pro Tip: Agar aap already HDFC Bank ka KYC-compliant customer hain, toh no documentation required hai pre-approved loans ke liye.hdfcbank+1

Application Process: Step-by-Step Guide

Online Application:

- Check Eligibility: HDFC Bank website pe eligibility calculator use kareinhdfcbank+1

- Mobile Verification: Apna mobile number verify kareinhdfcbank

- Personal Details: Basic information submit kareinhdfcbank

- Income Verification: Bank account link karein ya NetBanking se login kareinhdfcbank

- Document Upload: Required documents ki scanned copies upload kareinhdfcbank+1

- Loan Offer: Tailored offer receive kareinhdfcbank

- Agreement: Terms accept karein aur e-sign kareinhdfcbank

Other Application Methods:

- NetBanking: Existing HDFC customers ke liyehdfcbank+1

- ATM: HDFC ATMs se apply kar sakte hainhdfcbank+1

- Branch Visit: Nearest HDFC branch jaakarhdfcbank+1

- Loan Assist App: Mobile app throughhdfcbank

Processing Time:

- Pre-approved customers: 10 secondshdfcbank+1

- New customers: 4 hours se 4 dayshdfcbank+1

EMI Calculation: Kitna Monthly Payment?

EMI Formula:

EMI = P×R×(1+R)NP×R×(1+R)N / (1+R)N−1(1+R)N−1groww

Where:

- P = Principal loan amount

- R = Monthly interest rate

- N = Number of months

Sample EMI Calculations:

| Loan Amount | Tenure | Interest Rate | Monthly EMI |

|---|---|---|---|

| Rs. 5 Lakh | 5 years | 10.75% | Rs. 10,809 |

| Rs. 10 Lakh | 5 years | 10.75% | Rs. 21,618 |

| Rs. 30 Lakh | 5 years | 10.75% | Rs. 64,854 |

Important: EMI calculation ke liye HDFC Bank ka official EMI Calculator use karein accurate results ke liye.hdfcbank+2

Benefits: HDFC Personal Loan Ke Fayde

Key Advantages:

1. Instant Disbursal

- Pre-approved customers ko 10 seconds mein paisahdfcbank+1

- Others ko 4 hours meinhdfcbank+1

2. No Collateral Required

- Completely unsecured loanhdfcbank+1

- Koi property mortgage nahi karni padti

3. Flexible Usage

- Kisi bhi purpose ke liye use kar sakte hainhdfcbank+1

- End-use restrictions nahi hain

4. Easy Documentation

- Minimal paperworkhdfcbank+1

- 100% digital process availablehdfcbank

5. Competitive Rates

- Starting 9.99% p.a. segroww+1

- Fixed rates – no surprise changes

6. Flexible Tenure

- 3 months se 72 months takcleartax+1

- EMI as low as Rs. 2,162 per lakhhdfcbank+1

Disadvantages: Kya Drawbacks Hain?

Potential Cons:

1. Higher Interest Rates

- Personal loans generally home loans se expensive hainandromedaloans

- Maximum rate 24% tak ja sakta haigroww+1

2. Processing Fees

- Up to Rs. 6,500 processing feecleartax+1

- GST alag se lagti hai

3. Prepayment Charges

- Early closure pe up to 25% chargescleartax

- Financial flexibility kam ho jati hai

4. Impact on Credit Score

- Monthly EMI miss karne se CIBIL score gir jata haihdfcbank

- Multiple applications se score affect hota haiyoutube

5. Debt Burden

- High EMI se monthly budget tight ho jata haihdfcbank

- Other loan eligibility affect ho sakti hai

Rejection Reasons: Loan Reject Kyu Hota Hai?

Common Rejection Reasons:

1. Low Credit Score

- 720 se kam score pe rejection chances highhdfcbank+1

- Past payment defaults

2. Insufficient Income

- Rs. 25,000 se kam monthly incomehdfcbank+1

- Income proof incomplete

3. Job Instability

- Frequent job changesyoutubehdfcbank

- Current employer mein kam experience

4. High Debt-to-Income Ratio

- Existing EMIs bahut zyadahdfcbank+1

- 50-60% se zyada debt burden

5. Documentation Issues

How to Improve Approval Chances:

- Build Credit Score: Regular payments, low credit utilizationyoutube

- Show Additional Income: Rental income, investments, bonuseshdfcbankyoutube

- Add Co-applicant: Spouse ya parent ko co-applicant banayeinyoutube

- Clear Existing Debts: EMI burden kam kareinyoutube

- Maintain Job Stability: Same employer ke saath kam se kam 1 yearyoutube

HDFC vs Other Banks: Comparison

| Bank | Interest Rate | Max Amount | Processing Fee |

|---|---|---|---|

| HDFC Bank | 9.99% – 24% | Rs. 40 Lakh | Up to Rs. 6,500 |

| SBI | 10.30% – 15.30% | Rs. 20 Lakh | 1% – 2% |

| ICICI Bank | 10.75% – 19% | Rs. 50 Lakh | Up to 2% |

| Axis Bank | 10.49% – 22% | Rs. 40 Lakh | 1% – 1.5% |

HDFC Bank Advantages:

- Fastest disbursal (10 seconds)hdfcbank

- Strong digital platformhdfcbank

- Wide range of loan productshdfcbank

- Excellent customer servicemoneycontrol

Special Loan Types: Different Options

HDFC Personal Loan Variants:

1. Marriage Loans

2. Medical Emergency Loans

3. Education Loans

4. Home Renovation Loans

5. Premium Personal Loans

6. Personal Loan for Women

Digital Features: Modern Banking

Online Tools:

1. EMI Calculator

- Instant EMI calculationhdfcbank+1

- Different scenarios compare kar sakte hain

2. Eligibility Calculator

- Quick eligibility checkhdfcbank

- Pre-qualification without affecting credit score

3. Mobile App

- Loan application tracking

- EMI payment options

- Statement download

4. NetBanking Integration

- Existing customers ko easy access

- Account linking for verificationhdfcbank

Tips for Beginners: Smart Borrowing

Before Applying:

1. Check Your Credit Score

- Free CIBIL report download karein

- Errors ko rectify kareinyoutube

2. Calculate EMI Burden

- Total income ka 40-50% se zyada EMI na rakhein

- Emergency fund maintain karein

3. Compare Options

- Multiple banks ke rates compare kareinpaisabazaar

- Processing fees aur other charges check karein

4. Plan Your Usage

- Loan amount ka proper utilization plan banayein

- Wasteful spending avoid karein

After Getting Loan:

1. Set Up Auto-Pay

- EMI bounce avoid karne ke liye

- Credit score maintain karne ke liye

2. Prepayment Planning

- Extra money mile toh prepayment consider karein

- Interest savings calculate kareinpaisabazaar

3. Monitor Your Credit

- Regular CIBIL score check karein

- Future borrowing capacity maintain karein

Frequently Asked Questions

Q: HDFC Bank personal loan ke liye minimum salary kitni chahiye?

A: HDFC Bank personal loan ke liye minimum Rs. 25,000 net monthly income chahiye. Ye amount sab deductions ke baad ka hona chahiye. Agar aapki salary is se kam hai, toh aap additional income sources show kar sakte hain jaise rental income, dividends, ya part-time work income. Government employees aur MNC employees ko sometimes better rates milte hain stable income ki wajah se. Remember, higher income better loan terms aur lower interest rates ki guarantee deti hai.cleartax+2

Q: HDFC personal loan kitne din mein approve ho jata hai?

A: HDFC Bank personal loan approval time depend karta hai aapki customer status pe. Pre-approved customers ko sirf 10 seconds mein loan mil jata hai without any documentation. New customers ke liye normal processing time 4 hours se 4 days tak ho sakta hai. Agar aap existing HDFC Bank customer hain with good banking relationship, toh approval faster hogi. Digital application process aur complete documentation submit karne se processing time minimize ho jata hai. Weekend aur holidays processing time affect kar sakte hain.hdfcbank+2

Q: Kya HDFC personal loan pre-close kar sakte hain? Charges kya hain?

A: Haan, HDFC Bank personal loan ko prepay ya foreclose kar sakte hain. Prepayment charges up to 25% of principal outstanding ho sakte hain. Partial prepayment bhi allowed hai where aap loan ka kuch portion advance mein pay kar sakte hain. Early closure se aap total interest payment mein bahut save kar sakte hain. For example, Rs. 10 lakh loan ko 1 year baad close karne se Rs. 2.44 lakh interest save ho sakta hai. Prepayment decision lene se pehle charges calculate kar lein.paisabazaar+1

Q: HDFC personal loan reject hone ke main reasons kya hain?

A: HDFC personal loan rejection ke main reasons hain: Low credit score (720 se kam), insufficient income (Rs. 25,000 se kam), job instability (frequent job changes), high debt-to-income ratio (existing EMIs zyada), aur incomplete documentation. Past loan defaults, multiple credit inquiries, aur wrong information bhi rejection cause kar sakte hain. Agar loan reject ho gaya hai, toh 3-6 months wait karein, apni profile improve karein, aur phir reapply karein. Co-applicant add karna bhi helpful ho sakta hai.hdfcbank+2youtube

Q: HDFC personal loan ka interest rate kaise calculate hota hai?

A: HDFC personal loan interest rate 9.99% se 24% per annum range mein hota hai. Aapka exact rate depend karta hai several factors pe: Credit score (750+ best rates ke liye), monthly income (higher income = lower rates), employment type (salaried vs self-employed), loan amount, tenure, aur existing relationship with HDFC Bank. Salaried employees ko generally better rates milte hain compared to self-employed. Government employees aur MNC employees ko preferential rates mil sakte hain. Rate fixed hai, matlab pura tenure same rahega.groww+1

Q: Documents verification mein kitna time lagta hai HDFC personal loan mein?

A: HDFC Bank personal loan documents verification typically 24-48 hours mein complete ho jata hai digital applications ke liye. Agar aap existing KYC-compliant customer hain, toh verification instant ho sakta hai. New customers ke liye physical verification bhi ho sakti hai through video KYC. Incomplete ya unclear documents submit karne se verification delay ho sakta hai. All documents properly scan karein, readable quality mein submit karein. Bank representative se video call bhi schedule ho sakti hai final verification ke liye. Weekend applications Monday ko process hoti hain.hdfcbank+1

Conclusion: Smart Financial Decision

HDFC Bank personal loan ek reliable aur quick financial solution hai emergencies aur planned expenses ke liye. 9.99% se shuru hone wale competitive rates, instant disbursal facility, aur minimal documentation ke saath ye beginners ke liye ek excellent choice hai.groww+2

Key points remember karne wale hain:

- Minimum Rs. 25,000 monthly income aur 720+ credit score maintain kareincleartax+1

- Pre-approved offers check karein fastest approval ke liyehdfcbank

- EMI calculator use karke proper planning kareinhdfcbank+1

- Compare different banks best deal ke liyepaisabazaar

Agar aapko HDFC Bank personal loan ke bare mein koi doubt hai ya financial advice chahiye, toh InvestsNow pe visit karein expert guidance ke liye.

Ready to apply? HDFC Bank personal loan ke liye yaha apply karein aur apne financial goals achieve karein!

Related YouTube Video: HDFC Bank Personal Loan Complete Guide – detailed explanation ke liye dekhiye.youtube

Remember: Personal loan ek financial commitment hai. Sirf tab lein jab actually zarurat ho aur repayment capacity clear ho. Smart borrowing hi successful financial future ki key hai!