HDFC Bank Savings Account Benefits: Unlock High Interest, Easy Access, and More (2025)

HDFC Bank Savings Account Benefits: Unlock High Interest, Easy Access, and More

In today’s fast-paced world, a reliable savings account is crucial for managing your money efficiently. One of the most trusted names in the banking industry is HDFC Bank, which offers a variety of benefits for its savings account holders. Whether you are looking to save for the future or simply need a secure place for your funds, HDFC Bank provides a range of features to meet your financial needs.

In this article, we’ll delve into the key benefits of an HDFC Bank Savings Account, along with its features, eligibility, and much more.

What are the Key Benefits of an HDFC Bank Savings Account?

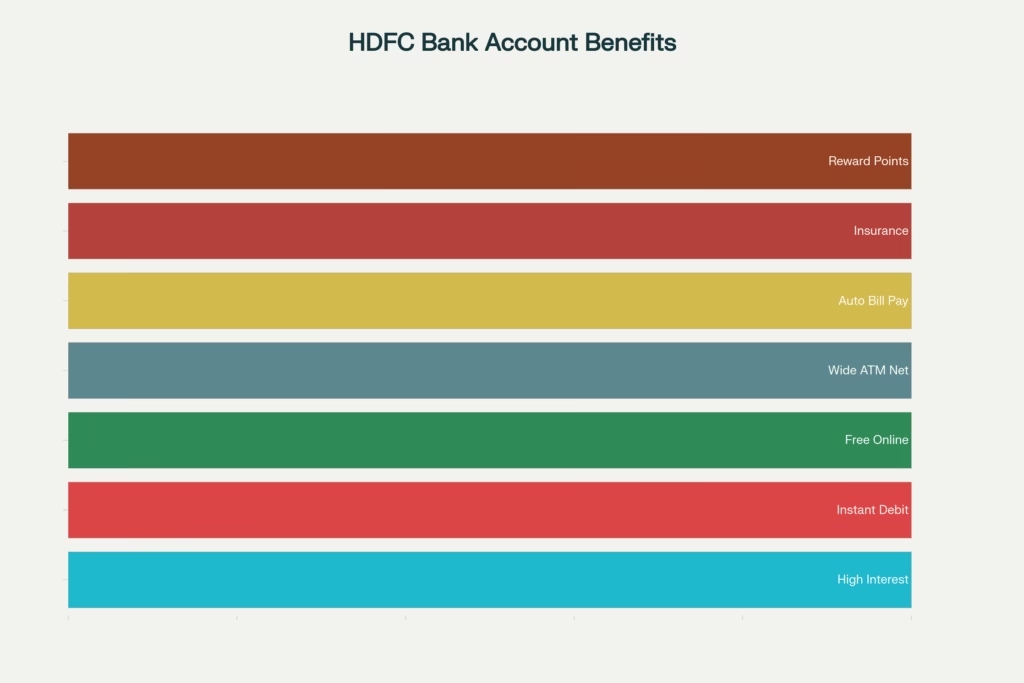

When you choose an HDFC Bank savings account, you unlock several attractive benefits. Here’s a breakdown:

1. High-Interest Rates

HDFC Bank offers competitive interest rates on its savings accounts, allowing your money to grow at a faster pace. The interest rate varies based on the type of account you choose, but it generally ranges from 3% to 3.5% annually. This is higher than the national average, ensuring that your savings earn a decent return.

2. Easy Access to Funds

HDFC Bank offers convenient access to your funds through its ATM network, internet banking, and mobile banking apps. You can transfer money, pay bills, and check your balance with ease, making it a user-friendly banking experience.

Plus, you can also access your account using HDFC’s vast network of ATMs across India, offering quick and secure withdrawals.

3. Digital Banking Services

With HDFC Bank, managing your savings account has never been easier. The bank provides Internet Banking and Mobile Banking, so you can carry out all transactions, check balances, and access account statements from the comfort of your home.

4. No Minimum Balance Requirement (For Some Accounts)

HDFC Bank offers savings accounts with no minimum balance requirements, especially for those who do not want to maintain a large amount in their savings accounts. This makes it an ideal choice for those who are just starting their banking journey.

5. Wide Range of Account Types

HDFC Bank provides a range of savings account options tailored to meet different needs. These include:

- Regular Savings Account: Ideal for everyday banking needs.

- Pravasi Bhartiya Sahay Yojana (P.B.S.Y): A savings account specifically designed for Non-Resident Indians (NRIs).

- HDFC SmartPay Savings Account: For individuals with high transaction needs.

No matter what your financial goals are, there’s an HDFC Bank savings account that suits your requirements.

6. Attractive Debit Cards and Offers

HDFC Bank offers debit cards with exciting rewards and offers. With these cards, you can make payments online, at retail stores, or even withdraw cash from ATMs worldwide. The bank regularly runs promotions, including cashback offers, exclusive deals, and discounts on various products and services.

7. Access to Overdraft Facilities

HDFC Bank savings account holders can also access overdraft facilities, which allow you to withdraw more than your current balance, up to a pre-approved limit. This facility comes in handy during emergencies when you need instant access to funds.

How to Open an HDFC Bank Savings Account?

Opening a savings account with HDFC Bank is a simple and quick process. You can either visit the nearest branch or apply online.

Here’s how you can get started:

- Eligibility: You need to be an Indian citizen or a resident of India to open an account.

- Documents Required:

- Proof of identity (Aadhaar, PAN, passport, etc.)

- Proof of address (utility bill, passport, etc.)

- Passport-size photographs

- Online Process: You can also open an account by visiting the HDFC Bank website or using the mobile app.

If you’re unsure about the process, you can always get assistance from HDFC Bank’s customer care.

FAQ – HDFC Bank Savings Account

Q1: HDFC Bank savings account ke kya benefits hain?

HDFC Bank savings account ke kai benefits hain. Ye high-interest rates, easy fund access, aur convenient digital banking services offer karta hai. Agar aapko low minimum balance wali account chahiye toh bhi HDFC Bank aapke liye best option hai.

Q2: HDFC Bank me account kaise open karein?

Aap HDFC Bank ke branch me jakar ya online apply kar sakte hain. Online process simple hai, aur aapko apne documents ko upload karna padta hai.

Q3: Kya HDFC Bank savings account pe free ATM withdrawals hote hain?

Haan, HDFC Bank savings account holders ko apne debit card se limited free ATM withdrawals milte hain.

Q4: HDFC Bank savings account ka minimum balance kya hai?

HDFC Bank ki savings account me kuch types aise hain jisme minimum balance ka requirement nahi hota. Lekin kuch accounts me aapko minimum balance maintain karna padta hai.

Conclusion

Opening an HDFC Bank savings account gives you access to a wealth of benefits, including high-interest rates, easy digital access, and a wide range of account types to choose from. With its vast network and excellent customer service, HDFC Bank makes managing your money simpler and more convenient.

Interested in learning more about managing your savings? You can explore more financial tips and articles at Invest Snow.

Additionally, if you’re planning to take a loan for your financial needs, don’t miss out on exploring Gromo Loan Options for easy access to financing.

Start your journey with HDFC Bank today and enjoy the perks of a trusted and reliable savings account.