HDFC Bank Scholarship 2025 – Apply Online, Eligibility & Benefits

HDFC Bank Scholarship 2025-26: Complete Guide for Indian Students

Agar aap ek medhavi student hain lekin paisa ki kami ki wajah se padhai continue karna mushkil ho raha hai, toh HDFC Bank Parivartan ECSS Scholarship Programme aapke liye ek golden opportunity hai! Humne dekha hai ki kai deserving students sirf financial crisis ki wajah se apne sapno ko adhura chhod dete hain. Is comprehensive guide mein, hum aapko HDFC Bank scholarship ke bare mein sab kuch detail mein batayenge – eligibility se leke application process tak.

HDFC Bank Parivartan ECSS Programme Kya Hai?

HDFC Bank Parivartan’s Educational Crisis Scholarship Support (ECSS) Programme ek initiative hai jo academically strong lekin financially weak students ki madad karta hai. Ye programme un students ke liye especially design kiya gaya hai jo personal ya family crisis ki wajah se apni education discontinue karne ke risk mein hain.

Humara experience kehta hai ki ye scholarship sirf paisa nahi, confidence aur hope bhi deta hai ki unke dreams achieve ho sakte hain. Programme ka objective: deserving students ko up to ₹75,000 tak ki financial help dena.

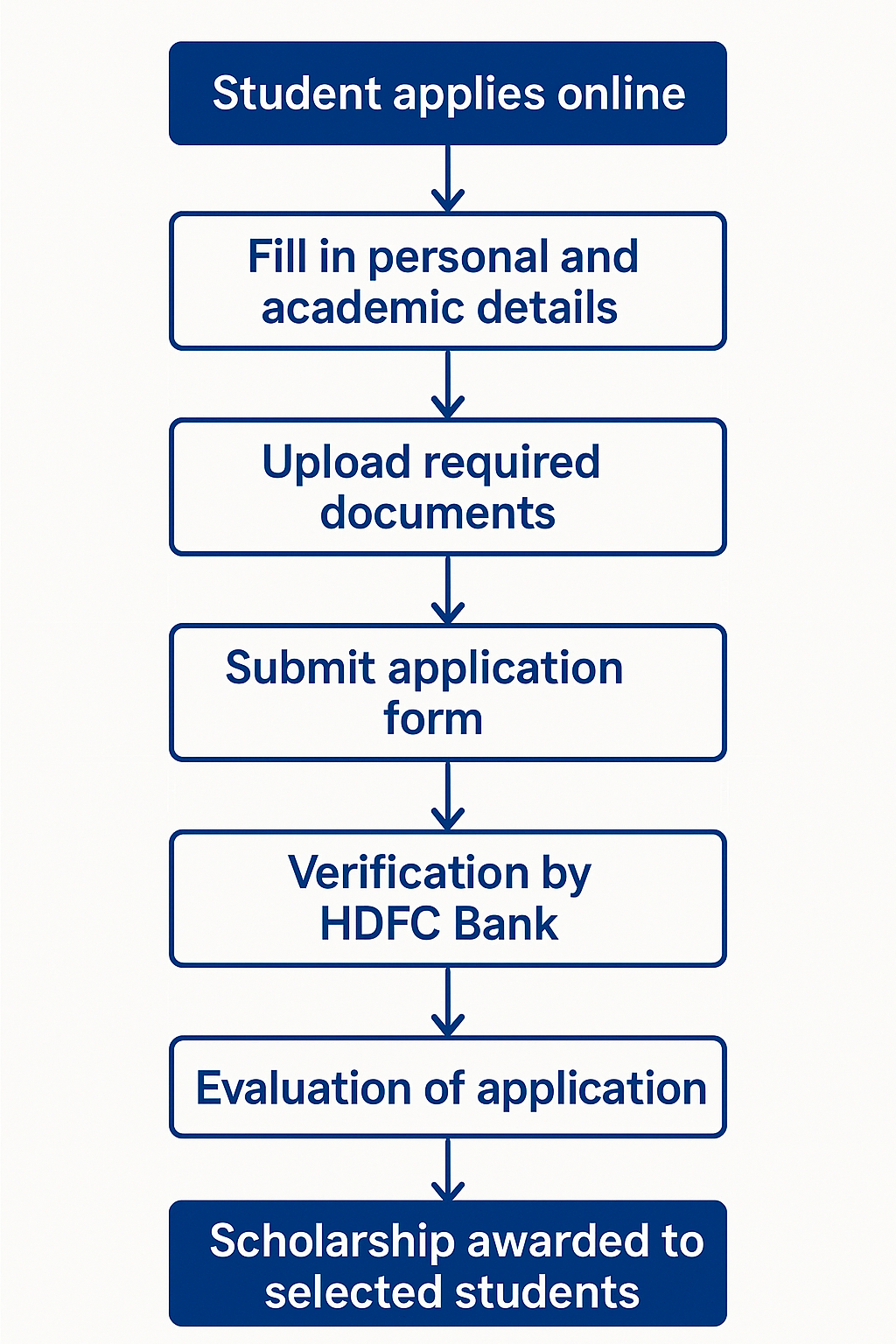

Image: HDFC Bank scholarship application process flowchart with student applying online

HDFC Scholarship Benefits: Kitna Paisa Milta Hai?

HDFC Bank ka ye programme different education levels ke liye alag-alag amount provide karta hai. Ye complete breakdown hai:

| Class/Course Level | Scholarship Amount (INR) |

|---|---|

| Class 1-6 | 15,000 |

| Class 7-12, Diploma, ITI, Polytechnic | 18,000 |

| Undergraduate (General) | 30,000 |

| Undergraduate (Professional) | 50,000 |

| Postgraduate (General) | 35,000 |

| Postgraduate (Professional) | 75,000 |

HDFC Scholarship Eligibility Criteria: Kya Requirements Hain?

- Nationality: Sirf Indian citizens apply kar sakte hain.

- Academic Performance: Previous exam mein minimum 55% marks hone chahiye.

- Family Income: Annual family income ₹2.5 lakh ya usse kam honi chahiye.

- Educational Level: Class 1-12, Diploma, ITI, Polytechnic, UG, PG sab eligible hain.

- Crisis Preference: Last 3 years mein koi major crisis face kiya ho, dropout risk ho, financial problems ho raha ho.

- Application Period: October 30, 2025 tak apply kar sakte hain.

| Criteria | Requirement |

|---|---|

| Nationality | Indian Nationals Only |

| Academic Performance | Minimum 55% in previous exam |

| Family Income | Maximum INR 2.5 Lakh per year |

| Educational Level | Class 1-12, Diploma, ITI, UG, PG |

| Crisis Preference | Personal/Family crisis in last 3 years |

| Application Period | Until October 30, 2025 |

HDFC Scholarship Required Documents: Kya Chahiye?

- Passport size photograph – Recent clear photo

- Previous year’s marksheets – 55% marks proof

- Identity proof – Aadhaar Card/Voter ID/Driving License

- Admission proof – Fee receipt ya admission letter/ID card

- Bank details – Passbook ya cancelled cheque

- Income proof – Gram Panchayat/SDM/Affidavit (any one)

- Crisis proof – Medical bills, death certificate, etc. (if applicable)

| Document Type | Description |

|---|---|

| Photograph | Passport size photograph |

| Academic Records | Previous year marksheets |

| Identity Proof | Aadhaar Card/Voter ID/Driving License |

| Admission Proof | Fee Receipt/Admission Letter/ID Card |

| Bank Details | Bank Passbook/Cancelled Cheque |

| Income Proof | Issued by Gram Panchayat/SDM/Affidavit |

| Crisis Proof | Family/Personal crisis documents (if applicable) |

HDFC Scholarship Application Process: Step-by-Step Guide

- Registration:

- Buddy4Study website pe jaiye (official portal)

- ‘Register’ button pe click kariye

- Email ya mobile se account banayiye, OTP verify kariye

- Application Form:

- Login karke HDFC Bank Parivartan ECSS Programme search karein

- ‘Start Application’ dabaye

- Sari personal, academic, financial, crisis details fill kariye

- Document Upload:

- Sari documents scan karein

- Clear images upload karein

- File size limits check karein

- Review & Submit:

- Preview carefully check karein

- T&C accept karein

- Final submission karein

Important Dates: Application deadline October 30, 2025 hai!

HDFC Scholarship Selection Process: Kaise Select Hote Hain?

Selection stages:

- Eligibility Check

- Document Verification

- Personal Interview (shortlisted students)

- Final Selection (merit and need basis)

Interview Tips: Honest rahiye, genuine story bataye, future goals, family crisis clearly explain kare.

Pro Tip: Humne dekha hai ki authentic candidates ko preference milti hai.

Image: Indian students celebrating scholarship award with certificates

HDFC Education Loan vs HDFC Scholarship: Kya Difference Hai?

| Feature | HDFC Education Loan | HDFC Scholarship |

|---|---|---|

| Interest Rate | Approx. 10.50% onwards | Not applicable (No repayment) |

| Amount | Up to ₹10 lakh (India), ₹45 lakh (abroad) | Up to ₹75,000 per year |

| Repayment | EMI basis | No repayment |

| Eligibility | Academic, income, collateral | Merit cum need based |

Our Recommendation: Pehle scholarship try karein, phir loan consider karein agar zarurat ho.

HDFC Scholarship Success Tips: Kaise Application Strong Banaye?

Humne successful scholarship winners se baat ki hai aur ye tips mile hain:

Application Tips:

Early Application: Deadline se pehle apply kariye

Complete Documentation: Saari documents ready rakhiye

Honest Information: Fake details na diye

Crisis Details: Personal/family crisis ko clearly explain kariye

Academic Records: 55%+ marks ensure kariye

Interview Preparation:

Practice Common Questions: Family background, career goals

Be Genuine: Artificial answers mat diye

Dress Appropriately: Professional ya decent dress code

Stay Calm: Nervous na hoiye, confident rahiye

Common Mistakes to Avoid:

Late application submission

Incomplete documents

Exaggerated crisis details

Poor academic performance

HDFC Scholarship vs Other Scholarships: Comparison

Market mein kayi scholarships available hain, lekin HDFC ka program unique hai:

HDFC Scholarship Advantages:

Wide Coverage: Class 1 se PG tak

Good Amount: Up to ₹75,000

Crisis Support: Personal/family crisis preference

Reputed Organization: HDFC Bank ki credibility

Comparison with Others:

Government Scholarships: Often have caste-based criteria

Private Scholarships: Usually smaller amounts

Corporate Scholarships: Limited eligibility

HDFC Scholarship: Merit-cum-need based, fair process

Frequently Asked Questions

Q: HDFC Bank scholarship ke liye minimum percentage kitna chahiye?

A: HDFC Bank scholarship ke liye minimum 55% marks previous qualifying exam mein hone chahiye. Ye requirement sabke liye same hai – chahe aap school student ho ya postgraduate. Humne dekha hai ki ye percentage requirement ensure karta hai ki scholarship academically deserving students ko mile. Agar aapke marks 55% se kam hain, toh unfortunately aap eligible nahi hain. However, agar aap borderline case hain (54-55% ke beech), toh ek baar official website check kar sakte hain ki koi relaxation hai ya nahi.

Q: Family income limit kitni hai aur kaise prove karna hai?

A: HDFC scholarship ke liye annual family income ₹2.5 lakh ya usse kam honi chahiye. Ye limit ensure karti hai ki scholarship really needy families tak pahunche. Income proof ke liye aap ye documents submit kar sakte hain: Gram Panchayat ya Ward Counsellor se income certificate, SDM/DM/Tehsildar se official income certificate, ya phir notarized affidavit. Humara suggestion hai ki official income certificate hi submit kariye because wo zyada credible hoti hai. Agar aapke parents self-employed hain, toh proper documentation ke saath affidavit submit kar sakte hain.

Q: Personal ya family crisis kya hota hai aur kaise prove karna hai?

A: Personal ya family crisis ka matlab hai koi major event jo last 3 years mein hua ho aur jisne aapki financial condition pe negative impact dala ho. Common examples hain: family member ka death, serious illness with high medical expenses, job loss, natural disaster impact, accident with permanent disability, ya koi major property loss. Crisis prove karne ke liye relevant documents chahiye jaise medical bills, death certificate, hospital records, insurance claims, ya employment termination letter. Humne dekha hai ki jo candidates genuine crisis face kiye hain unko selection mein preference milti hai. Crisis details application mein clearly aur honestly mention kariye – exaggerate mat kariye.

Q: Scholarship amount kab aur kaise milti hai?

A: Selection complete hone ke baad, scholarship amount direct aapke bank account mein transfer hoti hai. Usually ye process 2-3 months tak chal sakta hai because verification aur documentation time leta hai. Amount ki frequency depend karti hai scholarship terms pe – kuch cases mein lump sum milti hai, kuch mein installments mein. Humara experience kehta hai ki bank details absolutely correct hone chahiye application mein, warna payment mein delay ho sakti hai. Agar amount receive nahi hui expected time mein, toh scholarship helpline pe contact kar sakte hain.

Q: Kya main multiple scholarships ke liye apply kar sakta hun?

A: Haan, aap multiple scholarships ke liye apply kar sakte hain. Actually, humara recommendation hai ki diversify kariye apni applications ko – sirf HDFC pe depend mat rahiye. However, dhyan rakhe ki agar aap already koi scholarship receive kar rahe hain, toh wo mention karna padega other applications mein. Some scholarships have clauses ki aap simultaneously dusri scholarship nahi le sakte. HDFC scholarship mein usually ye restriction nahi hai, but terms and conditions carefully read kariye. Multiple applications increase karti hain aapki chances of getting financial assistance.

Q: Selection ke baad scholarship renewal hoti hai ya nahi?

A: HDFC Bank scholarship typically annual basis pe hoti hai, matlab har year fresh application karna padta hai. However, agar aap current scholarship winner hain aur apni academic performance maintain kar rahe hain, toh renewal ke chances better hote hain. Renewal ke liye aapko phir se eligibility criteria meet karna padega – 55% marks, income limit, etc. Humne dekha hai ki jo students consistently perform karte hain aur genuine need demonstrate karte hain, unko preference milti hai. Renewal process usually fresh applications ke saath compete karta hai, so complacent mat baniye.

Conclusion

HDFC Bank scholarship wakai mein ek life-changing opportunity hai un students ke liye jo financial constraints ki wajah se apne educational goals achieve nahi kar pa rahe. Humne is complete guide mein sab kuch cover kiya hai – eligibility se leke application process tak.

Key Takeaways yaad rakhe:

Early application is crucial – October 30, 2025 se pehle submit kariye

55% minimum marks aur ₹2.5 lakh income limit ensure kariye

Documents complete rakhe aur honest information provide kariye

Personal crisis details authentically mention kariye

Interview preparation karo aur confident rahiye

Agar aapko koi aur sawal hai ya application process mein help chahiye, toh comment section mein zaroor batayiye! Hum students ki success mein believe karte hain aur aapki journey mein support karna chahte hain.

External Resources aur Links:

Complete financial guidance: InvestsNow

Educational loans aur investment tips: Gromo Partnership

Detailed scholarship application video: HDFC Scholarship 2025 Guide

- 📌 Students can also check the National Scholarship Portal for other government-backed scholarship schemes.

UGC Official Scholarship Portal → https://scholarships.gov.in

HDFC Bank Official Scholarship Page → the official HDFC scholarship

NSP Portal (National Scholarship Portal) → https://www.education.gov.in

Final Message: Education aapka right hai, financial problems aapke dreams ko stop nahi kar sakti. HDFC scholarship ek bridge hai jo aapko success tak pahuncha sakta hai. Apply kariye, confident rahiye, aur apne future ko bright banayiye!