Top Ten Demat Accounts With Amazing Benefits (2025)

Top Ten Demat Accounts 2025: Beginners ke liye Complete Guide

Top 10 Demat Accounts Kya Hai aur Kyun Zaroori Hai?

Demat account matlab Dematerialized Account – ye ek digital locker ki tarah hai jahan aapke shares, bonds, aur other securities electronically store hote hain. Physical certificates ka zamana ab gaya, ab sab kuch digital format mein hai jo trading aur investment ko bahut easy banata hai.

Humne apne experience mein dekha hai ki jitne bhi successful investors hain, unka pehla step hamesha ek reliable demat account choose karna hota hai. Ye account aapke investment journey ki foundation hai.

Top 10 Demat Accounts in India 2025

Based on our testing aur market analysis, yahan hain sabse best demat accounts jo beginners ke liye perfect hain:

Zerodha – Market Leader

Zerodha undoubtedly India ka sabse bada discount broker hai with over 3 million clients. Humne personally dekha hai ki beginners ke liye ye kaise perfect choice hai.

- Account Opening Charges: ₹200

- AMC: ₹300 per year

- Equity Delivery: Completely free

- Intraday Trading: ₹20 or 0.03% (whichever is lower)

- 100+ technical indicators aur advanced charting tools

Pros: Exceptional support, detailed reports, top trading platforms (Kite)

Cons: Higher account opening feeGroww – Beginner-Friendly Champion

Groww originally mutual fund platform tha, but ab ye complete investment solution hai. In my experience, beginners ke liye ye sabse user-friendly option hai.

- Account Opening: Completely free

- AMC: Free for lifetime

- Brokerage: ₹20 per order or 0.05% (whichever is lower)

- US stocks investment facility available

Perfect for: First-time investors jo simple interface chahte hain

Upstox – Technology Pioneer

Upstox technology-driven broker hai jo beginners ko advanced trading tools provide karta hai reasonable charges mein.

- Account Opening: Free

- AMC: ₹150 per year

- 3-in-1 Account facility

- Margin trading competitive rates

Angel One – Trusted Name

37 years ka experience aur 42 lakh+ clients ke saath Angel One ek trusted choice hai.

- Account Opening: Free

- First Year AMC: Free

- Equity Delivery: ₹0 for first 30 days

- ARQ Prime advisory engine

5paisa – Cost-Effective Option

Budget-conscious investors ke liye 5paisa excellent choice hai with lowest charges.

- Options Trading: Just ₹10 per order

- Robo-advisory services

- Free account opening

ICICI Direct – Full-Service Excellence

ICICI Direct traditional banking ke saath-saath modern features provide karta hai.

- 3-in-1 Account

- Comprehensive research reports

- Branch support available

HDFC Securities – Premium Banking

HDFC Securities premium investors ke liye designed hai jo comprehensive services chahte hain.

- Wealth management services

- Daily sector-wise reports

- Multiple trading platforms

Kotak Securities – Innovation Leader

Kotak Securities innovative features aur competitive pricing ke liye famous hai.

- Advanced research tools

- Mobile-first approach

- Competitive brokerage structure

Sharekhan – Research Expert

Sharekhan apne detailed research reports aur market insights ke liye known hai.

- In-depth stock analysis

- Educational resources

- Branch support

Motilal Oswal – Professional Choice

Motilal Oswal serious investors ke liye comprehensive services provide karta hai.

- Low AMC: ₹199 per year

- Professional research team

- Advanced trading platforms

Discount Broker vs Full-Service Broker: Kya Choose Karein?

Discount Brokers (Recommended for Beginners)

- Low brokerage charges – typically ₹20 per trade

- Online-first approach with user-friendly platforms

- No advisory fees – self-directed investing

- Technology-driven solutions

Best for: Cost-conscious investors jo DIY approach prefer karte hain

Full-Service Brokers

- Personalized advisory services

- Wealth management options

- Physical branch support

- Comprehensive research reports

Best for: High-net-worth individuals jo personalized guidance chahte hain

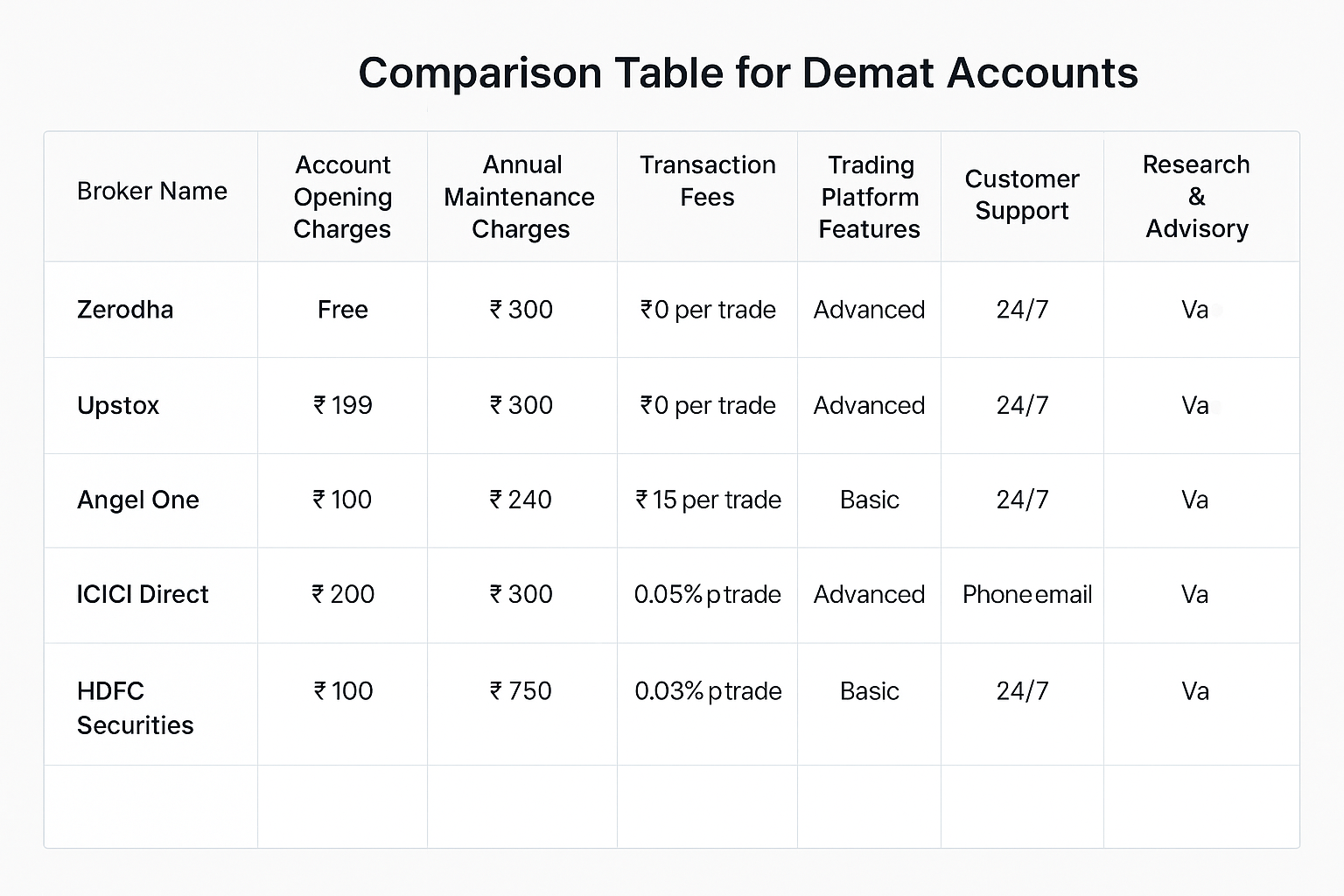

Demat Account Charges Breakdown

Understanding charges bohot important hai. Humne dekha hai ki most beginners ye charges properly understand nahi karte:

- Account Opening Charges: ₹0 to ₹200

- Annual Maintenance Charges (AMC): ₹150 to ₹750

- Brokerage Charges: ₹10 to ₹20 per trade

- DP Charges: ₹13.5 per scrip when selling

- STT (Securities Transaction Tax): Government-imposed tax

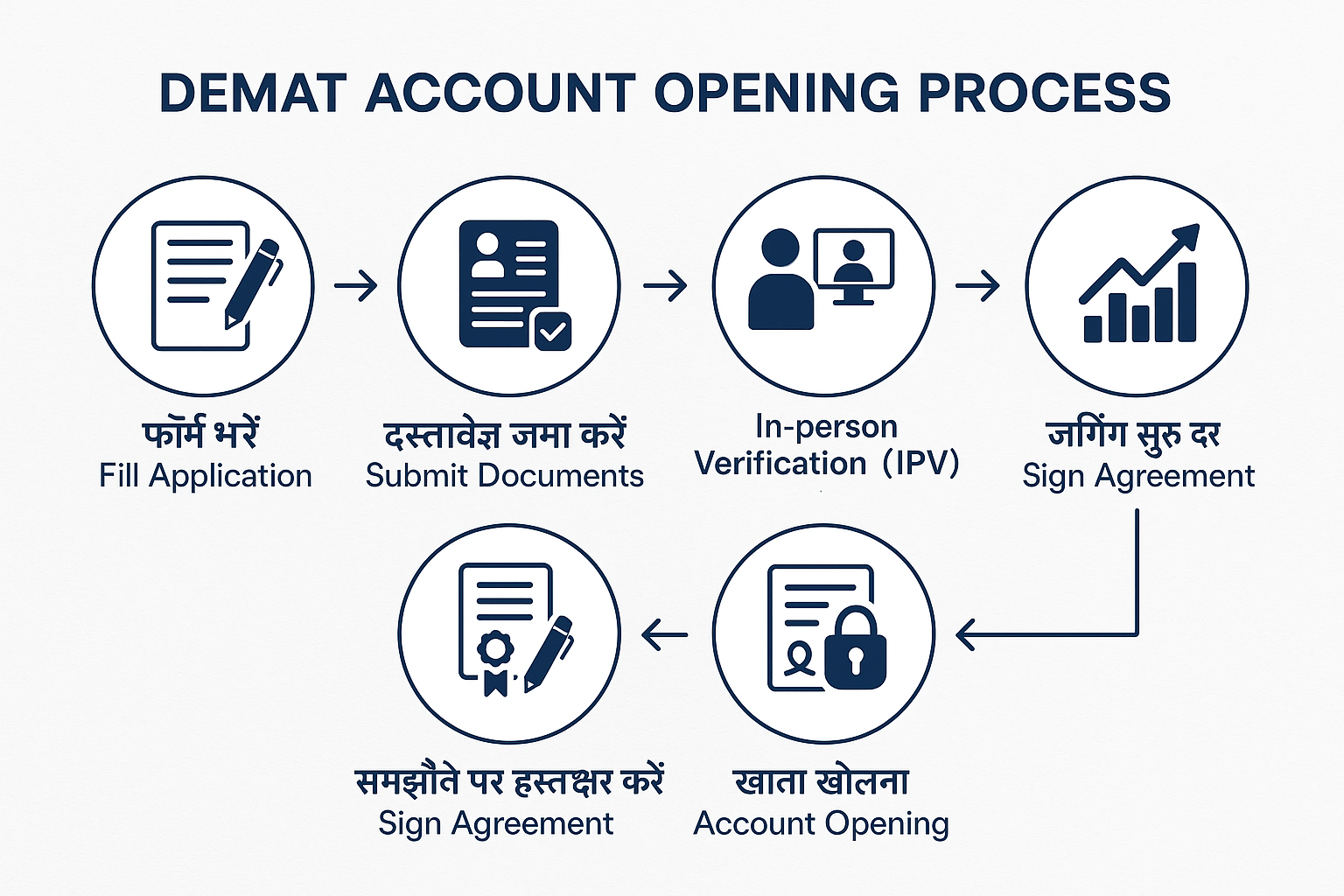

Demat Account Kaise Open Karein – Step by Step Process

- Step 1: Broker Selection

- Compare features aur charges

- Read reviews aur ratings

- Check SEBI registration

- Step 2: Documentation

- PAN Card (mandatory)

- Aadhaar Card for address proof

- Bank account details

- Passport size photographs

- Step 3: Online Application

- Fill application form

- Upload documents

- Complete eKYC process

- Step 4: Verification

- In-person verification by DP representative

- Document verification

- Account activation

- Step 5: Fund Transfer

- Link bank account

- Transfer initial amount

- Start trading!

Beginners ke liye Important Tips

- Start Small

Initially small amounts se start karein. Humne dekha hai ki overconfident beginners often big losses face karte hain. - Choose Right Account Type

BSDA (Basic Services Demat Account) consider karein if your holding value is less than ₹4 lakh – AMC free hoti hai. - Understand All Charges

Hidden charges se bachne ke liye all fee structures clearly read karein. - Use Educational Resources

Most brokers provide free educational content – utilize karein. - Practice with Virtual Trading

Real money invest karne se pehle virtual trading try karein.

Mobile Apps aur Trading Platforms

Modern trading mostly mobile apps pe hoti hai. Top platforms:

- Kite by Zerodha – Advanced features, clean interface

- Groww App – Beginner-friendly design

- Upstox Pro – Professional tools

- Angel One App – Comprehensive features with ARQ advisory

Research Tools aur Educational Resources

Investment success ke liye proper research zaroori hai, jaise:

- Technical indicators aur charts

- Fundamental analysis tools

- Market news aur updates

- Stock screeners

- Educational webinars

Pro Tip: Zerodha Varsity aur Groww ke educational content se start karein – free aur comprehensive hai.

Investment Options Available

- Equity Shares (long-term wealth)

- Intraday Trading (short-term profits)

- Mutual Funds via SIP (systematic investing)

- IPOs (new company shares)

- Futures & Options (advanced trading)

- ETFs (diversified investing)

- International Stocks (global exposure)

Security aur Safety Measures

- SEBI registration (mandatory)

- Investor Protection Fund coverage

- Two-factor authentication

- Data encryption

- Insurance coverage on deposits

Humne dekha hai ki reputed brokers always prioritize customer security.

Customer Support Quality

- 24/7 chat support

- Phone support

- Email assistance

- Branch visits (for full-service brokers)

- Video calling support

Testing ke basis pe, Zerodha aur Angel One have excellent customer support systems.

Frequently Asked Questions

Q: Kya main multiple demat accounts rakh sakta hun?

A: Haan bilkul! Aap multiple demat accounts rakh sakte hain different brokers ke saath. Humne dekha hai ki experienced investors often 2-3 accounts maintain karte hain diversification ke liye. Lekin beginners ke liye ek good account sufficient hai initially. Zyada accounts maintain karna confusing ho sakta hai aur AMC charges bhi badh jaate hain. Pro tip: Pehle ek account se experience gain karein, phir need ke according additional accounts consider karein.

Q: Demat account opening mein kitna time lagta hai?

A: Modern digital processes ke saath, most brokers 24-48 hours mein account activate kar dete hain. Experience ke according, Groww aur Upstox fastest hain – same day activation, proper documents ke saath. Traditional brokers like ICICI ya HDFC 2-3 business days le sakte hain verification process ke liye. Important: Complete documentation ready rakhiye – PAN, Aadhaar, bank details, photos. Incomplete documents delay cause karte hain.

Q: Minimum amount kitna invest karna padta hai?

A: Most modern brokers mein koi minimum investment amount nahi hai! Aap ₹100 se bhi start kar sakte hain. Practical terms mein ₹1000-5000 reasonable starting amount hai kyunki brokerage charges proportion mein consider karne padenge. Zerodha mein equity delivery free hai, so even ₹500 investment meaningful hai. Advice: Start small, learn market dynamics, then gradually investment increase karein.

Q: Mobile app safe hai ya desktop better hai trading ke liye?

A: Both are equally safe agar reputed broker choose karein! Mobile apps actually kaafi advanced ho gaye hain – live notifications, quick order, portfolio tracking sab available hai. Testing mein dekha hai ki Kite, Groww, aur Angel One apps desktop-level features provide karte hain. Desktop advantage: Bada screen, multitasking, detailed analysis. Mobile: Anywhere access, instant trade. Recommendation: Mobile app daily monitoring ke liye, desktop detailed research ke liye use karein.

Q: Agar broker close ho jaye to mere shares ka kya hoga?

A: Ye common fear hai beginners mein, but actually aapke shares completely safe hain! NSDL/CDSL depositories mein aapke shares stored hain, broker ke paas nahi. Broker close ho jaye to aap easily shares transfer kar sakte hain another broker ko. SEBI regulations ensure karte hain ki investor funds protected rahein. Pro tip: InvestsNow ki detailed broker reviews check karein reliability ke liye.

Q: Tax implications kya hain demat account mein?

A: Tax planning important part hai investing ka! Short-term gains (1 year se kam holding) pe 15% tax lagega equity mein. Long-term (1+ year) pe ₹1 lakh tak exempt, baaki 10% tax. STT trades mein automatic deduct hota hai. Dividend bhi taxable hai as per your tax slab. Suggestion: Basic tax knowledge gain karein ya CA consult karein significant investments ke liye. Proper record maintenance zaroori hai ITR filing ke liye.

Groww – Complete beginner friendly

Zerodha – Best platform aur research tools

Upstox – Advanced tech, competitive charges

Angel One – Trusted, advisory supportReady hain investment shuru karne ke liye?

Yahaan se apna Free Demat Account kholein (affiliated)

Agar aapko koi sawal hai ya confusion hai demat account selection mein, toh comment mein zaroor poochiye! Hum aapki help ke liye ready hain. Happy investing!

*Disclaimer: Market investments involve risks. Please research thoroughly aur if needed professional advice lein before making investment decisions. Ye article educational purpose ke liye hai, investment advice nahi hai.*

“`