Unbelievable Flipkart Axis Bank Credit Card Review 2025: Kya Worth Hai?

Flipkart Axis Bank Credit Card Review 2025: Complete Guide for Beginners

Agar aap online shopping karne ke shauk mein hain, aur especially Flipkart Axis Bank Credit Card ke baare mein soch rahe hain, toh yeh comprehensive guide aapke liye bilkul perfect hai. Humne is article mein card ke har aspect ko detail mein explain kiya ha—features,, benefits, fees, drawbacks, aur application process tak sabkuch cover kiya hai.

Flipkart Axis Credit Card showing 5% cashback benefits

Online shopping ke zamane mein credit cards ek zaroori tool ban gaye hain, especially jab baat cashback aur rewards ki ho. Flipkart Axis Credit Card India ke sabse popular co-branded credit cards mein se ek hai jo, specifically Flipkart shoppers ke liye design kiya gaya hai. Iske alawa yeh card; other partner merchants par bhi acche rewards deta hai.

Flipkart Axis Bank Credit Card Kya Hai?

Flipkart Axis Bank Credit Card is a co-branded credit card launched in partnership between Axis Bank and Flipkart. Yeh card primarily online shoppers ke liye perfect hai jo Flipkart, Myntra, aur other partner merchants par regular shopping karte hain. Card ka main USP hai unlimited cashback jo directly statement mein credit hota hai, na ki points you vouchers ke form mein. flipkart+2

Is card ka target audience mainly woh log hain jo:

- Regular Flipkart/Myntra users hain

- Online shopping zyada karte hain

- Swiggy, Uber jaisi services use karte hain

- Airport lounge access chahiye (though yeh benefit ab discontinue ho gaya hai).Axis Bank

Key Features and Benefits

Cashback Structure—Yahan Milta Hai Paisa Wapas

Flipkart Axis Credit Card ka cashback structure kaafi attractive hai, lekin recently kuch changes aaye hain: flipkart+1

Flipkart & Cleartrip: 5% cashback, capped at ₹4,000 per quarter per merchant at Axis Bank

Myntra: 7.5% cashback, capped at ₹4,000 per quarter (Axis Bank)

Partner Merchants (Swiggy, Uber, PVR, Cult.fit): 4% unlimited cashbackcardinsider+1

Other Online/Offline Spends: 1% cashbackcardmaven+1

Welcome Benefits Package

Naaye cardholders ko milte hain yeh welcome benefits :axisbankyoutube

- ₹250 Flipkart Gift Voucher on first transaction (paid cards only)

- 50% off up to ₹100 on first Swiggy order for new users

- Benefits activate karne ke liye 30 days ke andar first transaction karna zaroori haiaxisbank

Annual Fee aur Waiver Criteria

Joining Fee: ₹500 + GSTaxisbank

Annual Fee: ₹500 + GST (from second year)axisbank

Fee Waiver: Annual spend of ₹3.5 lakh requiredaxisbank+1

Important Note: Rent payments (MCC 6513) aur wallet load transactions (MCC 6540) fee waiver calculation mein count nahi hote.axisbank

Airport Lounge Access – Ab Discontinued

Pehle yeh card 4 complimentary domestic lounge visits per year deta tha, lekin June 20, 2024 se lounge access completely discontinue ho gaya hai. Yeh ek major drawback hai jo pehle cardholders ko attract karta tha.axisbank+1

Excluded Transactions – Yahan Nahi Milta Cashback

Kuch specific transactions par cashback nahi milta :flipkart+1

- Fuel spends (ab 1% fee bhi lagta hai ₹50,000+ spend par)business-standard

- Gift card purchases

- EMI transactions

- Wallet loading (1% fee ₹10,000+ spend par)business-standard

- Gold item purchases

- Cash advances

- Government service payments

- Rent payments (1% fee lagti hai)business-standard

- Insurance aur utility payments (1% fee ₹25,000+ spend par)business-standard

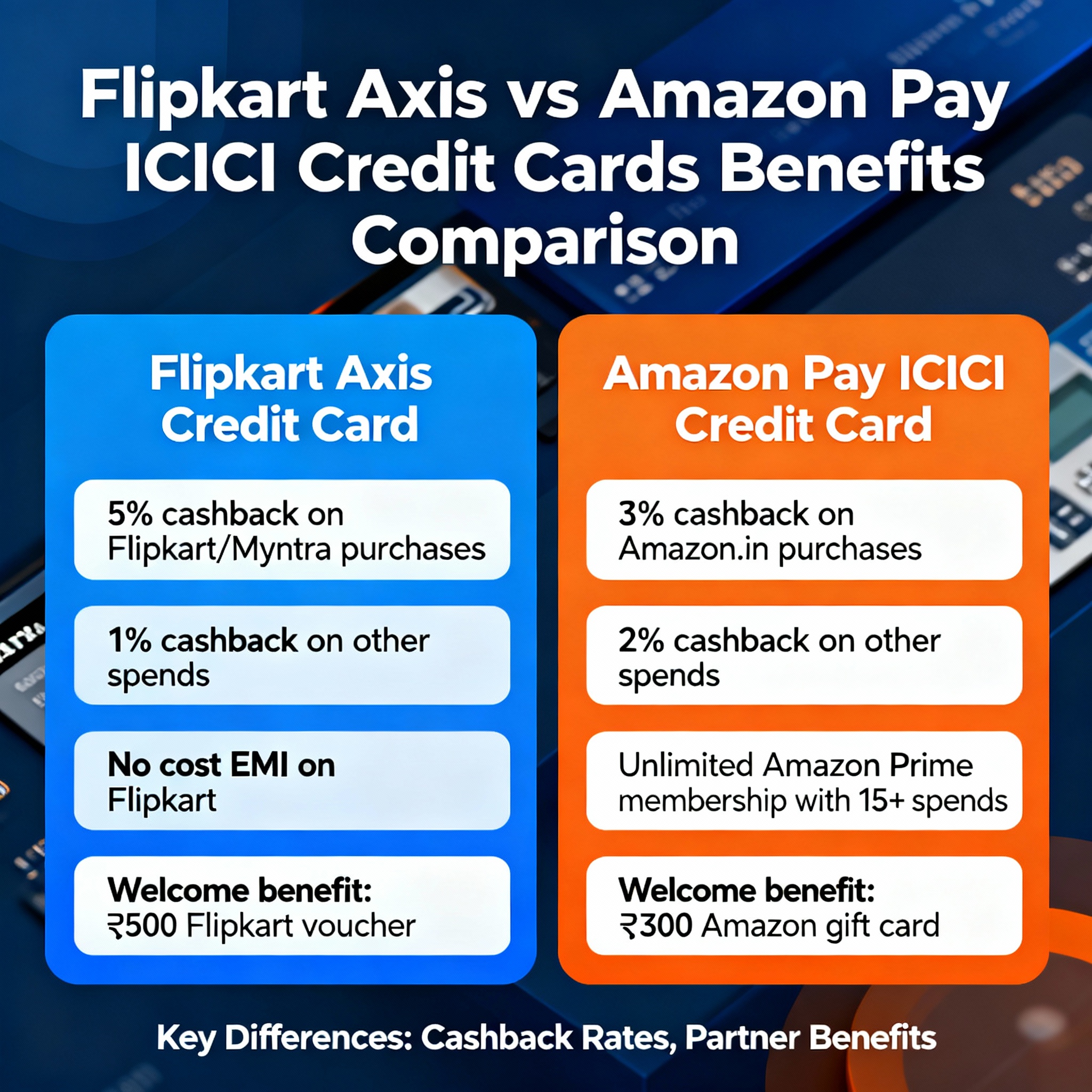

Comparison chart of Flipkart Axis vs Amazon Pay ICICI credit card benefits

Flipkart Axis vs Amazon Pay ICICI – Detailed Comparison

India mein do main e-commerce credit cards hain – Flipkart Axis aur Amazon Pay ICICI. Dono ka comparison dekhte hain :paisabazaar+1

| Aspect | Flipkart Axis | Amazon Pay ICICI |

|---|---|---|

| Annual Fee | ₹500 | Free |

| Flipkart Cashback | 5% for all users | 5% for Prime, 3% for non-Prime |

| Partner Cashback | 4% on Swiggy, Uber, PVR | 2% on various partners |

| Base Cashback | 1% | 1% |

| Cashback Credit | Statement balance | Amazon Pay wallet |

| Lounge Access | Discontinued | Not available |

Flipkart Axis choose karein agar:

- Aap regular Flipkart shopper hain

- Swiggy/Uber frequent use karte hain

- Direct cashback statement mein chahiye

Amazon Pay ICICI choose karein agar:

- Aap Amazon Prime member hain

- Free card chahiye

- Bill payments/wallet reloads par cashback chahiye

Eligibility Criteria – Kaun Apply Kar Sakta Hai

Application process guide for Flipkart Axis Credit Card

Flipkart Axis Credit Card ke liye eligibility criteria simple hai :axisbank+1

Age: 18-70 yearsaxisbank

Income: ₹15,000/month minimum (can vary)mymoneymantra

Credit Score: 750+ recommendedmymoneymantra

Nationality: Indian residents aur NRIs eligibleaxisbank

Employment: Salaried or self-employedgroww

Required Documents:

- PAN Card copy/Form 60

- Latest salary slip/Form 16/IT returns

- Identity proof (Aadhaar, Passport, DL)

- Address proof (electricity bill, passport, ration card)

- Recent color photographaxisbank

Application Process – Kaise Apply Karein

Online Application (Recommended)

- Axis Bank website par jaaiye ya affiliated link use kariye

- Personal details fill kariye – name, DOB, mobile, email

- Employment details add kariye – company name, income, experience

- OTP verification complete kariye

- Eligible cards list dekh kar Flipkart Axis select kariyeyoutube

- Document upload kariye

- Video KYC complete kariyeyoutube

Offline Application

- Nearest Axis Bank branch visit kariye

- Application form fill kariye

- Documents submit kariye

- Bank representative will process further

Application Status Track: Axis Bank website ya customer care se reference ID use kar ke check kar sakte hain.mymoneymantra

Fees & Charges Structure

Recent changes ke baad fees structure mein kuch updates aaye hain :business-standard+1

Basic Charges:

- Finance charges: 3.75% per month (previously 3.6%)axisbank+1

- Cash advance: 2.5% (min ₹500)axisbank

- Foreign currency transactions: 3.5%axisbank

- Late payment: ₹500-₹1,200 based on outstandingaxisbank

New Fees (Effective Dec 2024):

- Education payments via third-party apps: 1%business-standard

- Utility payments: 1% on ₹25,000+ per cyclebusiness-standard

- Wallet loads: 1% on ₹10,000+ per cyclebusiness-standard

- Fuel transactions: 1% on ₹50,000+ per cyclebusiness-standard

- Online gaming: 1% on ₹10,000+ per cyclebusiness-standard

Pros and Cons Analysis

Major Advantages

High Cashback Rate: 5% on Flipkart aur 7.5% on Myntra excellent hai beginners ke liyeflipkart+1

Unlimited Rewards: No capping on partner merchant cashbackcardmaven+1

Direct Cashback: Statement mein direct adjustment, no points hasslecardmaven

Partner Benefits: Swiggy, Uber par 4% accha hai urban users ke liyeflipkart

Welcome Benefits: ₹350+ worth benefits acche hainaxisbank

Key Disadvantages

High Annual Fee Waiver Threshold: ₹3.5 lakh spend requirement tough hai beginners ke liyeaxisbank+1

Lounge Access Discontinued: Major benefit remove ho gayaaxisbank+1

Limited Offline Benefits: 1% cashback offline spending par kam haicardinsider

High Exclusions: Bahut saare transaction types excluded hainflipkart+1

New Fee Structure: Recent changes ne card ko expensive bana diyabusiness-standard

Real User Experience aur Reviews

Recent user reviews mixed feedback de rahe hain :cardinsider

Positive Points:

- Flipkart shopping par genuine 5% cashback milta hai

- Cashback statement mein properly credit hota hai

- Partner merchant benefits good hain

Negative Feedback:

- Annual fee waiver difficult hai achieve karna

- Lounge access removal se disappointment

- New fees structure users ko pasand nahi aa raha

- Customer service sometimes slow responsecardinsider

Smart Tips for Maximum Benefits

Cashback Maximize Kaise Karein

- Quarterly Planning: ₹4,000 cashback cap ko reach karne ke liye quarterly ₹80,000 Flipkart spend plan kariye

- Partner Merchant Focus: Swiggy, Uber par unlimited 4% cashback ka fayda uthayiye

- Fee Waiver Strategy: ₹3.5 lakh annual spend target set kariye, but rent/wallet loads avoid kariye

- Welcome Benefits: Card activation ke turant baad first transaction kar ke benefits claim kariye

Cost-Benefit Analysis

Annual fee ₹590 (including GST) recover karne ke liye:

- Flipkart par minimum ₹11,800 spend (5% cashback)

- Ya partner merchants par ₹14,750 spend (4% cashback)

- Ya regular spends ₹59,000 (1% cashback)

Who Should Apply?

Perfect Candidate Profile

- Heavy Flipkart Users: Monthly ₹5,000+ Flipkart shopping

- Urban Professionals: Regular Swiggy, Uber users

- Online Shopping Lovers: 70%+ spending online

- Income: ₹25,000+ monthly income stable hai

Avoid Karne Wale

- Low Spenders: Monthly ₹10,000 se kam total spend

- Offline Shopping Focus: Mall/local shopping priority

- Fee-Sensitive: Annual fee pay karne mein hesitation

- Utility Bill Focus: Mainly bill payments karte hain (now chargeable)

Alternatives to Consider

Agar Flipkart Axis suitable nahi lag raha, toh yeh alternatives dekh sakte hain:

Amazon Pay ICICI: Free card, Amazon focuspaisabazaar

SBI Cashback: 5% online, ₹999 annual fee

HDFC Millennia: 5% online, ₹1,000 annual fee

Axis ACE: 2% all spends, ₹500 annual fee

Latest Updates aur Future Changes

Recent Changes (2024-25):

- Airport lounge access discontinuedaxisbank

- Multiple transaction fees introducedbusiness-standard

- Finance charges increasedaxisbank

- Welcome benefits structure revisedflipkart

Expected Trends:

- More fee-based revenue model

- Focus on high-value customers

- Partner merchant network expansion possible

External Resources aur Tools

Credit card decision lene mein help ke liye yeh resources useful hain:

- InvestsNow – Financial planning aur credit card guidance

- Axis Bank official website – Latest terms check karne ke liye

- Related YouTube videos for practical reviews

Frequently Asked Questions (FAQ)

Q: Flipkart Axis Bank Credit Card ka joining fee kitna hai aur kya waiver mil sakti hai?

A: Flipkart Axis Credit Card ka joining fee ₹500 + GST (total ₹590) hai. Pehle saal ke liye yeh mandatory pay karna padta hai. Second year se annual fee ₹500 + GST lagti hai, jo ₹3.5 lakh ka annual spend complete karne par waive ho jati hai. Lekin dhyan rahe ki rent payments aur wallet loading transactions is spend calculation mein count nahi hote. Beginners ke liye yeh threshold achieve karna thoda challenging ho sakta hai, isliye proper planning kiye bina apply na karें.axisbank+1

Q: Kya Flipkart Axis Credit Card par airport lounge access milta hai?

A: Nahi, June 20, 2024 se Flipkart Axis Bank Credit Card par complimentary airport lounge access completely discontinue ho gaya hai. Pehle yeh card 4 domestic lounge visits per year deta tha, but ab yeh benefit available nahi hai. Yeh card ke major drawbacks mein se ek hai kyunki bahut se users lounge access ke liye hi yeh card lete the. Agar aapko lounge access chahiye toh other premium cards consider karne padenge.axisbank+1

Q: Flipkart Axis Credit Card par cashback kaise milta hai aur kab credit hota hai?

A: Flipkart Axis Card par cashback direct statement balance mein credit hota hai, points ya vouchers ke form mein nahi. Cashback rate yeh hai: Flipkart/Cleartrip par 5% (₹4,000 quarterly cap), Myntra par 7.5% (₹4,000 quarterly cap), partner merchants (Swiggy, Uber, PVR) par 4% unlimited, aur baaki sab par 1%. Cashback next statement cycle mein automatically adjust ho jata hai. Yeh direct cashback system Amazon Pay card se better hai jo wallet mein credit karta hai.flipkart+2

Q: Flipkart Axis Credit Card vs Amazon Pay ICICI Card – konsa better hai beginners ke liye?

A: Beginners ke liye choice depends karta hai aapke shopping pattern par. Flipkart Axis choose kariye agar: aap regular Flipkart user hain, Swiggy/Uber frequently use karte hain, aur annual fee (₹590) pay karne mein problem nahi hai. Amazon Pay ICICI choose kariye agar: aap Amazon Prime member hain (5% vs 3% difference), free card chahiye, aur bill payments par cashback important hai. Overall, agar aap heavy Flipkart shopper hain aur partner merchants use karte hain toh Flipkart Axis better value deta hai despite annual fee.paisabazaar+1

Q: Flipkart Axis Credit Card apply karne ke liye minimum income kitni chahiye?

A: Flipkart Axis Credit Card ke liye minimum income requirement ₹15,000 per month hai salaried individuals ke liye. Self-employed ke liye typically ₹30,000 per month income expected hai. Lekin practical experience ke hisaab se, agar aapki monthly income ₹25,000+ hai aur credit score 750+ hai toh approval chances zyada better hote hain. Age limit 18-70 years hai , aur both residents aur NRIs apply kar sakte hain. Documents mein PAN card, income proof (salary slip/ITR), address proof, aur identity proof required hai.axisbank+2

Q: Kya Flipkart Axis Credit Card par fuel transactions par cashback milta hai?

A: Nahi, fuel transactions par cashback nahi milta. Ulta, recent changes ke baad agar aap monthly ₹50,000+ fuel transactions karte hain toh 1% additional fee lagti hai. However, card fuel surcharge waiver deta hai – 1% waiver ₹400-₹4,000 ke transactions par, maximum ₹400 per month. Toh practically fuel par yeh card beneficial nahi hai. Agar aap regular fuel expenses karte hain toh specialized fuel cards ya other cashback cards consider kariye.flipkart+3

Q: Flipkart Axis Credit Card par kaunse transactions par cashback nahi milta?

A: Kai transactions excluded hain cashback se : Complete exclusions: Fuel spends, gift card purchases, EMI transactions, wallet loading, gold purchases, cash advances, government payments, rent payments. New fee structure (Dec 2024): Education payments via third-party apps (1% fee), utility bills (1% fee on ₹25,000+ monthly), wallet loads (1% fee on ₹10,000+ monthly), fuel (1% fee on ₹50,000+ monthly), online gaming (1% fee on ₹10,000+ monthly). Yeh changes card ko expensive bana deti hain, isliye apply karne se pehle apna spending pattern analyze kariye.flipkart+2

Q: Flipkart Axis Credit Card ka application process kitna time leta hai?

A: Online application process 7-21 working days mein complete hoti hai. Steps yeh hain: Online form fill karo (5-10 minutes), document verification (2-3 days), credit check aur approval (3-7 days), physical card dispatch (3-5 days). Video KYC requirement hai which speeds up the process. Application status Axis Bank website ya customer care (1800 103 5577) se track kar sakte hain. Agar documents proper hain aur credit score good hai toh faster approval milti hai. Rejection case mein reasons bataye jate hain taki future applications improve kar sakein.axisbank+1youtube

Conclusion

Flipkart Axis Bank Credit Card beginners ke liye ek decent option hai agar aap heavy Flipkart user hain aur partner merchants par spend karte hain. 5% Flipkart cashback aur 4% partner cashback attractive rates hain, lekin recent changes ke baad card expensive ho gaya hai. ₹3.5 lakh annual fee waiver requirement aur lounge access discontinuation major drawbacks hain.

Agar aap monthly ₹15,000+ online spend karte hain, especially Flipkart/Myntra/Swiggy par, toh yeh card profitable ho sakta hai. But low spenders aur fee-sensitive users ke liye alternatives like Amazon Pay ICICI better option ho sakte hain.

Apply karne se pehle apna spending pattern properly analyze kariye aur calculate kar liye ki annual fee recover kar payenge ya nahi. Credit card responsible use kariye aur full payment time par kariye taki interest charges se bacha ja sake.

Agar aapko koi aur sawal hai Flipkart Axis Credit Card ke baare mein, toh comment mein poochiega! Humne ismein sabkuch detail mein explain kiya hai beginners ko help karne ke liye.

Related Links:

- Apply for card: Flipkart Axis Credit Card

- Financial guidance: InvestsNow.in

- Video reviews: YouTube Credit Card Review