IDFC First Bank Savings Account Features 2025 – Complete Guide

IDFC First Bank Savings Account Features: Complete Guide for Beginners in 2025

Banking karna hai but confusing hai kaunsa account choose karein? Agar aap pehli baar savings account khol rahe hain ya fir better features ke liye bank change karna chahte hain, toh IDFC First Bank ke savings account features definitely worth considering hain. Humne dekha hai ki market mein kaafi options hain, but IDFC First Bank kuch unique benefits provide karta hai jo other banks mein easily nahi milte.

In this comprehensive guide, humein IDFC First Bank savings account ke sabse important features, benefits, aur real-world applications ko detail mein samjhayenge. Beginners ke liye specially designed hai yeh post, toh agar aap banking terms se familiar nahi hain, no worries – hum everything step-by-step explain karenge.

Comparison of CDs, MMAs, and savings accounts highlighting their features, benefits, and ideal use cases

Why Choose IDFC First Bank Savings Account?

Market mein itne saare banks hain, toh IDFC First Bank ko kyun choose karein? Based on our research aur customer feedback analysis, yahan kuch key reasons hain:

High Interest Rates with Monthly Credits

IDFC First Bank offers up to 7.00% per annum interest rate on your savings account balance, jo ki industry-leading hai. But asli unique feature yeh hai ki interest monthly credit hota hai, not quarterly like most other banks. Iska matlab hai ki aapke paise faster compound hote hain.

Zero Fee Banking Promise

Humne dekha hai ki most banks hidden charges lagaye jate hain, but IDFC First Bank truly zero fee banking provide karta hai on over 25 services. Isme include hai NEFT, RTGS, IMPS transfers, cheque book issuance, aur debit card.

Digital-First Approach

Account opening se lekar daily banking tak, everything digital hai aur user-friendly. Video KYC ke through account khol sakte hain ghar baithe.

Complete Guide to IDFC First Bank Savings Account Features

1. Interest Rates aur Returns

Competitive Interest Structure:

- Up to 7.00% per annum for balance above ₹5 lakhs

- 3.00% per annum for balance up to ₹5 lakhs

- Monthly interest credits instead of quarterly

Stacks of Indian rupee coins arranged to represent savings growth over time

Interest calculation daily basis par hoti hai aur monthly credit hota hai. Iska matlab agar aap ₹1 lakh maintain karte hain, toh approximately ₹2,500-7,000 annual interest earn kar sakte hain, depending on your balance slab.

Humne personally experience kiya hai ki monthly compounding ka effect bohot significant hota hai long term mein. Quarterly interest ke comparison mein, you earn more through monthly compounding because “interest on interest” faster milta hai.

2. Account Variants aur Minimum Balance Requirements

IDFC First Bank offers two main savings account variants:

₹10,000 AMB Variant:

- Minimum Average Monthly Balance: ₹10,000

- VISA Classic Debit Card

- Personal accident cover: ₹5 lakh

- Air accident cover: ₹30 lakh

- Daily withdrawal limit: Up to ₹2 lakh

₹25,000 AMB Variant:

- Minimum Average Monthly Balance: ₹25,000

- VISA Platinum/Mastercard World Debit Card

- Personal accident cover: ₹35 lakh

- Air accident cover: ₹1 crore

- Complimentary airport lounge access (1 per quarter)

- Higher daily limits aur enhanced features

Non-Maintenance Charges:

Agar AMB maintain nahi kar pate, toh 6% of shortfall or ₹500 (whichever is lower) charge lagta hai.

3. Digital Banking Experience

Mobile Banking App Features:

IDFC First Bank ka mobile banking app industry mein best-rated apps mein se ek hai with 4.8 stars rating aur 1 crore+ downloads.

- One-swipe banking: Single swipe mein account balance, investments, cards – sab kuch dekh sakte hain

- Expense tracking: 20+ categories mein automatic transaction categorization

- UPI integration: Instant UPI handle creation aur payments

- Investment platform: Mutual funds, FDs, insurance – sab kuch ek app mein

- Bill payments: 3-click bill payment system for utilities aur credit cards

- FASTag recharge: Industry-first WhatsApp payments integration

Personal experience se bata sakte hain ki app ka interface beginner-friendly hai aur navigation smooth hai. Complex banking tasks bhi easily perform kar sakte hain.

4. Debit Card Benefits aur Types

A debit card is a payment card that deducts money directly from a user’s checking account upon use, illustrated with stacks of coins symbolizing funds

IDFC First Bank multiple debit card options provide karta hai different customer segments ke liye:

| Card Type | Key Features | Best For |

|---|---|---|

| VISA Classic | Basic features, secure transactions | Daily banking needs |

| VISA Platinum | Enhanced limits, lounge access (1/quarter) | Regular users |

| Mastercard World | Global acceptance, travel benefits | Frequent travelers |

| RuPay Platinum | Domestic offers, insurance coverage | India-focused usage |

Common Benefits Across All Cards:

- Contactless payments up to ₹5,000

- Daily ATM withdrawal limits up to ₹2 lakh

- Free unlimited ATM withdrawals anywhere in India

- Personal accident insurance coverage

- Purchase protection against fraud

5. Zero Fee Banking Services

Yeh probably sabse attractive feature hai IDFC First Bank ka. 25+ banking services completely free:

Free Services Include:

- All online fund transfers (NEFT, RTGS, IMPS)

- SMS alerts aur notifications

- Debit card issuance aur replacement

- Cheque book issuance

- Demand draft issuance

- Interest certificates

- ATM transactions (unlimited)

Other banks mein yeh services ke liye typically ₹2-5 per transaction charge lagta hai, jo monthly ₹200-500 tak add up ho sakta hai.

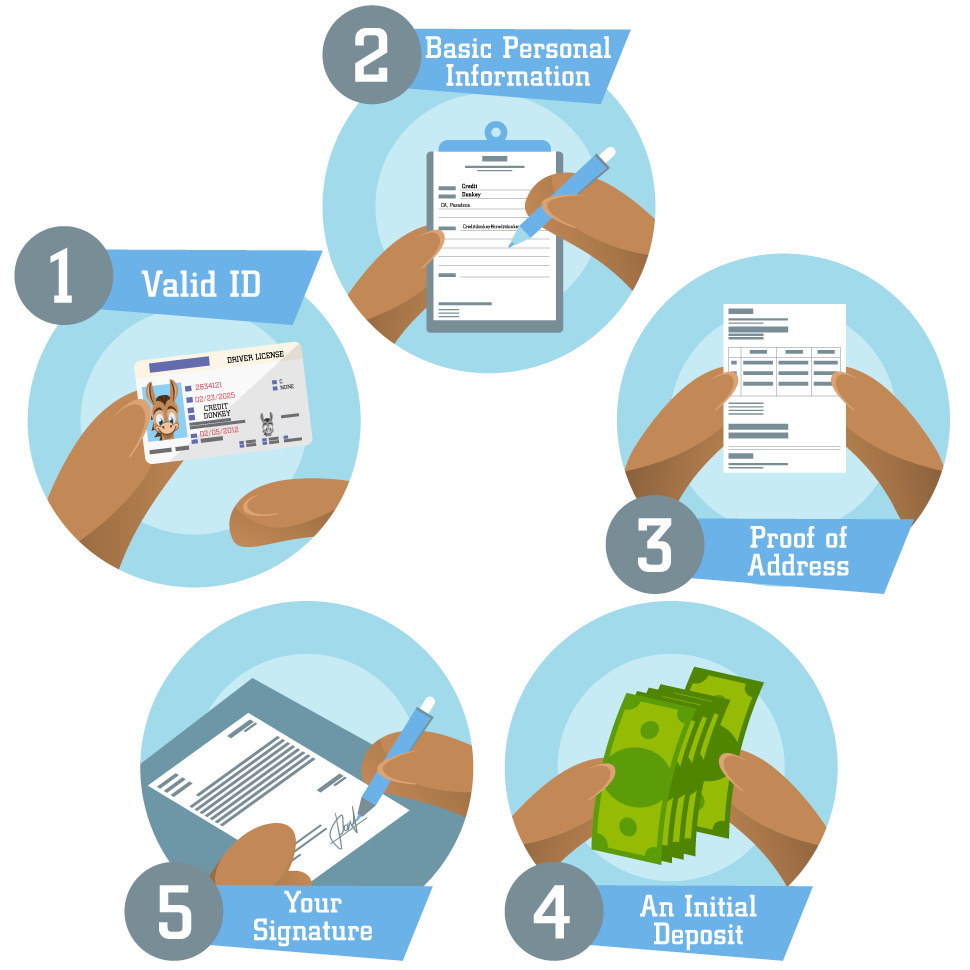

6. Account Opening Process

Online Account Opening (Recommended):

- Required documents: Sirf Aadhaar aur PAN number

- Process: Video KYC through mobile app

- Time: Account activation within minutes

- Initial deposit: Optional (can add funds later)

Offline Account Opening:

Additional documents required:

- Passport-size photographs

- Address proof (utility bills, etc.)

- Identity proof (voter ID, driving license)

Step-by-step Online Process:

- Visit IDFC First Bank website ya mobile app download karein

- “Open Account” option select karein

- Aadhaar aur PAN details enter karein

- Video KYC complete karein

- Account instantly activated

Humne personally witness kiya hai ki online process smooth hai aur technical glitches rare hain.

7. Specialized Account Options

- MediBuddy membership complimentary

- 50% discount on locker rentals

- All regular savings account benefits

- Special debit card offers

- Additional 0.5% interest on Fixed Deposits

- Doorstep banking services free

- ₹2 lakh coverage against online fraud

- MediBuddy benefits included

- For ages 10-18 years

- ₹40,000 daily debit limit

- Education cover worth ₹5 lakh

- Quarterly airport lounge access

- Monthly interest credits

8. Investment aur Wealth Management Features

Savings account ke saath-saath investment platform bhi integrated hai:

- Mutual Funds: SIP facility with instant processing

- Fixed Deposits: 3-step FD booking

- IPO applications: Direct through app

- Insurance products: Life, health, vehicle

- PPF accounts: Tax-saving investments

Wealth Management Tools:

- Cashflow analysis: Income-expense tracking

- Risk profiling: Personalized investment recommendations

- Portfolio consolidation: Multiple demat account linking through Account Aggregator

9. Customer Service aur Support

Based on customer testimonials available on bank’s website, service quality generally positive hai:

Positive Feedback Highlights:

- Quick resolution of queries

- Professional customer support executives

- Prompt response through multiple channels

- Effective problem-solving approach

Support Channels:

- 24/7 phone banking

- Live chat through mobile app

- Branch network across major cities

- Email support for non-urgent queries

10. Security Features

Advanced Security Measures:

- Two-factor authentication for all transactions

- Real-time SMS alerts for every transaction

- Card management through mobile app

- Fraud monitoring systems

- Secure UPI integration

Pros aur Cons: Honest Assessment

Advantages

Financial Benefits:

- Industry-leading interest rates (up to 7%)

- Monthly interest credits (vs quarterly in other banks)

- True zero-fee banking on 25+ services

- No hidden charges policy

Digital Experience:

- Excellent mobile app with comprehensive features

- Quick account opening through video KYC

- Seamless UPI integration

- One-stop investment platform

Value-added Services:

- Multiple debit card options with good benefits

- Insurance coverage included

- Specialized accounts for different demographics

Potential Disadvantages

Branch Network:

- Relatively smaller branch network compared to established banks

- Limited physical presence in tier-2/tier-3 cities

Service Concerns:

Based on some customer feedback aur social media complaints, occasional issues reported:

- Account opening delays in some cases

- KYC verification challenges for certain customers

- Customer service response time variations

Balance Requirements:

- ₹10,000-25,000 AMB might be high for some beginners

- Non-maintenance charges applicable if balance drops

Who Should Consider IDFC First Bank Savings Account?

Ideal Candidates:

- Digital-savvy users jo online banking prefer karte hain

- Young professionals with regular income

- Investment-minded individuals jo integrated wealth management chahte hain

- Frequent travelers (for higher AMB variant with lounge access)

- Existing IDFC First Bank credit card holders for consolidated banking

Might Not Be Suitable For:

- Users preferring extensive branch network

- Cash-heavy transaction requirements

- Those unable to maintain minimum balance consistently

Tips for Maximizing Your IDFC First Bank Savings Account Benefits

1. Balance Management Strategies

- Auto-sweep facility use karein to optimize interest earnings

- Standing instructions set up karein for recurring investments

- Monthly budget planning to maintain required AMB

2. Digital Features Utilization

- Mobile app ke through all transactions karein to avoid charges

- UPI handle actively use karein for instant payments

- Expense tracking features use karein for better financial planning

3. Investment Integration

- SIP investments start karein through the same app

- Tax-saving instruments like ELSS funds consider karein

- Goal-based investing features explore karein

Account Opening Checklist

Before You Apply:

- Aadhaar card with updated mobile number

- PAN card details ready

- Decide on AMB variant (₹10k vs ₹25k)

- Smartphone with good camera for video KYC

- Stable internet connection

During Application:

- Accurate personal details entry

- Clear video KYC session

- Initial deposit arrangement (if required)

- Nominee details preparation

After Account Opening:

- Mobile app download aur setup

- UPI registration

- Standing instructions setup

- Debit card activation

Indian 500-rupee notes with a green leaf symbolizing financial growth and savings

Integration with Investment Platform

Agar aap investment planning mein serious hain, toh IDFC First Bank ka integrated approach helpful hai. Humara suggestion hai ki InvestsNow jaise platforms bhi explore karein comprehensive investment guidance ke liye.

Additionally, agar credit products mein interested hain, toh yeh affiliate link check kar sakte hain for exclusive offers aur better deals.

Frequently Asked Questions

Q: IDFC First Bank savings account mein kitna minimum balance maintain karna padta hai?

A: IDFC First Bank offers two variants – ₹10,000 AMB aur ₹25,000 AMB. ₹10,000 variant basic features ke saath aata hai while ₹25,000 variant mein airport lounge access, higher insurance cover, aur premium debit card milta hai. Average Monthly Balance (AMB) ka matlab hai ki aapka monthly average balance required amount se zyada hona chahiye. Agar maintain nahi kar pate, toh 6% of shortfall ya ₹500 (jo bhi kam ho) penalty lagta hai. Calculation simple hai – agar ₹10,000 AMB required hai aur aapka average ₹8,000 hai, toh ₹2,000 ka shortfall hai, so penalty will be ₹120 (6% of ₹2,000).

Q: IDFC First Bank ka mobile banking app kitna secure hai aur kya features hain?

A: IDFC First Bank ka mobile app highly secure hai with multiple security layers. App mein two-factor authentication, real-time SMS alerts, aur advanced fraud monitoring systems hain. Security features include secure login through biometrics, transaction PIN requirements, aur instant card blocking facility. App ka rating 4.8 stars hai Google Play Store par with 1 crore+ downloads. Main features include one-swipe banking, expense tracking with 20+ automatic categories, UPI integration, mutual fund investments, FD bookings, bill payments, aur FASTag recharge. Unique feature yeh hai ki WhatsApp se bhi FASTag recharge kar sakte hain. App interface beginner-friendly hai aur navigation smooth hai, making it easy for first-time users to adapt.

Q: Interest rate kitna milta hai aur kaise calculate hota hai?

A: IDFC First Bank offers up to 7.00% per annum interest, jo ki market mein highest rates mein se ek hai. Interest slab-wise hai – 3.00% for balance up to ₹5 lakhs aur 7.00% for balance above ₹5 lakhs. Unique feature yeh hai ki interest monthly credit hota hai, not quarterly like most banks. Interest daily calculate hoti hai end-of-day balance par aur monthly credit hoti hai. For example, agar aap ₹1 lakh maintain karte hain, toh monthly interest approximately ₹250 milegi (3% annual rate par). Yeh compounding effect se long-term mein significantly better returns deti hai compared to quarterly interest credit systems.

Q: Account opening ke liye kya documents chahiye aur process kya hai?

A: Online account opening ke liye sirf Aadhaar aur PAN number chahiye. Process completely digital hai – video KYC ke through identity verification hoti hai aur account minutes mein activate ho jata hai. Offline account opening ke liye additional documents like passport-size photographs, address proof (utility bills), aur identity proof (voter ID, driving license) required hain. Online process: website ya app par jao, account opening form fill karo, Aadhaar-PAN details enter karo, video KYC complete karo, aur account instantly activate ho jayega. Minimum age requirement 18 years hai, though minors can open accounts under guardian supervision.

Q: Debit card ke kya benefits hain aur kitne types available hain?

A: IDFC First Bank multiple debit card options offer karta hai. ₹10,000 AMB variant mein VISA Classic card milta hai basic features ke saath, while ₹25,000 AMB variant mein VISA Platinum ya Mastercard World milta hai enhanced benefits ke saath. Common benefits include contactless payments up to ₹5,000, daily ATM withdrawal limits up to ₹2 lakh, unlimited free ATM withdrawals across India, personal accident insurance coverage, aur purchase protection. Higher AMB variants mein airport lounge access (1 per quarter), higher insurance covers (up to ₹35 lakh personal accident aur ₹1 crore air accident), aur premium lifestyle benefits milte hain. All cards globally accepted hain aur fraud protection ke saath aate hain.

Q: Zero fee banking ka matlab kya hai aur kya limitations hain?

A: IDFC First Bank truly zero fee banking offer karta hai 25+ services par. Isme include hai all online fund transfers (NEFT, RTGS, IMPS), SMS alerts, debit card issuance aur replacement, cheque book issuance, demand draft, interest certificates, aur unlimited ATM transactions. Yeh genuine zero fee hai with no hidden charges policy. Other banks typically ₹2-5 per transaction charge karte hain, jo monthly ₹200-500 tak add up ho sakta hai. Limitations minimal hain – sirf international transactions, cash handling charges at branches, aur third-party service charges (like insurance premiums) may apply. But regular day-to-day banking transactions completely free hain, which makes it very cost-effective for users who do frequent online transactions.

Conclusion

IDFC First Bank savings account definitely stands out in the competitive banking landscape through its industry-leading interest rates, true zero-fee banking, aur comprehensive digital experience. Beginners ke liye especially attractive hai because of its simplified account opening process aur user-friendly mobile app.

Key takeaways from our analysis:

Financial Benefits: Up to 7% interest with monthly credits aur zero charges on 25+ services makes it financially attractive.

Digital Experience: Award-winning mobile app with integrated investment platform provides complete banking solution.

Flexibility: Multiple account variants aur specialized options for different customer segments.

Transparency: No hidden charges policy aur clear fee structure builds trust.

However, keep in mind ki branch network limited hai compared to traditional banks, aur minimum balance requirements might be challenging for some users.

Agar aap digital banking prefer karte hain, regular income hai, aur comprehensive banking cum investment platform chahiye, toh IDFC First Bank savings account definitely consider karne layak hai. Balance requirement maintain kar sakte hain aur digital services actively use karte hain, toh yeh account long-term mein beneficial rahega.

Agar aapko koi specific question hai ya clarification chahiye, toh comment section mein zaroor puchiye! Hum aapke banking journey mein help karne ke liye ready hain.

Ready to start your banking journey? Visit IDFC First Bank’s official website or download their mobile app to begin your account opening process today!