Groww – India’s Simplest Investment App for Beginners in 2025

Groww – India’s Simplest Investment App for Beginners in 2025

Investing doesn’t have to be complicated. And thanks to platforms like Groww, it’s now possible for anyone – from college students to full-time professionals – to start investing with as little as ₹100. In this article, we’ll dive deep into what Groww is, how it works, what features it offers, and why it’s becoming the go-to platform for first-time investors in India.

What is Groww?

Groww is a SEBI-registered online investment platform that allows users to invest in mutual funds, stocks, SIPs, FDs, and more. Founded in 2016, the Bangalore-based company has rapidly grown to become one of India’s most trusted apps for DIY investing.

You can download Groww from the Play Store or App Store and start investing in minutes.

Key Features of Groww App

Here’s what makes Groww stand out:

- ✅ Zero Account Opening Charges

- ✅ Invest in Mutual Funds with ₹100

- ✅ Direct Mutual Funds with No Commission

- ✅ Stock Trading at ₹20 per order

- ✅ User-Friendly Dashboard & Portfolio Tracker

- ✅ Instant Paperless KYC Process

You also get access to curated lists like “Top Performing Funds”, “Tax Saving Funds”, and “High Growth Stocks” which make decision-making easier.

How to Open an Account on Groww

Opening an account on Groww is a smooth, 100% digital process:

- Download the Groww App

- Sign up using Email or Google Account

- Complete your KYC with Aadhaar + PAN

- Add Bank Details for transactions

- Start Investing right away

⚡ Pro Tip: Groww also allows UPI-based investments for faster checkout. Learn more about how to invest via UPI here.

Mutual Fund Investments via Groww

Groww offers direct mutual funds, which means there are no distributor commissions, resulting in higher returns for you.

- 💼 Equity Funds

- 🛡️ ELSS for Tax Saving

- 🏦 Debt Funds for Fixed Returns

- 💸 SIP Starting ₹100

The app allows users to compare multiple funds side by side with risk ratings, past performance, and expense ratios. It’s ideal for SIP beginners and passive investors.

Stock Trading on Groww

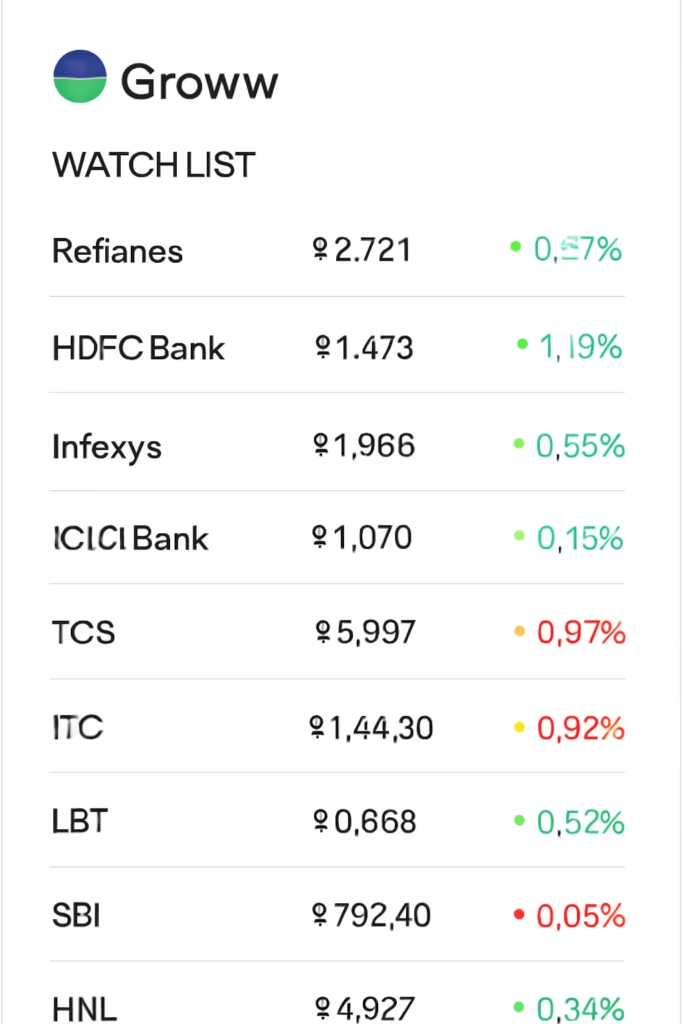

Besides mutual funds, Groww also offers stock trading:

- 📈 Invest in NSE & BSE-listed shares

- 📊 Track real-time market prices

- 💰 Place intraday or long-term orders

- 📝 Analyze with charts & company data

There’s no AMC (Annual Maintenance Charges) and the brokerage is capped at ₹20/order, making it beginner-friendly.

Is Groww Safe to Use?

Absolutely! Groww is registered with:

- ✔ SEBI (INZ000208032)

- ✔ BSE/NSE for trading

- ✔ AMFI for mutual funds

- ✔ CDSL as a depository

All transactions are encrypted and your investments are held with trusted fund houses and in your own name.

Groww vs Other Investment Apps

| Feature | Groww | Zerodha | Paytm Money |

|---|---|---|---|

| Mutual Funds | ✅ Direct Plans | ❌ Regular | ✅ Direct |

| Stock Trading | ✅ Yes | ✅ Yes | ✅ Yes |

| UI Simplicity | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐ |

| Referral Program | ✅ Yes | ❌ No | ❌ No |

Groww wins for its clean UI, simplicity, and zero-hidden-fee structure.

Groww Affiliate & Referral Program

You can earn rewards by sharing Groww with your friends. Looking for other financial services? Try this Affiliate Loan Application Link to apply for loans, credit cards, or financial products online — quick approval & paperless process.

FAQs about Groww

1. Is Groww free to use?

Yes, account opening and mutual fund investments are free. Brokerage charges apply only for stock trading.

2. Can I withdraw anytime from Groww?

Yes, mutual fund redemptions typically take 1–3 working days. Stocks can be sold during market hours.

3. Does Groww have SIP options?

Yes, you can start a SIP in any fund with just ₹100.

4. Is Groww better than Zerodha?

Groww is ideal for beginners; Zerodha is more suitable for active traders.

5. Can I use Groww for tax saving?

Yes, ELSS mutual funds on Groww help you save tax under section 80C.

Conclusion

Whether you’re new to investing or someone looking for a low-cost, easy-to-use platform, Groww is a fantastic choice in 2025. With a clean UI, paperless onboarding, and access to both mutual funds and stocks, it simplifies wealth creation for every Indian.

So, what are you waiting for? Start your investment journey with Groww today – and make your money work harder for you.

➡️ Visit https://www.investsnow.in/ for more finance tips and investing guides!