Best Zero-Forex Debit Cards in India (2025)

Forex Debit Cards: International Travel Complete Guide for Beginners

Introduction

In the international travel ke zamane mein, forex debit cards aaj ke time mein sabse important financial tool ban gaye hain. Kya aap ek college student hain jo abroad study karne ja rahe hain, you phir aap ek professional hain jo business trip pe jane wale hain? Forex debit cards are the most secure and convenient way to manage your international financial needs.t cards are the most secure and convenient way to manage your international financial needs. jupiter+2

Regular cash carry karna ya typical debit cards use karna international travel mein bahut risky aur expensive ho sakta hai. Forex cards aapko locked-in exchange rates, enhanced security, aur global acceptance provide karte hain. Is comprehensive guide mein hum aapko forex debit cards ke baare mein sab kuch detail mein batayenge – features se lekar application process tak, jo aapko ek informed decision lene mein help karega.hdfcbank+1

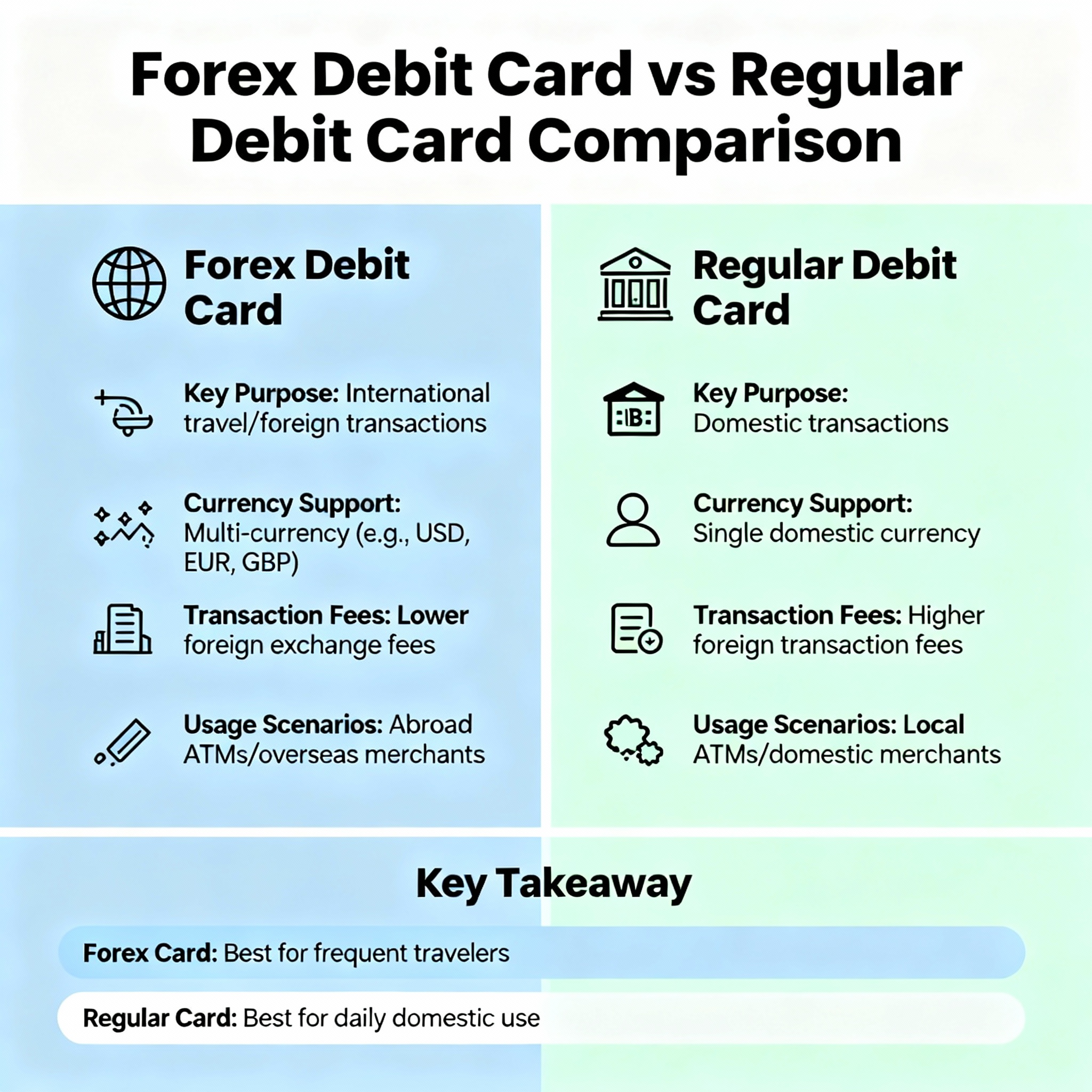

Image: Forex debit card vs regular debit card comparison infographic

Visual comparison showing differences between forex debit cards and regular debit cards for international travel

Forex Debit Cards Kya Hain?

Basic Definition

Forex debit card ya forex card ek prepaid travel card hai jo aapko foreign currencies carry karne aur use karne ki facility deta hai. Ye essentially ek debit card ki tarah kaam karta hai, lekin international travel ke liye specially design kiya gaya hai. Aap is card ko apne desired foreign currency mein load kar sakte hain—jaise USD, EUR, or GBP—aur phir abroad jaake use kar sakte hain. jupiter+3

Kaise Kaam Karta Hai?

Forex cards ka working mechanism bahut simple hai:

- Pehle aap card ko Indian Rupees mein fund karte hainjupiter+1

- Bank aapke provider ko amount ko aapke chosen foreign currency mein convert kar deta hai

- Exchange rate us time lock ho jata hai jab aap card load karte hainhdfcbank

- Abroad jaake aap is card ko normal debit card ki tarah use kar sakte hain

- ATM withdrawals, POS transactions, and online payments – sab kuch possible haihdfcbank+1

Single vs Multi-Currency Cards

Single Currency Cards: Ye cards sirf ek particular currency support karte hain, jaise sirf USD ya sirf EUR. Ye un travelers ke liye ideal hain jo sirf ek country visit karne wale hain.jupiter

Multi-Currency Cards: Ye advanced cards multiple currencies (up to 22 currencies tak) ek hi card mein load kar sakte hain. Perfect choice hai un logo ke liye jo multiple countries visit karte hain ya students jo Europe mein various countries ghoomte rehte hain.hdfcbank+1

Forex Cards ke Main Features

Locked-in Exchange Rates

Sabse bada advantage ye hai ki jab aap forex card load karte hain, tab ka exchange rate lock ho jata hai. Matlab agar USD rate ₹83 hai loading ke time, toh aapko same rate milega chahe baad mein market mein fluctuation ho. Ye protection currency volatility se bachata hai aur budgeting mein help karta hai.hdfcbank+1

Global Acceptance

Modern forex cards Visa aur Mastercard network par chalte hain, jo ensure karta hai ki ye worldwide accepted hain. ATMs se cash withdraw kar sakte hain, restaurants mein pay kar sakte hain, online shopping kar sakte hain – almost everywhere usage possible hai.hdfcbank+2

Enhanced Security Features

Forex cards EMV chip technology aur PIN protection ke saath aate hain. Agar card kho jaye ya chori ho jaye, toh easily block kar sakte hain aur replacement card mil jata hai. Regular cash carry karne se kahin zyada secure option hai.icicibank+1

Online Management

Modern forex cards ke saath user-friendly mobile apps aur internet banking facilities milti hain. Balance check karna, transaction history dekhna, card reload karna – sab online possible hai. Real-time alerts bhi milte hain har transaction ke liye.icicibank+1

Image: Benefits of forex cards illustrated infographic with icons

Infographic showing key benefits of using forex debit cards for international travel

Forex Cards vs Regular Debit Cards vs Credit Cards

Cost Comparison

| Feature | Regular Debit Card | Credit Card | Forex Card |

|---|---|---|---|

| Foreign Transaction Fee | 3.5% + GST | 3.5% + GST | Zero ya minimal |

| ATM Withdrawal Fee | ₹125 + 3.5% markup | High charges | $2-3 typical |

| Exchange Rate | Daily fluctuating | Daily fluctuating | Locked-in rates |

| Annual Fee | ₹125-₹1999 | ₹500-₹2000 | ₹0-₹500 |

Security Comparison

Regular debit cards directly aapke bank account se linked hote hain, jo security risk create karta hai international usage mein. Agar fraud ho jaye toh main account compromise ho sakta hai. Credit cards mein over-spending ka risk hai aur high interest rates.moneyhop+1

Forex cards sabse secure hain kyunki:

- Prepaid nature – sirf loaded amount hi spend ho sakta haimoneyhop

- Bank account se direct link nahi hai

- Easy blocking aur replacement facilityhdfcbank+1

- Insurance coverage bhi milta haihdfcbank

Convenience Factor

Forex Cards ki convenience unmatched hai:

- Multiple currencies ek card meinhdfcbank+1

- No daily market rate dependencymoneyhop+1

- Budget control – prepaid naturemoneyhop

- 24×7 customer support globallyhdfcbank

Best Forex Cards in India 2025

Top Providers aur unke Features

1. HDFC Bank ForexPlus Cardshdfcbank+2

- 22 currencies support karta hai

- Zero cross-currency markup charges

- Complimentary insurance coverage up to ₹10.30 lakh

- Airport lounge access

- Charges: Card issuance ₹500 + GST, Reload ₹75 + GSThdfcbank

2. ICICI Bank Forex Cardsicicibank+1

- 15 currencies support

- Multi-currency loading facility

- 24×7 global customer assistance

- Travel insurance included

- Charges: Cross-currency fee 3.5% + GST applicableicicibank

3. BookMyForex True Zero Markup Cardbookmyforex+1

- Zero markup interbank rates

- Same-day doorstep delivery

- Instant digital reload facility

- Free International SIM card

- Charges: Zero issuance/annual/reload chargesamberstudent

4. Axis Bank Multi-Currency Forex Cardelanloans+1

- Up to 16 currencies support

- Mobile banking management

- TripAssist services

- Low ATM withdrawal charges

- Charges: Issuance fee ₹500 + GSTelanloans

5. SBI Foreign Travel Cardsbi

- Multiple currency options

- Global ATM access

- POS terminal acceptance

- Tap, swipe, aur chip payment options

Students ke liye Best Options

Students ke liye specially designed forex cards available hain:amberstudent+2

HDFC Bank ISIC Student ForexPlus Cardsiecindia

- ISIC membership included (International Student Identity Card)

- Global student discounts

- Zero cross-currency charges

- Emergency cash delivery assistance

ICICI Bank Student Forex Cardicicibank+1

- Student-specific benefits aur merchant discounts

- 15 currencies support

- Mobile app integration

- Comprehensive travel insurance

Niyo Global Cardshiksha

- Zero forex markup for students

- Easy online management

- Global acceptance

- Competitive exchange rates

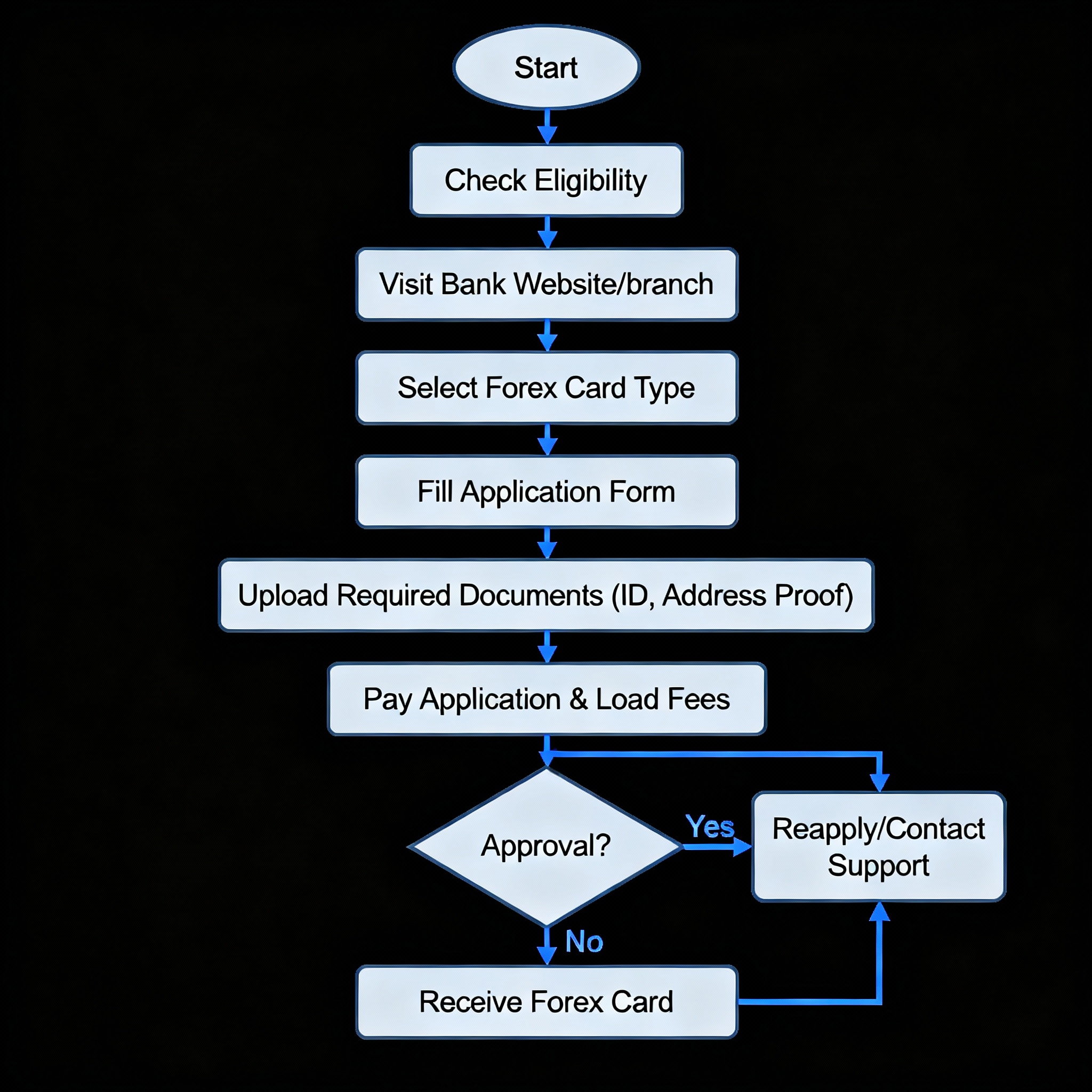

Image: Step-by-step forex card application process flowchart

Complete flowchart showing the step-by-step process to apply for a forex debit card in India

Application Process aur Required Documents

Step-by-Step Application Process

Online Applicationmultimoney+1

- Bank/Provider website par jaaiye

- Application form fill kariye

- Required documents upload kariye

- KYC verification complete kariye

- Card delivery – 24-48 hours meinbookmyforex

Branch Application

- Nearest branch visit kariye

- Application form fill kariye with documents

- Verification process complete kariye

- Card collection ya home delivery choose kariye

Required Documents Listwsfx+2

Mandatory Documents for All Applicants

- Valid Passport – first aur last page ki copymultimoney+1

- PAN Card – RBI regulations ke according mandatoryhdfcbank+1

- Visa copy (where applicable) – destination country kamultimoney

- Confirmed air ticket – travel intent proof ke liyewsfx+1

Purpose-Specific Documentswsfx+1

For Students:

- University admission lettermultimoney+1

- Form I-20 (US students ke liye)bookmyforex

- Student visa copy

- Educational loan documents (if applicable)wsfx

For Business Travel:

- Company invitation lettermultimoney

- Business visa

- Company authorization letter

For Tourism:

- Travel itinerary

- Hotel bookings (optional)

- Tour package details (if any)

Additional Financial Documentshdfcbank

- Bank statements – last 6 monthshdfcbank

- Income proof – salary slips ya IT returns

- Form A2 – foreign exchange declaration formwsfx

- Account passbook copy (for funding the card)hdfcbank

Eligibility Criteria

Basic Eligibility:

- Indian resident hona chahiyebookmyforex

- Valid passport holder

- KYC compliant documents

- Minimum age: 18 years (12+ years with guardian consent)fi

Special Notes:

- Non-resident Indians (NRIs) eligible nahi hainfi

- PAN card mandatory hai all forex transactions ke liyemultimoney+1

- Some banks apne existing customers ko priority dete hainhdfcbank

Charges aur Fees Breakdown

Major Banks ke Charges Comparison

| Bank/Provider | Issuance Fee | Reload Fee | ATM Withdrawal | Cross-Currency Fee |

|---|---|---|---|---|

| HDFC Bank | ₹500 + GST | ₹75 + GST | $3-5 | Zero (USD card) |

| ICICI Bank | Variable | Variable | $2-3 | 3.5% + GST |

| Axis Bank | ₹500 + GST | ₹100 + GST | $2 equivalent | 3.50% markup |

| BookMyForex | Zero | Zero | $2 minimal | Zero markup |

| IndusInd Bank | ₹150 + GST | ₹100 + GST | $2 equivalent | 3.5% markup |

Hidden Charges to Watch Out Forskydo+1

Common Additional Fees

- Balance inquiry charges: ₹25 per queryunimoni+1

- Transaction slip retrieval: Applicable chargesunimoni

- Card replacement fee: ₹250-₹300 + GSThdfcbank+1

- Inactivity fees: Some banks charge after 6 monthsunimoni

- Dynamic Currency Conversion (DCC): 1% + GST on certain transactionsicicibank

Money-Saving Tips

- Zero markup cards choose kariye jaise BookMyForexamberstudent

- Multi-currency cards prefer kariye cross-currency charges bachane ke liyehdfcbank+1

- Compare total cost including all hidden fees

- Student cards often have lower feessiecindia+1

Practical Usage Tips for Beginners

Pre-Travel Preparation

Currency Selection Strategy

- Main destination currency mein maximum amount load kariye

- Multi-currency card liye agar multiple countries ja rahe hainhdfcbank+1

- Exchange rate trends check kariye before loadinghdfcbank

- Buffer amount rakhiye emergency ke liye

Loading Strategies

- Advance booking karte time better rates mil sakte hainhdfcbank

- Market volatility periods mein avoid kariye loading

- Gradual loading consider kariye large amounts ke liye

- Rate comparison multiple providers mein kariye

During Travel Usage

ATM Usage Best Practices

- Local bank ATMs use kariye to minimize charges

- Daily withdrawal limits check kar liyebankbazaar

- Receipt collection – transaction record ke liye

- Balance monitoring regularly kariye app through

POS Terminal Payments

- Local currency mein payment request kariye, DCC avoid kariyeicicibank

- PIN protection – share mat kariye

- Transaction alerts enable kar liye mobile mein

- Backup payment method always ready rakhiye

Security Best Practices

Card Safety Measures

- PIN memorize kar liye, write mat kariye

- Card photos secure place mein store kar liye

- Customer care numbers save kar liye

- Blocking procedures pata kar liye

Emergency Preparedness

- Backup card ya cash rakhiye

- Embassy contact numbers note kar liye

- Insurance details accessible rakhiye

- Local emergency services numbers save kar liye

Troubleshooting Common Issues

Card Not Working Problems

Possible Causes aur Solutions

- International usage not activated

- Solution: Bank se activation karwaiyeidfcfirstbank

- Pre-travel notification send kariye bank ko

- Insufficient balance

- Solution: Online reload kariyeicicibank+1

- Balance check kare before major transactions

- Card expired or blocked

- Solution: Customer care contact kariye immediately

- Replacement card process start kariye

- Technical issues with ATM/POS

- Solution: Different ATM/terminal try kariye

- Local bank ATMs prefer kariye

Rate aur Charges Related Issues

Exchange Rate Discrepancies

- Live rates check kariye bank app mein

- Cross-currency charges confirm kariyeicicibank

- DCC rejection kariye if offered at terminalsicicibank

Unexpected Charges

- Statement analysis regularly kariye

- Customer care se clarify kariye unknown charges

- Fee structure review kariye bank documents mein

Future of Forex Cards

Digital Integration Trends

Modern forex cards mein digital wallet integration, contactless payments, aur AI-based expense tracking features aa rahe hain. Mobile apps mein real-time notifications, budgeting tools, aur currency converter built-in hain.bankbazaar+1

Emerging Technologies

Blockchain-based forex solutions aur cryptocurrency integration future mein possible hai. QR code payments aur biometric authentication bhi standard features ban rahe hain international cards mein.

Frequently Asked Questions

Q: Forex card aur international debit card mein kya difference hai?

A: Forex cards prepaid hote hain aur locked-in exchange rates provide karte hain, jabki international debit cards directly aapke bank account se link hote hain aur daily market rates use karte hain. Forex cards mein typically lower fees hote hain (zero markup vs 3.5% markup) aur better security features milte hain. International debit cards mein higher transaction charges aur currency volatility ka risk rehta hai, lekin direct account access milta hai without preloading.moneyhop+3

Q: Kitna paise load kar sakte hain forex card mein?

A: RBI guidelines ke according, individual annual limit है $250,000 (approximately ₹2 crore) under Liberalised Remittance Scheme. Daily limits vary by provider – typically $1000 for ATM withdrawals aur $7500 for POS transactions. Students ko additional education-related limits milti hain. Specific limits aapke bank aur card type pe depend karte hain, isliye provider se confirm karna better rahega.bookmyforex+1

Q: Agar card kho jaye toh kya karna chahiye?

A: Immediately customer care number dial karke card block karwaiye. Most banks provide 24×7 global assistance helpline numbers. Emergency cash delivery service available hai major banks mein. Replacement card usually 24-48 hours mein mil jata hai international locations pe. FIR lodge karna bhi advisable hai local police station mein. Backup payment method always ready rakhiye such situations ke liye.hdfcbank+1

Q: Kya forex card par interest milta hai?

A: Nahi, forex cards prepaid instruments hain isliye interest nahi milta. Ye savings account ya fixed deposits ki tarah investment tool nahi hain. However, kuch banks loyalty points ya cashback offer karte hain usage pe. Main benefit hai exchange rate protection aur international transaction convenience, not earning returns. Unused balance usually refundable hota hai with minimal charges.icicibank+2

Q: Students ke liye best forex card kaun sa hai?

A: Students ke liye HDFC Bank ISIC Student ForexPlus Card aur BookMyForex True Zero Markup Card best options hain. HDFC card mein ISIC membership, global student discounts, aur comprehensive insurance milti hai. BookMyForex card zero markup rates provide karta hai with instant reload facility. ICICI Student Card bhi good option hai with mobile app integration aur student-specific benefits. Choose karne se pehle destination country, duration, aur expected spending pattern consider kariye.amberstudent+2

Conclusion

Forex debit cards modern international travel ke liye absolutely essential financial tool ban gaye hain. Traditional cash carry karne ya regular debit cards use karne ke comparison mein, forex cards significantly better value, security aur convenience provide karte hain.moneyhop+1

Key takeaways jo aapko yaad rakhne chahiye:

- Locked-in exchange rates currency fluctuation se protection dete hainhdfcbank+1

- Zero markup options available hain jo substantial savings provide karte hainbookmyforex+1

- Multi-currency support multiple countries ke travel mein helpful haihdfcbank+1

- Enhanced security features regular cards se better protection dete hainicicibank+1

- Student-specific cards additional benefits aur lower fees ke saath available hainamberstudent+1

Forex card choose karte time, total cost (including hidden charges), currency options, customer support, aur your specific travel needs ko consider kariye. Beginners ke liye recommendation hai ki pehle zero markup cards explore kariye jaise BookMyForex, aur phir established banks like HDFC ya ICICI ke options compare kariye.thomascook+4

Agar aap first-time international traveler hain, toh proper research kariye, required documents pehle se arrange kariye, aur application process mein sufficient time diye. Right forex card aapko tension-free international experience provide karega aur unexpected charges se bachayega.multimoney+1

Related Resources:

- Complete forex card comparison aur latest rates ke liye visit kariye: InvestsNow Financial Solutions

- Best forex card deals aur instant application: Apply for Zero Markup Forex Card

- YouTube tutorial on forex card usage: Watch Complete Video Guide

International travel planning mein agar koi doubt hai ya specific guidance chahiye, toh comment section mein apne questions share kariye. Safe travels aur smart financial planning!