Bajaj Finance: Best Guide for Beginners (2025)

Introduction

Aaj ke time pe, financial planning har kisi ke life ka integral part ban chuka hai. Lekin maximum beginners confuse hote hain – “Loan kaise milega?”, “Savings kaha rakhein?”, “Invest kaise karein?” Bajaj Finance ek trusted solution hai India mein jo beginners ke liye easy, reliable aur convenient options provide karta hai—loan se leke EMI cards, FDs, aur mutual funds tak.

Is blog mein hum cover karenge:

- Bajaj Finance kya hai aur beginners ke liye kyu best hai?

- Loan lene ka practical process (step-by-step)

- EMI Card se shopping ka smart tareeka

- Fixed Deposit (FD) advantages for saving

- Mutual funds investing tips for naya investors

- Pros & cons, FAQs, practical guidance, YouTube video resources & affiliate links

Ye blog beginners ke liye likha gaya hai—simple Hinglish, stepwise guidance, real-life examples, and SEO-friendly keywords.

Bajaj Finance Ka Overview: Beginner ke Nazariye Se

Bajaj Finance Ltd. ek Non-Banking Financial Company (NBFC) hai jo retail, SME (small-medium enterprises), aur commercial lending plus deposits, insurance, mutual funds, aur asset management services provide karta hai. Market cap ₹6 lakh crore+, 70,000+ employees, aur India ke urban-rural areas mein strong presence.screener

Main Bajaj Finance Products:

- Personal Loans (quick approval, easy EMI)

- Business, Home & Gold Loans (flexi schemes)

- Mutual Funds & SIPs

- Fixed Deposits (FDs)

- Insta EMI Network Card

- Insurance (Life/Health/Motor)

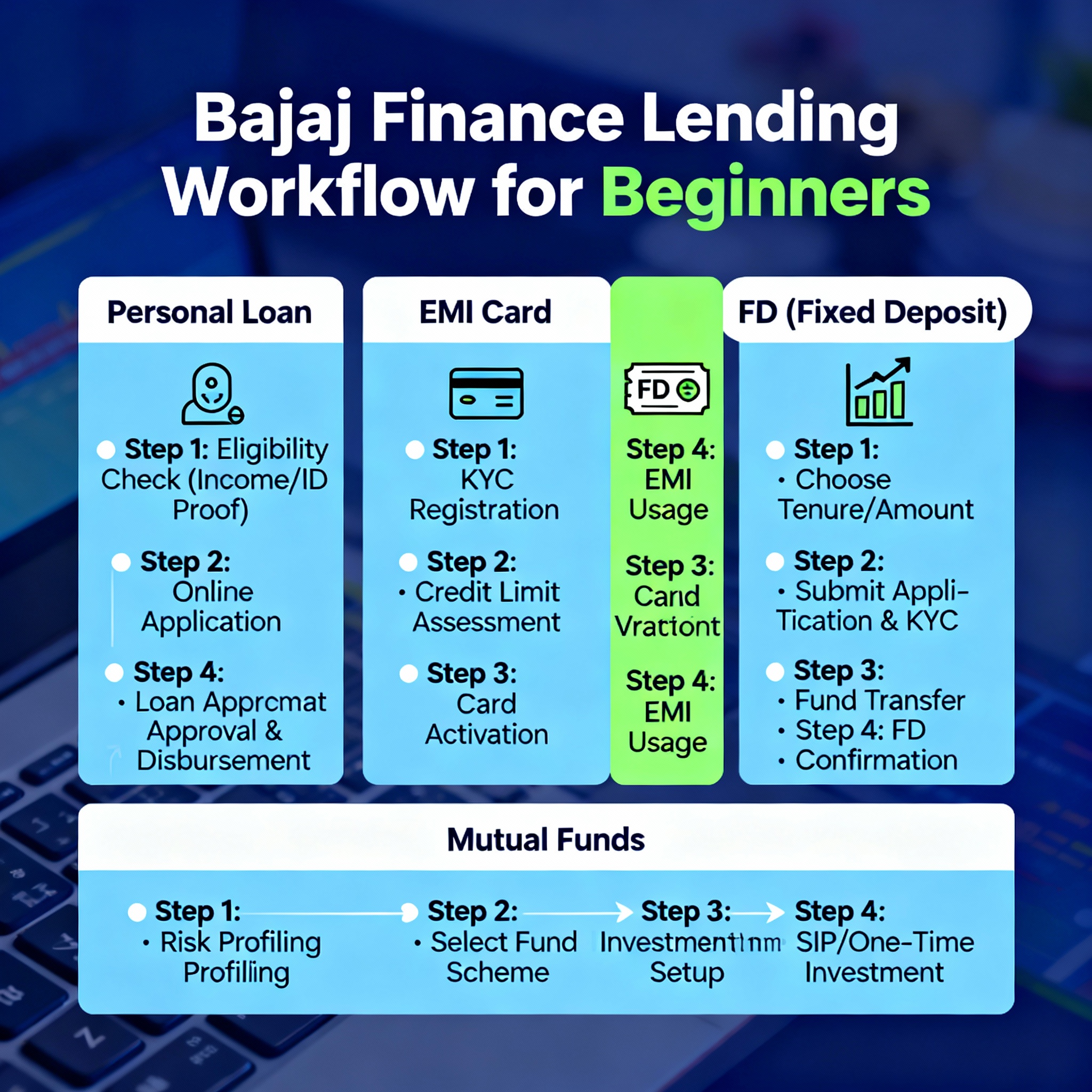

Image: Bajaj Finance Lending Workflow (Personal Loan, EMI Card, FD, Mutual Funds)

Diagram: Bajaj Finance main product workflow for beginners – personal loan, EMI card, FD, mutual funds.

Diagram: Bajaj Finance main product workflow for beginners – personal loan, EMI card, FD, mutual funds

Bajaj Finance Personal Loan: Beginner-Friendly Guide

Personal Loan Ke Liye Step-by-Step Process (2025)

- Eligibility Check – Indian nationality, age 21+, basic income, credit history.

- Online Application – Bajaj website pe basic details fill karein.

- Document Upload – PAN, Aadhaar, Salary Slip, Bank Statement (past 3 months).

- KYC Verification – Online DigiLocker integration se instant verification.bajajfinserv+1

- Approval & Disbursal – 24 hours ke andar amount aapke account mein.

In my experience: Humne dekha hai ki Bajaj Finance ka process one of the fastest hai India mein. Beginners ke liye minimal paperwork, EMI calculators, and easy tenure selection make it stress-free.

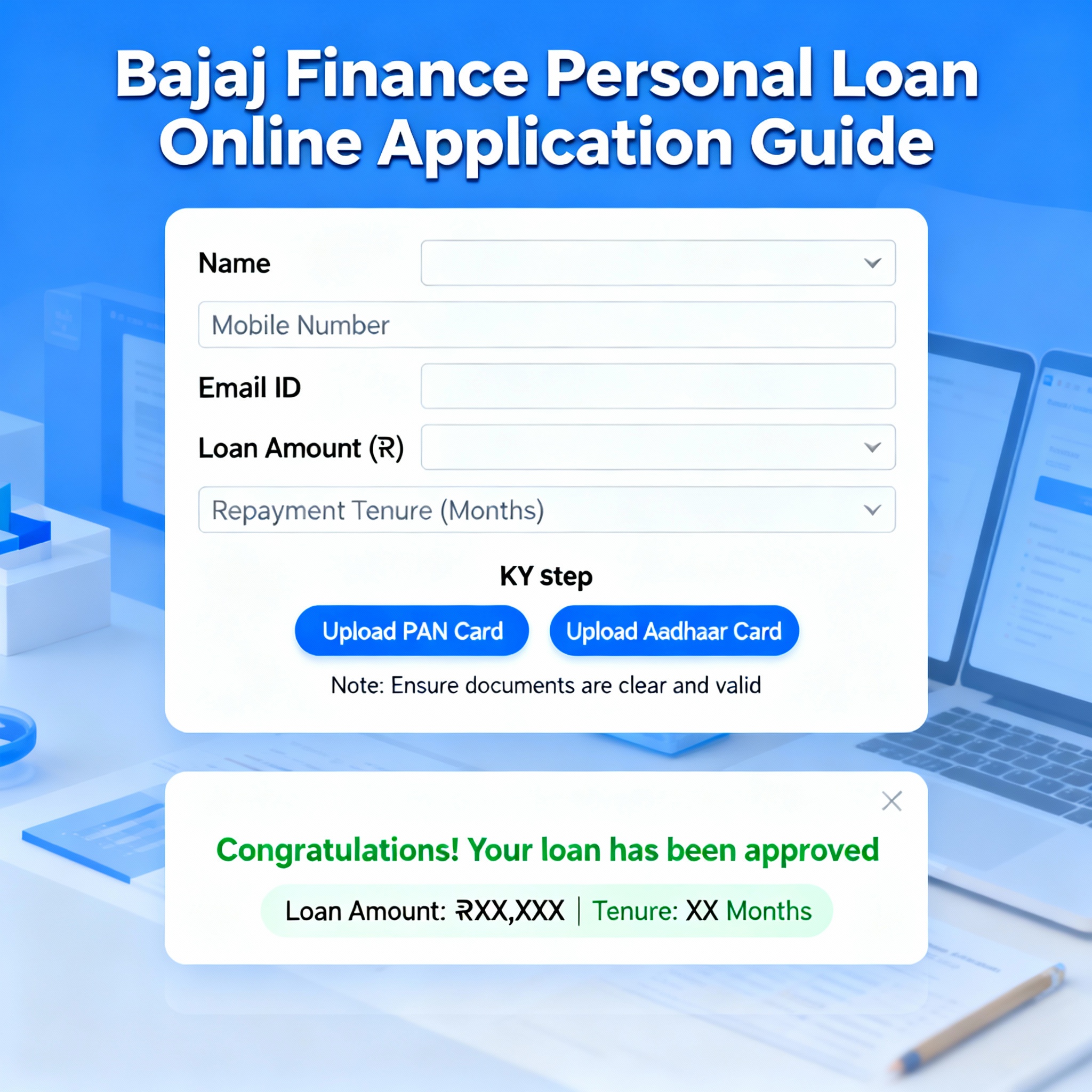

Image: Screenshot-style Guide – How to Apply for Bajaj Finance Personal Loan Online

Screenshot-style Image: Bajaj Finance personal loan online application process (beginner guide).

Screenshot-style Image: Bajaj Finance personal loan online application process (beginner guide)

Bajaj Finance Insta EMI Network Card: Smart Shopping for Beginners

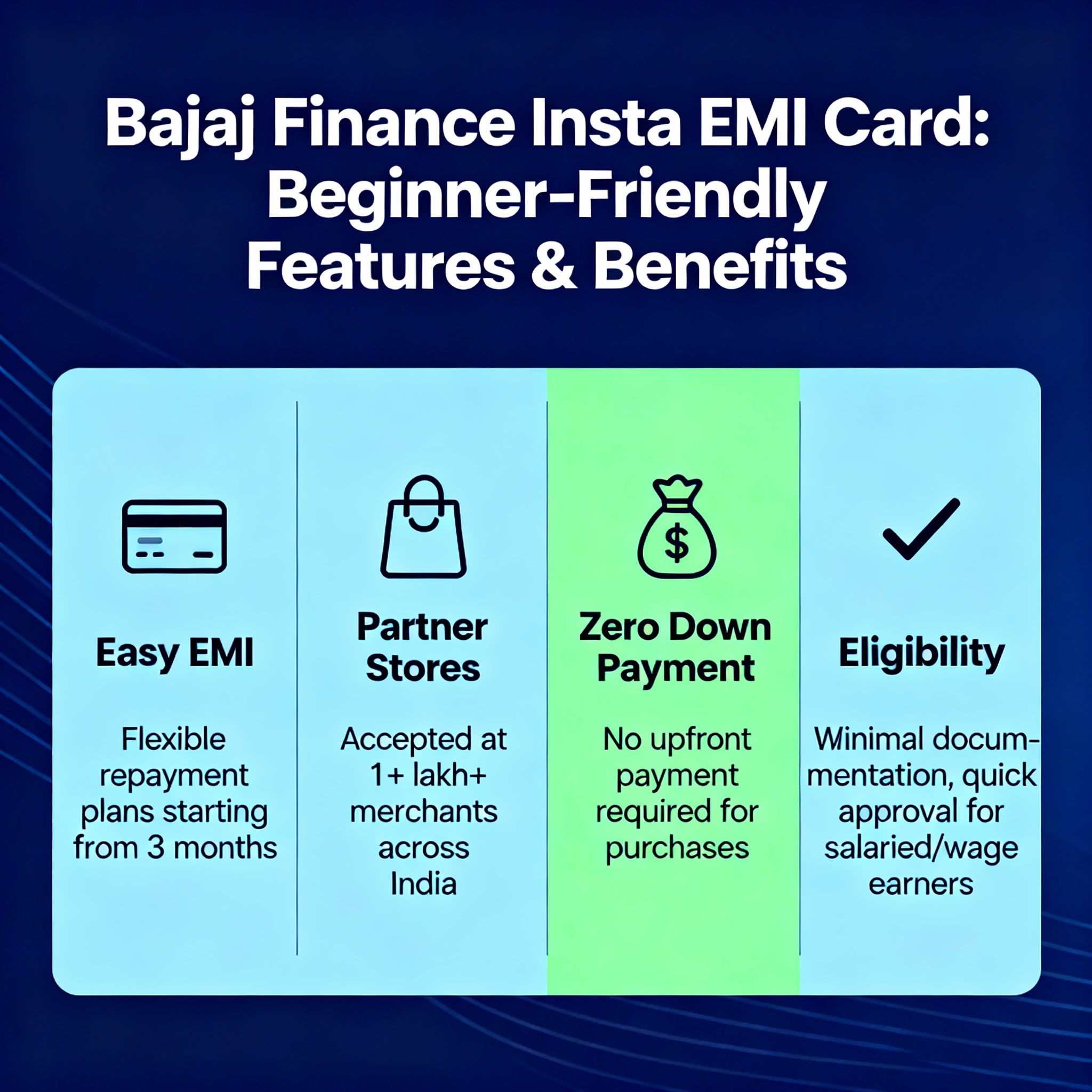

EMI Card ke Benefits:

- Pre-approved limit up to ₹3 lakh, shopping on 1.5+ lakh partner stores (Flipkart, Amazon, Croma, etc.)bajajfinservmarkets+2

- Zero down payment offers (specially festive season mein)

- No documents needed at shopping time—only online portal/app se manage karein

- Flexible repayment (3-60 months), easy foreclosure (zero charges)

Example: Agar aap latest smartphone kharidna chahte hain, EMI Card se cashless, instant EMI setup possible hai.

Image: Features & Benefits of Bajaj Finance Insta EMI Card

Infographic: Bajaj Finance Insta EMI Card features and benefits for beginners.

Infographic: Bajaj Finance Insta EMI Card features and benefits for beginners

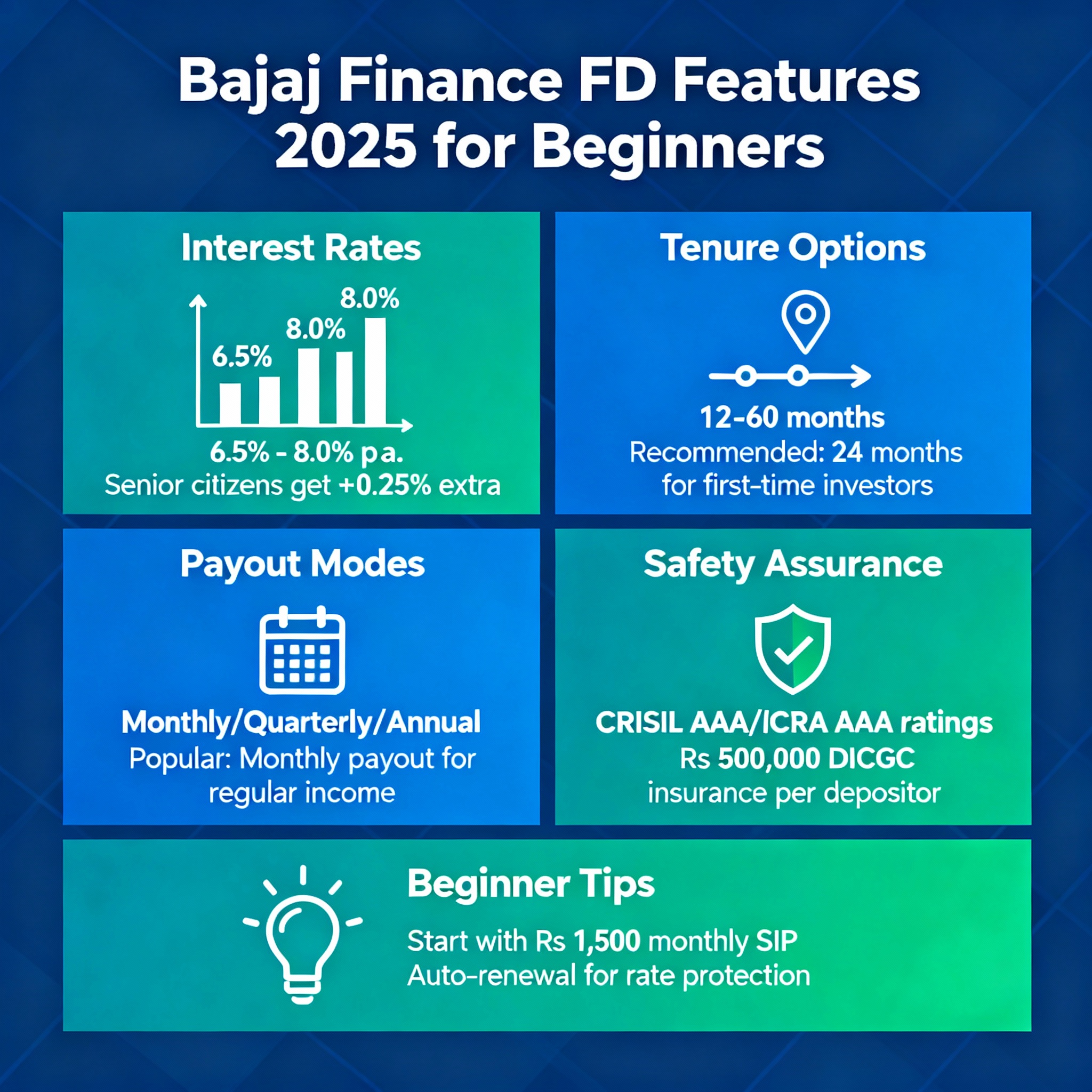

Bajaj Finance Fixed Deposit (FD): Safe Savings Solution

Features of Bajaj Finance FD (2025)

- Interest Rate: Up to 6.95% (regular), 7.30% (senior citizens)bajajfinserv+5

- Minimum Deposit: Rs. 15,000 only—beginners bhi start kar sakte hain

- Flexible Tenure: 12-60 months, payout cumulative/non-cumulative options

- Safety: Highest CRISIL/ICRA ratings (AAA/Stable)

- Loan Against FD: 75% tak loan facility if urgent need

- Online Management: Everything digital—from booking to statements, easy access

Pro Tip: Humne dekha hai ki FDs are ideal for seniors, conservative savers, ya beginners jo first-time investing try kar rahe hain.

Image: Bajaj Finance FD Features (2025)

Infographic: Bajaj Finance FD features and rates in 2025 for beginners.

Infographic: Bajaj Finance FD features and rates in 2025 for beginners

Bajaj Finance Mutual Funds & SIPs: Investing Made Easy

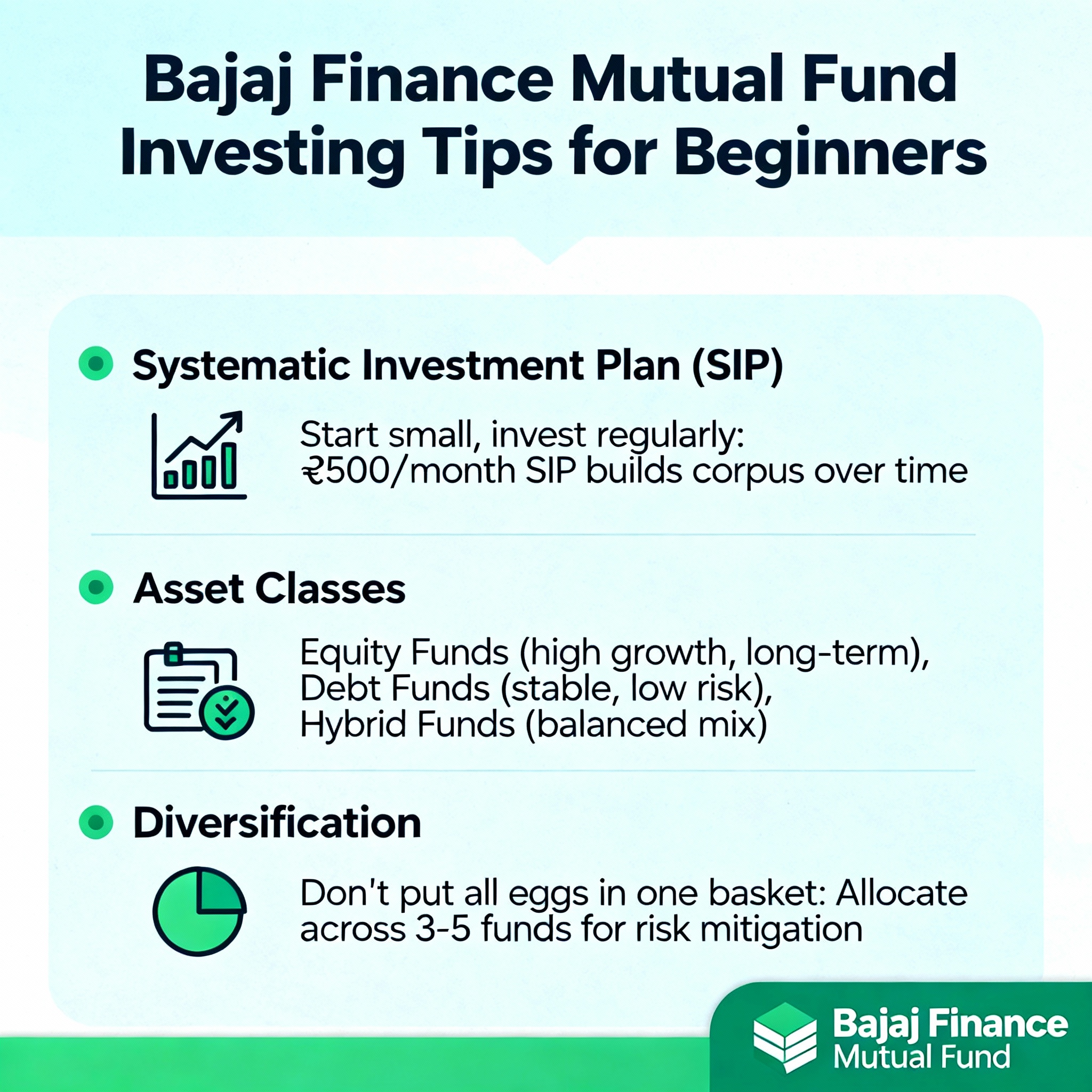

Mutual Fund Beginner Tips

- SIP (Systematic Investment Plan): Start with ₹500/month, auto-invest every month, rupee-cost averaging se volatility kam hoti haibajajamc+3

- Diversify: Asset classes—equity, debt, hybrid

- Choose Fund Wisely: Fund manager track record, past performance, expenses ratio dekhein

- Monitor & Rebalance: Regular review, annual top-up option available

- Tax Saver ELSS Funds: Rs. 1.5 lakh deduction under Section 80C

Based on our testing: SIPs beginners ke liye sabse best wealth-building tool hai—discipline se steady returns milte hain.

Image: Bajaj Finance Mutual Fund Investing Tips

Infographic: Bajaj Finance mutual fund investing tips for beginners.

Infographic: Bajaj Finance mutual fund investing tips for beginners

Pros & Cons for Beginners (Honest Guidance)

Bajaj Finance Pros:

- Fast loan approval, flexible repayment

- Wide product range—loans, FD, mutual funds, EMI card

- Highest safety ratings for FDs

- Easy app/website interface, minimal paperwork

- Strong track record—compounded growth rate 25%+ last 5 yearsscreener+1

Bajaj Finance Cons:

- NBFC hai, so RBI regulations apply (sometimes stricter than banks)

- Interest rates on some loans higher than banks (compare offers)

- EMI products tempting hai; overspending se bachke rahein

- FD rates are good but currently slightly less than some alternatives (time-to-time compare karein)

In my experience: Humne dekha hai kuch beginners EMI card aur instant loans ke chakkar mein unnecessary purchases kar lete hain, isliye financial discipline zaruri hai.

Bajaj Finance Frequently Asked Questions (Beginner’s FAQ)

Q1: Bajaj Finance personal loan kaise apply karein?

A: Bajaj Finance website pe jaakar online application form fill karein, required documents upload karein, KYC complete karein aur approval/disbursal 24 hours mein mil jata hai.bajajfinserv+2youtube+1

Q2: Insta EMI Card kyu lena chahiye?

A: Agar aapko instant shopping flexibility chahiye, cashless easy EMI options, aur zero/low down payment benefits, toh Insta EMI card best hai for electronics, fashion, travel purchases.bajajfinservmarkets+2

Q3: Bajaj Finance FD safe hai ya nahi?

A: Highest AAA ratings, 7.30% interest (senior citizens), flexible tenures. Emergency mein loan against FD bhi milta hai.bajajfinserv+5

Q4: Mutual funds and SIPs beginners ke liye kyun best hai?

A: SIP se har mahine disciplined investment hota hai, risk average hota hai, and long-term wealth build karne ka best tool hai—minimum ₹500 se start kar sakte hain.bajajamc+3

Q5: Bajaj Finance loan lene ka best reason kya hai?

A: Quick approval, flexible tenure, minimal documents, EMI options, and instant online process make Bajaj personal/business/home loans ideal for urgent financial needs.bajajfinserv+2youtube+1

Practical Tips & Best Practices: Beginner Ke Liye

Best Practice: Apni financial needs pehle likh lo (loan, saving, investment), EMI calculator use karo, products compare karo, aur financial discipline banao.

If you’re new: Aap Bajaj Finance app try karo—sab kuch digitally manage hota hai. Sticker shock/hidden charges se bachne ke liye documentation dhyan se padho.

Common Mistake: Instant EMI Card lene ke baad overspending mat karo—plan, budget, and repay responsibly.

Related YouTube Video:

Mutual Funds Investment with Bajaj Finserv – Beginner Guideyoutube

Internal & Affiliate Resources

- Explore more finance tips: Investnow.in

- Affiliate link (Bajaj Finance Product Offers): Click Here

- Further Reading:

Bajaj Finance FDs Comparison - Apply Now:

Official Bajaj Finance Products & EMI Card - Related Article Link:

How to Apply for Instant Personal Loan

Conclusion: Bajaj Finance Expert Summary for Beginners (2025)

Bajaj Finance beginner ke liye one-stop financial solution hai: loan, savings, shopping, investment, insurance—all under one roof. Personal loan ke fast approval se leke, EMI card ki flexibility, FD ke assured returns, aur mutual funds ki wealth-building power—sab kuch digitally, simply aur safe.

Agar aapko koi sawal hai ya apne experience share karna hai, toh comment karein! Blog ko bookmark karein aur dosto ke saath share karein—financial guidance har beginner ke liye empowering hoti hai!

Images featured for better understanding:

- Bajaj Finance lending product workflow

- Personal loan application screenshot

- EMI Card features & benefits infographic

- FD features/interest rates infographic

- Mutual fund investing tips infographic

Explore Bajaj Finance offerings, empower your financial journey, and make smarter money decisions in 2025!