Edelweiss Demat Account Review – Best Features, Charges & Benefits (2025)

Edelweiss Demat Account: Beginners ke Liye Complete Guide (2025)

- Step-by-step Edelweiss Demat Account opening process

- Updated charges, AMC, brokerage & hidden fees breakdown [6][8]

- Real examples, tips, aur humne dekha hai moments

- Pros-cons, competitor comparison, best practices

- 5+ detailed FAQs

- Handy images / infographics for quick recall

Disclosure: Post mein affiliate link hai. Agar aap link se signup karte hain to hume chhota commission milta hai—aapko extra cost nahin lagta.

Edelweiss Demat Account Kya Hai?

Edelweiss ek SEBI-registered full-service broker hai jo BSE, NSE & MCX par trading access deta hai [22]. Demat account ka matlab hota hai aapke shares electronically hold karna, bilkul bank account jaise but stocks ke liye.

Key Features (2025 Edition)

- Zero Account Opening Fee — online form bharo, OTP verify karo, bas[5][6].

- Free AMC First Year, ₹300 (Lite) ya ₹500 (Elite) from second year onwards [6][8].

- Flat ₹10 per trade Lite Plan brokerage [6]. Elite Plan advanced traders ke liye 0.03% intraday, 0.30% delivery [11].

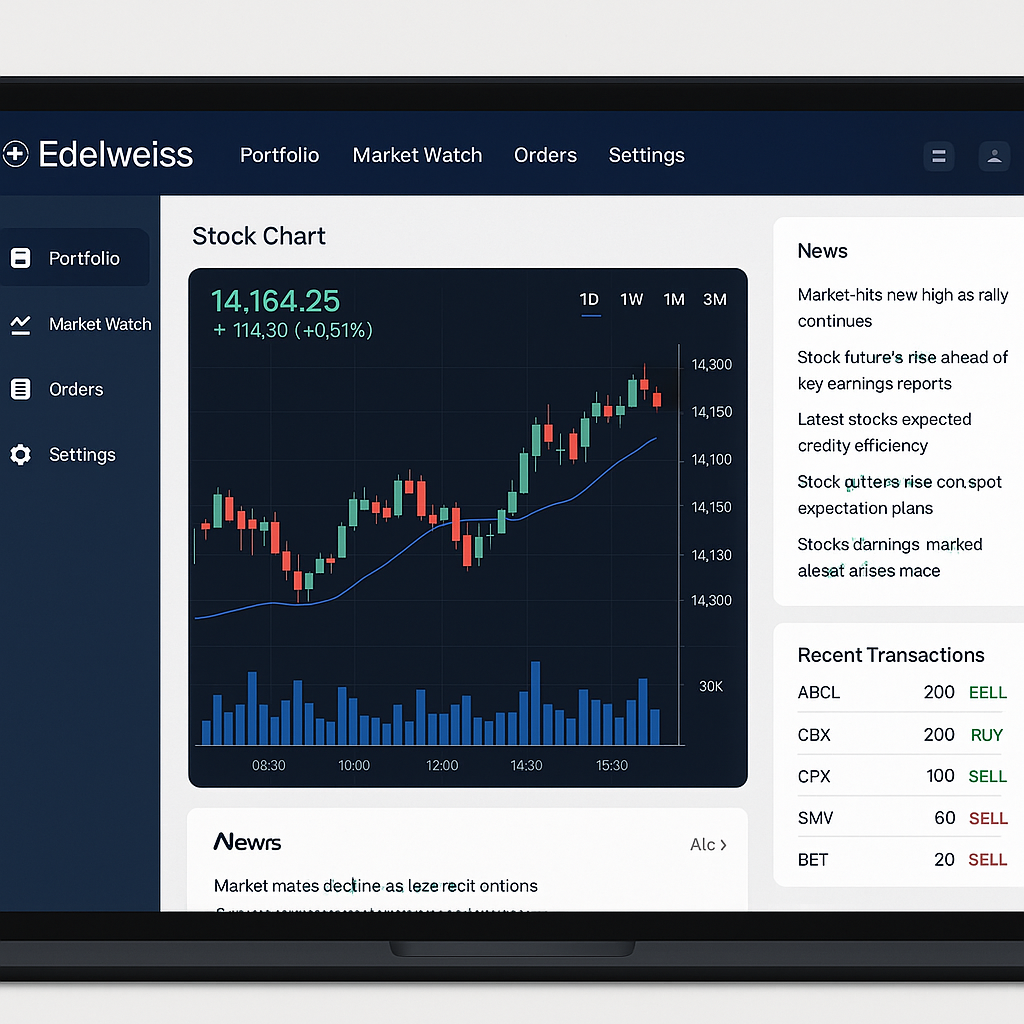

- Mobile Trader App rating 4.6/5 on app store — live data, 17+ technical indicators [17].

- Desktop TX3 Terminal for pro charting & seasonality analytics [16].

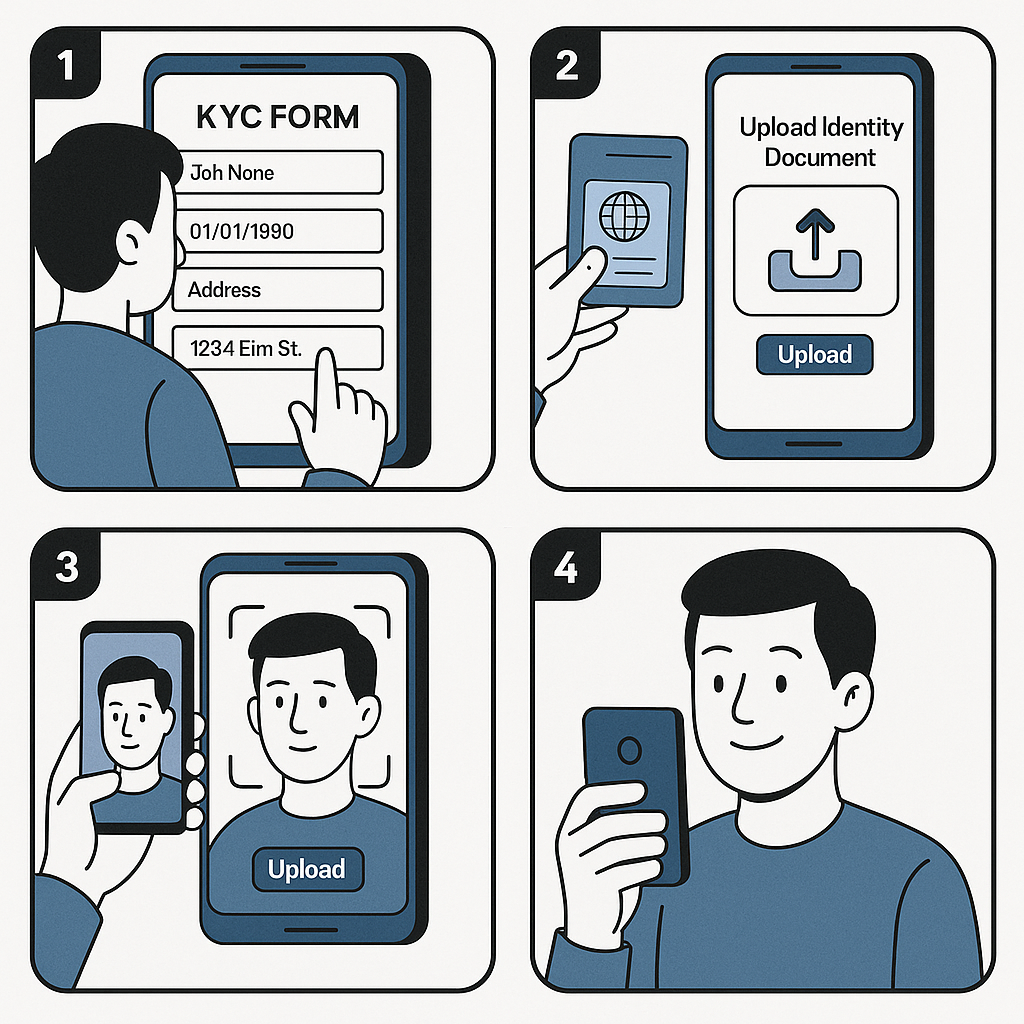

Edelweiss Demat Account Opening Process (step-by-step)

- Eligibility & Documents: Indian resident/NRI, PAN, Aadhaar, cancelled cheque, signature, photo.

- Online Application: Click official signup link, mobile + email OTP verification.

- Profile Form: Personal, bank & nominee details fill karo.

- KYC Upload: PAN & Aadhaar PDF/image upload, live selfie.

- eSign & IPV: Aadhaar-based eSign plus 5-second selfie video for in-person verification.

- Plan Choose: Lite (₹10/Order) ya Elite (0.03%).

- Account Activation: 24-48 hours ke andar login creds SMS & email[9][12].

Charges & Fees Breakdown (2025)

| Charge Type | Lite Plan | Elite Plan |

|---|---|---|

| Account Opening | ₹0 (online) [5][6] | |

| Annual Maintenance (Year 1) | ₹0 — Free [6] | |

| AMC (Year 2 onwards) | ₹300 + GST [6] | ₹500 + GST [8] |

| Equity Delivery Brokerage | Flat ₹10/order [6] | 0.30% [11] |

| Equity Intraday Brokerage | Flat ₹10/order [6] | 0.03% [11] |

| DP Charges (Sell) | ₹13.5 per ISIN (+GST) [8] | |

Pros & Cons (Real Talk)

| Pros | Cons |

|---|---|

| • Free account opening & first-year AMC • Flat ₹10 trades keep cost predictable • Strong research desk, daily market notes • 475+ offline branches for in-person help [22] | • AMC rises after Year 1 (₹300/₹500) • Call-and-Trade extra ₹20/call [27] • Elite Plan brokerage higher for small tickets • No 3-in-1 bank account integration |

Best Practices & Pro Tips

- Start Small: Shuru mein ₹5-10k invest karke platform samjho.

- Diversify: Stocks + index ETFs + mutual funds.

- Use Stop-Loss: Risk ko cap karo; 1-2% capital per trade se zyada risk mat lo.

- Weekend Portfolio Review: Saturday 30 minutes allocate; unnecessary positions cut karo.

- Keep Learning: InvestSnow par free modules complete karo.

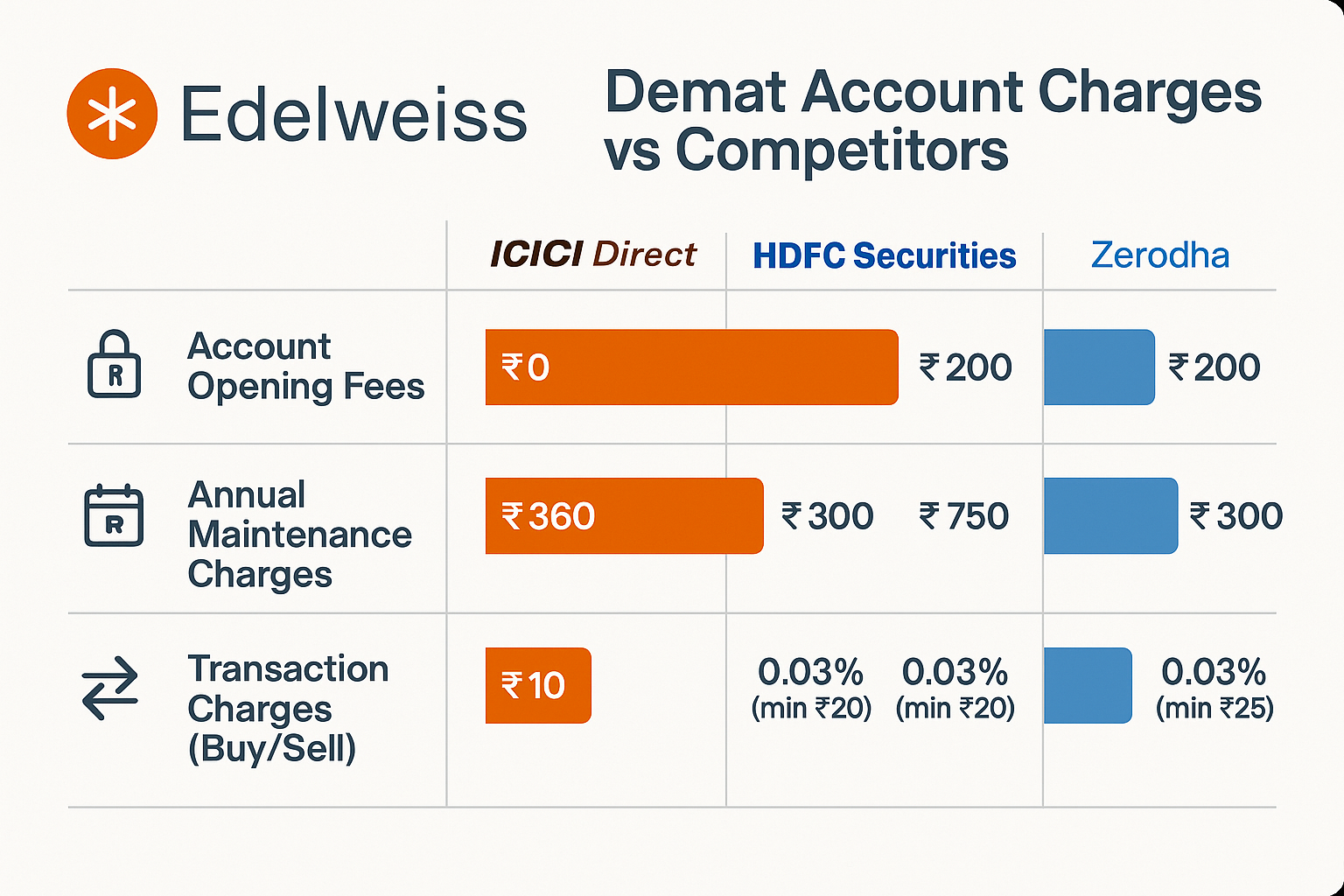

Edelweiss vs Competitors (Fee Snapshot)

| Broker | Account Opening | AMC (Year 2+) | Brokerage (Delivery) |

|---|---|---|---|

| Edelweiss Lite | ₹0 [5] | ₹300 [6] | Flat ₹10 [6] |

| Zerodha | ₹200 online [25] | ₹300 [25] | Flat ₹20 |

| Dhan | ₹0 [22] | ₹0 | Flat ₹20 |

| Upstox | ₹0 | ₹150 (waived Year 1) | Flat ₹20 |

Humne dekha hai beginners ko flat-fee structure zyada samajh aata hai. Zerodha & Upstox discount brokers hain, lekin Edelweiss extra research support deta hai jo newbies ke liye life easy banata hai.

Frequently Asked Questions

Q1: Edelweiss Demat Account activate hone mein kitna time lagta hai?

A: Online documents sahi hone par 24-48 hours ke andar account numbers email/SMS mil jaate hain [9][12]. Offline route se 3-5 working days lag sakte hain.

Q2: First-year ke baad AMC automatically deduct hota hai?

A: Haan, second financial year mein AMC ₹300 (Lite) ya ₹500 (Elite) ledger se debit hota hai [6][8]. Balance maintain karke rakho, warna negative ledger interest lag sakta hai.

Q3: Kya NRI clients bhi Edelweiss Lite Plan choose kar sakte hain?

A: Yes, NRIs from GCC, UK, Singapore, Australia, NZ eligible hain — extra PIS permission & NRI KYC docs lagenge [9]. Lite vs Elite dono available, but remittance rules alag hoten.

Q4: Mobile Trader app safe hai?

A: App SSL encrypted, biometric login + device binding use karta hai. 256-bit encryption and ISO certified backend servers [17].

Q5: Mutual funds ke liye separate demat account chahiye?

A: Nahin, Edelweiss ke through direct mutual funds purchase karne par units statement-of-account (SOA) mode mein rakh sakte ho. Stocks, bonds, ETFs demat mein dikhte hain.

Conclusion

Bottom Line: Agar aapko beginner-friendly platform chahiye jahan research, customer support & flat brokerage ek saath mile, to Edelweiss Demat Account solid choice hai. Low entry barrier, free first-year AMC, aur TX3/EMT tools se learning curve smooth ho jata hai.

Click here for instant online signup!

Koi bhi confusion ho? Neeche comments drop karo — main personally reply karunga. Happy Investing!

© 2025 • Content written in Hinglish for educational purposes. Trading/investment market risk ke saath linked hai. Please do your own research.