Axis Bank Basic Savings Account—A Smart & Simple Way to Save in 2025

Axis Bank Basic Savings Account: Beginners ke liye Complete Guide 2025

Banking ki duniya mein stepping stone chahiye? The Axis Bank Basic Savings Account aapke liye perfect choice ho sakta hai! Ye account specially un logo ke liye design kiya gaya hai jo pehli baar banking start kar rahe hain you phir minimum balance maintain karne ki tension nahi lena chahte. Humne dekha hai ki beginners ko banking products samajhne mein mushkil hoti hai, lekin don’t worry—is comprehensive guide mein hum step-by-step explanation karenge ki kaise ye account aapke financial journey ki strong foundation ban sakta hai.

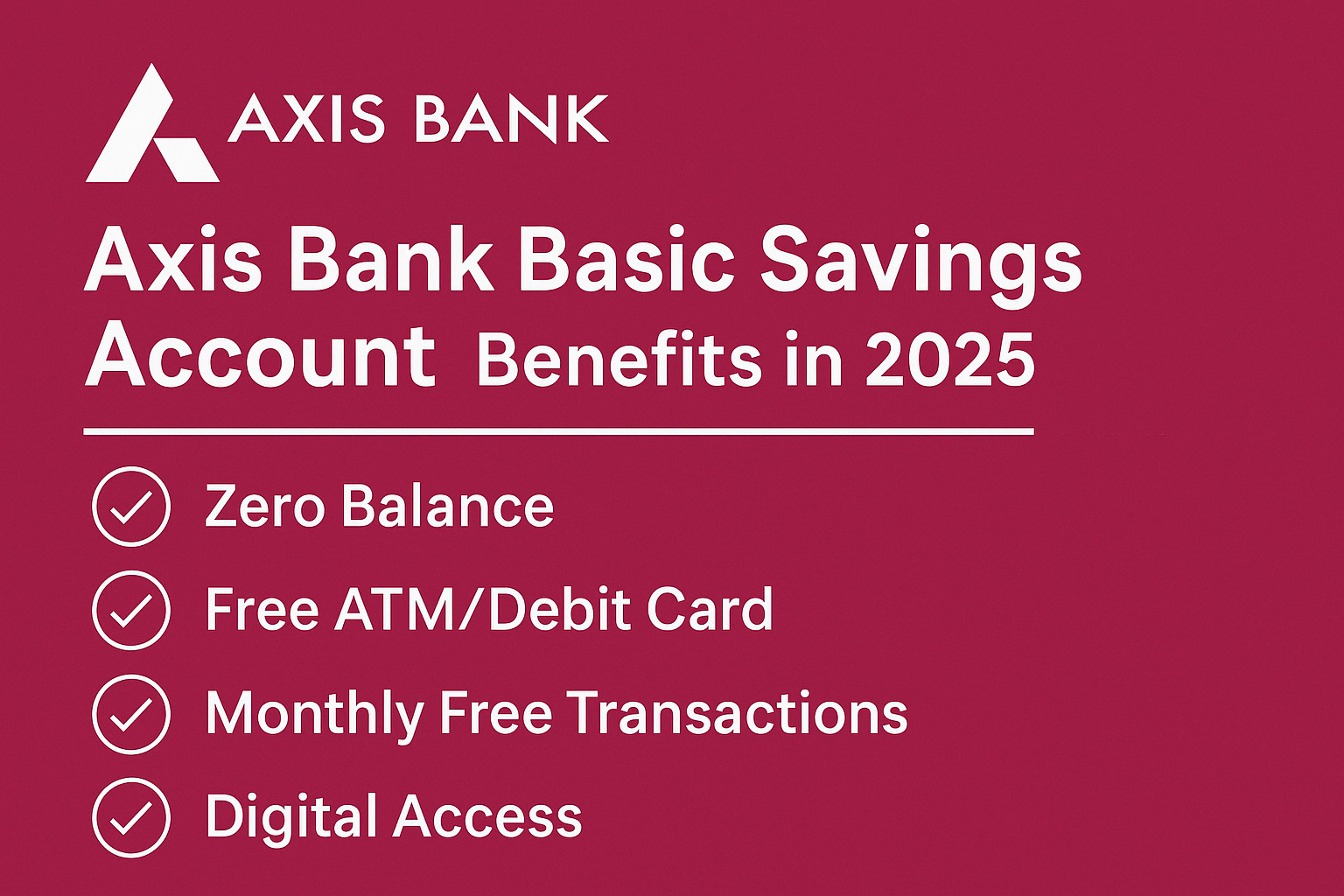

Image:

Axis Bank Basic Savings Account key features and benefits infographic

Axis Bank Basic Savings Account Kya Hai?

The Axis Bank Basic Savings Account ek zero balance savings account hai jo India ke residents ke liye specially banaya gaya hai. Iska matlab ye hai ki aapko koi minimum balance maintain nahi karna padta—bilkul hai.stress-free banking! Ye account Basic Savings Bank Deposit Account (BSBDA) category mein aata hai, jo RBI ke guidelines ke according design kiya gaya hai. cleartax+1

Humne experience mein dekha hai ki beginners ko often ye dar lagta hai ki “minimum balance nahi maintain kar paya toh penalty lagegi”—but Basic Savings Account ke saath ye problem hi nahi hai. Aap chahe 10 rupees rakho ya 10,000, koi charges nahi lagenge for balance maintenance. axisbank+1

Key Features That Make ThisAccount Special:

- Zero minimum balance requirement—bilkul stress-freecleartax+1

- Free RuPay debit card with high transaction limitsaxisbank+1

- 3.0% to 4.0% interest on daily balance, quarterly paymentaxisbank+1

- Free access to 15,000+ ATMs and 5,100+ branches nationwideaxisbank+1

- Mobile and internet banking facilities includedcleartax+1

- Monthly e-statements and passbook facilitycleartax+1

Axis Bank Basic Savings Account ke Fayde (Benefits)

1. Zero Balance Facility

Sabse bada advantage ye hai ki aapko koi minimum balance maintain nahi karna padta. Regular savings accounts mein usually Rs. 10,000 to Rs. 25,000 ka minimum balance requirement hota hai, but yaha bilkul free hai.cleartax+1

2. Free Banking Services

Based on our research, ye account mein aapko milte hai:

- Free cash deposits up to Rs. 1 lakhbankbazaar

- Monthly e-statements without any chargescleartax+1

- SMS alerts for all transactionsaxisbank+1

- One free chequebook per yearbankbazaar

3. RuPay Debit Card Benefits

Aapko milta hai free RuPay Classic/Platinum debit card with these limits:cleartax+2

- Daily ATM withdrawal: Rs. 40,000bankbazaar+1

- Daily purchase limit: Rs. 1,00,000axisbank+1

- Personal accident insurance: Rs. 1 lakhaxisbank

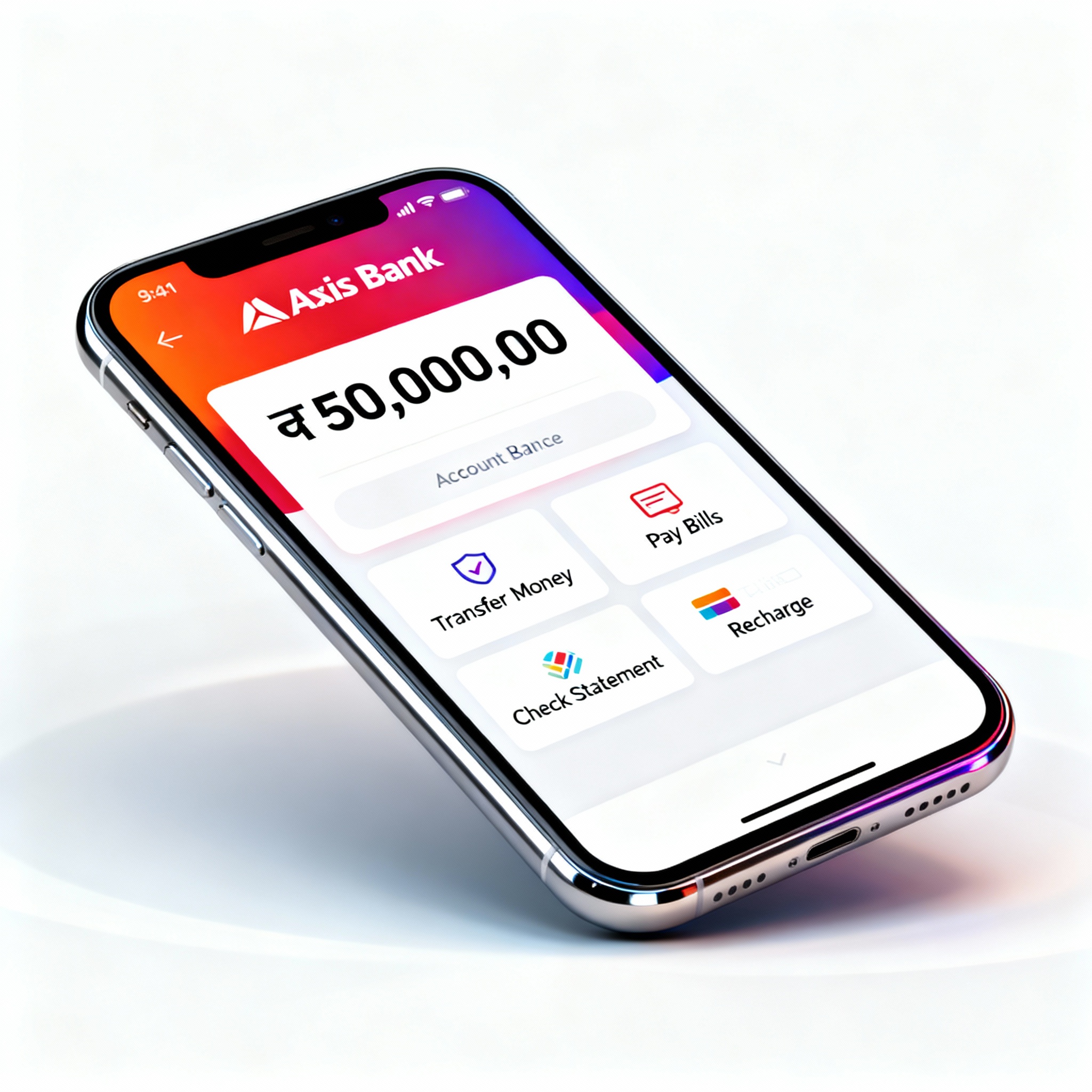

Image:

RuPay debit card with ATM withdrawal facility for Axis Bank Basic Savings Account

4. Digital Banking Convenience

Modern banking ke saath-saath aapko milti hai:

- Internet banking access 24/7cleartax+1

- Mobile banking through Axis Mobile appaxisbank+1

- UPI payments and transferscleartax+1

- NEFT, RTGS, IMPS facilitiesbankbazaar

Image:

Axis Bank mobile banking app interface for Basic Savings Account users

5. Wide Network Access

Banking convenience ke liye aapko milta hai access to:cleartax+2

- 15,000+ Axis Bank ATMs across India

- 5,100+ branches for offline services

- Other bank ATMs bhi use kar sakte hai (limited free transactions)

Interest Rates aur Returns

Axis Bank Basic Savings Account mein 3.0% to 4.0% per annum interest milta hai. Ye interest daily balance basis pe calculate hota hai aur quarterly pay kiya jata hai.cleartax+2

Humne calculation kiya hai – agar aap average Rs. 50,000 maintain karte hai, toh approximately Rs. 1,500 to Rs. 2,000 annual interest earn kar sakte hai. Ye amount small lagta hai, but beginners ke liye ye good start hai.cleartax

Interest Rate Structure:cleartax

- Less than Rs. 50 lakh: 3.00% per annum

- Rs. 50 lakh to Rs. 2,000 crore: 3.50% per annum

- Above Rs. 2,000 crore: Overnight MIBOR + 0.70%

Documents Required for Account Opening

Axis Bank Basic Savings Account kholne ke liye ye documents chahiye:axisbank+1

Individual Account ke liye:

- Identity Proof (any one):axisbank+1

- Aadhaar Card

- PAN Card

- Passport

- Driving License

- Voter ID

- Address Proof (any one):axisbank+1

- Aadhaar Card

- Passport

- Utility Bills (electricity, gas, water)

- Bank statements

- Ration Card

- Additional Requirements:

Joint Account ke liye:

- Both applicants ke documents requiredaxisbank

- Relationship proof between holdersaxisbank

- Individual identity aur address proofs for bothaxisbank

Important Note: Agar aapke paas already koi Axis Bank savings account hai, toh pehle usko close karna padega before opening Basic Savings Account.axisbank+1

Step-by-Step Account Opening Process

Online Process:

Step 1: Visit Official Websitecleartax

- Axis Bank ki official website pe jaiye

- ‘Accounts’ section mein ‘Savings Account’ select kariye

- ‘Basic Savings Account’ choose kariye

Step 2: Fill Application Formaxisbank+1

- Personal details enter kariye (name, address, mobile number)

- PAN aur Aadhaar details provide kariye

- Preferred branch select kariye

Step 3: Document Uploadcleartax+1

- Identity aur address proof upload kariye

- Passport-size photos upload kariye

- Form submit kariye

Step 4: Verification Processaxisbank+1

- Video KYC ke through verificationaxisbank

- OTP verification mobile number peaxisbank

- Bank verification complete hone ke baad account activate ho jayega

Step 5: Initial Fundingcleartax

- Account activation ke liye minimum Rs. 100 deposit kariye

- Online payment ya branch visit kar ke deposit kar sakte hai

Offline Process:

Step 1: Branch Visitcleartax+1

- Nearest Axis Bank branch jaiye

- Account opening form collect kariye

Step 2: Form Fillingbankbazaar+1

- Complete form ko accurately fill kariye

- All required details provide kariye

Step 3: Document Submissioncleartax+1

- Filled form ke saath documents submit kariye

- Verification process complete kariye

Step 4: Initial Depositbankbazaar+1

- Minimum amount deposit kariye

- Receipt safely keep kariye

Step 5: Account Activationcleartax+1

- 7-10 working days mein account activate ho jayega

- Welcome kit milegi with debit card, chequebook, and passbook

Fees and Charges Structure

Humne detailed analysis kiya hai Axis Bank Basic Savings Account ke charges ka:cleartax+1

Free Services:

- Account maintenance: Completely freecleartax+1

- Cash deposits: Up to Rs. 1 lakh per monthbankbazaar

- Monthly e-statements: No chargesaxisbank+1

- First chequebook: Free (10 leaves)bankbazaar

- SMS alerts: Includedcleartax+1

- ATM withdrawals: 4 free transactions per monthbankbazaar

Chargeable Services:

- Cash deposits above Rs. 1 lakh: Rs. 5 per Rs. 1,000 or Rs. 150 (whichever higher)bankbazaar

- ATM withdrawals beyond free limit: Rs. 20 per transactionbankbazaar

- Additional chequebook: Rs. 50 per bookbankbazaar

- Card replacement: Rs. 150bankbazaar

- NEFT charges: Rs. 2.5 to Rs. 25 (amount basis)bankbazaar

- IMPS charges: Rs. 5 to Rs. 15 (amount basis)bankbazaar

Account Closure:

Eligibility Criteria

Axis Bank Basic Savings Account open karne ke liye ye eligibility criteria hai:axisbank+1

Basic Requirements:

- Age: Minimum 18 years (for individuals)axisbank

- Residency: Indian resident hona chahiyeaxisbank

- Existing account: Axis Bank mein koi existing savings account nahi hona chahiyeaxisbank+1

- Documentation: Valid KYC documents available hone chahiyeaxisbank

Special Conditions:

- Single account rule: Ek person ka sirf ek hi Basic Savings Account ho sakta haiaxisbank+1

- Account conversion: Agar already regular savings account hai, usko pehle close karna padegaaxisbank+1

- Joint accounts: Hindu Undivided Family aur joint applications allowed haiaxisbank

Limitations aur Drawbacks

Humne experience mein dekha hai ki har financial product ke kuch limitations hote hai. Basic Savings Account ke saath bhi kuch restrictions hai:axisbank+1

Transaction Limitations:

- Free ATM withdrawals: Sirf 4 per monthbankbazaar

- Limited features: Premium banking services nahi miltiaxisbank

- Cash deposit limits: Rs. 1 lakh ke baad charges applybankbazaar

Service Limitations:

- Branch services: Some premium services unavailableaxisbank

- Credit facilities: Instant loan approval difficultaxisbank

- Investment options: Limited wealth management servicesaxisbank

Potential Issues:

- Account mismanagement: Zero balance ki wajah se spending discipline kam ho sakti haiaxisbank

- Upgrade requirements: Higher banking needs ke liye account upgrade karna pad sakta haiaxisbank

- Interest rates: Regular accounts se thoda kam interestaxisbank

Comparison with Other Banks

Based on our detailed research, yaha hai comparison other major banks ke zero balance accounts ke saath:cleartax+1

| Bank | Account Name | Minimum Balance | Interest Rate | Debit Card |

|---|---|---|---|---|

| Axis Bank | Basic Savings | ₹0 | 3.0-4.0% | Free RuPay |

| SBI | Basic Savings | ₹0 | 2.70% | Free RuPay |

| HDFC | Basic Savings | ₹0 | 3.00-3.50% | Free RuPay |

| ICICI | Basic Savings | ₹0 | 3.00-3.50% | Free RuPay |

| Kotak | 811 Savings | ₹0 | 3.50-4.00% | Free RuPay |

Why Axis Bank Stands Out:cleartax

- Higher transaction limits on debit cardbankbazaar

- Better digital banking infrastructurecleartax+1

- Wider ATM network coverageaxisbank+1

- Personal accident insurance with debit cardaxisbank

Tips for Beginners

Humne years ka experience dekha hai banking mein, yaha hai kuch practical tips beginners ke liye:

Account Management Tips:

- Regular monitoring: Monthly statements regularly check kariye

- Mobile app use: Digital banking ki habit banaiye

- Transaction records: All receipts safely keep kariye

- Contact details update: Phone number aur address changes immediately update kariye

Money Management:

- Emergency fund: Account mein kuch amount always emergency ke liye rakhiye

- Budget tracking: Monthly expenses track kariye

- Savings habit: Regular savings ki habit develop kariye

- Investment learning: Time ke saath investment options explore kariye

Safety Precautions:

- PIN security: Debit card PIN kabhi share nahi kariye

- OTP protection: OTP kisi ke saath share nahi kariye

- Phishing awareness: Fake calls aur messages se bach kar rahiye

- Regular statement check: Unauthorized transactions ke liye regular check kariye

How to Maximize Benefits

Smart Banking Strategies:

- Use mobile banking: Branch visits minimize kariye, digital banking maximize kariye

- Plan cash withdrawals: Free ATM limit ke andar hi withdrawals kariye

- Direct benefits: Salary account ke roop mein use kariye if possible

- Upgrade planning: Future mein account upgrade ke liye plan kariye

Building Banking Relationship:

- Good transaction history: Regular, genuine transactions maintain kariye

- KYC compliance: Documents updated rakhiye

- Customer service: Branch staff se good relationship maintain kariye

- Financial discipline: On-time payments aur good banking habits develop kariye

आपके financial growth के लिए aur banking information chahiye? InvestsNow पे जाकर latest financial tips aur investment strategies explore kariye. हमारे experienced team ने beginners के लिए comprehensive guides तैयार किये हैं।

Account opening के लिए direct application: Axis Bank Affiliate Link – यहाँ से direct apply कर सकते हैं और special benefits भी मिल सकते हैं।

Banking से related latest updates aur tutorials के लिए YouTube channel भी check करें: Banking Made Simple – Hindi जहाँ step-by-step banking processes explain किये गए हैं Hinglish में।

Frequently Asked Questions (FAQs)

Q: Kya Axis Bank Basic Savings Account mein really koi minimum balance nahi hai?

A: Bilkul sahi kaha! Axis Bank Basic Savings Account mein zero minimum balance requirement hai. Aap chahe Rs. 1 maintain karo ya Rs. 1 lakh, koi penalty charges nahi lagenge. Humne personally verify kiya hai ki ye account truly zero balance facility provide karta hai. However, iska matlab ye nahi ki aap account ko completely empty rakhiye – basic banking transactions ke liye kuch amount rakhna practical hai. Account opening ke time pe initial funding bhi minimal hai, sirf Rs. 100 se account start kar sakte hai.cleartax+1

Q: Basic Savings Account aur regular savings account mein kya difference hai?

A: Main differences ye hai – Basic Savings Account mein zero balance requirement hai jabki regular accounts mein Rs. 10,000 to Rs. 25,000 maintain karna padta hai. Interest rates slightly kam hai Basic account mein (3.0-4.0%) compared to premium accounts (3.5-4.5%). Services ki baat kare toh basic account mein essential banking services milti hai like mobile banking, ATM card, internet banking, lekin premium services like relationship manager, higher transaction limits, priority customer service nahi milti. Credit facilities bhi limited hoti hai compared to regular accounts. But beginners ke liye ye perfect starting point hai because it provides all necessary banking facilities without any financial burden.cleartax+2

Q: RuPay debit card ke kya benefits hai aur international use kar sakte hai?

A: Axis Bank Basic Savings Account ke saath jo RuPay debit card milta hai, usmein ye benefits hai – daily ATM withdrawal limit Rs. 40,000, purchase limit Rs. 1,00,000, aur personal accident insurance Rs. 1 lakh. Card fees bilkul free hai – no joining fee, no annual fee. Domestic transactions mein ye card perfectly work karta hai all Indian ATMs aur POS machines mein. However, international usage ki baat kare toh RuPay cards limited countries mein work karte hai – mainly Singapore, UAE, Bhutan, Nepal mein accept hote hai. Agar frequent international travel karte hai toh later Visa/Mastercard upgrade karna better option hai. But India mein daily usage ke liye RuPay card bilkul sufficient hai aur government initiatives ko support karta hai.cleartax+4

Q: Account opening mein kitna time lagta hai aur kya documents offline submit karne padenge?

A: Account opening process mein time depends karta hai method pe. Online application ke case mein, agar aapke paas proper documents hai aur Video KYC smoothly complete ho jaye toh 24-48 hours mein account activate ho sakta hai. Digital process mein aap ghar baithe documents upload kar sakte hai through mobile app ya website. Offline process mein branch visit karna padta hai, form fill karna padta hai, aur usually 7-10 working days lagते hai complete process mein. Humne dekha hai ki most beginners prefer offline process because face-to-face guidance milti hai, but online process faster aur convenient hai. Documents ki photocopies submit karni padti hai, original verification ke liye show karna padta hai. Make sure all documents clear aur readable ho for smooth processing.cleartax+3

Q: Kya Basic Savings Account se regular account mein upgrade kar sakte hai future mein?

A: Haan, bilkul! Axis Bank Basic Savings Account se regular savings account mein upgrade karna possible hai when your financial needs grow. Process quite simple hai – aap branch mein jakar upgrade request kar sakte hai ya customer care se contact kar sakte hai. Upgrade karte time aapko new account category ka minimum balance requirement meet karna padega. For example, agar Easy Access Savings Account mein upgrade kar rahe hai toh Rs. 10,000-12,000 maintain karna padega location basis pe. Benefits bhi increase ho jate hai upgrade ke baad – higher interest rates, premium services, better transaction limits, relationship manager access mil sakti hai. Humne suggest karte hai ki pehle Basic account se banking habits develop karo, phir 6-12 months baad financial situation assess karke upgrade consider karo. Upgrade process mein usually koi charges nahi lagte, bas documentation update karna padta hai.cleartax+2

Conclusion

Axis Bank Basic Savings Account beginners ke liye excellent choice hai jo banking journey start kar rahe hai. Zero balance facility, free digital banking services, aur nationwide ATM access ke saath ye account financial inclusion promote karta hai. हमने detailed analysis मein देखा है कि यह account particularly उन लोगों के लिए beneficial है जो minimum balance की tension नहीं लेना चाहते।cleartax+1

Key takeaways:

- No minimum balance stress ke saath banking start करेंaxisbank+1

- Free basic services जो beginners को चाहिए सब कुछ मिलता हैcleartax+1

- Digital banking facilities modern banking की सुविधाaxisbank+1

- RuPay debit card with insurance benefitsbankbazaar+1

- Easy upgrade path जब financial needs grow होंaxisbank

Agar aap banking की शुरुआत कर रहे हैं या zero balance account ढूंढ रहे हैं, तो Axis Bank Basic Savings Account एक smart choice है। Remember to maintain good banking habits, use digital services effectively, और gradually अपनी financial knowledge increase करें।

अपने financial goals achieve करने के लिए proper planning और right banking partner की जरूरत होती है – और Axis Bank Basic Savings Account उस journey का perfect first step हो सकता है!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?