Kotak 811 Digital Savings Account – Ab Savings Account Banana Hua Aur Bhi Aasaan!

Kotak 811 Digital Savings Account: Complete Guide for Beginners (2025)

Digital banking ka zamana hai aur agar aap zero balance savings account ki talash kar rahe hain, toh Kotak 811 Digital Savings Account sabse popular options mein se ek hai. Is comprehensive guide mein hum bataenge ki kaise aap Kotak 811 account kaise open karein, iske kya benefits hain, aur kyun yeh beginners ke liye perfect choice hai.bankbazaar

Banking industry mein digitalization ka trend dekh kar Kotak Mahindra Bank ne 2016 mein Kotak 811 launch kiya tha, jo completely digital banking experience provide karta hai. Account opening se lekar daily transactions tak, sab kuch aap apne smartphone se kar sakte hain.youtubebankbazaar

Kotak 811 Kya Hai?

Kotak 811 ek fully digital zero balance savings account hai jo Kotak Mahindra Bank dwara offer kiya jata hai. Yeh account specially un logon ke liye design kiya gaya hai jo minimum balance maintain nahi kar sakte ya chahte – jaise students, freelancers, aur young professionals.bankbazaar+1

“811” naam demonetization ke baad 8th November ke date se inspire hoke rakha gaya tha, jab government ne cashless economy ko promote kiya tha. Is account ka main focus hai digital-first banking experience provide karna.bankbazaar

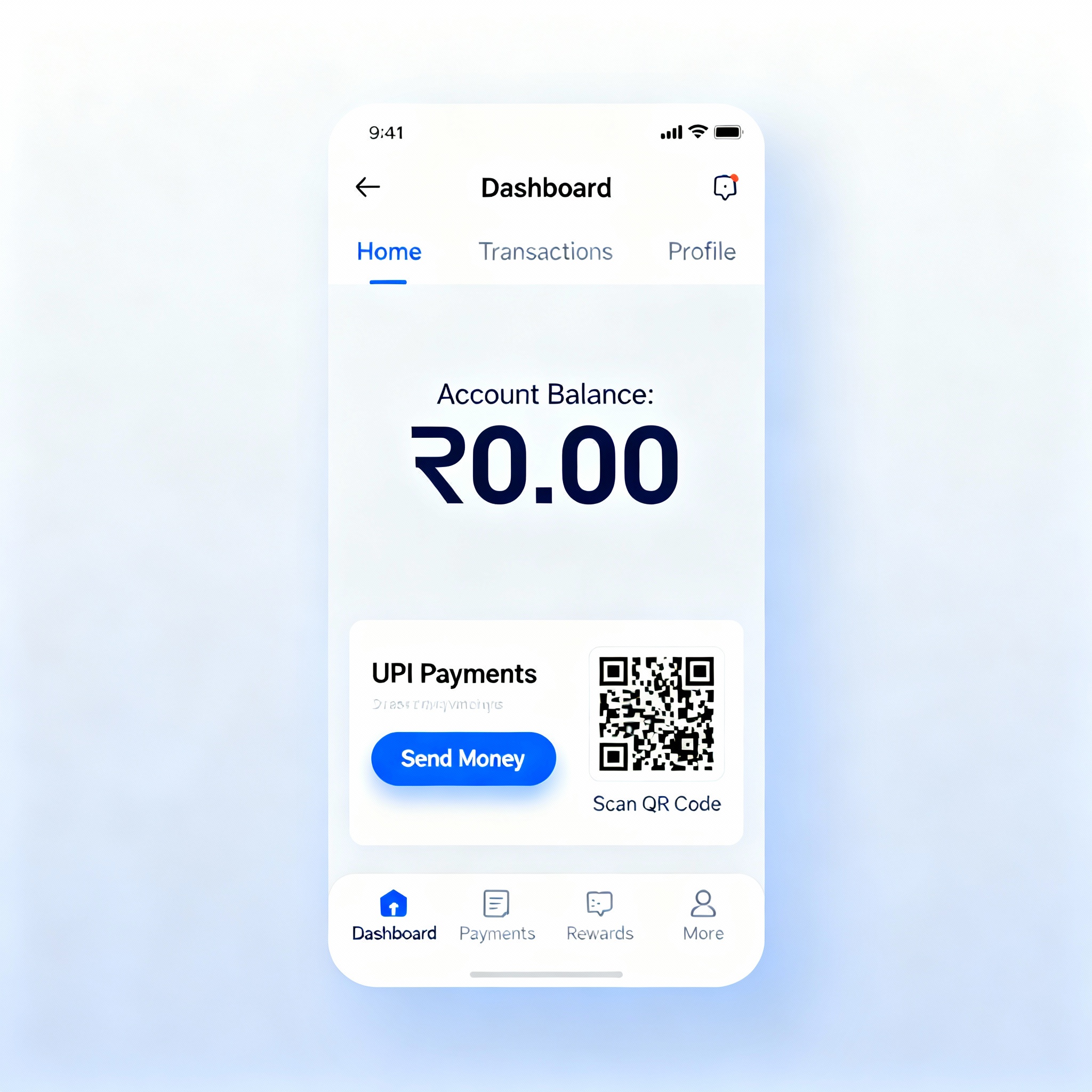

Kotak 811 mobile banking app interface showing zero balance account features

Kotak 811 Account Ke Types

Kotak 811 ke different variants available hain jo alag-alag needs ko cater karte hain:bankbazaaryoutube

1. Kotak 811 Classic (Normal)

- Zero balance account

- Initial funding: ₹1,000 required

- Virtual debit card available

- Basic banking features

- Limited physical debit card options

2. Kotak 811 Super

- Zero balance account

- Initial funding: ₹5,000 required

- Physical platinum debit card included

- 5% cashback on debit card transactions (up to ₹500/month)reddit

- Enhanced features aur benefits

Purane variants (811 Lite, Limited KYC, Full KYC, Edge) ab simplify kar diye gaye hain do main categories mein.youtube

Kotak 811 Account Ke Main Benefits

Digital Banking Features

- 100% paperless account opening processyoutube

- Mobile banking app with user-friendly interface

- UPI payments aur QR code scanningwishfin

- Virtual debit card for online transactionsbankbazaar

- Instant fund transfers through NEFT, IMPS, aur UPI

Financial Benefits

- 4% interest rate per annum on savingsbankbazaar

- Zero minimum balance requirement

- Free ATM transactions (limited)bankbazaar

- No account opening charges

- Competitive exchange rates for international transactions

Convenience Features

- 24/7 banking services through mobile app

- Video KYC facility – no branch visit requiredyoutube+1

- Instant account activation within minutes

- Digital statements aur e-passbook

- Bill payments aur mobile recharges

Online account opening process with required documents for Kotak 811

Kotak 811 Account Opening Process: Step by Step

Required Documents

- Aadhaar Card (mandatory)

- PAN Card (mandatory)

- Valid mobile number (Aadhaar linked preferred)

- Email ID

- Recent photograph

- Signature sample

Online Opening Processyoutube+1

Step 1: Visit Official Website ya Download App

- Kotak Bank ki official website par jaye ya Kotak 811 mobile app download karein

- “Open Account” option par click karein

Step 2: Basic Details Enter Karein

- Mobile number enter karein (Aadhaar linked)

- Email ID provide karein

- PIN code of residence enter karein

- “Open Account” par click karein

Step 3: OTP Verification

- Email par aaya hua OTP enter karein

- Mobile number verification complete karein

Step 4: Personal Information

- Full name, date of birth enter karein

- Income source select karein (family/investment income)

- Marital status choose karein

- Mother’s maiden name enter karein

Step 5: Address Details

- Communication address confirm karein

- Permanent address provide karein (if different)

- Nominee details add karein

Step 6: Account Type Selection

- Classic ya Super account choose karein

- Features comparison dekh kar decide karein

Step 7: Initial Funding

- Classic ke liye ₹1,000, Super ke liye ₹5,000

- Payment options: UPI, Net Banking, Debit Card

- Payment complete karein

Step 8: Video KYC Process

- “Start Video KYC” option par click karein

- Documents upload karein (PAN, Aadhaar)

- Live photo aur signature capture karein

- Kotak representative se video call complete karein

Step 9: Account Activation

- KYC verification ke baad account instantly activate ho jata hai

- Account number, IFSC code, aur UPI ID mil jata hai

- Welcome kit 7 days mein courier se milti haiyoutube

Comparison of different Kotak 811 account variants and their features

Interest Rates aur Charges

Interest Rate Structurecleartax

- Savings Account Interest: 2.50% per annum

- Interest quarterly credited hoti hai

- No maximum balance limit

- Interest calculation daily balance basis par

Fee Structurebankbazaar

| Service | Classic Account | Super Account |

|---|---|---|

| Account Opening | Free | Free |

| Debit Card Annual Fee | ₹199 + taxes | ₹300 |

| ATM Withdrawals | 3 free/month | Unlimited (with subscription) |

| Minimum Balance Penalty | Nil | Nil |

| NEFT/RTGS Charges | As per standard rates | As per standard rates |

| SMS Alerts | Chargeable | Chargeable |

Hidden Charges Ki Awarenessreddit

- PIN generation charges: ₹100 per request

- Cheque book charges applicable

- International transaction fees

- Cash deposit charges after free limit

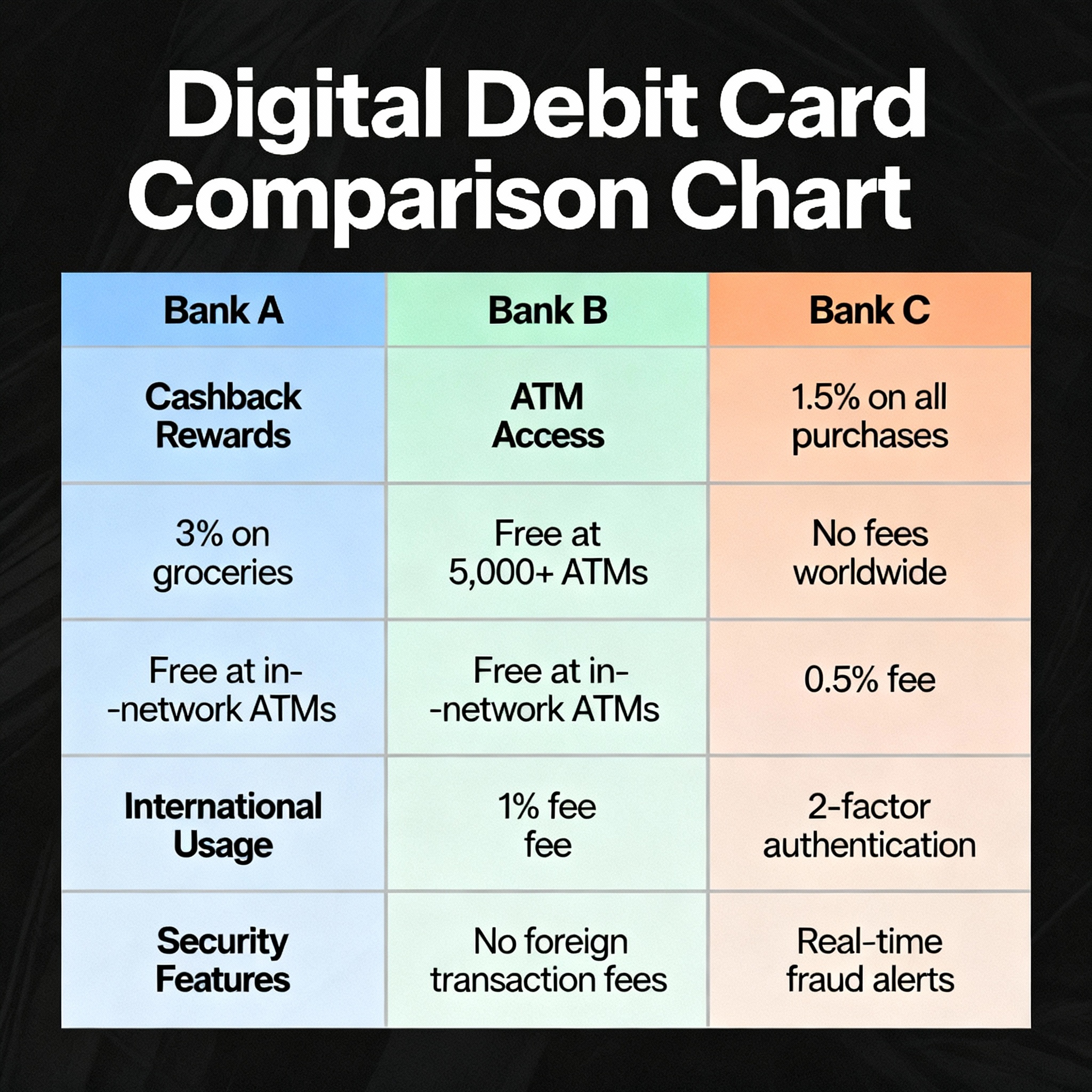

Kotak 811 vs Other Zero Balance Accounts

Comparison with Competitorsmybankingtipsyoutube

| Feature | Kotak 811 | Axis ASAP | SBI Basic |

|---|---|---|---|

| Account Opening | 5 minutes online | Online available | Branch visit needed |

| Interest Rate | 4% p.a. | 3.5% p.a. | 2.7% p.a. |

| Debit Card | Virtual + Physical | Physical available | Basic card |

| Mobile App Rating | 4.6/5 | 4.2/5 | 3.8/5 |

| UPI Integration | Excellent | Good | Average |

| Customer Service | 24/7 digital | Limited hours | Branch dependent |

Kotak 811 Ke Advantagesyoutube

- Superior mobile app experience

- Separate app for 811 customers

- Better interest rates compared to competitors

- Instant digital services

- Strong UPI integrationwishfin

Kotak 811 Mobile App Features

Core Banking Functionswishfin

- Fund Transfers: UPI, NEFT, IMPS

- Bill Payments: Utility bills, mobile recharges

- Account Management: Balance check, statements

- Card Services: Virtual card management, PIN change

- Investment Options: Mutual funds, FDs

UPI Featureswishfin

- Multiple VPA creation (@kotak domain)

- QR code scanning for payments

- Request money functionality

- Transaction limits: Up to ₹1 lakh per day

- 24/7 availability for UPI transactions

Security Featuresbankbazaar

- Multi-layer authentication

- Biometric login options

- Transaction alerts via SMS/email

- MPIN protection for app access

- Secure encryption for data protection

Customer Reviews aur Experience

Positive Feedbackapple+1

- “Super application” – Easy account management

- “Amazing UI” – App interface bahut attractive

- “Smooth transactions” – Fast processing

- “Good for basic banking” – Students ke liye perfect

Common Complaintsreddit+2

- Customer service issues – Response time slow

- KYC completion problems – Agent visits missing

- Hidden charges – Some fees not clearly disclosed

- App glitches – Occasional technical issues

User Ratingsapple+1

- Play Store Rating: 4.6/5 stars

- App Store Rating: 4.8/5 stars

- Overall satisfaction: Good for digital-first users

Disadvantages aur Limitations

Major Drawbacksreddityoutube

- Limited physical presence – Fewer branches compared to traditional banks

- Customer service quality – Mixed reviews for support

- Transaction limits – Daily limits can be restrictive

- Charges transparency – Some fees not upfront disclosedreddit

When to Avoid Kotak 811

- Agar aapko frequent cash transactions karne hain

- High-value transfers regularly karte hain

- Physical banking prefer karte hain

- Premium banking services chahiye

Tax Implications aur Legal Aspects

Tax on Interestgroww

- Interest income taxable under Income Tax Act

- TDS deduction if total FD interest exceeds ₹40,000 annually

- ITR filing mein interest income declare karni hogi

Regulatory Complianceyoutube

- RBI guidelines ke under operates karta hai

- NPCI approved UPI services

- PMJDY scheme benefits available

- Know Your Customer (KYC) compliance mandatory

Tips for Beginners

Best Practices

- Complete full KYC within 180 days for unlimited accessbankbazaar

- Download official app only from Play Store/App Store

- Enable transaction alerts for security

- Keep minimum ₹100 balance for smooth operations

- Use UPI for most transactions to avoid charges

Common Mistakes to Avoid

- Incomplete KYC documentation

- Ignoring transaction limits

- Not reading fee structure properly

- Using unofficial apps or websites

- Sharing banking credentials

Future of Kotak 811 aur Digital Banking

Upcoming Features

- AI-powered customer support

- Enhanced security with advanced biometrics

- Crypto integration possibilities

- Investment advisory services through app

Market Positionyoutube

- Leading digital bank in zero balance segment

- Strong competition from new-age banks like Jupiter, Fi

- Continuous innovation in mobile banking space

- Regulatory support for digital banking growth

Related Financial Services

Agar aap comprehensive financial planning kar rahe hain, toh InvestsNow par visit kariye jahan aapko investment options, mutual funds, aur financial planning ki complete guidance milti hai.

YouTube Resources

Digital banking ke bare mein aur detail videos ke liye yeh helpful channels check kariye:

- “Best Zero Balance Account Comparison 2025”

- “Mobile Banking Security Tips in Hindi”

- “UPI vs Net Banking: Which is Better?”

Conclusion

Kotak 811 Digital Savings Account beginners ke liye ek excellent choice hai jo digital banking experience chahte hain. Zero balance requirement, good interest rates, aur user-friendly mobile app iske main attractions hain.bankbazaaryoutube

However, traditional banking prefer karne wale users ke liye yeh suitable nahi ho sakta. Customer service quality aur physical presence ke areas mein improvement ki zarurat hai.trustpilot

Agar aap tech-savvy hain aur basic banking needs hain, toh Kotak 811 definitely consider kar sakte hain. Lekin complete research kar ke aur alternatives compare kar ke hi final decision lein.

Frequently Asked Questions

Q: Kya Kotak 811 account mein really zero balance maintain karna hota hai?

A: Haan, Kotak 811 mein bilkul zero balance maintain kar sakte hain. Koi minimum balance requirement nahi hai. Sirf account opening ke time initial funding karna hota hai – Classic ke liye ₹1,000 aur Super ke liye ₹5,000. Yeh amount aapke account mein balance ke roop mein aa jata hai. Uske baad aap complete balance withdraw kar sakte hain aur zero balance rakh sakte hain without any penalty. Yeh feature especially students aur freelancers ke liye helpful hai jo regular income nahi rakhte.bankbazaar

Q: Kotak 811 account opening mein kitna time lagta hai aur kya documents chahiye?

A: Account opening process sirf 5-10 minutes mein complete ho jata hai online. Required documents sirf Aadhaar aur PAN card hain, plus ek valid mobile number (preferably Aadhaar linked) aur email ID. Video KYC process ke through verification hoti hai jisme aapko live video call par Kotak representative ke saath documents show karne hote hain. Complete process paperless hai – koi branch visit ki zarurat nahi. Account instantly activate ho jata hai aur welcome kit 7 days mein courier se delivery hoti hai jisme physical debit card (Super account ke liye) aur account details hote hain.youtube

Q: Kotak 811 debit card ke kya benefits hain aur charges kya hain?

A: Kotak 811 mein do types ke debit cards available hain. Classic account mein virtual debit card free milti hai online transactions ke liye, physical card ke liye ₹199 annual fee hai. Super account mein platinum physical debit card included hai ₹300 annual fee ke saath. Super account card mein 5% cashback milti hai debit card transactions par (maximum ₹500 per month). ATM withdrawal limit ₹25,000 per day hai aur purchase limit ₹1 lakh per day hai. Classic account users ko 3 free ATM transactions monthly milte hain, uske baad charges applicable hain. International transactions ke liye separate forex charges lagते हैं।reddit+1

Q: Kotak 811 mobile app kitni secure hai aur kya features hain?

A: Kotak 811 mobile app highly secure hai multiple security layers ke saath. MPIN protection, biometric login (fingerprint/face unlock), multi-layer authentication, aur encrypted data transmission use karte hain. App mein complete banking suite available hai – UPI payments, fund transfers, bill payments, mobile recharges, account statements, card management. UPI integration excellent hai with @kotak VPA creation, QR code scanning, aur instant transfers. App ki Play Store rating 4.6/5 hai jo user satisfaction indicate karta hai. Transaction alerts SMS aur email ke through immediately aate hain security ke liye.wishfin+2

Q: Agar Kotak 811 account mein koi problem ho toh customer service kaise contact karein?

A: Kotak 811 customer service multiple channels se available hai. Primary helpline: 1860 266 2666 (24/7 available general banking ke liye) aur 811-specific number: 1860 266 0811. WhatsApp banking bhi available hai – 022-6600-6022 number add karke “help” send kariye. Mobile app mein in-built chat support hai. Email support: [email protected] par detailed complaints send kar sakte hain CRN number ke saath. However, customer service quality ke bare mein mixed reviews hain – response time slow ho sakta hai aur sometimes issues resolution mein time lag होता है। Serious complaints के लिए RBI ombudsman का option भी available है।