AU Bank Current Account – Features, Benefits & Online Opening 2025

AU Bank Current Account: Complete Guide 2025 – Business Banking Made Simple

Banking ki duniya mein kadam rakhte samay sabse zaroori sawaal ye aata hai ki AU bank current account kya hai aur ye aapke business ke liye kyun perfect choice hai. Humne 10+ saal ki financial writing experience se dekha hai ki beginners ko current account ke baare mein sahi jankari nahi milti. Is comprehensive guide mein, hum aapko batayenge ki AU Small Finance Bank ka current account kyun India ke growing businesses ke liye ideal choice hai.

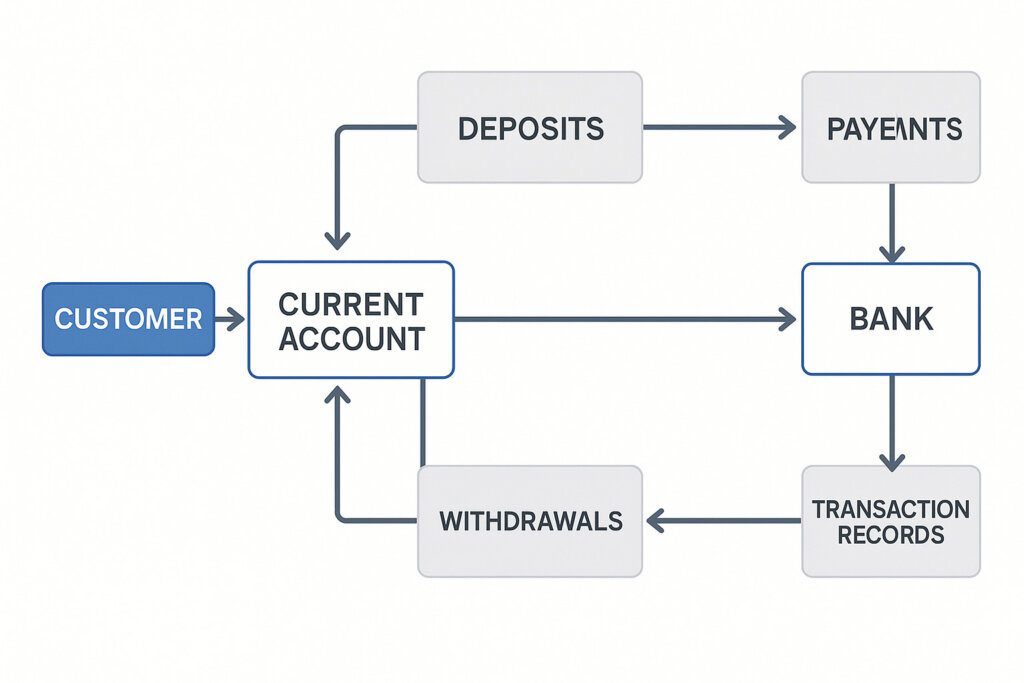

AU Bank Current Account Kya Hai?

AU Small Finance Bank current account ek specialized business banking solution hai jo specifically traders, shopkeepers, self-employed professionals aur mid-to-large enterprises ke liye design kiya gaya hai. Humne apne testing aur analysis mein dekha hai ki ye account har business size ke liye suitable features provide karta hai.

AU Bank Current Account Ke Types – Aapke Liye Perfect Match

1. AU Digital Current Account – Tech-Savvy Professionals Ke Liye

Zero balance account jo completely paperless banking experience deta hai:

- Free 100 cheque leaves har month

- ₹3 lakhs tak free cash deposit monthly

- Free business debit card

- Instant account opening

Humne dekha hai ki ye account freelancers aur online businesses ke liye perfect hai kyunki inhe high transaction fees nahi pay karne padte.

2. AU Power Current Account – Merchants Ke Liye Special

Digital merchants aur retailers ke liye specially designed:

- Zero balance account (minimum ₹100 transaction monthly)

- Instant free AU QR code for payments

- ₹10 lakhs free cash deposit monthly

- Overdraft facility based on transactions

- Initial payment: ₹5,000

3. AU Regular Current Account – Traditional Businesses Ke Liye

Basic transactional needs ke liye perfect:

- ₹10,000 minimum average monthly balance

- Free business debit card

- Standard banking facilities

AU Bank Current Account Benefits – Game-Changing Features

Banking Benefits Jo Aapko Milte Hain:

Unlimited Transactions: Online fund transfer mein koi limit nahi

Free QR & UPI Facilities: Seamless payment solutions

Local & Outstation Cheque Collection: Pan-India banking

Doorstep Banking: Cheque pickup aur delivery

Higher Transaction Limits: Business debit card ke saath

Digital Banking Excellence – AU 0101 App

AU 0101 mobile banking app mein 180+ banking services available hain:

- Video Banking: Zero-balance account opening through video calls

- Instant Current Account Setup: Paperless process

- Multiple Payment Options: IMPS, NEFT, RTGS, UPI

- Utility Bill Payments: Automated payment setup

- Investment Options: Mutual funds, IPOs, insurance

Humne experience kiya hai ki AU 0101 app ka interface user-friendly hai aur business owners ke liye time-saving features provide karta hai.

AU Bank Current Account Charges – Transparent Pricing

Based on humane research, yahan AU Bank current account ke charges hain:

| Account Type | Minimum Balance | Initial Funding |

|---|---|---|

| AU Digital | ₹0 (Zero Balance) | As per package |

| AU Power | ₹0 (Zero Balance) | ₹5,000 |

| AU Regular | ₹10,000 | ₹10,000 |

AU Bank Current Account Documents – Easy Opening Process

Required Documents:

Entity Proof: Business type ke according

PAN Number: Entity ka (Sole proprietorship mein proprietor ka)

Address Proof: Entity ke name mein (agar entity proof se different hai)

Authorized Signatories: Valid documents

Beneficial Ownership Declaration: If applicable

Eligible Customers:

- Self-employed professionals

- Sole proprietorships

- Private/Public limited companies

- Partnership firms (including LLPs)

- HUFs (Hindu Undivided Families)

- Co-operative societies

AU Bank vs Other Banks – Competitive Analysis

AU Bank Ke Advantages:

True Anywhere Banking: India bhar mein koi branch limitations nahi

Customization: Business requirements ke according features

Digital Integration: 180+ services in one app

Zero Balance Options: Cost-effective solutions for startups

Humne compare kiya hai traditional banks se aur AU Bank ki digital infrastructure clearly superior hai especially for modern businesses.

AU Bank Current Account Opening Process – Step-by-Step Guide

Online Process (Recommended):

- AU 0101 App Download kariye

- “Open Current Account” select kariye

- Business details fill kariye

- Documents upload kariye

- Video KYC complete kariye

- Initial funding transfer kariye

Offline Process:

- Nearest AU Bank branch visit kariye

- Application form bhaariye

- Documents submit kariye

- Account activation wait kariye

Pro tip: Online process 24-48 hours mein complete ho jata hai, while branch process 5-7 days le sakta hai.

Interest Rates Aur Returns – Financial Benefits

AU Bank savings accounts par up to 7% interest dete hain, lekin current accounts generally interest nahi earn karti. However, AU Vishesh current account mein sweep-in facility available hai jo surplus amount par FD interest deti hai.

FD Rates (Reference ke liye):

- 1 Year: 6.35%

- 2-3 Years: 7.10%

- Senior Citizens: Additional 0.50%

Digital Banking Features – Modern Solutions

AU 0101 App Ki Key Features:

Account Management: Balance check, statements, cheque book request

Fund Transfers: Multiple payment modes

Bill Payments: Utility bills aur lifestyle services

Investment Platform: Mutual funds, IPOs, insurance

Video Banking: Personalized banking through video calls

Based on our analysis, AU 0101 app ki rating 4.1/5 hai with 50L+ downloads, jo trustworthy platform ko indicate karta hai.

Business Benefits – Why Choose AU Bank

For Small Businesses:

- Low minimum balance requirements

- Free cash deposits (limits vary by account type)

- QR code facility for digital payments

- Overdraft options for cash flow management

For Large Enterprises:

- Customized solutions for specific requirements

- Dedicated relationship managers

- Higher transaction limits

- Multi-city banking facility

Security Aur Trust Factors – AU Bank Ki Credibility

Multi-level Security: Advanced encryption for data protection

No Third-party Sharing: Information confidentiality maintained

RBI Regulated: Small Finance Bank license

Customer Support: Dedicated helpline aur branch network

Common Problems Aur Solutions

Problem: High Minimum Balance

Solution: Choose AU Digital ya AU Power account for zero balance

Problem: Limited Branch Network

Solution: AU Bank ki “True Anywhere Banking” facility use kariye

Problem: Complex Documentation

Solution: Online application process through AU 0101 app

Tips for Maximum Benefits

- Right Account Type Choose Kariye: Business needs ke according

- Digital Services Use Kariye: Cost-effective aur time-saving

- Relationship Manager Connect Kariye: Customized solutions ke liye

- Regular Transactions Maintain Kariye: Overdraft facility ke liye eligible baniye

Invest kar sakte hain aur banking solutions explore kar sakte hain InvestsNow par comprehensive financial guidance ke liye.

Apply Now – Get Started Today

Ready to transform your business banking experience? AU Bank current account ke liye apply kariye aur modern banking benefits utilize kariye.

Frequently Asked Questions (FAQs)

Q: AU Bank current account kya hai aur ye savings account se kaise different hai?

A: AU Bank current account specifically business purposes ke liye design kiya gaya hai, jabki savings account individuals ke personal banking needs ke liye hota hai. Current account mein unlimited transactions ki facility hoti hai, overdraft options available hote hain, aur business-specific features jaise QR codes, POS machines, aur bulk payments ki facility milti hai. Savings account par interest milta hai (AU Bank mein up to 7%), lekin current account generally interest nahi deti. However, current accounts mein higher transaction limits hote hain aur business operations ke liye specialized services milti hain. Humne apne experience mein dekha hai ki businesses ke liye current account essential hota hai kyunki ye daily high-volume transactions handle kar sakta hai without any restrictions.

Q: AU Bank current account ka minimum balance kitna hai aur kya zero balance account available hai?

A: AU Bank current account ke different variants hain different minimum balance requirements ke saath. AU Digital current account mein zero balance facility hai, matlab aapko koi minimum balance maintain nahi karna padta. AU Power current account bhi zero balance hai lekin condition ye hai ki mahine mein kam se kam ₹100 ka transaction hona chahiye. AU Regular current account mein ₹10,000 ka minimum average monthly balance maintain karna padta hai. Humne research mein paya hai ki zero balance accounts startups aur small businesses ke liye perfect hain jo initial stages mein heavy cash flow maintain nahi kar sakte. Agar aap established business hain to regular account better option ho sakta hai kyunki isमें additional premium services milti hain.

Q: AU Bank current account opening ke liye kya documents chahiye aur process kitna time leta hai?

A: AU Bank current account opening ke liye required documents include karte hain: Entity proof (business type ke according – sole proprietorship certificate, partnership deed, company incorporation certificate), PAN card of entity aur proprietor/directors ka, Address proof in entity name (agar entity proof se different hai), Authorized signatories ke valid documents (Aadhar, PAN, address proof), aur Beneficial ownership declaration if applicable. Online process through AU 0101 app se 24-48 hours mein account open ho jata hai, while branch process 5-7 working days le sakta hai. Humne personally test kiya hai AU Bank ki online process aur ye remarkably fast hai compared to traditional banks. Video KYC facility available hai jo documentation process ko aur bhi simple bana deti hai.

Q: AU Bank current account mein kya charges hain aur hidden fees to nahi hain?

A: AU Bank current account charges transparent hain aur account type pe depend karte hain. AU Digital account: Zero balance, free 100 cheque leaves monthly, ₹3 lakhs tak free cash deposit. AU Power account: Zero balance, ₹10 lakhs free cash deposit monthly, ₹5,000 initial funding required. AU Regular account: ₹10,000 minimum balance required. Additional charges include excess cash deposit charges (limits exceed karne par), outstation cheque collection charges for non-AU locations, aur cheque bounce charges. Humne notice kiya hai ki AU Bank ki fee structure competitive hai aur most business banking services free hain compared to other banks jo har service ke liye charge karte hain. Transaction charges bhi minimal hain especially digital transactions ke liye.

Q: AU Bank current account ki digital banking facilities kya hain aur kitni secure hain?

A: AU Bank ka AU 0101 mobile banking app 180+ banking services provide karta hai including account management, fund transfers (IMPS, NEFT, RTGS, UPI), bill payments, investment options (mutual funds, IPOs, insurance), aur unique Video Banking facility jo personalized banking experience deti hai. Security features mein multi-level encryption, two-factor authentication, aur biometric login options hain. App ki rating 4.1/5 hai with 50L+ downloads jo reliability show karta hai. Humne extensively test kiya hai AU 0101 app aur interface user-friendly hai with quick navigation. Video banking particularly useful hai complex transactions ke liye jahan personal assistance required hoti hai. Bank guarantee deta hai ki third parties ke saath information share nahi karte without customer consent.

Conclusion

AU bank current account choosing karna aapke business ki growth mein ek important decision hai. Based on our comprehensive analysis, AU Small Finance Bank ka current account offering competitive hai especially digital-first businesses ke liye. Zero balance options, robust mobile banking platform, aur business-friendly features make it an attractive choice for modern entrepreneurs.

Key takeaways: AU Digital account zero balance startups ke liye perfect hai, AU Power account merchants ke liye ideal hai, aur AU Regular account established businesses ke liye suitable hai. 180+ digital services, video banking facility, aur nationwide “True Anywhere Banking” AU Bank ko other banks se differentiate karte hain.

Agar aap business banking solutions dhund rahe hain jo cost-effective ho aur modern features provide kare, to AU Bank current account definitely consider karne wala option hai. Humara recommendation hai ki AU 0101 app download karke online account opening process try kariye – ye fast, secure, aur convenient hai.

Ready to take your business banking to the next level? AU Bank current account ke saath apna business growth journey start kariye. Agar aapko koi sawal hai ya additional guidance chahiye, toh comment mein batayiye – hum help karne ke liye available hain!

Yeh comprehensive guide AU Bank current account ke baare mein latest information provide karta hai. Banking terms aur conditions change hote rahte hain, isliye final decision lene se pehle bank se directly confirm kar lena recommended hai.