Best Term Insurance Plan SBI in 2025 – Benefits, Features & Premium Guide

Best Term Insurance Plan SBI: Complete Guide to Best Protection for Your Family

Term insurance is incomplete without mentioning SBI! Jab aap apne family ki financial security ki soch rahe hain, tab SBI Life Insurance ki term insurance plans definitely consider karni chahiye. SBI Life Insurance Company ne multiple term insurance plans banaye hain jo affordable premium mein maximum protection provide karte hain. In this comprehensive guide mein, hum SBI ke best term insurance plans ke baare mein detail se samjhaenge—especially beginners ke liye.

SBI term insurance family protection concept

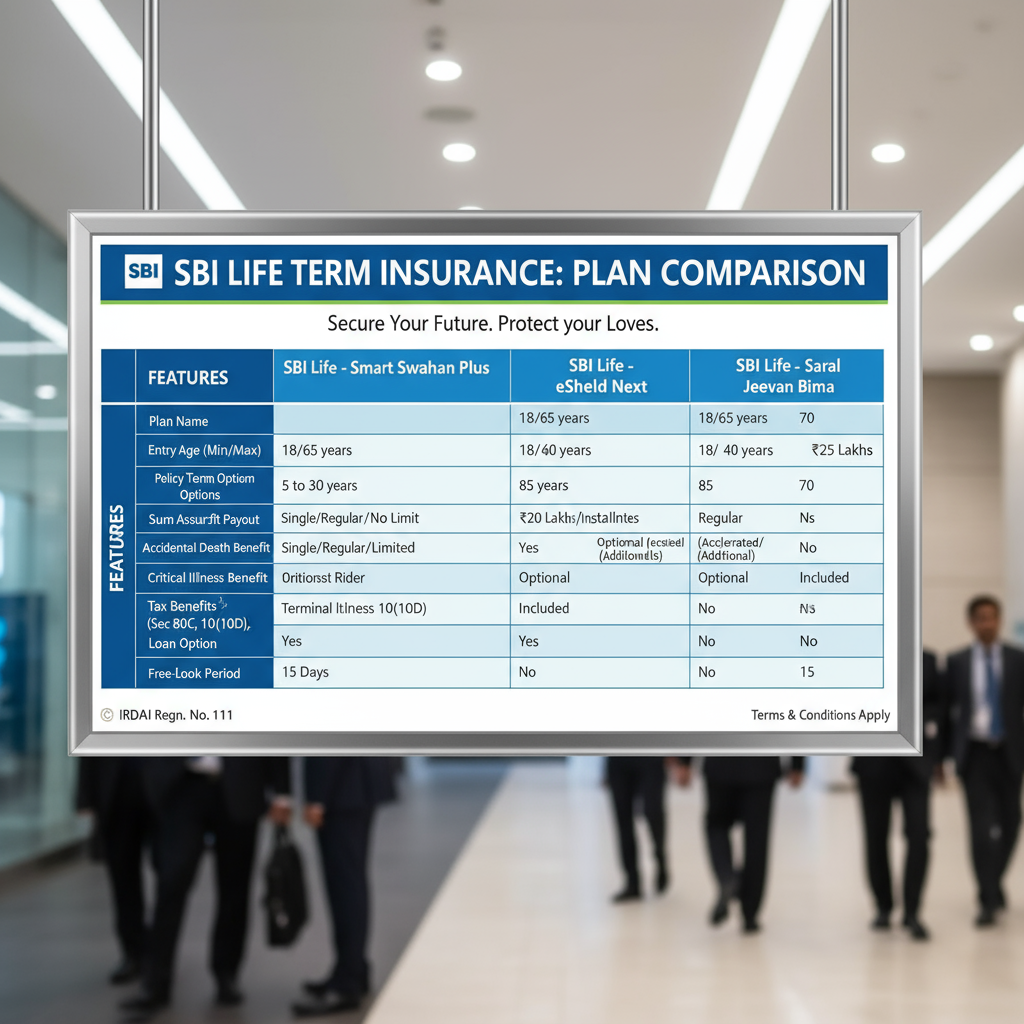

Best Term Insurance Plan SBI: Quick Overview

SBI Life Insurance Company, a joint venture between State Bank of India and BNP Paribas, is one of the most trusted insurance companies in India. Company ka claim settlement ratio 99.20% hai, jo batata hai, ki ye company apne promises ko fulfill karti hai. With over 825 branch offices across India, SBI Life Insurance ek reliable choice hai term insurance ke liye. paisabazaar+3

SBI Life’s Popular Term Insurance Plans

1. SBI Life eShield Plan

eShield plan SBI Life ka most popular aur affordable term insurance plan hai. Iska main attraction hai ki ye pure term insurance plan hai jo high coverage low premium mein provide karta hai. policybazaar

Key Features:

- Minimum Coverage: Rs. 20 lakhpolicybazaar

- Maximum Coverage: No upper limitpolicybazaar

- Entry Age: 18 to 65 yearspolicybazaar

- Policy Term: 5 to 30 years policybazaar

- Premium Options: Level Cover or Increasing Policybazaar

Benefits:

- Terminal illness cover built-inpolicyx

- Accidental death benefit rider availablepolicyx

- Non-smoker discount availablepolicyx

- Tax benefits under Section 80C and 10(10D)policybazaar

2. SBI Life Smart Shield

Smart Shield plan flexibility aur comprehensive protection provide karta hai. Ye plan different coverage options ke sath aata hai.paisabazaar

Key Features:

- Minimum Coverage: Rs. 25 lakhpaisabazaar

- Maximum Coverage: No limitpaisabazaar

- Entry Age: 18 to 60 yearspaisabazaar

- Maturity Age: Up to 65 yearspaisabazaar

- Premium Payment: Single premium ya regular premiumbankbazaar

Plan Options:

- Level Term Insurancepaisabazaar

- Increasing Term Insurancepaisabazaar

- Decreasing Term Insurancepaisabazaar

Term insurance premium calculator interface design

3. SBI Life Smart Shield Premier

Ye plan high net-worth individuals ke liye specially designed hai. Higher coverage amount aur premium benefits ke sath aata hai.sbilife

Key Features:

- Minimum Coverage: Rs. 2 crorespolicybazaar

- Maximum Coverage: No limitpolicybazaar

- Entry Age: 18 to 60 yearspolicybazaar

- Maturity Age: Up to 85 yearspolicybazaar

- Policy Term: 10 years to (85-entry age)policybazaar

SBI Term Insurance Premium Calculation

Premium calculation mein multiple factors involved hain jo aapke premium amount ko decide karte hain:insurancedekho

Main Factors:

- Age: Younger age mein premium kam hota haiinsurancedekho

- Gender: Generally females ko lower premium milta haiinsurancedekho

- Smoking Habits: Non-smokers ko significant discount milta haiinsurancedekho

- Health Status: Medical history aur current healthinsurancedekho

- Sum Assured: Higher coverage means higher premiuminsurancedekho

- Policy Term: Longer terms may have lower annual premiuminsurancedekho

Premium Example:

30-year-old non-smoker male ke liye Rs. 1 crore coverage:

Factors Jo Premium Reduce Kar Sakte Hain:

- Non-smoker discountinsurancedekho

- Higher sum assured discount (up to 30%)policybazaar

- Online purchase discountpolicybazaar

- Female gender discountinsurancedekho

SBI term insurance plans comparison visual

How to Buy SBI Term Insurance Online

Online buying process bahut simple aur hassle-free hai:policyx

Step-by-Step Process:

- Visit Official Website: SBI Life ki official website ya trusted insurance aggregatorpolicyx

- Compare Plans: Different plans compare kareinpolicyx

- Premium Calculator: Use karein accurate premium estimate ke liyepolicyx

- Fill Application: Personal details, medical informationpolicyx

- Choose Nominees: Important step – nominee details carefully fill kareinyoutube

- Document Upload: KYC documents upload kareinpolicyx

- Medical Tests: If required (depends on age and sum assured)policyx

- Payment: Online payment through various modespolicyx

- Policy Issuance: Email par policy documents receive kareinpolicyx

Required Documents:

- Photo ID proof (Aadhar, PAN, Passport)policyx

- Address proofpolicyx

- Income proofpolicyx

- Medical reports (if required)policyx

- Bank account detailspolicyx

SBI Term Insurance vs Competitors

Claim Settlement Ratio Comparison:

| Insurance Company | Claim Settlement Ratio | Market Position |

|---|---|---|

| SBI Life | 99.20% | Excellent |

| HDFC Life | 99.50% | Excellent |

| ICICI Prudential | 97.90% | Very Good |

| Max Life | 99.65% | Excellent |

Premium Comparison:

30-year-old male, Rs. 1 crore coverage:

| Plan | Annual Premium | Monthly Premium |

|---|---|---|

| SBI eShield | Rs. 11,868 | Rs. 989 |

| HDFC Click 2 Protect | Rs. 13,499 | Rs. 1,181 |

| Axis Smart Term | Rs. 10,429 | Rs. 918 |

SBI Term Insurance Benefits

Death Benefits:

- Lump Sum Payment: Full sum assured nominee ko ek sath milta haipolicybazaar

- Income Option: Monthly income option bhi available hai kuch plans meinpolicybazaar

- Tax-Free: Death benefit completely tax-free hota haipolicybazaar

Riders Available:

- Accidental Death Benefit Rider: Accident mein death pe extra amountinsurancedekho

- Accidental Total & Permanent Disability: Disability pe coverageinsurancedekho

- Critical Illness Cover: Major illness pe advance paymentinsurancedekho

- Waiver of Premium: Premium payment waive ho jata hai certain conditions meininsurancedekho

Tax Benefits:

- Section 80C: Premium payment pe tax deductionpolicybazaar

- Section 10(10D): Death benefit tax-freepolicybazaar

Eligibility Criteria for SBI Term Insurance

Basic Eligibility:

| Parameter | Minimum | Maximum |

|---|---|---|

| Entry Age | 18 years | 60-65 years (plan dependent) |

| Maturity Age | – | 70-85 years |

| Policy Term | 5 years | 30 years |

| Sum Assured | Rs. 20-25 lakh | No upper limit |

| Income Proof | Required for higher coverage | – |

Medical Requirements:

- Below 45 years: Usually no medical tests requiredinsurancedekho

- Above 45 years: Basic medical testsinsurancedekho

- High Sum Assured: Detailed medical examinationinsurancedekho

Why Choose SBI Term Insurance?

Advantages:

Trust Factor: SBI brand ki credibility aur government backingpaisabazaar

High Claim Settlement: 99.20% claim settlement ratiopolicybazaar

Wide Network: 825+ offices pan-Indiainsurancedekho

Affordable Premium: Competitive pricingpolicyx

Flexible Options: Multiple plan variants availablepaisabazaar

Online Convenience: Easy online purchase processpolicyx

Tax Benefits: Comprehensive tax savingpolicybazaar

Considerations:

Limited Innovation: Traditional approach, latest features kamjoinditto

Premium Comparison: Some competitors offer lower premiumsjoinditto

Digital Experience: Room for improvement in digital toolsjoinditto

Common Mistakes to Avoid

Inadequate Coverage: Inflation ko consider kiye bina coverage choose karnainsurancedekho

Medical History Hiding: Medical conditions hide karna claim rejection ka reason ban sakta haipolicybazaar

Nominee Details: Incomplete ya outdated nominee informationyoutube

Premium Payment: Irregular premium payment se policy lapse ho sakti haiinsurancedekho

Plan Comparison: Bina compare kiye plan choose karnainsurancedekho

Best Practices for SBI Term Insurance

Early Purchase: Young age mein buy karein – premium kam hogainsurancedekho

Adequate Coverage: At least 10-15 times annual income ka coverageinsurancedekho

Regular Review: Life changes ke sath coverage review kareininsurancedekho

Health Maintenance: Healthy lifestyle maintain karein premium benefits ke liyepolicyx

Documentation: Important documents safe rakheinpolicyx

Beneficiary Update: Regular nominee details update kareinyoutube

For detailed financial planning and investment guidance, check out comprehensive resources at Investsnow for expert insights and latest updates.

Related video content aur detailed tutorials ke liye, aap YouTube pe SBI Life ke official channel ya finance experts ke videos dekh sakte hain jo step-by-step guidance provide karte hain.

Insurance aur investment se related aur bhi opportunities explore karne ke liye, Gromo affiliate program join kar sakte hain jo additional income opportunities provide karta hai.

Frequently Asked Questions (FAQs)

Q: SBI Life ka claim settlement ratio kitna hai aur yeh kyon important hai?

A: SBI Life ka claim settlement ratio 99.20% hai, jo industry average se kaafi achha hai. Yeh ratio batata hai ki company har 100 claims mein se 99+ claims settle karti hai. High claim settlement ratio ka matlab hai ki aapke family ko claim rejection ka risk kam hai. Yeh ratio insurance company choose karne ka sabse important factor hai kyunki insurance ka actual benefit tabhi milta hai jab claim properly settle ho jaaye.policybazaar

Q: SBI term insurance online buy karne ke kya benefits hain?

A: Online term insurance purchase ke multiple benefits hain: (1) Convenience – Ghar baithke 24/7 purchase kar sakte hain, (2) Online Discounts – Up to 15% discount milta hai online purchase pe, (3) Quick Processing – Instant quotes aur fast policy issuance, (4) Document Upload – Easy digital document submission, (5) Comparison Tools – Multiple plans easily compare kar sakte hain, (6) Paperless Process – No physical documentation required. Online process typically 2-3 days mein complete ho jata hai compared to offline process jo 7-10 days le sakta hai.policybazaar+2

Q: SBI eShield aur Smart Shield mein kya difference hai?

A: SBI eShield: Pure term plan hai jo basic protection provide karta hai, minimum Rs. 20 lakh coverage se start hota hai, online-focused plan hai with terminal illness benefit built-in. Smart Shield: More comprehensive plan hai jo Rs. 25 lakh minimum coverage ke sath multiple plan options provide karta hai (Level, Increasing, Decreasing term insurance). Smart Shield mein single premium option bhi available hai, jabki eShield sirf regular premium ke sath aata hai. Beginners ke liye eShield better choice hai due to lower minimum coverage requirement aur simple structure.paisabazaar+3

Q: Term insurance mein premium payment miss ho gaye to kya hoga?

A: Premium payment miss hone pe policy lapse ho sakti hai, lekin SBI Life grace period provide karti hai: (1) Grace Period – 30 days ka grace period milta hai monthly premium ke liye, 31 days quarterly/half-yearly/annual ke liye, (2) Revival Option – Lapsed policy ko 5 years tak revive kar sakte hain with accumulated interest aur medical requirements, (3) Automatic Debit – ECS/NACH set up karein to avoid missing payments, (4) SMS Alerts – Premium due dates ke liye alerts set karein. Grace period ke andar premium pay karne se policy continuity maintain rahti hai without any penalty.insurancedekho+1

Q: SBI term insurance mein medical tests kab required hote hain?

A: Medical tests ki requirement age aur sum assured pe depend karti hai: (1) Below 35 years – Rs. 1 crore tak usually no medical tests, (2) 35-45 years – Basic medical tests required for higher coverage, (3) Above 45 years – Detailed medical examination mandatory, (4) High Coverage – Rs. 2 crore+ ke liye comprehensive medical tests, (5) Pre-existing Conditions – Medical history ke basis pe additional tests. Non-smokers ko generally easier medical underwriting milta hai. Medical tests insurance company ke empanelled labs mein free of cost hote hain.insurancedekho

Agar aapko SBI term insurance ke bare mein koi aur questions hain ya personalized advice chahiye, to expert financial advisors se consultation kar sakte hain. Remember, term insurance ek long-term commitment hai, so proper research aur planning ke sath decision lein!