Ultimate Arya Vysya Loans Guide 2025: Unlock Subsidies & Low-Cost Finance!

Arya Vysya Loans: Beginner’s Guide to Community, State & Central Schemes shikshanaratna+1

Introduction

Shuruat ka sabse bada sawaal hota hai: “Community-specific loans kahan milte hain, aur subsidy/low-interest ke real options kya hain?”—aur yahaan hi kai log miss kar dete hain state corporations, NBCFDC concessional lines, ya cooperative bank routes ko.nbcfdc+1

Is guide mein practical tarike se cover hoga: AP aur Karnataka ke Arya Vysya corporations, Telangana/Andhra ke OBMMS pathways, central schemes jaise MUDRA/PMEGP/Stand-Up India, plus cooperative bank loans—taaki ek beginner confident ho kar apply kar sake.mudra+2

In my experience, jo log pehle eligibility aur documentation checklist clear kar lete hain, unka approval aur disbursal cycle significantly fast hota hai—especially jab bank-linked subsidy ya concessional lending channel partner ke through route hota hai.bhoopalapally.telangana+1

Arya Vysya loans kya hote hain?

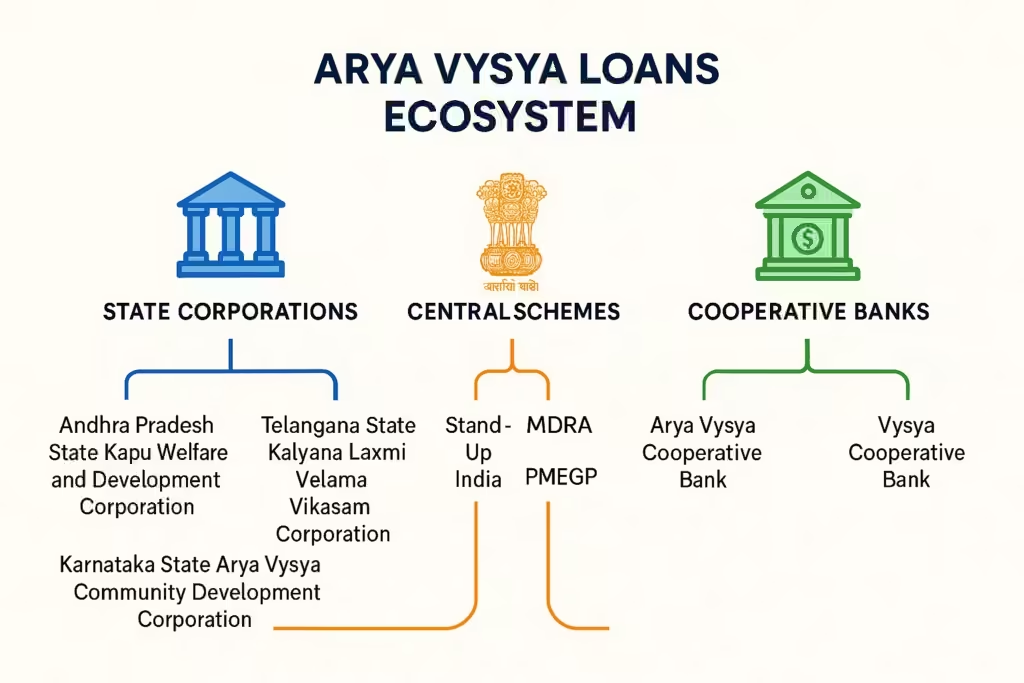

Broadly, Arya Vysya loans teen pillars par based hote hain: (1) State community development corporations (AP Arya Vysya Welfare & Development Corporation, Karnataka Arya Vysya Community Development Corporation), (2) State welfare/BC/OBMMS-linked economic support schemes, (3) Central MSME/self-employment schemes jaise PMMY (MUDRA), PMEGP, aur Stand-Up India; inke alawa cooperative banks jaise Arya Vaishya Co-Op Bank routine retail/business products bhi offer karte hain.shikshanaratna+2

Beginners ke liye sabse practical strategy hoti hai—pehle state/community channel ka eligibility tap karna (kyunki subsidy/low interest milta hai), phir central schemes ko combine karna (jaise MUDRA working capital + PMEGP subsidy), aur zarurat ho to cooperative bank se secured loan leke capital stack ko complete karna.thearyavaishyacoopbankltd+2

State corporations: AP & Karnataka

- Andhra Pradesh: Government order aur OBMMS ecosystem ke through Arya Vysya Welfare & Development Corporation exist karta hai, jiska objective self-employment/economic support schemes ko implement karna hai with subsidy-bank linkage models, jisse community entrepreneurs ko viable ticket sizes mil payen.apobmms.apcfss+1

- Karnataka: Karnataka Arya Vysya Community Development Corporation ne 2023-24 aur 2024-25 mein multiple schemes approve kiye—Self-Employment Direct Loan (approx ₹1 lakh with 4% interest + ₹20,000 subsidy), Food Truck/Commercial Vehicle scheme (up to ₹1 lakh subsidy; fabricated mobile canteen par extra subsidy), aur Jalashakti irrigation support (4% interest loan + electrification subsidy), with defined age and coverage relaxations.vaasavi+1

Image: “Workflow diagram — Apply → District/Corporation Scrutiny → Bank Sanction → Subsidy Release → Utilization & Repayment”shikshanaratna+1

Telangana/Andhra OBMMS and BC-linked pathways

Telangana aur Andhra dono mein OBMMS portals ke zariye economic support/self-employment schemes run hoti hain jahan MPDO/Municipal channels, district collectors approvals, aur bank consent process standard hota hai, isse selection transparency aur subsidy disbursal streamline hota hai.tgobmms.cgg+1

Telangana district documentation mein group activities, funding pattern (bank loan + subsidy mix), aur sector coverage (agriculture, transport, industries, business) clearly described hota hai—yeh beginners ko realistic unit cost planning aur bank tie-ups samajhne mein help karta hai.tgobmms.cgg+1

Ground reality: AP subsidy loans mein banks ne kabhi-kabhi CIBIL/credit-score basis par applications reject kiye—yeh ek practical risk hai jise application se pehle credit hygiene improve karke mitigate kiya ja sakta hai.apobmms.apcfss+1

NBCFDC concessional loans (OBC channel)

National Backward Classes Finance & Development Corporation (NBCFDC) members of Backward Classes (central/state notified) ke liye concessional lines provide karta hai up to ₹25 lakh per beneficiary, jahan channel partner ke through beneficiary rate approx 7–8% p.a. hota hai with 1% timely payment rebate provisions, subject to income ceiling up to ₹3 lakh family income.nbcfdc+1

Yeh loans income-generating activities, education finance, aur SHG pathways ke through bhi available hote hain—beginners ke liye yeh stable low-cost capital ka strong source hota hai jab state channel partners active hain.nbcfdc+1

Central schemes jo Arya Vysya applicants le sakte hain

- PMMY (MUDRA): Shishu (up to ₹50k), Kishor (₹50k–₹5 lakh), Tarun (₹5–₹10 lakh) categories, manufacturing/services/trade + allied agri activities cover, aur nationwide participating banks/NBFCs ke through simplified processing—particularly first-time micro-entrepreneurs ke liye best fit.mudra+1

- PMEGP (KVIC): Bank-driven subsidy scheme for new units with mandatory EDP training; yeh capital subsidy + loan combine karke greenfield units ko push karta hai, jisse upfront promoter margin burden kam hota hai and viability improve hoti hai.kviconline+1

- Stand-Up India: Per bank branch at least one SC/ST and one Woman borrower ke liye ₹10 lakh–₹1 crore greenfield enterprise finance with CGFSI guarantee support, 7 saal repayment aur 18 months tak ka moratorium typical—agar household mein woman entrepreneur ho to yeh powerful route banta hai.slbcgujarat+1

Image: “MUDRA vs PMEGP vs Stand-Up India — ticket size, audience, subsidy/guarantee, tenure comparison infographic”kviconline+1

Cooperative banks: Arya Vaishya Co-Op products

Arya Vaishya/Arya Vaishya-named cooperative banks local level par housing, property-mortgage, personal/security-backed, aur MSME-linked products chalate hain, jisse traders aur professionals ko community-oriented servicing mil sakti hai.codeforbanks+1

Example: Property Mortgaged Loan, Housing Loan, Personal Security Loan jaisi categories site-level/product pages par milti hain; beginner borrowers ke liye document checklist (KYC, income, property papers) ready rakhna process fast karta hai.thearyavaishyacoopbankltd+1

Eligibility snapshot (practical)

- NBCFDC: BC members notified by Centre/State; family income up to ₹3 lakh; up to ₹25 lakh ticket size with 7–8% beneficiary rates via channel partners.nbcfdc+1

- Telangana BC development group activities: Bank loan + subsidy blended model with max unit cost benchmarks aur group society eligibility structure; proposals MPDO/Municipal via bank consent.bhoopalapally.telangana+1

- Karnataka Arya Vysya CDC: Self-employment direct loans ~₹1 lakh at 4% with subsidy; vehicle/food truck scheme with enhanced subsidy; irrigation-linked loan + subsidy criteria.vaasavi+1

- Stand-Up India: SC/ST and Women borrowers for greenfield enterprise; ₹10 lakh–₹1 crore; 7 years repayment; CGFSI guarantee.bankofmaharashtra+1

- PMMY/PMEGP: MUDRA up to ₹10 lakh for micro units; PMEGP is bank-driven subsidy + EDP for new units with KVIC framework.mudra+1

Interest rate, subsidy, tenure: numbers that matter

NBCFDC beneficiary rates typical 7–8% p.a. hoti hain (depending on tranche up to ₹25 lakh) with annual timely payment rebate share, jo cost of credit ko aur neecha laata hai if on-time repayment maintained rahe.nbcfdc+1

Karnataka Arya Vysya CDC schemes mein 4% concessional interest aur defined subsidy slabs mention kiye gaye—yeh micro-entrepreneurs ke liye net EMI ko kaafi manageable banata hai.vaasavi+1

Stand-Up India ka composite loan 7 saal tak repayable with up to 18 months moratorium, aur margin/guarantee convergence options ke saath structure hota hai—greenfield growth ke liye cashflow relief deta hai.slbcgujarat+1

Documents checklist (beginner-friendly)

- ID/KYC: Aadhaar, PAN, photos—bank/MSME norms ke mutabik.codeforbanks+1

- Community/eligibility proof: Caste/BC/EBC certification where applicable (state notified list adherence), income certificate, aur portal application receipts if OBMMS route choose kiya hai.tsmesa+1

- Business docs: Project report, quotations/invoices, bank consent (for subsidy-linked), EDP/training proof where PMEGP applicable.bhoopalapally.telangana+1

Apply kaise karein (step-by-step)

- State/community routes: AP/TS OBMMS portals par registration, MPDO/Municipality route se scrutiny, district collector approval, bank consent, aur then subsidy release to mapped account—yeh flow structured hai aur timing adherence zaroori hoti hai.apobmms.apcfss+1

- NBCFDC: State channel partners ke through application; verify latest income limits, activity coverage, aur repayment norms before filing; education finance ke liye alag tenure/moratorium rules follow hote hain.nbcfdc+1

- PMMY/PMEGP/Stand-Up: PMMY ke liye participating banks/NBFCs; PMEGP guideline ke mutabik KVIC/KVIB/DIC coordination + bank sanction; Stand-Up India ke liye scheduled commercial banks aur CGFSI guarantee convergence beneficial hota hai.mudra+1

Practical examples (from field learnings)

- Agar first-time trader hai aur ₹7–10 lakh ka working capital chahiye, to MUDRA Tarun + community corporation subsidy (if available) ka combo cashflow ko stabilize karta hai, especially seasonality heavy trades mein.mudra+1

- Food service aspirants (mobile canteen/food truck) ke liye Karnataka CDC ka subsidy add-on substantially capex burden reduce karta hai; vehicle finance bank through lo aur fabrication par additional subsidy ka plan banayein.shikshanaratna+1

- AP mein subsidy loans ke liye credit score clean rakhna critical hai kyunki selection ke baad bhi bank rejection ho sakta hai—application se 60–90 din pehle credit report hygiene fix karna smarter move hota hai.newindianexpress+1

Pros and cons

- Pros: Subsidy + low interest blending se EMI light hota hai, early-stage survivability improve hoti hai, aur formal banking history build hoti hai jo aage larger tickets unlock karti hai.nbcfdc+1

- Cons: Window-driven application cycles, documentation rigor, credit-score sensitivity (bank-linked), aur portal-level selection delays practical bottlenecks ban sakte hain.newindianexpress+1

Best practices (in my experience)

- Eligibility-first approach: Pehle decide karein ki state/community route, NBCFDC, ya central scheme—kis bucket mein strongest fit banta hai; mixed approach banayein jahan feasible ho.kviconline+1

- Bank consent early: Subsidy-linked proposals mein bank consent letter aur quotations early stage par hi ready rakhein to turnaround improve hota hai.bhoopalapally.telangana+1

- Training/EDP leverage: PMEGP beneficiaries ke liye EDP requirement ko advantage banaayein—yeh project management aur lender confidence dono uplift karta hai.kviconline+1

Compliance and classification nuance

Telangana/Andhra mein BC/EBC classification lists time-to-time update hoti rehti hain; isliye latest state list aur portal notifications cross-check karna zaroori hota hai before relying on any caste-based eligibility, kyunki eligibility direct sanction probability ko impact karti hai.tsmesa+1

Anecdotally, Telangana mein BC development programmes group activity and funding patterns clearly define karte hain, jabki Andhra ne multi-corporation subsidy loans ko OBMMS se streamline kiya hai—including separate corporations like Arya Vysya as referenced in government orders.gad.ap+1

Historical context: Vysya banking legacy

ING Vysya Bank ka Kotak Mahindra Bank ke saath merger 2015 mein complete hua, jisse private banking footprint consolidate hua—yeh legacy isliye relevant hai kyunki Vysya trade-finance culture historically strong rahi hai aur aaj bhi cooperative/SME servicing ecosystems mein dikhti hai.asianbankingandfinance+1

Is context ko samajhna beginners ko help karta hai ki community networks, cooperative banks, aur MSME lines ek dusre ko complement karke affordable capital stack banate hain.thearyavaishyacoopbankltd+1

Quick comparison table

- NBCFDC: Up to ₹25 lakh, 7–8% beneficiary rates, income cap up to ₹3 lakh, channel partner via state.nbcfdc+1

- PMMY: Up to ₹10 lakh (Shishu/Kishor/Tarun), micro units ke liye simple use-cases.mudra+1

- PMEGP: Bank-driven subsidy + mandatory EDP for new units; KVIC framework.kviconline+1

- Stand-Up India: ₹10 lakh–₹1 crore for SC/ST/Women, CGFSI guarantee, 7-year tenure + moratorium.bankofmaharashtra+1

- State CDC (Karnataka): 4% interest + targeted subsidies for self-employment/vehicles/irrigation.vaasavi+1

- Cooperative Banks: Housing/PML/Personal products; local documentation norms apply.codeforbanks+1

Agar aap naya hai, toh aise shuru karein

- Step 1: Business idea ko MUDRA/PMEGP eligibility se map karein; agar woman/SC/ST in household hai to Stand-Up India explore karein.slbcgujarat+1

- Step 2: State/community window check karein—AP/Karnataka Arya Vysya corporations ya TS/AP OBMMS ke notification cycles track karein.tgobmms.cgg+1

- Step 3: Project report, quotations, income/community proofs, bank consent ready karein; PMEGP ke liye EDP slots confirm karein.kviconline+1

- Step 4: Credit report hygiene improve karein (old dues close/settle); bank interview ke liye cashflow narrative tayyar rakhein.newindianexpress+1

Image: “Document checklist visual — ID/KYC, Income/Community proofs, Bank consent, Project report, EDP certificate”bhoopalapally.telangana+1

Common mistakes to avoid

- Sirf subsidy dekhna aur bank consent/document strength ignore karna; isse rejection risk badhta hai even after shortlist.newindianexpress+1

- Wrong scheme-product match: Working capital need ko PMEGP jaisi capex-heavy subsidy se solve karna aur WC ke liye MUDRA na lena.mudra+1

- Latest classification/government order cross-check na karna aur outdated list par rely karke application file kar dena.tsmesa+1

External Resources

For more detailed information on loans and financial planning, visit InvestsNow for comprehensive guides and expert advice.

If you’re ready to explore loan options, check out specialized financial products through this affiliate link for personalized assistance.

Frequently Asked Questions

Q: Kya Arya Vysya ke liye dedicated state corporations exist karte hain?gad.ap

A: Haan, Andhra Pradesh mein “A.P State Arya Vysya Welfare and Development Corporation” government order references ke saath operate karta hai, jabki Karnataka mein “Karnataka Arya Vysya Community Development Corporation” ne 2023-24 aur 2024-25 action plans approve kiye hain with self-employment, vehicle/food truck, aur irrigation-linked concessional schemes.shikshanaratna+1

Q: Telangana/Andhra mein apply route kya hota hai—aur selection kaise hoti hai?apobmms.apcfss

A: OBMMS portals par online application hoti hai, jahan MPDO/Municipality se proposals forward hote hain, district approval milta hai, aur bank consent ke baad subsidy release hoti hai; selection transparency improve karne ke liye grama sabha/district workflows documented hote hain.apobmms.apcfss+1

Q: NBCFDC se individual loan kaise milta hai—interest kitna lagega?nbcfdc

A: NBCFDC BC members (income up to ₹3 lakh family) ko channel partners ke through up to ₹25 lakh concessional loans deta hai; beneficiary rate generally 7–8% p.a. hota hai with timely payment rebate framework, aur education finance ke liye longer tenure/moratorium options milte hain.nbcfdc+1

Q: MUDRA (PMMY) aur PMEGP mein difference kya hai—beginner ke liye kaunsa better?mudra

A: PMMY micro units ke liye working capital/asset-light needs ko cover karta hai up to ₹10 lakh across Shishu/Kishor/Tarun, jabki PMEGP ek bank-driven subsidy scheme hai for new units with EDP requirement—agar capital subsidy chahiye aur greenfield capex plan hai to PMEGP useful, varna day-one cashflow ke liye MUDRA zyada nimble hota hai.kviconline+1

Q: Stand-Up India se loan lene ke liye kya criteria hai aur tenure kya milega?slbcgujarat

A: Stand-Up India SC/ST aur Women borrowers ke liye greenfield enterprise finance deta hai ₹10 lakh–₹1 crore ke range mein, CGFSI guarantee support ke saath, 7 saal repayment aur up to 18 months moratorium typical structure hota hai—yeh women-led businesses ke liye especially beneficial hai.bankofmaharashtra+1

Q: Cooperative banks (jaise Arya Vaishya Co-Op) se kis type ke loans mil sakte hain?thearyavaishyacoopbankltd

A: Cooperative banks routine housing, property mortgage, personal/security-backed aur MSME-oriented advances dete hain; product eligibility/document checklist (KYC, income, property docs) follow karke swiftly process karwana possible hota hai.codeforbanks+1

Q: AP subsidy loans mein rejection ka risk kyun aata hai aur kaise avoid karein?newindianexpress

A: Practical challenge hota hai bank stage par CIBIL/credit score sensitivity, jisse shortlist ke baad bhi rejection ho sakta hai; isliye application se pehle credit report clean-up, existing dues settlement, aur income proofs alignment karna crucial hota hai.apobmms.apcfss+1

Q: Telangana mein BC-linked schemes ke liye funding pattern/group activity kaise kaam karta hai?bhoopalapally.telangana

A: District documentation ke mutabik max unit cost caps, 50:50 bank loan-subsidy blending for societies, aur sector coverage (agri, transport, industries, business) define hote hain—proposals bank consent ke sath MPDO/Municipal channel se forward kiye jaate hain.tgobmms.cgg+1

Q: Kya Arya Vysya classification har state mein same hoti hai?tsmesa

A: Nahi, state-wise BC/EBC lists update hoti rehti hain aur community/category placement differ kar sakta hai; isliye latest state notifications aur official lists validate karna necessary hai before applying on caste-based eligibility.telangana+1

Q: ING Vysya Bank ka merger ka Arya Vysya financing se kya lena-dena?ing

A: Merger historical context dikhata hai ki Vysya banking/commerce ecosystem historically strong raha hai; aaj ke time mein cooperative banks aur MSME schemes us legacy ko community level par practical finance access mein translate karte hain.ing+1

Conclusion

Bottom line: Arya Vysya loans ke liye three-pronged approach best kaam karta hai—state/community corporations (AP/Karnataka) for subsidy/concessional lines, BC/OBMMS workflows (TS/AP) for structured support, aur central MSME schemes (MUDRA/PMEGP/Stand-Up) for scalable, nationwide access; cooperative banks ko complementary channel ke roop mein use karein.gad.ap+1

Beginners ko pehle eligibility + documents perfect karne chahiye, phir right product-scheme match choose karna chahiye—jaise working capital ke liye MUDRA, greenfield capex ke liye PMEGP, aur woman-led ventures ke liye Stand-Up India—taaki repayment aur growth dono predictable rahe.kviconline+1

Genuine call-to-action: Specific city/state context aur business idea share karke scheme shortlist banana chahte hain to details ready rakhein—hum ek custom roadmap bana denge with exact steps, docs, aur timeline recommendations, jisse approval odds real mein improve ho sakein.nbcfdc+1

Image: “Call-to-action banner — ‘Get your loan-ready file: Eligibility map + Docs kit + Bank consent checklist’”bhoopalapally.telangana+1

Note: Is guide mein secondary keyword variations naturally include kiye gaye—jaise “Arya Vysya Corporation loans”, “NBCFDC concessional loans”, “BC corporation Telangana loans”, “MUDRA loan for Vysya entrepreneurs”, “PMEGP subsidy for new units”—sirf clarity aur search intent capture ke liye, bina stuffing ke.mudra+1

Agar koi sawal ho ya personalized checklist chahiye, comment karke poochhein—response mein exact scheme fit, subsidy/interest math, aur application sequence mil jayega taaki next 30–60 din mein file bank-ready ho sake.kviconline+1

Key takeaways highlights:

- Community + State + Central blending se lowest effective cost aur strongest approval odds milte hain.shikshanaratna+1

- PMMY/PMEGP/Stand-Up ko use-case wise match karein for smart capital stacking.slbcgujarat+1

- OBMMS/NBCFDC channels aur cooperative banks ko parallel tracks ki tarah plan karein for timing hedges.thearyavaishyacoopbankltd+1

![Cooperative Bank Personal Loan: Eligibility, Interest Rate, Process [2025] 5 Cooperative Bank Personal Loan: Eligibility, Interest Rate, Process [2025]](https://www.investsnow.in/wp-content/uploads/2025/09/generated-image-19-1.avif)